If high-precision maps cannot be “fresh”, they cannot become a necessary condition for advanced autonomous driving.

Author: Qiu Kaijun

Can you go to the bathroom in the middle of the night with just a little bit of light?

Most people would say yes.

Because you are very familiar with the layout of your home. You even know that before going to bed, your child left a toy car at the door of the bathroom to be careful not to step on it.

To give an example, if you were a robot, you would actually have a high-precision map of your home that details the location, size, and distance of various items in your home, and it is the latest high-precision map – you still looked at the situation in your home before going to bed.

So, if the autonomous driving car, which is also an autonomous driving robot, also has a very large and very fresh high-precision map, that would be great. It travels on the road, just as safely and reliably as you walk around your home.

The autonomous driving industry really has high-precision maps now. So, let’s quickly draw a high-precision map covering the whole country and start using it?

We consulted multiple front-line enterprise executives and learned that Alibaba’s high-precision map, NavInfo, Baidu, and other enterprises can provide high-precision map coverage of the country’s highways, national city expressways, and even ordinary urban roads.

But – a possible fatal problem – most can only be updated once per quarter – the “freshness” is far from meeting the requirements of advanced autonomous driving. It’s like you rented your house to someone else for several years, who knows what it turned into?

High-precision maps need to be “fresh” and rely on either large-scale self-collecting cars to scan the roads like bees to collect honey – this is almost an impossible task; or rely on crowdsourcing to collect data by mobilizing vehicle owners to provide data to map vendors – if it involves mapping, it is subject to administrative regulations.

What can we do?

High-precision maps have come to a life-or-death challenge – if high-precision maps cannot be “fresh”, they cannot become a necessary condition for advanced autonomous driving.

It is worth noting that the autonomous driving technology route without high-precision maps, such as Tesla, is also running quickly, and high-precision maps will not have much time.

However, from the perspective of industry development requirements, policies will be relaxed sooner or later, and whoever can “keep it fresh” will have stronger competitiveness.

In this article, you will read these core information:

-

The major high-precision map suppliers can provide bottom maps that cover highways and even major urban expressways, but the freshness is not enough, and the accuracy is still flawed.

-

“Mapping is easy but map maintenance is hard” The continuous expansion and operation difficulty of high-precision maps are far greater than once mapping, which requires crowdsourcing, testing the ability of map vendors to acquire data from terminals, but the policy involved in crowdsourcing mapping has not been relaxed yet.- Currently Gaode, Baidu, NavInfo, and Tencent are the main players in high-precision maps. If the crowdsourcing mapping policy is liberalized, Gaode and Baidu, which have a large number of highly-sticky C-end users and many main car manufacturer customers, will have significant advantages in crowdsourcing updates.

High-precision Map: Wide Coverage, Not Enough Precision

Where is the precision of high-precision maps?

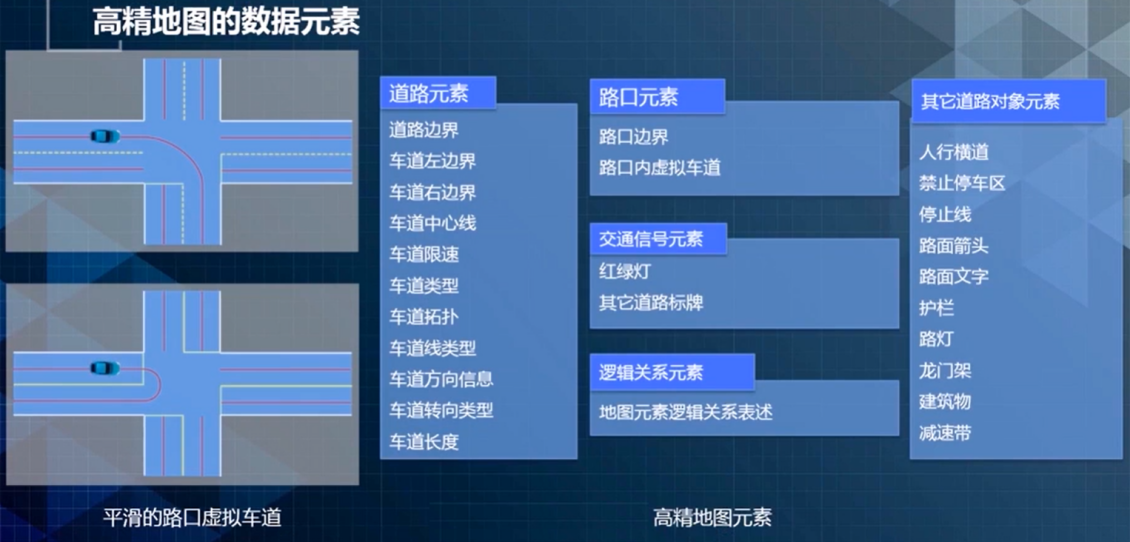

In fact, high-precision maps (HD MAP) not only mean “high precision”, but they have three meanings:

