Transformation Plans of Two Korean Automotive Companies: Hyundai and Kia

Author: Zhu Yulong

At the beginning of the year, two Korean automakers, Hyundai and Kia, released their “2022 Kia CEO Investor Day” and “2022 Hyundai CEO Investor Day” respectively. At this juncture, on the one hand, they emphasized the achievements of their previous pure electric vehicle development and launched a new electric vehicle platform (the modified IMA). On the other hand, they continued to invest in automation.

I plan to write two articles this weekend to explore the progress of the transformation plans of the two Korean automotive companies.

Overview of the Two Strategies

Pure Electric Vehicles

In 2021, Hyundai sold 141,000 BEVs, with the goal of doubling it to 840,000 by 2026 and 1.87 million by 2030. Kia’s goal for 2022 is to sell 160,000 BEVs, to increase it to 807,000 by 2026 and 1.2 million by 2030. The two Korean car companies aim to sell 3.087 million BEVs in 2030.

Intelligent and Autonomous Driving

Previously, Hyundai and Kia had invested a lot of resources in autonomous driving. In 2022, Hyundai will also need to perform high-speed highway L3 on the G90 luxury car, continuing to evolve along the way. In terms of parking, based on the previous Lidar function, they will develop the second-generation RSPA function and evolve it into remote automatic parking. Starting from this generation, the parking and autonomous driving controllers are integrated.

Kia’s strategy is essentially the same as Hyundai’s. Of course, based on the previous RoboTaxi, the two Korean car companies will independently evolve.

For auto companies that have not split their electric vehicle and traditional internal combustion engine businesses, it is actually very difficult to increase the electric vehicle’s sales volume to a certain level. Hyundai and Kia have done it quickly. They first evolved rapidly from the EMP platform to the next-generation IMA (Integrated Module Architecture).

Update of the Vehicle Platform and Iteration of the Battery

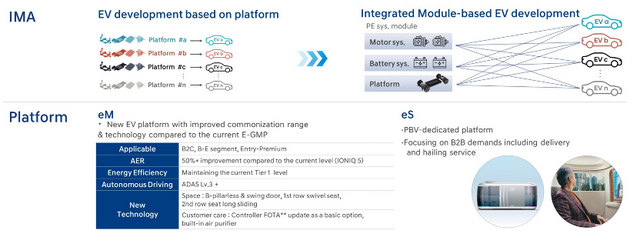

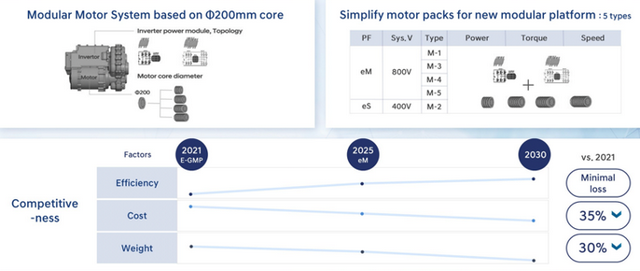

The core of this strategy is the development system of integrated modular architecture (IMA), with the aim of standardizing and modularizing the core components of electric vehicles such as batteries and motors, and flexibly applying them to each model to achieve efficient product lineup expansion.Modern plans to complete this work by 2025. After EMP, it will quickly evolve into the pure electric passenger car platform eM and the Purpose Built Vehicle (PBV) platform eS. Compared to the current E-GMP, eM will increase its coverage to cover all segmented markets, increase its cruising range by over 50%, and standardize various new technologies such as L3 level autonomous driving technology and OTA. eS is designed as a skateboard chassis (whether to invest in Cannon or leave some things behind) to enhance flexibility, not only for delivery and transportation services, but also to respond to B2B demands, supporting vehicle call services, sharing businesses, and B2B business areas.

