Author: Zhu Shiyun

Editor: Qiu Kaijun

“Unworthy of the name.”

On February 26, Zhang Yong, co-founder and CEO of NIO, said this (as shown in the figure above) when receiving the 2021 Annual Person of the Year award from First Electric Cars.

The other candidates included Xiaoli Wei and the founder of BYD.

“We cannot be more deserving than the previous competitors, and it’s a bit unworthy of the name. In terms of enterprise management, technology, operation, user, research and development, we should learn from the previous big brothers and good friends,” Zhang Yong said.

However, at least in terms of sales, NIO is qualified to be compared with Xiaoli Wei. According to the February 2022 sales report, NIO ranked second in the monthly sales of new car makers with 7117 vehicles, surpassing XPeng, and the gap with the first Ideal was only 1300 vehicles. This is not the first time that NIO has ranked among the top three in the monthly sales of new car makers. The “NIO vs. Xiaoli Wei” pattern has already stabilized.

But Zhang Yong doesn’t think so: “(The standard to surpass Xiaoli Wei should be) NIO’s sales difference with Xiaoli Wei should be greater than the price difference between the two.” What he referred to was Xiaoli Wei’s single vehicle price, which is several times higher than NIO’s. NIO must sell several times more cars than Xiaoli Wei to catch up with the latter.

As clear-minded as Zhang Yong, NIO’s position is being positioned correctly.

In fact, after Xiaoli Wei became the leader of China’s new car makers, NIO is the closest one to them. Many investors, dealers, and suppliers are looking for the next new force worth investing in.

Is it NIO?

This article will comprehensively analyze the differences between NIO and Xiaoli Wei from aspects such as sales, operation, production capacity, channels, services, supply chain, financing, and research and development.

Both are 100,000 vehicles: the sales volume differs several times

On January 8, 2022, NIO “hit the line” of 100,000 vehicles, 1042 days after the delivery of NIO NO1 in August 2018. Compared with Xiaoli Wei, NIO started delivery of vehicles later but was the last one to reach 100,000 vehicle deliveries.

