This article is authorized reprinted from Traveling Together (WeChat Official Account ID: carcaijing), which is created by Traffic Industry Group of the “Economic Observer” magazine. Author: Guo Yu, Editor: Shi Zhiliang.

This is the starting point rather than the end point. In order to win this race, besides technology, it is necessary to choose the right car companies and tell users what Lidar is and why cars with Lidar are superior.

In the past three months, the most comprehensive gathering of Lidar companies worldwide was in Las Vegas.

Whether it is foreign companies such as Velodyne, Luminar, Valeo, and Ibeo, or Chinese companies such as RoboSense, Hesai Technology, and Innovusion (Tutumuch), they all came to the US gambling city with their new products in early January to participate in one of the most anticipated global electronic technology exhibitions – the 2022 International Consumer Electronics Show (CES).

As automatic driving functions gradually become standard equipment for cars, the hardware Lidar behind autonomous driving has also stepped into the spotlight from behind the scenes. The Lidar companies participating in CES include not only veterans like Velodyne established in the last century, but also newcomers like Hesai Technology born only a few years ago.

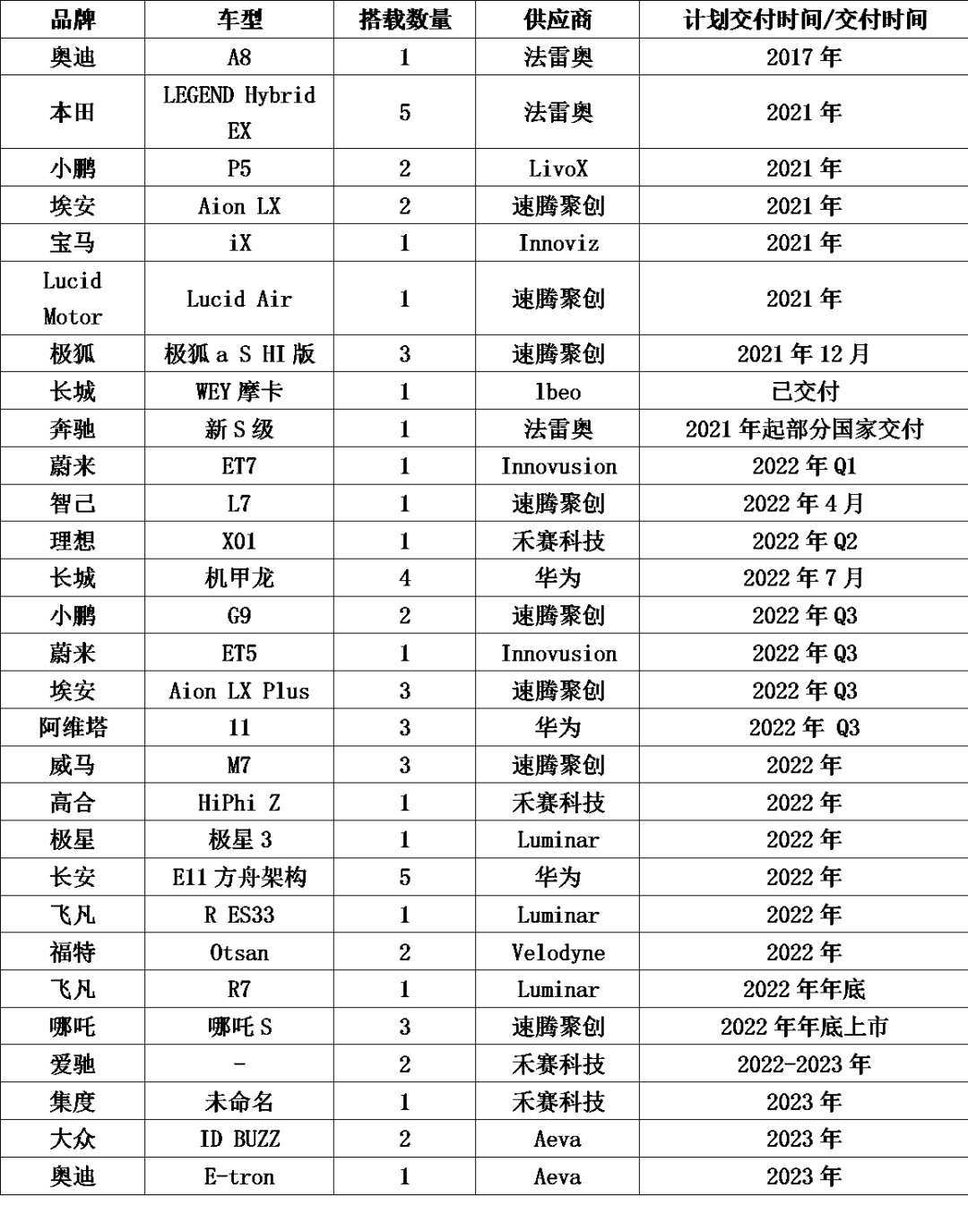

“The first year of Lidar on cars” – described the Lidar market in 2022 in the industry. With high-performance automotive-grade Lidar having already matured in terms of performance, cost, reliability, and capable of meeting mass production demands, the market recognition and application of Lidar have shown explosive growth since 2021. According to incomplete statistics from Traveling Together (ID: carcaijing), 17 models equipped with Lidar will be launched in 2022.

Consulting firm Yole predicts that the market size of automotive Lidar will reach 5.7 billion U.S. dollars by 2026. Gu Jianmin, CTO of Valeo China, estimates to Traveling Together(ID: carcaijing) that the market size will reach 50 billion U.S. dollars by 2030, and China will play an important role in it.A laser radar battle is unfolding. Innovusion Co-founder and CEO, Junwei Bao, told Carcaijing that there are currently four top laser radar companies worldwide with designated and mass production capabilities: Innovusion, Luminar, Hesai Technology, and SureStarTech. “Other manufacturers who have not yet obtained real designated projects or have no mass production plans are basically falling behind in this round of competition.”

There is still room for improvement. Are laser radars really as good as advertised after being installed? Have the laser radar companies chosen competitive host factories to sell enough related models? Especially with the current scarcity of chips. Is the current laser radar technology route the final choice for automakers? Zhang Junyi, the Director and Partner of Aowei Consulting, believes that those laser radar companies that have not yet entered the market still have a two to three year window. “If they can’t achieve mass production by then, they will basically give up.”

