On April 11, 2022, China Passenger Car Association (CPCA) released the March analysis report on the national passenger car market. The retail sales of passenger cars reached 1.579 million units, a year-on-year decrease of 10.5%, while the retail sales of new energy vehicles reached 1.445 million units, a year-on-year increase of 137.6%.

Production

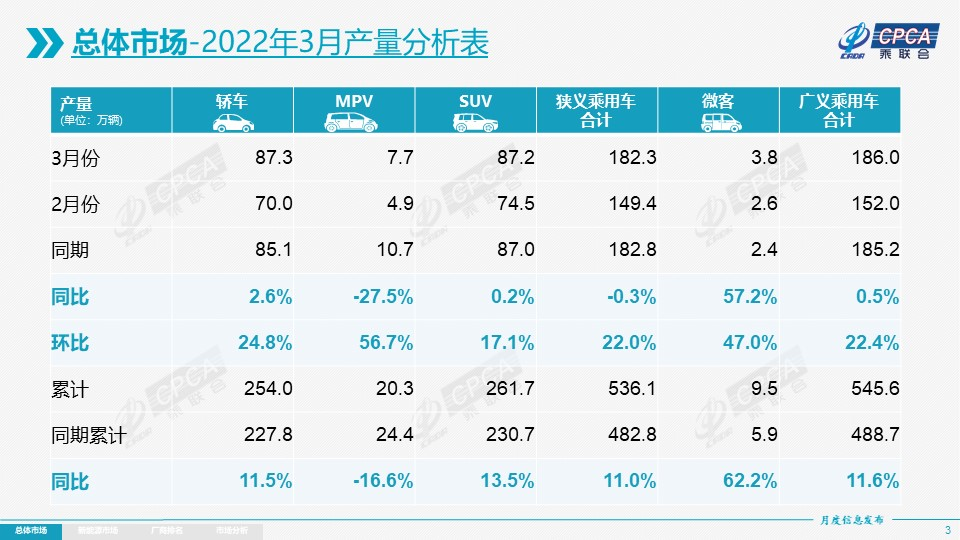

In terms of production, 1.823 million passenger cars were produced in March, a year-on-year decrease of 0.3%, but an increase of 22.0% on a month-on-month basis, showing strong performance. Among them, the production of luxury brands decreased by 31% year-on-year and 8% month-on-month; the production of joint venture brands decreased by 10% year-on-year and increased by 17% month-on-month; the production of independent brands increased by 23% year-on-year and 36% month-on-month.

Retail

In terms of retail, the sales of passenger cars in March 2022 reached 1.579 million units, a year-on-year decrease of 10.5% and an increase of 25.6% month-on-month. The March retail trend showed a large divergence. The cumulative retail sales from January to March were 4.915 million units, a year-on-year decrease of 4.5%, with a decrease of 230,000 units year-on-year, and the overall trend was lower than expected.

In March, the retail sales of independent brands were 750,000 units, a year-on-year increase of 17% and a month-on-month increase of 37%. In March, the domestic retail market share of independent brands was 48.2%, an increase of 11.5 percentage points year-on-year; the cumulative market share from January to March was 48%, an increase of 9.7 percentage points compared to the same period in 2021.

In March, the main joint venture brands sold 590,000 units, a year-on-year decrease of 30% and a month-on-month increase of 9%. The market share of Japanese brands in March was 20%, a year-on-year decrease of 3 percentage points.

New Energy

In terms of new energy, the wholesale sales of new energy passenger cars in March reached 455,000 units, a year-on-year increase of 122.4% and a month-on-month increase of 43.6%, with a growth rate close to that of previous years. From January to March, the wholesale sales of new energy passenger cars reached 1.190 million units, a year-on-year increase of 145.4%.

In March, the retail sales of new energy passenger cars reached 445,000 units, a year-on-year increase of 137.6% and a month-on-month increase of 63.1%, which was better than the trend in March in previous years. From January to March, the domestic retail sales of new energy passenger cars reached 1.070 million units, a year-on-year increase of 146.6%.