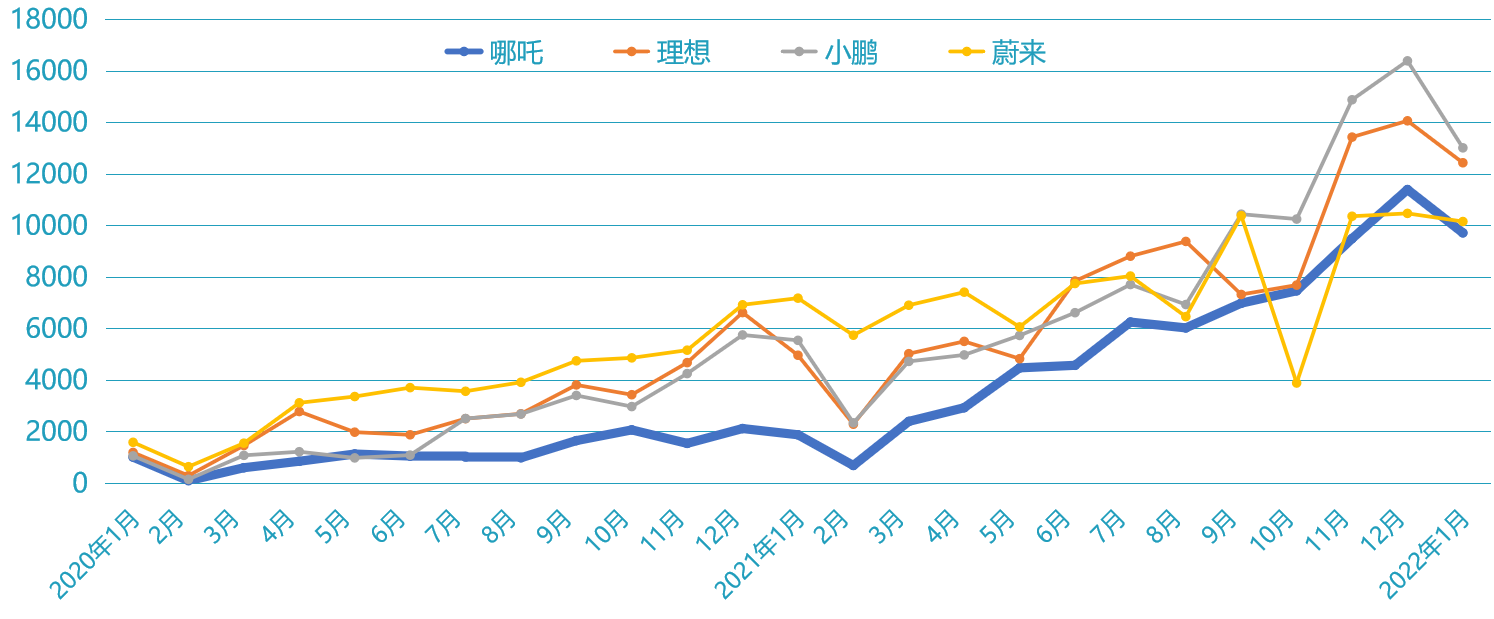

NIO’s sales have caught up with Xiaoli Wei

However, since October last year, NIO’s sales curve has suddenly become steep. Moreover, NIO’s sales growth is limited by production capacity and the supply chain, rather than market demand. Some dealers have orders that are even double the delivery volume. For a while, NIO became a “new emerging force” worth paying attention to.

Both are 100,000 vehicles, but the direct benefits NIO got are far behind Xiaoli Wei.According to 360’s investment announcement, in the first half of 2021, NIO achieved a revenue of 1.63 billion yuan and sold 17,000 vehicles, with an average revenue per vehicle of 958,000 yuan. By comparison, NIO, XPeng, and Li Auto achieved single-vehicle revenue of 3.77 million yuan (cumulative as of Q1 2021), 2.296 million yuan (cumulative as of Q3 2021), and 3.347 million yuan (cumulative as of Q3 2021), respectively, when reaching the threshold of 100,000 vehicles, which were 3.9 times, 2.4 times, and 3.5 times that of NIO.

Based on the single-vehicle revenue of 958,000 yuan, 100,000 vehicles would bring NIO a revenue of 95.58 billion yuan. In comparison, NIO, XPeng, and Li Auto generated revenues of 37.0 billion yuan, 20.6 billion yuan, and 29.4 billion yuan, respectively, from 100,000 vehicles sold (at the same points in time).

NIO’s disadvantage lies in its lower vehicle pricing. Currently, NIO V accounts for about 70% of NIO’s sales structure, with a price ranging from about 60,000 to 120,000 yuan for a smart electric vehicle. The more upscale NIO U PRO is priced between 100,000 and 160,000 yuan. Compared with NIO, XPeng, and Li Auto, NIO’s prices are significantly lower.

Of course, this also means that NIO’s potential market space is much larger than that of XPeng and Li Auto.

Single-Vehicle “Burn Rate”: NIO is Not Inferior to XPeng and Li Auto

Apart from the benchmark of 100,000 vehicles and monthly sales of over 10,000 units, the most attention-grabbing criterion for new car-making forces is the “burn rate” efficiency.

In the first half of 2021, NIO incurred a net loss of 690 million yuan, with an average net loss per vehicle of about 40,500 yuan. The estimated business loss is about 46,000 yuan per vehicle (calculated based on a 13% value-added tax rate for the manufacturing industry), higher than the loss levels of NIO and Li Auto at 30,000 yuan and 32,000 yuan per vehicle, respectively, during the same period, but lower than XPeng’s 69,500 yuan per vehicle.

It is worth noting that in this period, besides NIO enjoying greater economies of scale than its competitors, NIO’s level of scaling was nearly equal to that of XPeng and Li Auto.

At the end of June 2021, NIO had sold more than 120,000 vehicles, while XPeng and Li Auto had cumulative sales of 65,000 and 64,000 vehicles, respectively, and NIO had delivered 50,000 vehicles.