Coexisting with this is bubble and confusion. Several industry insiders told Carcaijing that the laser radar market is becoming a marketplace of stacked materials. Zhang Junyi believes that the performance, cost, and accuracy of laser radar from different manufacturers are different and cannot be judged solely based on quantity.

The Wind is Coming

“I am so happy that the first laser radar project funded by individuals and funds has achieved mass production.” On noon of January 26th, Zhang Junyi posted this message in his circle of friends, along with a related video of Innovusion. More than three years have passed since he invested in Innovusion.

Innovusion was founded in November 2016 and has research and development centers in Silicon Valley, Suzhou, and Shanghai, China. It is known that Innovusion has partnered with NIO, with the laser radar being installed on the NIO ET7 and ET5, with the two models to be released in the first and third quarters of 2022, respectively.

Zhang Junyi explained that investing in component projects such as laser radar is quite challenging. One needs to consider both technology and the possibility of future large-scale production, cost control, and other factors. After comprehensive deliberations, he and several partners decided to increase investment in the project, proving their high confidence in this field.

“If there are ten shortcomings in a company, but one point convinces you, and you have no better choices at the moment, you may still invest in it.” A tech investor informed Carcaijing that investing in the primary market is often a probability problem. If you encounter a particularly hot track, investing in it first may be even more critical than evaluating the company’s reliability.The laser radar being installed on vehicles is like a racetrack. As long as the racetrack remains hot, it means that there are always people willing to take over and make a profit by selling. “As for whether the company you invest in will eventually become a leading player, most investors are not concerned now. They have only installed tens of thousands of cars in total and have an estimated value of tens of billions of dollars. These companies are even more expensive than the secondary market.”

Over the past three years, Zhang Junyi’s identity has changed from co-founder of NIO Capital to partner of Aurum Partners. Now, he feels that it is difficult to invest in an established laser radar company like Innovusion. “It is not worthwhile to invest in companies in the early stages, but more prudent to invest in projects backed by industrial companies.” Zhang Junyi told Car Caijing (ID: carcaijing).

