Karakush Analysis

This week, with the release of XPeng’s annual report, we finally get a comprehensive overview of the top three Chinese EV makers for 2021. From the numbers, we can make some simple observations:

- NIO earned the most, but also spent the most

- XPeng sold the most, but also lost the most

- Li Auto pinched the most pennies and had the most fun doing it

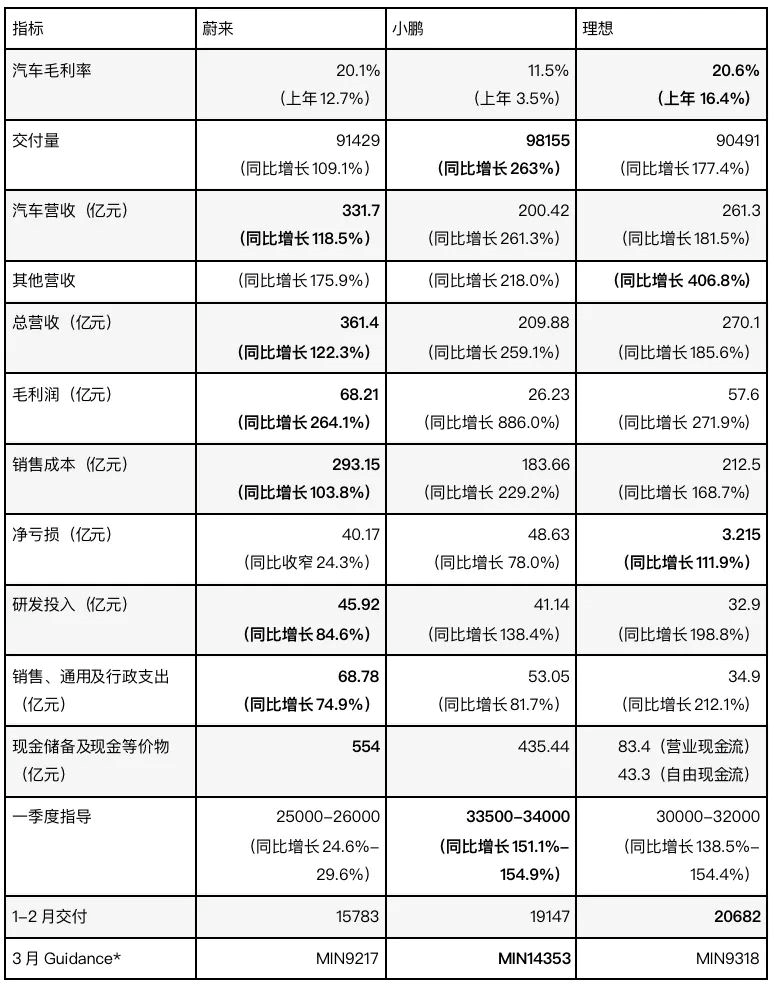

For other more in-your-face findings, please see the table below:

These numbers mean a lot, but they’re worth chewing on again. In this year, NIO, XPeng, and Li Auto completed their 0-1 verification and began their 1-10 growth. 2021 has become an extraordinary node, summarizing their past survival efforts and laying the groundwork for their savage expansion in the future. On the whole, they are all fundamentally good, but each has its own shortcomings and problems.

Today, we will focus on what lies beneath these numbers and what will determine future prospects.

XPeng is on fire, Li Auto is killing it, and NIO is falling behind?

Since the second half of last year, NIO has almost stopped chasing the new energy vehicle delivery rankings, with its top three ranking being frequently squeezed out by newcomers like Nether Motors. This situation continued into January and February of this year, with the public constantly worrying about its lack of growth.

NIO is quite helpless. From their point of view, this sales ranking, which was divided into “new forces,” in the past, was able to reflect the status of small, agile startups on the brink of life or death. Nowadays, it seems neither scientific nor polite.

In terms of product combination, NIO’s ES8, ES6 and EC6 are priced mainly between 300,000 and 500,000 yuan, XPeng’s P7 and G3 are mainly priced between 150,000 and 350,000 yuan, and Li ONE is priced at 338,000 yuan.

In terms of financial performance, despite not selling as much as XPeng, NIO and Li Auto both achieve gross profit margins of over 20%, with NIO achieving more than 4 billion yuan and Li Auto achieving more than 3 billion yuan. While these indicators may still have room for improvement, they already reflect the boundaries of the market. Not to mention other more affordable products, where the direction of effort and capacity ceiling is not the same.

The important question today is not whether NIO can beat Nether and retain a spot in the top three, but whether it has any development depth in its specific market and can support its continued high-speed growth?