1. Wholesale

1. Wholesale

In March, the penetration rate of wholesale for new energy vehicle manufacturers was 25.1%, an increase of 14 percentage points from the penetration rate of 11.1% in March 2021. In March, the penetration rate of new energy vehicles in domestic independent brands was 41%, in luxury cars was 34%, while the mainstream joint venture brands had only 3%. In March, the wholesale sales volume of pure electric vehicles was 371,000, an increase of 116.8% year-on-year, and the sales volume of plug-in hybrid vehicles was 84,000, an increase of 151.3% year-on-year.

- Retail

In March, the penetration rate of domestic new energy vehicles in retail was 28.2%, an increase of 17.6 percentage points from the penetration rate of 10.6% in March 2021. In March, the penetration rate of new energy vehicles in domestic independent brands was 46%, in luxury cars was 32%, while the mainstream joint venture brands had only 4.3%.

- Export

In March, the export volume of new energy vehicles was 11,000, of which Tesla China’s exports were only 60 units due to the end-of-quarter factor, a decrease of 33,000 units from the previous month. SAIC passenger vehicle exported 4,658 new energy vehicles, Dongfeng Yixuan special exported 2,532, BYD exported 1,109, and Dongfeng Motors exported 1,046. Other domestic automakers rely mainly on the domestic market for new energy vehicles.

- Automaker data

In March, a diversified approach was adopted by the new energy passenger vehicle market. The leading companies were BYD with 104,338 units, Tesla China with 65,814 units, and SAIC-GM-Wuling with 51,157 units. The number of subsequent automakers was not outstanding, including Chery with 21,817 units, GAC Aion with 20,317 units, Changan Automobile with 15,624 units, XPeng Motors with 15,414 units, Great Wall Motors with 15,057 units, Geely Automobile with 14,166 units, NIO with 12,026 units, Ideal Automobile with 11,034 units, SAIC Passenger Vehicle with 10,880 units, and Leap Motor with 10,059 units.

- New forces

In March, the sales performance of new force automakers, such as XPeng Motors, Ideal Automobile, NIO, Leap Motor, WmAuto, were relatively good in terms of year-on-year and month-on-month growth. In particular, the price increases of XPeng Motors, Ideal Automobile, and NIO did not have a big impact and had good month-on-month growth. In mainstream joint venture brands, new energy vehicle wholesale sales of North-South Volkswagen were 12,709, accounting for 63% of the joint venture market share, indicating the initial success of Volkswagen’s firm electrification transformation strategy. Other joint ventures and luxury brands still need to make efforts.

- Conventional hybrids

In March, the wholesale of conventional hybrid passenger vehicles was 74,625, an increase of 62% year-on-year and 32% month-on-month. Among them, Toyota sold 44,610, Honda sold 22,990, Great Wall Motors sold 2,602, GAC Motor sold 1,792, Geely Automobile sold 1,239, and Dongfeng Nissan sold 1,184. Hybrid vehicles are gradually becoming a new hotspot.Production: Although the production was slightly affected by the epidemic, the growth of production and sales in the auto market in March was relatively good. The improvement of supply of joint venture chips helped promote the stable production and sales in March.

Retail: Affected by the spreading of the new crown epidemic in March, dealers in Geelyn, Shanghai, Shandong, Guangdong, Hebei and other places were all affected in terms of their in-store visits and transactions, and the changes of local management measures had certain effects on logistics efficiency, resulting in a large loss in retail.

New Energy: Affected by the intensive price hikes in March, the performance of orders before the price hike was impressive, and the overall orders were sufficient. The domestic retail penetration rate further increased to 28.2%. Despite the impact of “chip shortage and power shortage”, consumers’ enthusiasm for new energy vehicles is still high.

Market Outlook: In recent years, the demand of the passenger car market has presented a divided K-shaped trend, with the continuous decrease of traditional fuel vehicles and the continuous increase of new energy vehicles, forming a structural growth trend in the domestic auto market. The traditional fuel vehicle products face greater growth pressure, while the electrification and intelligentization of new energy vehicle products’ social supply chain system are still in the innovative rising stage.

Affected by the recent domestic epidemic, the auto industry supply chain is more tense, and the impact of price hikes and the epidemic on the economy will also affect consumers’ final purchasing power. The automobile market will bear some pressure in the short term.

🔗Source: China Passenger Car Association (CPCA)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.