Author: Chang Yan

“Pressure is now on XPeng’s side.”

Whether intentionally or unintentionally, XPeng has always been the last to announce sales figures each month and financial results each quarter.

As the key data of various companies continues to soar with the rapid development of the new energy industry, everyone begins to worry about XPeng’s performance.

“However, XPeng can always achieve better results and gradually turn the phrase from concern into a joke.”

And that’s exactly what happened with XPeng’s Q4 and full-year 2021 results, which were recently announced at a shareholder meeting.

“Expected to Lock in the Champion of Deliveries in the First Quarter of 2022 Among New Forces”

As each company’s financial results meeting ended, the Q1 guidance for each enterprise also appeared in public one after another.

In fact, this is a very simple mathematical problem. Given the production targets for Q1, and with sales numbers already set for January and February, it is easy to calculate sales numbers for March.

XPeng says its Q1 2022 delivery target is 33,500 to 34,000 units, the highest among the three major estimated valuations, and more importantly, when competitors lowered their March sales expectations to within tens of thousands of units, XPeng still had the confidence to deliver about 15,000 new cars that month.

Looking back at XPeng’s delivery numbers in the past 3 years, we can see that XPeng sold over 15,000 vehicles in both November and December 2021. In the face of rising industry-wide prices and shortages in the supply chain, as well as fluctuations in epidemic prevention policies in some regions, XPeng’s ability to quickly reach almost the same peak level as last year in March is closely related to its products and overall operational efficiency.

Although finding a needle in the sea seems like an easier task than accomplishing the more difficult task of 100,000 deliveries, XPeng managed to complete it.

On March 23rd, XPeng’s best-selling model, the P7, became the first pure electric new force vehicle to reach 100,000 units.

# The Success of P7 and its Implications for XPeng Motors

# The Success of P7 and its Implications for XPeng Motors

In the B-class market for pure electric cars where XPeng Motors (or XPeng) P7 competes, consumers demand more stringent and comprehensive requirements, and this field has always been the interval where the best pure electric products crowd. The fact that P7 can maintain its sales growth and stand firm again, not only implies that it has its unique value in design, configuration, and other aspects, but also indicates that the “smart” label launched by P7 from the initial release has been fully recognized.

In the company’s earnings call, He XPeng, the chairman of XPeng, stated that “P7’s delivery volume exceeded 60,000 units in 2021, winning the delivery champion among new pure electric vehicle models, which is undoubtedly a hot-selling and intelligent benchmark model, and we will strive to achieve a monthly delivery breakthrough of 10,000 units within this year.”

These characteristics have become the DNA of XPeng Motors’ brand and the technical capability that different vehicle models can learn from each other. After P5 had achieved a monthly sales of over 5,000 units, He XPeng claimed that its monthly sales were expected to gradually approach those of P7 in the second half of this year.

When discussing P5’s sales, we can see the value of refined management on the one hand. He XPeng also admitted that XPeng encountered some problems in delivery last year. A typical example was that many consumers chose models with lithium iron phosphate batteries in their orders, but due to the priority arrangement of suppliers’ production capacity, the proportion of lithium iron phosphate in the delivered vehicles in 2021 was “very small.”

However, XPeng quickly adjusted its relevant strategies this year. He XPeng stated that there are both good and bad news affecting XPeng’s delivery volume: the bad news is the epidemic, especially in Shanghai, where many supply chain’s key positions are located; the good news is that XPeng’s positions in many areas, especially in the supply of battery cells, are becoming increasingly higher.

“We will do better than we imagine.”

On the other hand, we can also see the value of intelligence. Obviously, XPeng P5 is a product with a higher “intelligent” weight than “vehicle”. The launch of urban NGP and more XPILOT functions will further improve the acceptance of this car.

In the earnings report, XPeng directly wrote that it “is expected to lock in the champion of new energy vehicle delivery in Q1 2022,” and the confidence comes from here.## The Positive Cycle of Intelligent Value and the Birth of XPeng G9

It is obvious that XPeng is in a positive cycle of intelligent dividends.

In short, XPeng’s early massive investment in intelligence is becoming the main factor for the recognition of XPeng’s products on the market, and XPeng’s revenue on the market has become an important economic support for the next round of intelligent competition.