Currently, NIO’s average transaction price exceeds 400,000 yuan. According to a survey by the automotive industry digital information platform Wilson, the average transaction price of luxury car brands in the Chinese market is ranked: Porsche (CNY 775,400), Land Rover (CNY 663,228), Mercedes-Benz (CNY 428,616), NIO (CNY 426,320), and BMW (CNY 416,744). NIO is up against Mercedes-Benz and BMW.This is both a blue ocean and a huge challenge. Traditional competitors need to achieve annual sales of over 100,000 to 200,000, with transaction prices humbly moving downward to the range of 250,000 to 400,000 yuan, not daring to exceed the pricing of the BB. NIO has now achieved a scale of 100,000 at first-tier prices and has established a strong foothold in the market.

This year is a big year for NIO’s products, as three new cars, the ET7, ET5, and ES7, will begin delivery, with two sedans and a mid-to-large size five-seater SUV opening up new markets compared with the current product line-up.

In terms of market capacity, the mid-to-large sedan market, where ET7 is located, has a sales volume of 750,000 yuan or more, with a monthly average of 15,000 units for the BMW 5 series; ES7 is in the middle and large five-seater SUV market, with a capacity of 200,000 units and a monthly average of over 4,000 for the imported BMW X5, which may be even greater after local production. ET5 is the model that will truly drive the growth in scale, and the relatively lower unit price is believed to bring stronger growth.

These provide new growth engines for NIO, implying growth potential. However, there are still many factors that affect/limit its actual performance, such as the supply chain and production capacity. These are problems that everyone encounters, and therefore they are not problems when they are solved. NIO is still constrained by its own products.

For example, ET7 is co-produced on the same line as the ES6, and the factory will still produce and deliver the ES7 by the third quarter, making the situation at the factory more complicated as they need to ensure production of the existing three models while preparing for mass production of the new ET7. It is expected that the production ramp-up process for ET7 will be slower, and regular production capacity will only be reached in the third quarter.

High-end is the way to go

All three companies will launch new models this year, and high-end trends are particularly prominent.

NIO’s 775 maintains a price of over 300,000 yuan, with the 77 priced above 400,000 yuan; XPeng’s mid-to-large SUV G9 should be priced at over 300,000 yuan; Ideal’s large SUV L9 is priced in the range of 450,000 to 500,000 yuan.

This kind of high-end positioning is a branding strategy for NIO, an elevation for Ideal, and a necessary transformation for XPeng.

# Translation

# Translation

The main product offered by XPeng Motors is currently the P7, with cumulative sales exceeding 100,000 units this month, a deserving hit. The target for this year is to ensure that monthly sales of P7 exceed ten thousand. The P5, which is offered at a lower price, was launched in the third quarter of last year. Unfortunately, due to limited time and supply chain difficulties, only less than 8,000 units were delivered, below expectations. They hope to improve this in the second half of this year.

On the bright side, XPeng Motors is confident about gaining a larger market share. For the first quarter of this year, they have set an ambitious delivery target of 33,500 to 34,000 units, making it the lowest quarter for deliveries. This indicates that they have a conservative estimated annual sales target of 140,000 units, an increase of more than 40% from last year, where they achieved a growth rate of 263%, which was perhaps too optimistic.

On the downside, XPeng Motors’ gross margin was 11.5% last year. Although this represents an improvement of eight percentage points from previous years due to economies of scale driving sales, the growth of the P5 model may dilute the average profits.

One risk is the potential to increase losses. Among the three major automakers, XPeng Motors is the most profitable, and insufficient profits coupled with high investment has been a direct cause of this.

XPeng Motors’ investment is top-grade. Research and development investment is on par with NIO, and sales, general, and administrative expenses are 1.5 times as much, which is 70% of NIO. Despite net losses exceeding 4 billion yuan for NIO, their losses have been decreasing annually, and they have been financing sales and management expenses entirely through gross profits, leaving the research and development expenses as their main focus.

XPeng Motors’ net profit cannot cover either of the two major expenses or any of its individual components. In fact, the gross profit of its products almost seems charitable relative to its research and development standards. In terms of the price range of XPeng’s products, there are hardly any products that are technologically similar.

XPeng Motors certainly doesn’t lack funds. They have ample cash flow, two financing channels, and a racing circuit to provide support for their rapid development. However, from a financial health perspective, XPeng Motors needs G9 to enter a higher price range, improve the overall gross margin, and establish more stable and controllable funding self-sufficiency.

XPeng Motors’ long-term goal is to increase the overall gross margin of the company to above 25%.

Apart from increasing their high-premium product line, opportunities to increase value-added services include incidental sources, but it was only ¥946 million last year, accounting for 4.5% of total revenue, not yet worthy of further discussion.

