Byd to stop production of fossil fuel vehicles in 2022

Yesterday’s announcement by Byd has caused quite a stir. According to the statement, Byd plans to stop production of fossil fuel vehicles from March 2022 onwards, in order to meet their strategic development needs. Byd will focus on pure electric and plug-in hybrid vehicles in the automotive sector. I would like to write an article to discuss this matter.

Overall:

-

Byd’s fossil fuel vehicles have maintained low prices in recent years. Especially with their outdated models, such as the special F3 and Su Rui, which have entered their final stages of their life cycle. Among the other several models in the Song series, there are DM-i and pure electric vehicle models. With the rising demand for pure electric and plug-in hybrid vehicles, stopping fossil fuel production would not have an economic impact.

-

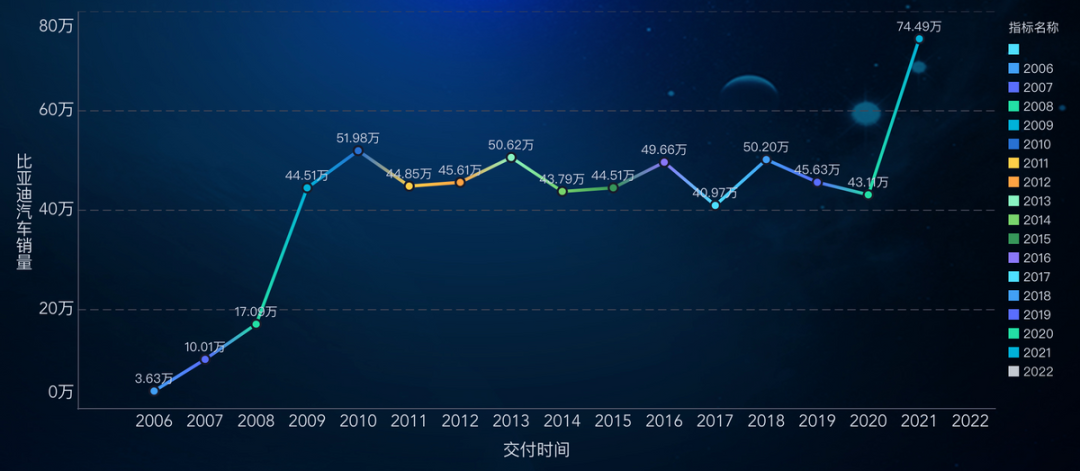

In terms of overall brand sales, Byd broke through the 40-50,000 sales range in 2021 and entered the 750,000 sales range, mainly due to the penetration rate of new energy vehicles. Byd also traded lower gross margins for market share (DM-I models have high cost-performance ratio and a strategy to avoid green license plates).

-

From the perspective of brand reputation, globally, it is currently in the transition from traditional fossil fuel vehicles to a full range of new energy vehicle brands. In terms of government and consumer recognition, pure electric vehicle companies have an advantage.

In summary, this decision currently has little harm and much benefit, making it a good strategy.