In tonight’s earnings conference call, He XPeng put forward a very bold view. He believes that the higher the intelligence of vehicles, the greater the penetration rate of corresponding technology. For example, he believes that with the city-to-point automatic driving capability of XPILOT 4.0 without human intervention from A to B, the penetration rate of this configuration will exceed 50%.

Of course, “this needs sales data to support it.”

From a purely user-centric perspective, higher-level automatic driving capabilities can on the one hand form more obvious experiential differences and brand labels for XPeng products compared to competing products; on the other hand, stronger and more practical automatic driving scenarios will truly change the interaction between humans and machines.

At the financial report conference, He XPeng said, “The R&D progress of the core function of XPILOT 3.5 City NGP is smooth. After obtaining the approval of relevant supervisory departments, it is planned to launch City NGP in the first batch of cities at the end of the second quarter of this year.”

“The test version of City NGP is iterating rapidly, and the safety and user experience of each version are continuously improving. XPILOT3.5 based on a new architecture performs far beyond expectations in urban scenarios.”

But what surprised me is that XPeng publicly stated that “the number of takeovers per hundred kilometers in the city of NGP on the P5 mass-produced vehicle has begun to approach that of the high-speed NGP, and the comprehensive experience is benchmarking cutting-edge Robotaxi companies in China and has achieved overtaking in certain aspects.”

This not only means that the competitive relationship between traditional passenger car companies and L4-level unmanned car companies that mainly focus on Robotaxi is undergoing a transformation, but also means that the progress of new car companies in the East and the West in landing this technology in the Chinese market has undergone a transformation on this progress chart.

And the core battle situation of this transformation is XPeng G9.

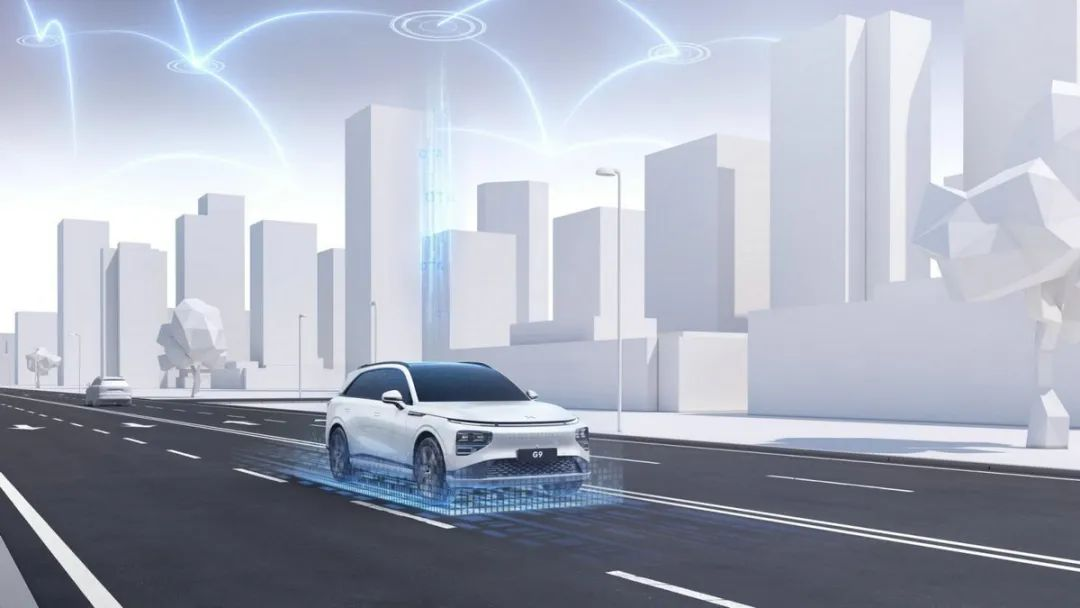

He XPeng said in the earnings conference call that XPeng G9 is progressing smoothly, and the PT production sample car has been produced and will be officially launched and sold in the third quarter of this year.