In addition, cost control must be improved. The selling cost of XPeng Motors is relatively higher, yet there is still room for improvement for its gross margin, for example, through new platform scaling, highly integrated design, and large-scale integrated casting, promoting the cost-effectiveness scale effect and operational leverage of the dynamic system, manufacturing process, and BOM cost system, resulting in a continuous decrease in the cost ratio.

What is the investment going into?Among the three, Ideal stands out with its remarkable advantages: achieving the highest gross profit margin, maintaining the lowest growth in two major operating expenses multiplied by 2, and a net loss increase of 111.9%, but still only reaching CNY 321.5 million, indicating its ability to be financially independent.

Especially noteworthy is the sales and management expenses, which are directly related to sales volume. The major portion of the growth comes from personnel increase, marketing activities, and network expansion. Ideal completed almost the same sales volume as NIO with only half of NIO’s expenses, indicating higher efficiency in capital utilization. This stability was particularly useful this year, as Ideal completed the most deliveries in January and February.

One of the sources of success may lie in the increasingly self-reliant online marketing.

One example is seen in the promotion of the new L9 car, where even though I haven’t seen the car yet, I already know how many milk bottles it can hold, how cool its screen is, and that it has a “Li Xiang Purple” treasure color. Every configuration item has established its superior and powerful features through Li Xiang’s and netizens’ debate.

It is like the “Dune” of Jodorowsky. The product (still) does not exist, but its explanation makes it look like a masterpiece. The founder’s aura was an enviable competitive advantage in the early development period of the three automakers. However, today, only Li Xiang seems to be persistently advertising for the company. This may even be reflected in the financial reports.

Of course, this is not to say that all extra expenses are excessive. The expenditures are matched with the business model. NIO’s high operating costs include the expansion of the energy replenishing system, which is not an issue that Ideal needs to consider for now.

On the one hand, more charging and swapping stations help improve the driving experience and become the moat of high-end attributes. On the other hand, NIO is gradually getting the return on these pre-investments. For example, NIO’s other revenue, including services, energy, accessories, used cars, and automotive finance, is two to three times that of the other two players and accounts for more than 8% of total revenue, with future growth potential.

Furthermore, expansion into overseas markets also leads to increased operating expenses. Both Xpeng and NIO face this issue, but it will be mitigated as sales volume increases profitability.

As for R&D, it can be seen that all three have the consensus to invest heavily. Although Ideal has the smallest amount of investment, its growth rate on the vertical axis is the highest, reaching 198.8%.

This year, competition will intensify: Xpeng stated that its R&D investment for this year alone will exceed the sum of the past one or two years.

NIO also said that its R&D investment will increase at a rate of “more than double”, meaning it will surpass CNY 9 billion. In terms of personnel, it has been reported that Huang Xin, formerly the Director of Autonomous Driving Products of Xpeng, has joined NIO. By the end of this year, NIO’s R&D team is expected to reach 9,000.

These efforts reflect the preparation for future market changes.## Link, intensified competition and economic downturn are everyone’s challenges

Competition is intensifying, including the technology giants such as Xiaomi, Didi and Apple, the new generation of emerging powers, and traditional enterprises. Some are long-term ambushes, while others are immediate threats. The three major domestic players in their respective segmented markets will encounter direct competitors. This is unprecedented.

Direct competition not only means that consumers have more choices, causing market pressure, but also results in resource squeezing, including high-end talents and fragile supply chains.

The chip problem last year is still a problem this year; the price increase of raw materials such as lithium in the first quarter has brought a direct and widespread price increase to the electric vehicle industry.

Li Xiang pointed out that the brands that have already determined the second quarter battery price increase with battery manufacturers are those that have increased prices. The majority that have not yet reached an agreement will also increase prices immediately after reaching an agreement. The increase in battery costs in the second quarter will be incredible.

NIO is one of the few brands that has not yet increased prices. Li Bin pointed out that NIO still has some time to observe changes in raw material prices such as batteries. There is no plan to increase prices for now. Stable prices are beneficial to users and the market. At the same time, he called on upstream manufacturers to avoid speculative price increases and to consider long-term interests. Artificially creating price increases is not good for the entire industry.

It is difficult to judge the situation with such words.

According to our colleague Hu’s opinion, buy a car as soon as possible (original article link).

However, based on the current financial situation, it seems that not buying a car might be a better option. Once you have this idea, you will find that you don’t really care about the price increase, whether it’s a difference of one or two thousand. Just like those who buy Bentley or Rolls-Royce, they don’t have the pressure of buying a car.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.