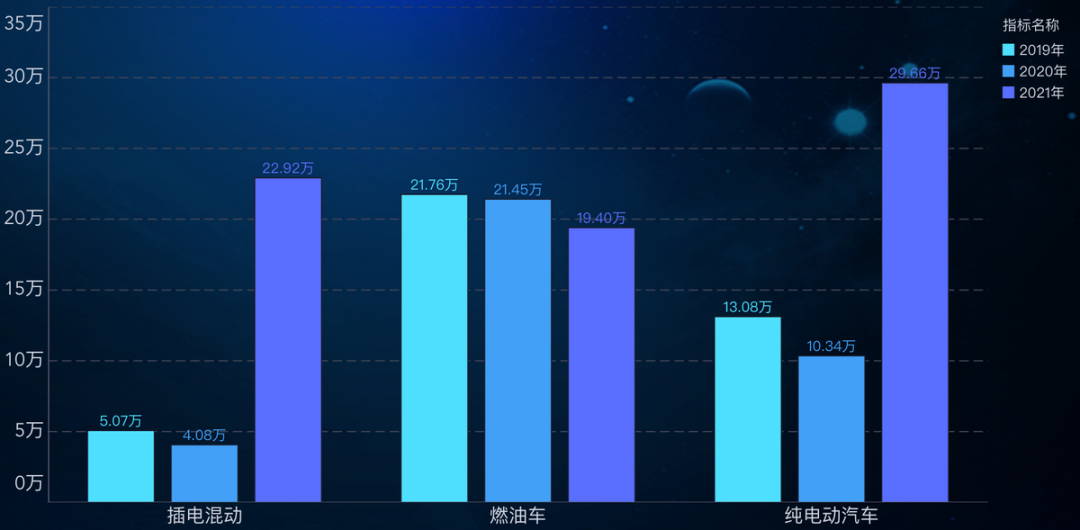

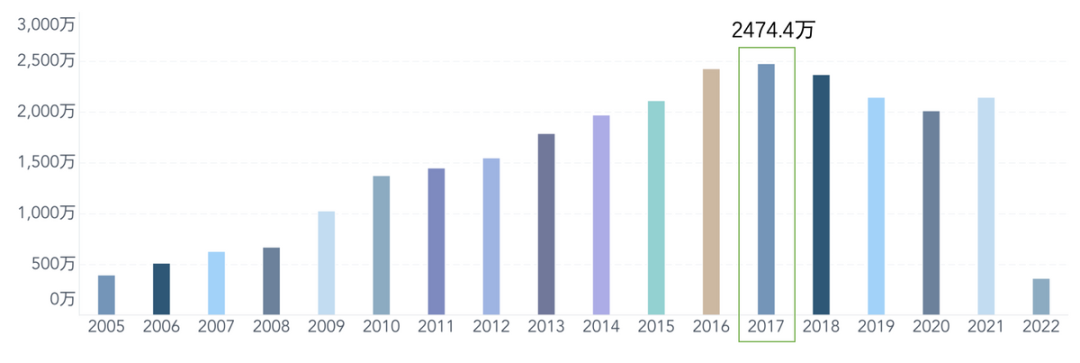

Reviewing Byd’s Sales Volume

I looked at data from recent years: from 2019 to 2021, Byd’s fossil fuel vehicles had a terminal insurance data of 217,617 units, 214,518 units, and 193,998 units respectively, remaining at about 200,000 each year. For the first two months of 2022, the terminal insurance data were 8,813 units and 3,464 units. In 2021, plug-in hybrids soared from 50 thousand to 229,000 units due to DM-i, while the sales volume for the first quarter of 2022 reached 141,000 units. Pure electric vehicles rose from a 100,000 to 130,000 level to 296,600 units in 2021 Q1, and 143,000 units for Q1 of 2022. Therefore, overall, fossil fuel vehicles are no longer that important for Byd.