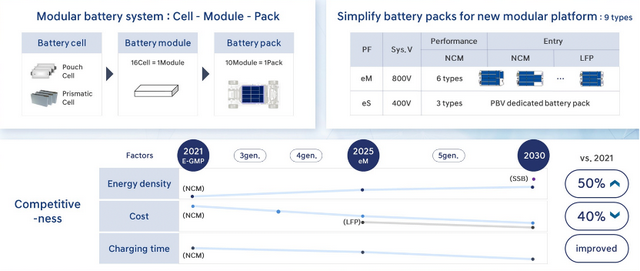

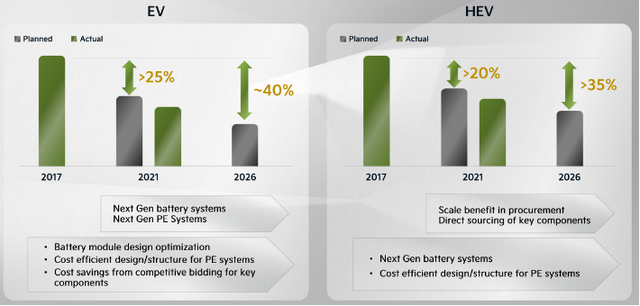

The next generation of Modern’s battery system standardizes to nine types, consisting of the battery technology stages of lithium battery cells (cell), battery modules (Batteries) and battery packs (pack). It has now changed to a cell-to-pack method, adding module proportion to increase energy density. The CTC process, which directly integrates the core and chassis, is also under consideration. From the perspective of 400 and 800V, the entire eM series is equipped with 800V, divided into a performance version and a basic version. The former only has a ternary plan, and the latter includes both ternary and lithium iron phosphate versions. Only the eS series has a 400V system. Through new designs, it is planned to increase battery energy density by 50% by 2030 compared to 2021, and reduce costs by 40%. Motor costs will be reduced by 35%, and weight will be reduced by 30%.

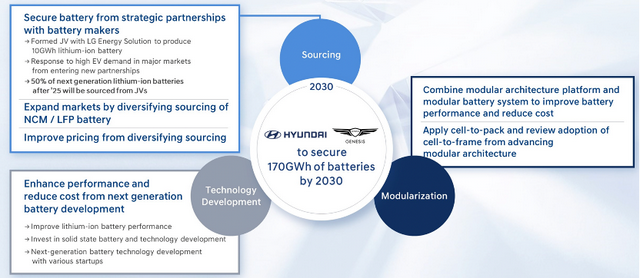

The joint venture battery factory with LG can supply 10 GWh, and in the future, 50% of the next generation batteries will be purchased from the joint venture battery factory after 2025. To enter the market, both lithium iron phosphate and ternary battery cells will be purchased (which is also why Modern has to purchase Chinese battery cells). In terms of investment, the main investment will be in next-generation battery cell technology and solid-state batteries, accumulated through global start-up companies. By 2030, Modern will need 170 GWh. In fact, if we calculate Tesla’s needs in 2022, it’s only about 110GWh, so the demand for Modern will still rise relatively slowly.

Note: Now, start-ups in the advanced battery industry need to be concerned about the continuity and form of cooperation with automotive companies.

Similar to modern times, KIA’s demand for power batteries will reach 119 GWh by 2030. In terms of battery cells, the switch to 5th generation battery cells will be made in 2025, and the cost of battery cells in 2030 will have a 40% decrease compared to that in 2022. The currently locked-in capacity for battery cell production is approximately 13 GWh, and additional capacity of 69 GWh/119 GWh in 2026 and 2030 will be completed through joint ventures or local procurement. From the current perspective, an open procurement process will be used to achieve cost reduction (which I think is difficult to achieve now).

The motor system will be developed by standardizing it into five types that can cover the needs of each vehicle type. By 2030, it is expected that the cost will be reduced by 35%, weight by 30%, and efficiency maximized.

Interestingly, both Hyundai and KIA will launch larger vehicle models, such as KIA’s EV9, which will be larger and cooler. Therefore, I believe that Korean car companies want to push a relatively high-performance and cost-effective large electric vehicle globally through new forms. There are many aspects in which Korea is fast in following trends.

Summary: In the era of smartphones, Korean manufacturers lost the Chinese market, but from a global perspective, Samsung is still in a relatively good position. Objectively speaking, Hyundai and KIA have had a very difficult time in China in recent years, but their development and iteration speed is good on a global scale. In terms of pure electric vehicles, traditional car companies are also developing relatively quickly.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.