First, high precision: both absolute and relative accuracy are within one meter, and even relative accuracy is within 20 centimeters, while the accuracy of general navigation maps (SD MAP) is only about 10 meters;

Second, richness: ordinary maps can tell you where you are and what malls and buildings are around you. In addition to this, high-precision maps contain road information such as road type, curvature, and lane position, as well as object information such as roadside infrastructure, obstacles, and traffic signs, with up to hundreds of data elements. Of course, many people believe that the more elements there are, the better, but enough is enough.

Third, freshness: high-precision maps must update map information frequently, including real-time traffic flow, red-green light status information, and other dynamic information. It also includes the update of static information, such as changes and repairs to roads, speed limit adjustments, etc.

Between high-precision maps and general navigation maps, there are also ADAS maps, which have more data elements than general navigation maps, but far from the level of high-precision maps.

After loading such accurate, rich, and fresh high-precision maps, cars can go to their destinations without the need for drivers, like an experienced horse that knows the way.

“When you have no ears and eyes, do you have a sense in your heart?” This is how Miao Lusheng, the general manager of the business development center of Gaode Maps’ automobile business, describes the role of high-precision maps. Especially for intelligent driving, high-precision maps can enable vehicles to predict the traffic information beyond the line of sight in advance.

Most people in the industry believe that high-precision maps are a necessary condition for achieving L3 autonomous driving. Because above L3, vehicle self-driving is the main approach, and ordinary maps, equipped with on-board sensing devices, are not sufficient to make accurate path planning and timely driving decisions.

So, how far has high-precision maps evolved? Is it not working since L3 level autonomous driving cannot be implemented?

First of all, as far as the three leading companies in China are concerned, they have achieved a relatively extensive coverage of high-precision maps.Vice President of Gaode Automotive Business Center, Miao Lusheng, stated that they completed the nationwide collection of high-definition maps for highways, cities, and expressways early on and were the first in China to achieve mass production. In 2019, Gaode also began large-scale data collection and production work for ordinary roads within cities.

Liu Yang, Product Director of Map of Navinfo, stated that they had already achieved full coverage of high-precision maps for highways supporting L3 three years ago. By the end of 2021, they had completed the collection of high-precision maps for main roads in nearly 30 cities, with a total mileage of nearly 200,000 kilometers.

According to the “Intelligent Connected Vehicle High-Precision Map White Paper,” Baidu also collected high-precision map data, covering 300,000 kilometers, mainly highways across the country, in accordance with the requirements of L3 automatic driving.

High-precision maps in foreign countries also have extensive coverage.

For example, in Germany, Mercedes-Benz’s 13,191 kilometers of highways supporting L3 automatic driving functionality is also covered by high-precision maps. The high-precision maps used by Mercedes-Benz are provided by the international renowned company, HERE.

However, L3 has not yet arrived. Xi Ning, General Manager of HERE in Greater China and Business Supervisor, stated that “The time point for L3 popularization among automakers has been generally postponed by 3-5 years.”

Why?

According to an individual in charge of self-driving technology from an automaker, “L3 cannot yet be commercially used, and the responsibility does not lie in high-precision maps.” There are two reasons: “One is the L3 solution itself, which has not learned enough scenes and has not solved the safety problems of Corner Case(extreme scenarios). The other is access issues.” In 2021, the Equipment Industry Department One of the Ministry of Industry and Information Technology released the “Smart Connected Vehicle Production Enterprise and Product Access Management Guidelines (Trial)” (draft for comments). How L3-level autonomous driving can gain access is still uncertain and, of course, cannot be released to customers.

The blame should not lie with high-precision maps. However, high-precision maps still have their issues.