This means that, in terms of scaling, NIO has a comparable burn rate per vehicle to XPeng and Li Auto, but only about 30% less than XPeng, which has a higher unit price, and about twice that of Li Auto.Although a higher unit price means a higher gross profit margin, it also brings higher sales expenses, especially for NIO who mainly operates under their direct sales system. In the first half of last year, NIO’s single-car sales expenses were 66,000 yuan, 58,000 yuan and 47,000 yuan, respectively.

“In contrast, NIO’s current channels are still mainly through dealerships, theoretically reducing sales expenses and operational costs. One NIO dealer told “EV Observer” that last year, NIO’s subsidies for single stores in new and second-tier cities were around 2.4 million yuan, paid over three years. Dealers profit through price differences and rebates. In addition, NIO also bears daily customer operation expenses such as 2,000 kWh/year/vehicle, three-lifetime battery guarantees, and replacement costs. However, the various miscellaneous costs that arise from enhancing the brand through strong service are borne by dealers.”

Looking at the operating profit margin, NIO is estimated to be around -48% in the first half of 2021, while Li Auto is -7.5%, -31% and -11%, respectively.

Obviously, NIO, which is entering an upward trend, needs to work harder to squeeze itself, especially when compared to the efficient Ideal vehicles.

Production Capacity: Insufficient and Idle

“The current heavy losses from each of NIO’s single cars may be related to their production layout.”

As of the end of June last year, Li Auto had production capacities of 120,000 vehicles/year for its collaborations with NIO and Jianghuai, 100,000 vehicles/year for XPeng’s factory in Zhaoqing, and 100,000 vehicles/year for Ideal’s factory in Changzhou, all of which are operating at full capacity. “In contrast, NIO, with its “dual certifications and dual factories” policy, was struggling.”

According to insiders close to NIO, their Tongxiang factory, which has a planned capacity of 80,000 vehicles, had only planned to produce 40,000 vehicles in the first year of 2021. However, at the same time, NIO also had a Yichun factory, which was still in small-scale production stage as of October last year. Furthermore, NIO has also planned a capacity of 100,000 vehicles for its Nanning factory, which is expected to be completed by the end of 2021.

In mid-2021, NIO had a total existing, trial production, and under construction capacity of 280,000 vehicles. However, their sales volume in the first half of the year was only 17,000 vehicles. Insufficient rates will certainly bring higher costs to their half-yearly financial report. “It is not NIO’s wish to bear the heavy burden of production capacity before achieving large-scale sales. Compared to Li Auto, NIO’s financing process before the “takeoff” of sales has been more difficult. Tongxiang and Yichun’s investment institutions were all their investors. Considering the example of Hefei investing in NIO to save them in the past, it is not difficult to understand why NIO’s production layout is faster than its business development pace.”However, it was only in the second half of last year that Weima started to expand its production, and the planned production capacity of 240,000, 200,000, and 200,000 units did not officially come to fruition until the end of the year; in contrast, NIO’s production capacity will be able to fully meet its fast-growing demands. Early challenges may also become benefits later on.

Sales System Construction: NIO vs. Weima

Despite the difficulties along the way, during the accumulation process of 100,000 units, NIO has built a sales system that is not inferior to that of Weima’s.

In terms of vehicle models, NIO already has three models on sale and one quasi-mass production model, comparable to the model matrix of NIO and XPeng. Ideal aims to produce a second model that is comparable to the Ideal ONE based on the foundation of 100,000 units.

In terms of sales channels, as of the end of 2021, NIO has built 333 sales and service network systems, including 70 direct stores, covering 193 cities. At its 100,000-unit mark, Weima built 234, 271, and 220 sales and service networks, covering 123, 95, and 204 cities, respectively. However, this also shows that NIO’s efficiency per store is relatively low.

Regarding infrastructure, on the eve of achieving 100,000 units, NIO has built a charging network of 1,637 free charging stations in cooperation, covering 150 cities. Under the same mark, NIO has laid out 146 supercharging stations, 1,826 destination charging piles, and 203 battery swapping stations nationwide. XPeng has set up 550 supercharging stations and 129 destination charging stations in 158 cities. Ideal has not yet built or laid out its charging infrastructure.