Indeed, although the technology for laser radar was originally invented overseas, Chinese companies have done the best job of engineering and mass producing it.

From 2004 to 2007, the US Department of Defense Advanced Research Projects Agency (DARPA) launched three autonomous vehicle challenge contests (DARPA Grand Challenge), which gave birth to Velodyne’s multi-beam mechanical laser radar. Velodyne soon became the synonym for laser radar and the only choice for all autonomous vehicle technology companies, occupying most of the market share of vehicle-mounted laser radar.

Now, the original inventor Velodyne is no longer dominant, and the size of laser radar has undergone changes from a large device to a small box due to changes in technological development. The buyers have also changed, with laser radar buyers no longer limited to autonomous driving companies, but also including car companies. According to Car Caijing (ID: carcaijing), as of 2022, there are 17 laser radar-equipped vehicle models on the market.

“We have indeed caught the wave of China’s new energy and autonomous driving boom. The demand in the domestic market will obviously be faster and more vigorous than overseas markets.” Qin Chunchao, co-founder and CEO of Quanergy, told Car Caijing (ID: carcaijing). Although the demand in the robotics field is also growing at a rate of one order of magnitude per year, it is totally different from the demand in the automotive field.

According to Car Caijing (ID: carcaijing), since last year, the global laser radar market has raised more than 8 billion yuan in financing, and more than 90% of the financing has been obtained by Chinese companies. At the end of February this year, domestic laser radar company Quanergy obtained more than 2.4 billion yuan in financing in preparation for IPO.

Eliminating the BubbleThe rapid development of intelligent electric vehicles in China has shrunk the changes in the automotive LiDAR market to the 9.6 million square kilometers of land. To some extent, the current status of the automotive LiDAR market in China represents the entire industry.

“Good at marketing” is the most commonly heard description of the LiDAR market during interviews with Carcaijing (ID: carcaijing).

Currently, in the industry, “equipping a car with X LiDARs” is becoming the latest mode of promoting automotive intelligence for automakers. And, “having acquired X carmaker partnerships,” as well as other quantifiers, are also becoming the latest way for LiDAR companies to promote their technology and mass production capabilities.

Many interviewees told Carcaijing (ID: carcaijing) that the automotive supply chain culture is severe, causing the market to be cost-driven. However, the large number of LiDARs cannot represent good performance. “It’s like installing multiple LiDARs that can only detect a distance of 50 meters, but cannot identify an object 250 meters away clearly,” said Wei Baoju.

An industry insider admitted to Carcaijing (ID:carcaijing) that some LiDAR companies blur key concepts, such as “mass production” when promoting products. LiDAR companies’ clients are mainly autonomous driving companies and automakers. Unlike automakers, who have large quantities of orders, autonomous driving companies should not use the term “mass production” even if they have signed a cooperation agreement for a small demand. But often, they add the two together in external promotions.

As more and more LiDAR companies are installed in cars, the slogan “the first year of LiDAR mass production” follows.

“This is more a marketing strategy for some LiDAR companies,” says He Saikang. Although LiDAR manufacturers will start delivering products in large quantities to production cars this year, the real explosion in mass production should still be in 2025. “Our framework orders are generally signed for a few years,” he said.

According to LiDAR delivery statistics, Velodyne is currently the only company in the world to achieve large-scale production. Gu Jianmin told Carcaijing (ID: carcaijing) that as of now, Velodyne has delivered more than 150,000 LiDAR units. “More than any other manufacturer in the industry.”

Laura Wrisley, Vice President of Global Sales at Velodyne, agrees with this view. She said the LiDAR market, which is set to grow the fastest in the coming years, will be driven by industrial and robotic technology, intelligent infrastructure, and smart cities, ahead of any widespread adoption of autonomous driving cars.

An industry consensus is that the effectiveness of LiDARs in cars has not yet been proven in the market, and at least another two to three years will be needed before preliminary conclusions can be made once the first batch of LiDAR-equipped cars enters the market. “At this stage, one cannot say which LiDAR company dominates the market.”It will take some time for the buzz to reach ordinary consumers.

What users can directly understand is the detection range and resolution of the LiDAR, that is, how far and how clearly this LiDAR can see. However, in addition to the performance of the LiDAR itself, the experience of the automatic driving system with integrated hardware is also very important.