An individual in the map industry believes that “The high-precision maps provided by map vendors are far from supporting L3-level automated driving.” The maps collected look quite comprehensive, but precision, freshness, and accuracy are still a big issue. In particular, freshness, the update frequency is too low.

Currently, “the high-precision maps of several major high-precision map suppliers are updated quarterly. There is a distance between this and the automakers’ expectations. Wu Xin Zhou, Vice President of XPeng Motors, once stated that the freshness of high-precision maps in urban scenarios is crucial, and they hope to be able to achieve daily updates.

Tesla, the world’s leading self-driving tech company, is not using high-precision maps either. Tesla CEO Elon Musk believes that high-precision maps are a “very bad” idea. The reason is that the freshness is not enough. Once the road changes slightly, the high-precision map becomes outdated.And Tesla doesn’t use lidar either. Musk believes that relying on full visual sensing devices can achieve autonomous driving.

However, Tesla also uses a “map” that is similar to high-precision maps, but mainly drawn by themselves.

Some netizens found that in the “shadow mode” of autonomous driving, Tesla stored the road information collected by the customer’s own vehicle, and drew their own maps.

The data of the map drawn by Tesla is more than that of the standard navigation map, but there are not as many features as the high-precision map, which is close to the ADAS map provided by many domestic companies.

The disadvantage of Tesla’s mapping approach is that there is no high-precision map base map, and there are always places where Tesla has not collected data, but the advantage is that the cost is low and when Tesla vehicles are running on the road in large numbers, they can provide a lot of fresh data.

Although many people do not agree with Tesla’s autonomous driving technology, currently it is globally leading in terms of functional advancement and experience. If Tesla’s model continues to evolve and is eventually verified in L4 level autonomous driving, it will also mean the death sentence of high-precision maps.

However, industry insiders of map said that autonomous driving may not require high-precision maps, but at least a unified space model for information exchange is needed between various components of autonomous driving, software, and hardware, as well as between humans and machines. This model is actually a map, maybe a normal map, maybe a high-precision map, or an ADAS map.

Overall, in China, high-precision map service providers’ high-precision map base maps are already available for car companies to use for navigation assistance driving on highways and some urban expressways. Behind Nio’s NOP, XPeng’s NGP, Ideal’s NOA, GAC Aion’s NDA, and Great Wall’s NOH are supported by high-precision maps.

However, in many car companies’ perception settings, when there is a conflict between smart sensing device information and high-precision map information, the information from the sensing device is still dominant.

This means that if high-precision maps are also seen as a sensor, their status is low and they are not the main components.

The “Freshness” problem

If high-precision maps can solve the freshness problem, it can also silence Musk’s mouth, and can even surpass lidar and HD cameras in the sensors for autonomous driving.

So why don’t map vendors increase the freshness of high-precision maps?

This is related to the map drawing and updating methods of high-precision maps.The main method of mapping is to collect laser radar data, GPS data, camera data, etc. through its own data collection vehicle for recognition, fusion, 3D modeling, and generation of high-precision maps, which are then sent to car companies.

For example, in late 2021, Navinfo had about 80 data collection vehicles capable of collecting high-quality map data. Baidu claims to have established the largest fleet of high-precision map collection vehicles in China.

After the initial release, the updates to the map still depend mainly on the map companies’ own collection vehicles to update the data, which is then processed and updated again to create high-precision maps and then sent to customers.

This mapping model is obviously time-consuming and labor-intensive.

Excluding the fast urban roads, the total length of expressways in China is about 160,000 km. If one collection vehicle collects valid data over 100 km in one day, it would take 16 days for 100 collection vehicles to complete one cycle of data collection.

The high-precision map collection on urban expressways is even more difficult, as the road conditions are more complex and the speed is slower.

Therefore, map companies that cover an area of over 300,000 km can only update every quarter.

However, high-precision maps can also be updated using the same approach as Tesla, which is crowd-sourced collection + recognition and extraction + dynamic delivery.

Under this model, consumer vehicles equipped with laser radar or high-definition cameras can obtain a lot of data during daily travels. By uploading the data to the map companies, it is equivalent to collecting data with one collection vehicle. If there are a large number of intelligent vehicles, the map companies would have a large team of collection vehicles.

In more commonly understood language, crowd-sourced collection is equivalent to mobilizing the masses to draw maps together, and the more people involved, the stronger the power. The collecting task that seems impossible can be resolved in the sea of people’s war.