The expansion of the sales and service network system has driven NIO to complete the “battlefield” transformation from rural areas to cities, from B-end to C-end.

Official data shows that in 2021, NIO’s users in first-tier, new first-tier, and second-tier cities accounted for as high as 64%, and the individual users of its flagship model NIO ES8 have exceeded 92%. In new first-tier, second-tier, and third-tier markets, individual users accounted for 79%, 82%, and 90%, respectively, higher than the industry average.

Scale Competition: NIO “Card Position” Among New Forces’ Greater Players

For 2022, Weima has respectively proposed “guaranteed” targets of 150,000, 250,000 and 200,000 units, while NIO has set a target of 150,000 units to stay in the head group position, but it also needs to withstand greater risks and pressures.After the 2022 Spring Festival, many new energy vehicle models have raised the prices by RMB 2,000 to RMB 8,000, due to subsidies reduction, chip shortage and soaring prices of battery raw materials. The entry-level brand, Ora, has even stopped taking orders for Black Cat and White Cat models priced under RMB 100,000, reacting fiercely. NETA, which is also positioned at RMB 100,000, has raised the prices of three models by RMB 2,000 to RMB 7,000. Unlike Ora, NETA hopes to maintain its growth momentum despite the price hikes.

“The pressure we face is the same, but we are at different stages of development from Ora”, said Zhang Honghan, Deputy General Manager of NETA Brand Center, in an interview with Electric Vehicle Observer. “Ora needs to cooperate with the Great Wall system, while NETA is in an important ‘positioning’ stage. If we still sell two to three thousand vehicles a month, no one will ask us about our subsequent arrangements. Staying in the game gives us more opportunities, more attention and more confidence from customers.”

The competition landscape of the new energy vehicle market is uncertain, and new carmakers are still fighting for survival. At this time, scale is far more important than profit or loss, because sales not only bring revenue, but also brand awareness to consumers and investors – an opportunity for long-term development.

Stress Tolerance: Cash Flow and Financing Competition

New carmakers are burning money while expanding their scale. This will be a dangerous “game” – cash flow can be cut off at any time. In Q3 2021, NIO and XPeng posted net losses of RMB 34,000 and RMB 62,000 respectively, while Li Auto had an average net loss of RMB 35,500 per vehicle for the whole year. Based on this net loss, if NIO, XPeng and Li Auto all achieved their full-year targets in 2022, they would face net losses of RMB 5.13 billion, RMB 15.53 billion and RMB 7.1 billion respectively.

As of the end of Q3 2021, NIO and XPeng had cash and cash equivalents of RMB 47 billion and RMB 45.3 billion respectively, while Li Auto held RMB 50.1 billion in cash by the end of last year.

Compared with the “burnable” NIO, XPeng and Li Auto, NETA will face greater pressure to achieve its goal of 150,000 vehicle sales.# NIO’s Cumulative Losses Exceed RMB 7.5 Billion in Contrast to Great Expectations for the Future

NIO, a member of Hezhong New Energy Automobile, has secured over RMB 120 billion in credit lines from banks and a cumulative total of approximately RMB 340-400 billion (assuming undisclosed information shows the amounts raised in the B+, B++, and D+ rounds were RMB 20 billion each) since its financing began in September 2017. Moreover, with approximately RMB 95.5 billion in operating revenue, NIO had received up to RMB 340-400 billion by the end of last year.

In the first half of 2021, NIO reported a net loss of RMB 2.014 billion, according to a loss of RMB 40,000 per vehicle. Based on this calculation, the net loss from selling 47,692 vehicles in the second half of the year was over RMB 1.9 billion. With consideration given to the disadvantageous effects on the new energy automobile industry in 2022, NIO expects this year’s per vehicle loss to decrease by 40% to RMB 24,000. The net loss incurred from selling 150,000 vehicles would then be RMB 3.6 billion. As a result, the amounts of actual and projected losses will exceed RMB 7.5 billion, accounting for between 19% and 22% of NIO’s total capital over the years.