A more fundamental problem is to first explain to users what LiDAR is. “How do you judge whether the LiDAR installed on this car is good or not?” When a user (ID: carcaijing) posed this question to a prospective car owner, they were immediately asked back, “What is LiDAR?”

How to Land

If there is a time window, there is a variable that can change the pattern of LiDAR.

What variables? One is the LiDAR company itself. Currently, most LiDAR companies are startups. How to adapt to large-scale production orders is a major challenge for “small workshops”. In addition, if the technology is not up to standard, there is also the risk of being replaced midway.

The second is the car company. How many LiDARs can LiDAR companies sell and how much money they can make depends more on the sales volume of the car model itself. “This is unreasonable. It’s not that the top students can always succeed.” Car companies also have the responsibility to educate users. “If the same car uses LiDAR from two different manufacturers, ordinary users cannot perceive the difference between the two, and can only judge through the experience of autonomous driving, which is closely related to the manufacturer’s algorithm.” Zhang Junyi believes that only when the autonomous driving experience is improved, the reputation of LiDAR will gradually improve, and the two are interlinked.

The third is the supply of core components such as chips, which tests both LiDAR companies and car companies. All along, whether it is the core components of LiDAR or automotive chips, they mostly rely on imports. The current COVID-19 pandemic has caused a shortage of chips, and whoever can supply them first will have a head start. However, this also requires resonance between LiDAR companies and car companies. “Many car companies have orders but no sales or deliveries due to a shortage of chips, so even if LiDAR is installed on the car, it will be very bad.”

From a larger perspective, the technological route adopted by vehicle-mounted LiDAR may not be the final choice of car companies, but only the best choice at present.Currently, the car-mounted LiDARs on the market use the time-of-flight (ToF) ranging principle, with the mechanical or semi-solid-state (MEMS micro-mirrors) technology route as the main approach. The LiDAR mainly consists of four modules: a laser emitter, a receiver, a processor, and a laser control module. Simply put, the time-of-flight method means that the emitter emits a laser with the control module directing its direction to reflect on the surface of the target object, producing a reflection beam that is received by the receiver. The processor calculates the round-trip time of this beam of light for precise distance measurement, where distance equals speed multiplied by time (the speed of light is known). As countless beams of light are sent out, countless points can be used to outline the object.

Specifically, the mechanical and semi-solid-state technology routes are suitable for two different application scenarios, without strict technical pros and cons. Mechanical LiDAR is mainly used in autonomous driving vehicles due to high performance being a priority. Large size, high cost, and even time-consuming manual tuning are not the main concerns of autonomous driving vehicles. Semi-solid-state LiDAR is mainly used in currently mass-produced passenger cars, as production costs, standardized processes, and even the aesthetics of the car’s appearance must be considered.

New technology routes are still under development. Currently, the two most promising technology routes that are widely recognized within the industry are OPA and Flash in solid-state LiDAR, and chip-stacking the components of mechanical LiDAR. However, neither route has the ability to be mounted on the car in the short term.

Leonardo sees solid-state technology as the next trend and is applying it to its near-field LiDAR (NFL) product. “The combination of these technologies will depend on the technical requirements of our customers and their corresponding applications,” said Gu Jianmin. Hesai Technology told Car Caijing (ID: carcaijing) that the company attaches great importance to the research and development of new technology routes. According to Hesai’s listing prospectus on the Chinext board in 2020 (as of the end of September), the company’s R&D investment accounted for 64% of its operating income. “We are exploring higher-performance, lower-cost solutions through chip-chipization, including pure solid-state LiDAR products that are already in our mass production plans.”

More application scenarios are being explored. One or more LiDARs are needed in enclosed or semi-enclosed environments such as factories, warehouses, ports, as well as smart infrastructure such as the Internet of Vehicles, rail transit, and highways. Bao Junwei believes that LiDAR may become ubiquitous like cameras in the future and become a necessity in life.

Realizing this future will take some time. When asked by Car Caijing (ID: carcaijing) whether they are considering purchasing a car with LiDAR, a respondent said, “To be honest, I am still in the stage of deciding whether to buy a fuel car or an electric car. I haven’t even considered LiDAR yet.”

Translation:

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.