Tesla’s Full Self-Driving (FSD) system has recently encountered another issue. In early February, Tesla was requested by the US safety regulator to recall nearly 54,000 cars and SUVs because the FSD system did not come to a complete stop at stop signs when activated, but rather slowly passed through them at extremely low speeds.

In the United States, many intersections do not have traffic lights, and STOP signs serve as a substitute. Drivers must come to a complete stop at STOP signs, observe and assess the road conditions for at least three seconds, and proceed only if there are no risks. When there are no cars around, some experienced drivers choose not to stop and instead proceed at a low speed.

Tesla’s FSD system functions in the same manner. When it detects no vehicles, pedestrians, or cyclists nearby, FSD rolls past the stop area at a maximum speed of 9 kilometers per hour. This feature is commonly known as “rolling stop”. Although “rolling stop” has not caused any accidents, with nearly 60,000 Tesla vehicles equipped with this function, it puts significant pressure on safety regulators.

The regulators expressed their frustration, stating that they cannot control people who disregard traffic rules, but can they not control FSD? One official notice required Tesla to “recall” all cars with open FSD features. Although they are officially recalled, these cars do not require a physical return to the factory. Tesla stated that it would disable the “rolling stop” function in the next OTA upgrade.

As an industry leader, Tesla’s FSD system has garnered widespread attention with every upgrade since its release. The US transportation regulatory authority has not only been monitoring the progress of FSD closely, but has also been filling the legal gap in the field of autonomous driving, which validates Tesla’s leading position in the industry.

As a technology leader, how many years ahead is Tesla’s FSD than domestic cars? What efforts have domestic automakers made to close the gap with Tesla?

Domestic automakers’ challenges in catching up

Like many domestic automakers, Tesla also relied on various suppliers for autonomous driving technology in the early stages.

The first supplier was a visual solution provider, Mobileye. Mobileye’s excellent environmental perception capabilities helped Tesla introduce the first-generation hardware HW 1.0 and the Autopilot cruise assistance function in 2014. However, Tesla found that Mobileye’s software update capabilities did not keep up with their fast iteration requirements, so it abandoned Mobileye and developed its own algorithm.The second supplier is the old friend of autonomous driving Nvidia. In 2016, after abandoning Mobileye, Tesla used the best autonomous driving platform at that time, Nvidia PX2, and installed eight cameras on all new vehicles, that is, Tesla’s second-generation hardware platform HW 2.0. Its self-developed perception algorithm deployed completely achieved Mobileye’s perception capability. In February of the same year, Tesla started to develop its own chips, and after three years, it finally abandoned Nvidia and used its self-developed FSD chip in 2019.

The third supplier is the radar supplier Continental. Since the first Tesla was manufactured in 2016, every Tesla has been equipped with Continental’s millimeter-wave radar to assist in visually measuring the distance and speed of surrounding objects. Until June 2021, Tesla’s AI director Andrej Karpathy announced at CVPR that the pure visual ranging and measurement of FSD can be as good as radar. The problem of false alarms caused by radar has caused trouble to FSD. Therefore, they decided to remove radar and move forward on the pure visual path.

Tesla entered the game early and is a firm believer in pure visual perception. All models use the same set of perception hardware, allowing data accumulated since the beginning of HW 2.0 to be used until now. Tesla uses its advantage in having a large number of mass-produced cars to collect data efficiently and continuously from consumer scenarios by establishing 221 triggers to collect the data they want (such as when they detect that the brake light of a certain target is on but it is still accelerating, they collect the data), resulting in efficient and continuous collection of consumer scenario data.

The constant stream of data, together with Software 2.0 (data-driven neural network), realizes the complete mapping from visual to vector space, allowing Tesla to take the lead in achieving closed-loop data in the industry, giving itself a lead of 1-2 years over other rivals. Andrej Karpathy also announced their plan in the recent Tesla AI Day and clearly stated that even if other competitors know how Tesla does it, it is difficult for them to imitate.Although major domestic auto manufacturers envy Tesla’s achievements in FSD, they are reluctant to completely copy Tesla’s approach. Firstly, copying the plan inevitably requires huge financial and human resources, and it is uncertain whether these investments can achieve the level of FSD. Secondly, even if the automotive companies are willing to invest, they always lag behind Tesla by 1-2 years, and can never keep up with Tesla’s pace, so they have no competitiveness in this field.

In the face of such a dilemma, what efforts have major domestic auto manufacturers made?

In fact, domestic automakers have the same technological roadmap as Tesla on a large scale. From easy to difficult, they have determined the route of priority lane cruising (corresponding to Tesla’s Autopilot), followed by high-speed/highway assistant driving (corresponding to Tesla’s NOA), and finally challenged urban autonomous driving (corresponding to Tesla’s FSD).

Due to not having Tesla’s mature and powerful generalization perception capability, domestic automakers have chosen to use high-precision maps and hardware upgrades to quickly achieve NOA and FSD.

Dilemma of high-precision maps

The introduction of high-precision maps can greatly reduce the difficulty of developing navigation assistance driving. It is like paving tracks on real roads. The automatic car only needs to follow the track information provided by navigation and keep moving forward. In a sense, autonomous driving that uses high-precision maps should not be called an autonomous driving car, but an autonomous driving train.

WEY, XPeng Motors, and Li Auto were the first to apply high-precision maps to assisted driving. Taking Ideal ONE as an example, its NOA implementation logic completely trusts the road structure information provided by high-precision maps. Compared to Tesla that purely relies on visual perception to identify roads, its stability is higher and less prone to interference by weather and lighting.

However, high-precision maps have a big problem – data freshness. If road repairs cause changes in road structure and the high-precision map is not updated in time, incorrect driving or even illegal lane changes may occur.