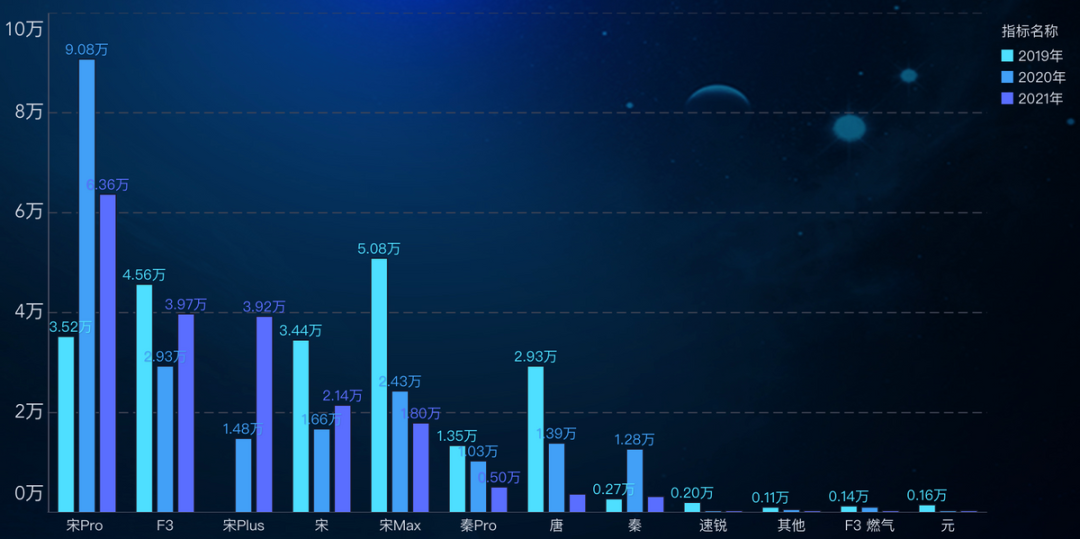

Based on BYD’s vehicle models, the main ones are F3, Song, and Song Pro, with the latter two being on the same platform as DM-i and pure electric vehicles. In 2021, the best-selling gasoline vehicles were the Song Pro with 63,600 units sold, followed by F3 with 39,700 units, Song Plus with 39,200 units, and Song with 21,400 units. BYD stopped producing F3 models in October 2021 and other gasoline models may be gradually discontinued based on demand. Currently, the main demand is still from the Song family, and with the gradual increase of DM-i orders, discontinuing gasoline vehicles and transitioning all consumers to DM-i plug-in hybrids is the future direction.

Based on BYD’s vehicle models, the main ones are F3, Song, and Song Pro, with the latter two being on the same platform as DM-i and pure electric vehicles. In 2021, the best-selling gasoline vehicles were the Song Pro with 63,600 units sold, followed by F3 with 39,700 units, Song Plus with 39,200 units, and Song with 21,400 units. BYD stopped producing F3 models in October 2021 and other gasoline models may be gradually discontinued based on demand. Currently, the main demand is still from the Song family, and with the gradual increase of DM-i orders, discontinuing gasoline vehicles and transitioning all consumers to DM-i plug-in hybrids is the future direction.

So March was basically the time frame set in place to discontinue pure gasoline vehicles, with the symbolic meaning being greater than the actual meaning.

During the exchange with investors, someone mentioned that BYD currently has 400,000 undelivered vehicles on hand (with a goal of 1.5 million in 2022, which based on Q1 numbers, will require continued production), and a large portion of which are DM-i models. Since PHEVs are basically produced on the same production line as gasoline vehicles, from the perspective of order accumulation and future development, stopping gasoline vehicles will not result in any loss of commercial interests. Of course, the biggest beneficiaries are BYD’s brand, since they are transitioning from a gasoline vehicle era to a new energy automotive company. In combination with BYD previously being positioned on Time’s TOP 100 Global Companies, there is a certain level of proactive public relations involved.

BYD’s considerations

To supplement, from the investor notes it can be seen that BYD’s considerations in this regard are as follows:

There are still 60% of households in China without cars, and if they all switch to pure electric vehicles, it will put a significant burden on consumers. The first car should be a plug-in hybrid, based on the existing DM-i hybrid technology, with the main differentiation being its relatively low price which is comparable to that of joint venture gasoline vehicles, and can satisfy consumers’ concerns about range or charging facilities while still being fuel-efficient and powerful. Then, pushing for pure electric vehicles, the second car for the household, will be appropriate. According to the proportion of PHEV to pure electric in Europe which is 45% PHEV, and 55% pure electric, this is also the trend in China in the long run.

For BYD, the low-end gasoline cars obviously drag down their price and brand image since they have to compete with joint venture gasoline vehicles, so it is necessary to sacrifice their weak point (traditional gasoline vehicles).

Since 2017, China has entered an era of stock competition. Therefore, BYD’s target of 1.5 million in 2022 is completely snatching customers from joint venture vehicles, which is still aggressive. One could not bear to starve his children for fear of feeding the wolf.