On one hand, XPeng G9 is China’s first mass-produced model based on the 800V high-voltage silicon carbide platform. He XPeng believes that this technology can make G9 a best seller like P7. On the other hand, G9 debuts with XPILOT 4.0 intelligent driving assistance system.

“Compared to other mass-produced intelligent driving assistance systems in the industry, XPILOT4.0 shows significant technological improvement. Under the precondition of ensuring high safety, XPILOT4.0 has more comprehensive usage scenarios, wider geographic coverage, and better interaction and driving experience.”

The two technologies of “electric” and “smart” are the key to XPeng G9 leading the XPeng brand to hit higher price ranges, and a higher selling price will bring higher gross profit margin, which we will explain in detail in the next section.

In addition, it is clear that XPeng G9 will only have 5-seaters and will not offer 6-seater and 7-seater design configurations, which may have an impact on some consumers’ final decisions.

The Must-Mentioned Economies of Scale

The two changes of G9 just mentioned will ultimately affect the overall planning direction of the XPeng brand.

One of them is XPILOT 4.0. In addition to its splendid technical specifications, a very critical point is that it will gradually unify the hardware and software platforms of XPeng’s new models’ intelligent driving assistance system.

In my opinion, this means that the technical segmentation between the various XPILOT versions and the complex problems of procurement, production, sales, and data usage caused by it will become a thing of the past.

In the future, different models of XPeng will be able to purchase the same hardware solution, share technical architecture, and achieve comprehensive reuse and gains of data algorithm through possible Robotaxi service.

This will be a big step forward for the XPeng brand in the field of intelligent driving.

The second one is the gross profit margin. During the earnings conference call, He XPeng talked about the expected gross profit margin for 2022. XPeng’s medium and long-term goal is to raise the company’s overall gross profit margin to more than 25%.As a point of comparison, Tesla’s indicator is 30%, while NIO is between 18-20%.

The improvement of overall gross profit margin cannot solely rely on the luck of a single product outbreak, but more importantly, it lies in platformization. This will drive XPeng’s transformation in power system, manufacturing processes and BOM cost system. The gross profit margin of new vehicle models, including G9, as well as the overall gross profit margin of the company, will be structurally improved.

Just as XPILOT 4.0 unified the soft and hard state of intelligent driving, XPeng’s entire vehicle platform will also achieve new unity and evolution next year.

The most important product news announced by He XPeng tonight is that “Xpeng Motors will launch two new vehicle platforms and their first vehicle models in 2023, namely the C-class vehicle platform and the B-class vehicle platform.”

It can be foreseen that the two new platforms will completely remove the regrets and shortcomings of the current XPeng vehicle models caused by historical platform limitations and special financial decisions and make significant progress in “design capabilities, electrification and intelligent driving capabilities”.

From technology to vehicles, the next step is production.

During the financial report conference call, He XPeng also mentioned that both new platforms will use advanced manufacturing processes (such as ultra-large integrated die-casting), which will “help Xpeng Motors achieve extremely strong cost control capabilities and cover a wider range of user groups in the rapidly growing mid-to-high-end market.”

XPeng said that the Zhaoqing factory will gradually increase its capacity to 500,000 vehicles per year, and “different vehicle models and platforms must be able to back up each other in Zhaoqing factory and other subsequent factories.”

In addition to reflecting the strong shared capabilities of new platforms and new vehicle models in terms of technology and components, this also reflects XPeng’s lessons and experiences in supply chain stability.

According to the content of the financial report conference call, in 2021, XPeng Motors developed and verified hundreds of alternative supply solutions to ensure supply chain stability. In 2022, they will still face challenges such as chip shortages and rising battery raw material costs. “XPeng Motors will continue to work with suppliers and overcome supply chain challenges with the ability to quickly develop alternative supply solutions.”Scalability has become the next key battlefield for China’s new force of car companies after achieving breakthroughs in single-product competition and brand survival. A larger product lineup means more opportunities to acquire customers up front, as well as stronger cost-reduction and efficiency-enhancing capabilities in the back end.

As other heavyweight candidates have already begun to emerge and tease their new models, it seems like the same old joke has come true again.

“Now the pressure is on XPeng.”

Let’s see if XPeng can still be the “pre-order delivery champion” by the end of the year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.