However, NIO’s fast-paced growth has made the company more likely to obtain capital from the market than in the past. After sales saw growth in the second half of last year, NIO completed its D2 round of funding led by CATL before the year’s end and won another RMB 2 billion D3 investment from CRRC and Shenzhen Capital Group at the end of February.

Furthermore, media reports note that NIO is planning a Pre-IPO round of financing aiming to raise $500 million with a target valuation of RMB 45 billion.

Sustainability: An Opportunity to Catch up with Selling Three to Five Hundred Thousand Vehicles

Despite paying attention to “staking out a place,” Zhang Yong, CEO of NIO, does not consider selling accumulated 100,000 vehicles or annually selling 150,000 to 200,000 vehicles as being among the head of new car makers. “I don’t think anyone can claim the title until they sell between three to five hundred thousand vehicles annually. Everybody should put in their effort to survive,” he told “Caijing Auto.” To that end, NIO has adopted the “three cards”: smart, extended range, and channel expansion, to develop systems capable of selling three to five hundred thousand vehicles.

At the beginning of 2021, NIO announced that it would invest RMB 2 billion in constructing an intelligent technology research and development center. On the same day, NIO unveiled its EQS-class NIO U, the only vehicle in its class equipped with a level-2 smart driving assistance system, as well as its Eureka 03, an under-development model using an extended-range and SOA architecture with domain control, making it capable of partial L4 autonomous driving in certain scenarios. The NIO S, which is also capable of extended-range and will be released this year, is part of the same system.The U and S models will lead NETA to make a “leap” from the 100,000 yuan market to the 150,000-200,000 yuan and above market, and more importantly, steer the NETA brand from “high performance-price” to “intelligentization” transformation, thus building a more sustainable competitive foundation.

Under this strategy, although it is far from being listed, NETA S has already called for the slogan of “catching up with the first generation” of intelligentization. “Thanks to the installation of TA PILOT 4.0, NETA S has achieved the same level as the current leading competitors in terms of intelligent driving.” Wang Junping, deputy director of NETA Automobile Intelligent Research Institute and responsible for intelligent driving, said at a press conference.

Of course, the aspiration of “catching up with the first generation” is beautiful. Whether it can really be achieved remains to be seen.

In addition to catching up on the intelligent driving track, NETA will also continue to enhance its unique competitive advantage in its system capabilities.

On the one hand, NETA plans to expand the number of directly operated stores from 70 to 100 and increase the coverage of 60 new cities to reach 250 cities in 2022. Compared with the direct sales-oriented WEY XUANYI, NETA, which is currently based on city partners, has advantages in network expansion speed and sales service operation pressure.

On the other hand, NETA S will provide two power modes: pure electric and range-extender. The range-extender system has a pure electric cruising range of up to 200 kilometers and a comprehensive range of 1100 kilometers, exceeding the industry mainstream level of 800-900 kilometers for range-extender vehicles. Entering the blue ocean submarket in the red ocean has always been NETA’s advantage. In the context of battery cost pressure and uneven distribution of charging infrastructure across the country, the range-extender systems of Idean ONE and Voyah, both of which are powered by NETA cars, have proved market demand.

NETA hopes that through the range-extender B-class car positioning of NETA S and its better intelligent and operational performance, it can form effective differentiation from new car forces and mainstream brand models of the same level, thus transforming into tangible and long-lasting competitive advantages.

Key competition point: Who is more intelligent?

XPeng is recognized as the leading competitor in China’s intelligent driving field. In the official data of NETA, NETA S and XPeng P7 are also examined in the same target audience.

So, who is more intelligent?

In terms of hardware, the TA PILOT 4.0 system NETA S will deploy uses Huawei MDC610’s automatic driving hardware platform, as well as the Huawei Ascend 310 chip, with a single-chip computing power of 16 TOPS and a platform computing power of 200 TOPS; the perception system consists of 2 solid-state LiDARs, 11 auxiliary driving cameras, 5 millimeter-wave radars, 12 ultrasonic sensors, a total of 30 sensors; the electronic and electrical architecture is based on Ethernet, including 5 functional areas such as Smart Cabin and smart driving.