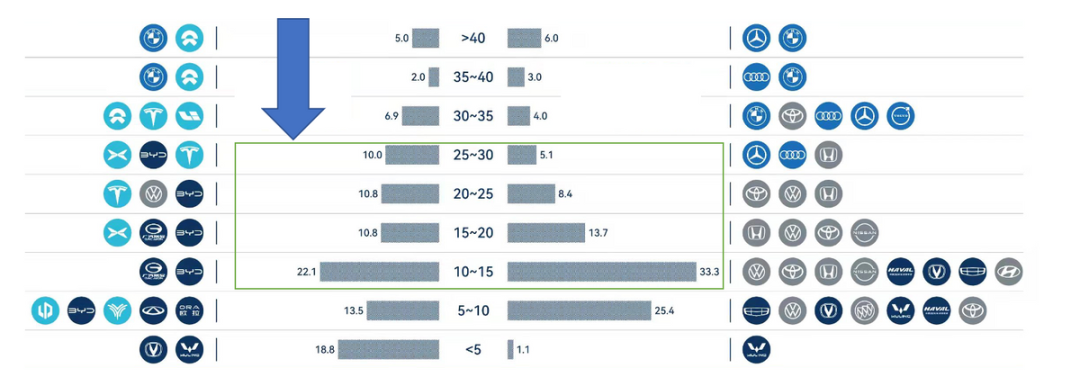

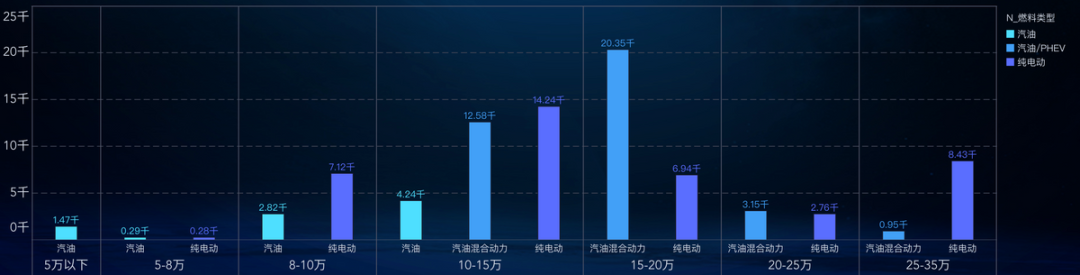

On the whole, after stopping the sale of gasoline vehicles and raising the price of pure electric vehicles, BYD’s vehicle types have entered the range of above 100,000 RMB. The main DM-i entry models cover 100k-150k RMB, while the improved models cover 150k-200k RMB. From the perspective of pure electric vehicles, this means that BYD will use the same lithium iron phosphate batteries to expand sales base from 100k-200k RMB, and make profits from vehicles priced above 200k RMB. Then BYD will rely on DM-i to break through at the brand level. From current data, it’s no longer necessary for BYD to keep gasoline vehicles to drag their feet.

In fact, from the production capacity point of view, with DM-i removing the previously used dual-clutch transmission and developing a dedicated engine, the parts shared by DM-i and gasoline vehicles will gradually be phased out, which will free up production capacity and space for gasoline vehicles.

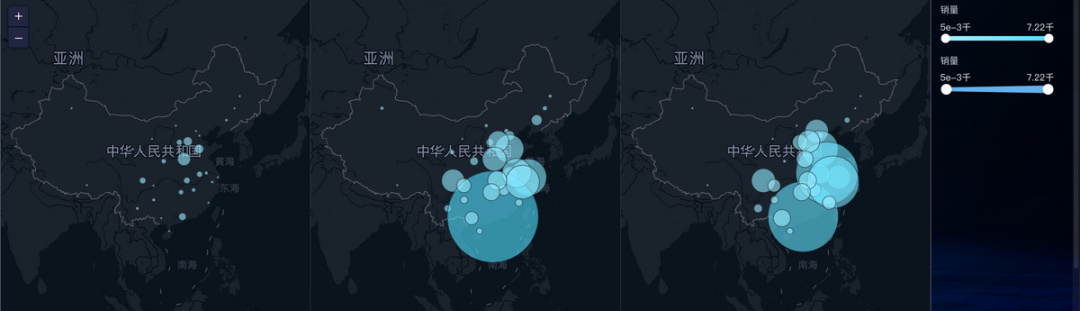

From the sales area perspective, plug-in hybrid vehicles inherit all the original gasoline vehicle 4S store networks, and from the perspective of sales expansion, it has already achieved an upgrade in geographic latitude, entering the areas where it hasn’t reached before.

Of course, what needs to be considered is that with the cessation of production and further adjustment of existing products, what will happen to the previous gasoline vehicle users? As I understand it, those who previously had large-scale adoption of F3 and other gasoline vehicles may face a significant drop in the value of second-hand cars. Actually, people who buy BYD gasoline vehicles are already quite niche, although there were 200,000 terminal consumer sales each year from 2019 to 2021, these customers may have to accept the inevitable devaluation of second-hand cars after the brand transition to new energy.Summary: I think BYD has done something interesting in the past two years — first building scale, then making profits. In the stock market, this has had a huge impact on joint venture brands, and for new energy vehicles affected by cost factors, it serves as a backbone. Of course, this model also implies that new energy vehicles have no way out if they don’t vertically integrate in the three-electricity field (they can’t compete on cost, nor keep up with technological iterations).

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.