Map companies have already done this for ordinary navigation maps.

If you drive with map navigation, you may receive a prompt asking if there has been a traffic accident ahead. In addition, there are millions of navigation map users who provide the system with feedback on map information every day. Some of the information is screened and confirmed to be updated to the map. This is the crowd-sourced update of ordinary navigation maps.

However, the information feedback from this crowd is very limited. The crowd-sourced update of high-precision maps requires much more data. To update maps with high quality, positioning, high-definition cameras, and even laser radar are needed.

However, this behavior may have already crossed the line of illegal or unauthorized activities.According to the departmental regulations of the national mapping management agency, units and individuals without electronic navigation map qualifications are not allowed to carry instruments with space positioning system (such as GPS) signal reception and positioning function to display, record, store, annotate spatial coordinates, elevation, land attribute information, and to check, verify, and modify high-precision map-related contents and other mapping activities during the use of high-precision maps, except for enterprises with navigation electronic map qualifications.

Ordinary consumers’ vehicles, if only recording the surrounding environment with cameras, are generally not recognized as mapping activities. However, if LiDAR is used, it is easy to meet the mapping standards and will be recognized as belonging to the category of “mapping activities”, and the subject of data collection should have corresponding mapping qualifications.

Therefore, it is completely impossible for ordinary people to have mapping qualifications.

As a result, the crowdsourcing collection and update of high-precision maps in China has not yet been carried out on a large scale.

Against this background, the cost of operating high-precision maps by map vendors is extremely high. Taking the cost of a collection vehicle as an example, the cost of a single vehicle ranges from several hundred thousand to over one million, in addition to the cost of collection vehicle personnel, data collection, analysis, and processing costs.

This is the so-called “easy to build a map, difficult to maintain one”.

It is impossible for any map vendor to establish a huge collection team and collect data at high frequency to update high-precision maps.

The freshness of high-precision maps has stagnated at the level of quarterly updates.

Who has the advantage in the “freshness” war?

If one day the crowdsourcing update policy is relaxed, who will have the advantage?

Let’s take a look at the current high-precision map landscape.

In August 2021, IDC, a research and consulting firm, released a report on the market share of high-precision map solutions. In the report, IDC divides high-precision map players into four categories.

The core player is the traditional map vendor with A-level mapping qualification in China; host manufacturers, new car-making forces, foreign map vendors, and innovative enterprises are also expanding their presence in this field.

But upon closer examination, the core players are the traditional map vendors.

New car-making forces and host manufacturers are more involved in the application of high-precision maps, or co-builders—hoping to use the data collected by selling their vehicles to draw or update their own maps.

Foreign suppliers, restricted by the policy of mapping outside China, can only cooperate with domestic enterprises, integrate domestic map vendors’ data, and play to their advantages in software platforms and stable customer bases. For example, HERE cooperates with Navinfo in China to provide high-precision maps from Navinfo to automakers.As for domestic start-up companies, they have neither the ability to map without a base map nor their own terminals. They only rely on innovative data collection, unique data processing capabilities, strong software delivery, and updating capabilities to serve OEMs. Compared with mapping companies or vertically integrated OEMs, their competitiveness is limited.

Therefore, the pattern of China’s high-precision map market is dominated by a few traditional mapping companies.

According to the “Market Share of High-Precision Map Solutions”, the Chinese high-precision map market developed rapidly in 2020, with a market growth rate of 70%. Baidu, NavInfo, YITU, Gaode, and HERE ranked among the top five in market share, accounting for 28.07%, 21.61%, 16.15%, 13.07%, and 7.8% respectively.

However, unlike the IDC report, the industry generally believes that China’s high-precision map market is mainly dominated by several companies such as Gaode, Baidu, and NavInfo.

From the application perspective, high-precision maps correspond to level-2 and above autonomous driving. Currently, there are only five companies in China that have reached and commercialized this level, including WeRide, Great Wall, and GAC, which have navigation and driving assistance systems.

In terms of cooperation with OEMs, Gaode has a significant lead, Tencent and Baidu each have one OEM. NavInfo’s customers are mainly joint venture brands such as BMW and Mercedes-Benz. They are relatively conservative in terms of L3 or near-L3 intelligent driving applications.

So, who will gain a greater advantage in future competition?

Although there may be differences in the bottom map construction aspect, it is fairly easy to catch up. However, the core of high-precision maps lies in updates and freshness, which will be the winning factor in future competition.