XPeng P7 applies NVIDIA Xavier for autonomous driving chip, with a single-chip computing power of 30TOPS; the perception system consists of 30 sensors including 12 ultrasonic sensors, 5 high-precision millimeter-wave radars, and 13 autonomous driving cameras; the electronic and electrical architecture is controlled by four domains, power, body, intelligent driving, and intelligent entertainment.

From the hardware perspective, XPeng P7, lacking lidar, mostly adopts the fusion of visual perception and high-precision map, while NETA S, with the assistance of lidar, will have a higher level of safety redundancy during autonomous driving.

In terms of software, both XPeng and NETA have announced the adoption of full-stack self-developed software to build their own autonomous driving systems. NETA engineers told Electric Vehicle Observer that the middleware part of NETA S software is entirely “written” by NETA itself.

It’s worth noting that compared to XPeng and NVIDIA, NETA and Huawei in China may have better collaborative advantages in software and hardware integration.

In terms of functionality, XPeng P7 equipped with XPILOT 3.0 system can realize navigation assisted driving functions on high-speed and city expressways, as well as memory parking functions in parking lots. NETA TA PILOT 4.0 can realize intelligent navigation on high-speed and city roads, as well as memory parking.

NETA claims that NETA S can achieve parking and long-distance summoning functions on unstructured roads within the last 5 kilometers without the help of high-precision maps.

However, it is not fair to compare the not-yet-delivered NETA S with XPeng P7, which was delivered in 2020. The XPeng P5, which began to be delivered at the end of 2021, is currently the highest level of XPeng.

XPeng P5 is equipped with two hybrid solid-state lidars and can realize navigation assistance functions on city roads (unstructured roads) under the XPILOT 3.5 system. This is what NETA TA PILOT 4.0 hopes to achieve.

Currently, the total number of employees in NETA’s intelligent research institute exceeds 600, including more than 300 in the intelligent driving team. According to Wang Junping, the proportion of master and doctoral degrees in the intelligent driving team is over 80%, and the proportion of algorithm software personnel is about 70%. This team is still small compared to that of WmAuto, especially XPeng.

This year, NETA will expand the number of employees in the intelligent research institute to more than 1,000, and the intelligent driving team will reach more than 500 people. In the future, NETA’s investment in autonomous driving will continue to be maintained at 800 million to 1 billion yuan per year.

Summary: It’s still a qualifying round for now.As Zhang Yong said, there is still a considerable gap between NETA and XPeng in terms of enterprise operation, technology, operation, user and R&D, but NETA also has its advantages in positioning and has the basis for catching up.

In addition, compared with Li Bin, Li Xiang, and He XPeng, although Zhang Yong does not have an Internet halo, he is the most insightful product manager in the small car market. His precise definition of NETA V reversed the trend of NETA. Moreover, although he is a traditional marketing person, Zhang Yong also has an open-minded attitude and learning ability, and is growing into a qualified operator of an intelligent electric car enterprise.

The war of intelligent electric vehicles is an unprecedented war. To win, it is not about comparing current strength, but comparing learning ability.

The war has just begun. “Now is still the qualifying round, and the future is the elimination round. After 2025, you still have the opportunity to catch up on the leaderboard,” Zhang Yong said.

Despite the ups and downs, NETA can still persistently catch up with XPeng until its sales are comparable, which shows its strong determination and learning ability.

Looking to the future, the popularization of intelligent electric vehicles is entering a deeper phase, from high-end cars to economic models, and this is where NETA is located. Although the slogan “making cars for the people” is tacky, the size and depth of the “people” market are indeed limitless. NETA needs to maintain strategic determination on the basis of the current “positioning,” continue to improve itself, and be a friend of time.

“My fate is not controlled by heaven, but by myself”- this enterprise motto may be somewhat juvenile, but with sincerity, a stone can be broken.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.