Dilemma of hardware upgrades

When Tesla FSD removed the millimeter-wave radar, domestic automotive manufacturers chose to install more sensors and increase chip computing power in order to compensate for the lack of perception capability through more sensors and computing power.

The number of LIDARs increased from 0 to a maximum of 4, and the number of millimeter-wave radar increased from 1 to a maximum of 6. Visual perception is no longer satisfied with monocular long-short focus and binocular mixed use, and chip computing power has expanded from several tens of TOPS to over a thousand TOPS.

Multiple sensors can compensate for the shortcomings of a single sensor, but when the number of sensors increases to a certain point, the impact on system performance may not be so significant, and even negative effects may arise. For example, with a stereo camera, when the glue and plastic in front of it soften in hot summer weather, the geometric parameters of the camera change, requiring additional methods and algorithms to correct this issue. The more sensors, the more potential issues there are.

What Should Carmakers Do to Outpace Tesla?

Given Tesla’s absolute lead in the field of autonomous driving, it is difficult to catch up in the next few years. Since domestic automakers have already produced products that exceed Tesla’s NOA experience through high-precision maps and hardware upgrades, they should continue down this path. They can compete with Tesla by utilizing strong domestic supplier ecosystems, including autonomous driving chips, high-precision maps, and sensors, to narrow the gap.

Pay Attention to the Ability to Combine Chip Software and Hardware

Many automakers fall into the trap of pursuing high computing power when choosing autonomous driving chips. It seems that the higher the computing power, the better the performance of the autonomous driving system. According to this logic, Tesla’s FSD with 144 TOPS is more than enough. However, FSD with 144 TOPS has already achieved “fully autonomous driving.”

In fact, what is lacking in the chip field is not computing power, but the ability to combine software and hardware. Tesla and Mobileye in foreign countries, and Horizon, a domestic autonomous driving solution provider, have all realized the importance of combining software and hardware.

When chip manufacturers have a clear understanding of the autonomous driving problems that need to be solved, the things that need improvement, the areas where they need to do well, and the areas that are not important, they have a rough software design in mind. Only high-efficiency execution of the final software on such hardware is what truly matters.

AI chip manufacturers such as NVIDIA and Qualcomm have chosen the route of decoupling software and hardware for flexibility, but the trade-offs they have made and the areas that perform well and those that do not are unknown. This may result in poor performance of certain software or models when deployed.

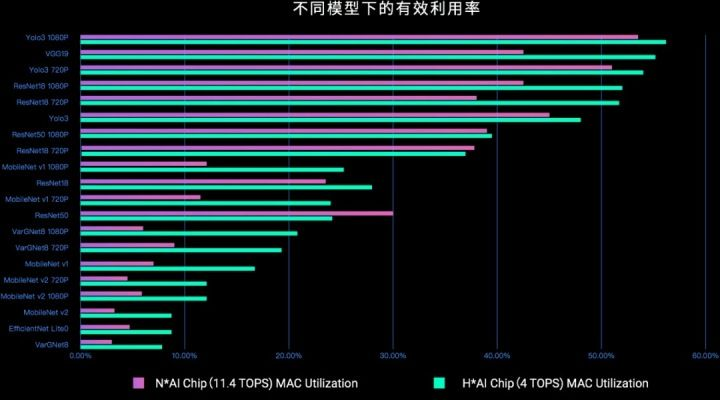

Horizon’s engineers attempted to deploy multiple different models on chips from N manufacturers (11.4 TOPS) and their own AI chips (4 TOPS) to compare the effective utilization of chips and compiled the statistical results into the following chart.

It can be seen that the N family AI chip has higher computing power than the Horizon AI chip, but its effective utilization rate of computing power has been greatly reduced, and there are significant differences in the effective utilization rate of different model algorithms. When using chips with decoupled hardware and software, although the computing power value of the chip is high, the actual effect of the model running on the chip is not good.

Therefore, when selecting chips, automakers must pay attention to the ability of chip manufacturers to combine software and hardware.

Map crowdsourcing solves the dilemma of high-precision maps

As mentioned earlier, although high-precision maps are useful, relying solely on a few dozen or hundreds of collection vehicles from companies like Baidu and Amap on the road, and then manually correcting and processing, cannot guarantee that the map data is “fresh” enough. Temporary construction frequently occurs on urban roads, so the “freshness” of the map is particularly important.

Automakers should work with map vendors to have front-mounted sensors transmit perception information to the cloud to update map data. When the actual road conditions of a location are detected by many mass-produced cars to be different from the high-precision map, the map will be automatically updated through cloud-based automated processing. In this way, the map data can be iterated fast enough to better serve the high-precision map ecology and other vehicles.

Constructing a data loop to get out of the material stacking misunderstanding

Autonomous driving is a system that needs to continuously solve long-tail problems, so it must have a mechanism for continuous iteration to drive the improvement of the system. The triplet of data, algorithm, and computing power can ensure the closed-loop of autonomous driving data, using data to drive the iteration of the algorithm. The longer the time, the more data accumulated, and the stronger the algorithmic ability, achieving a virtuous cycle.

Automakers need to think about the original intention of continuously increasing sensors. Is it to solve the problem of perception ability, and stacking material alone cannot solve the long-tail problems in autonomous driving. At this time, they should learn from Tesla and build a data engine that can fully utilize mass-produced car data. Because stacking materials can only solve immediate problems, a data loop is needed to solve long-term issues.

Tesla’s FSD has developed to this day, and there are many things that domestic automakers can learn from it. If it is about individual competition, no domestic automaker is Tesla’s opponent. We must unite China’s powerful supplier ecology to compete with Tesla and narrow the gap as much as possible.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.