There are divergences among companies such as Gaode, Baidu, NavInfo, and Tencent in this aspect.

If we have to crowdsource, whoever has the most users will have an advantage.

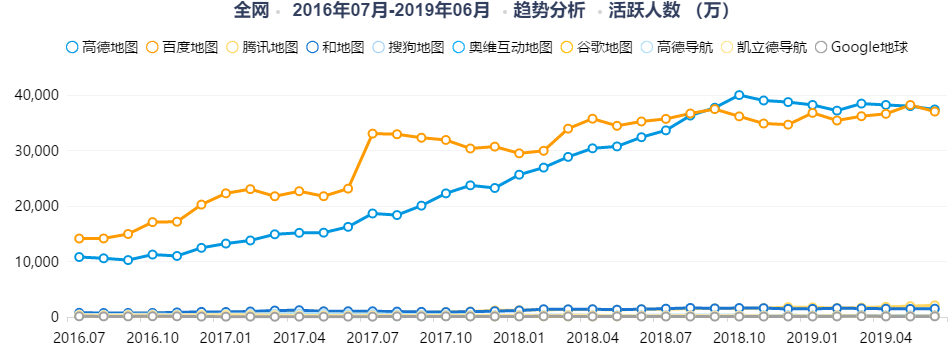

At the C-end user level, Gaode and Baidu are far ahead.

According to the navigation map market statistics, the sum of active users of Gaode and Baidu maps accounts for about 90% of the active users of map applications. Tencent Maps ranks third, but the gap between it and the first two in terms of active users is significant.

Market Share of Navigation Maps

The number and activity level of users of Gaode Maps are unparalleled, and the gap is still widening. In June 2021, the scale of monthly active users of Gaode Maps reached about 630 million, an increase of about 100 million compared to the same period in 2020, up 18.9%. Among them, 68.8% of new installation users come from Baidu Maps, and 17.5% of new installation users come from Tencent Maps.

The number and activity level of users of Gaode Maps are unparalleled, and the gap is still widening. In June 2021, the scale of monthly active users of Gaode Maps reached about 630 million, an increase of about 100 million compared to the same period in 2020, up 18.9%. Among them, 68.8% of new installation users come from Baidu Maps, and 17.5% of new installation users come from Tencent Maps.

This is also an important foundation for Gaode Maps to launch crowdsourcing updates. In the standard map stage, they have completed the closed loop of data updates.

Baidu is the only one that can compete with Gaode.

First of all, in terms of common navigation maps, Baidu’s market share is second only to Gaode. According to Baidu’s annual report, the monthly active users of Baidu mobile maps in the third quarter of 2021 were 326 million.

Secondly, in terms of updates, Baidu has been deeply cultivating AI ecology for many years and widely applying deep learning and artificial intelligence technology to map data production.

Third, relying on the overall strategy of the Apollo autonomous driving, Baidu has laid out earlier in the field of high-precision maps. It has the largest collection fleet of high-precision maps in the industry, and is promoting the landing and operation of Robotaxi in various regions nationwide. The data collection is equivalent to a collection vehicle, covering highways, urban roads, some parking lots, and closed parks.

In addition, Baidu also has its own car brand- Jidu Auto, which is about to start mass production. Baidu also hopes to form high-precision data sharing with the cooperative members of the Apollo platform to achieve crowdsourcing updates.

Gaode and Baidu have realized the ability to collect and update on a large scale, and have realized data closure based on a wide range of sticky users. This is something that 4D, Tencent, and even the strong R&D capabilities of Huawei do not have. If one day Didi can realize its own fleet or customized vehicles, it will also have the advantage of high-precision map updates.

However, whether the data closed-loop capability that has been verified on the standard map C-side can be smoothly migrated to the high-precision map still needs to be observed.

On the B-side customer level, there are not many automakers applying L2-level and above intelligent driving technologies, and new forces and independent brands have taken the lead. Whether traditional large automakers will apply them on a large scale and actively, so that companies such as 4D, Tencent, and Huawei can regain the advantage of B-side customers, also need to be observed.

Of course, speaking of it, no matter which high-precision map company it is, the biggest opponent at present is the autonomous driving technology without high-precision maps. Whether high-precision maps can evolve successfully before the opponent succeeds, and make autonomous driving inseparable from it, is the key.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.