In the past two months, I have also undergone significant changes, shifting my focus to the first-level investment in the automotive industry and entrusting all accounts to Yan Yan for management. Of course, it is still enjoyable to communicate with you all here. I would like to take a look at the overall situation in 2022 with everyone, mainly focusing on several directions including electrification, software, and autonomous driving.

Electrification

The main direction of electrification is still around the selection of batteries, efficient drive systems, fast charging, and hybrid systems. It is an evolution of the existing powertrain direction.

(1) Battery cost game

Ning Wang’s PPT is very clear: after technological progress and scaling up, lithium batteries have encountered comprehensive resource constraints, which has interrupted the trend of continuous cost reduction of the powertrain for many years.

Therefore, in 2022, automobile companies will inevitably make several choices: one is the selection of PHEV&EREV hybrid and comprehensive BEV ratios, and the other is the selection of chemical systems, focusing on lithium iron phosphate and 4680. Therefore, under the guidance of cost, safety, and competitive strategies, in 2021, we can see that most of the Chinese models have started to transform into low-end lithium iron phosphate models, and all battery companies need to pay attention to whether high-nickel and silicon-carbon negative electrodes under 4680 can bring cost reductions while ensuring safety.

Note: Traditional square shells cannot achieve cost reduction with high-nickel and high-silicon in 2022.

(2) There were many changes in the hybrid field last year, and the most prominent one was BYD’s breakthrough around DM-i (which was promoted as early as the second half of 2020).

In 2022, Chinese vehicle companies must choose to hedge against battery costs, not only to make the next step in the evolution of their gasoline-powered vehicles but also to release their own DHT series technologies: Great Wall Lemon hybrid DHT, Geely Leying power, GAC Ju Lang power, Chery Kumakun power, Dongfeng Mach power, BAIC Cube DHT, and SAIC passenger cars. Those who can participate have all participated. Starting in 2022, this road may become the route that various companies compete for, developing DHT transmissions and new engines. With the joint efforts of their PT departments and external consulting companies, it is not particularly difficult.

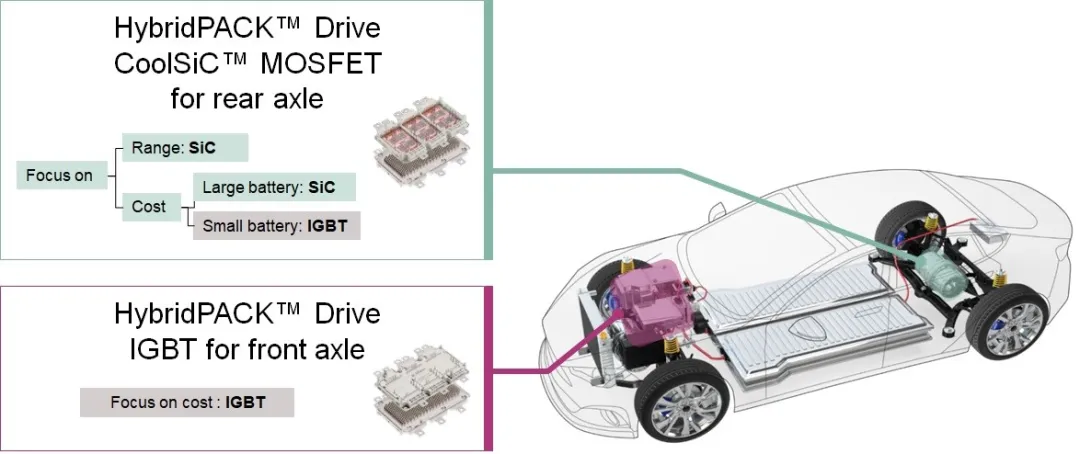

Therefore, in 2022, DHT technology that can adapt to a more extensive usage range may be the largest increase in new energy vehicles. Compared with the increase in battery costs, PHEV will inevitably become more attractive.(3) Energy consumption reduction: From a macro perspective, batteries are expensive, so how can we provide consumers with greater range? Domestic automakers have reached a mainstream consensus around reducing energy consumption by using silicon carbide (SiC) devices instead of insulated gate bipolar transistors (IGBTs) at the electric drive level. Therefore, in 2021, new generation models of devices are beginning to move towards SiC devices, and many enterprises have started to highly integrate electric drive systems. They not only regard the three-in-one drive shaft of motor, inverter, and reducer as a standard component, but also further integrate DCDC, OBC, PDU and other systems.

In fact, this thing revolves not only around 800V, but also features in 400V drive systems as costs come down. As Infineon said below, from a cost-driven perspective, high-capacity batteries will inevitably choose SiC technology to improve efficiency in the future.

(4) Game of fast charging and battery swapping for vehicles: In 2021, with the large number of pure electric cars on the road, currently, most pure electric vehicles need 40-50 minutes to be charged from 10% to 80% SOC. This has directly lead to queues at high-speed charging stations, and longer charging times in winter have objectively caused excessive lining up times for urban charging stations.

So in 2022, two technological routes have appeared: one is focused on systematic battery swapping (in essence, using more funds, separating the pattern, and giving consumers installments using ordinary batteries); and the other is for vehicles with shorter charging times, especially the development of 800V, with many released in 2021 and gradually landing in 2022.

Currently, fast charging mainly holds back on the development of fast-charging batteries, due to safety issues and the cost to ensure it. Therefore, there is a significant differentiation in methods among each battery company regarding the original VDA and 590 shell cells, long and short blades, and 4680 cells in fast charging batteries.

Intelligent direction

My understanding is that the intelligent direction must revolve around a powerful automotive company with software development capabilities. Before 2021, automotive companies mainly focused on EE architecture, but when it comes down to it, software capability is still a major problem. So I believe that in 2022, we can probably only see a prototype.# Developments in the Automotive Industry in 2022

Taking the Great Wall motors as an example, as we discussed yesterday, to achieve central computing, cockpit, and intelligent driving, a business entity is needed for software integration. This integration involves a lot of algorithm cutting, data training, integration, and optimization. From laying hardware to software maturity, the entire process may take up to 2 years to gradually integrate.

In 2021, we saw Germany and Japan gradually opening up experiments with Level 3 autonomous driving. The development of autonomous driving technology above Level 3 will change the driving habits of humans, and from a macro perspective, it will promote the overall development and progress of society in areas such as traffic safety, transportation costs, vehicle efficiency, and air pollution. It is an industrial revolution driven jointly by the industrial and transportation fields. Therefore, in 2022, China, which has always attached great importance to this area, may leave greater flexibility at the local level for companies to try social experiments with Level 3 autonomous driving.

From the perception level, camera technology has great synergy in security and consumption, and there is a certain industry chain accumulation that will inevitably permeate in this field. Most automakers are sparing no effort to increase the number of cameras and introduce new companies to reduce costs and improve performance.

Lidar is the core sensor for most automakers to achieve high-level autonomous driving. The core advantage of Lidar over other sensors is its high precision and 3D modeling capability. The pure vision solution dominated by cameras has limitations in accuracy, stability, and field of view, and it cannot meet the safety redundancy required for autonomous driving. For automakers other than Tesla that cannot compensate for hardware defects with AI, Lidar is a necessary choice in 2022. We should see the actual value of Lidar through mass production by automakers in 2022, gradually realize its necessity, and see it change from an instrument to a qualified component.

In 2022, automotive companies are adopting a more centralized autonomous driving computing platform architecture to develop, and it is also the first year for domestic newly established car companies to arm themselves with Orin, as mentioned earlier.# Intelligent Cockpit:

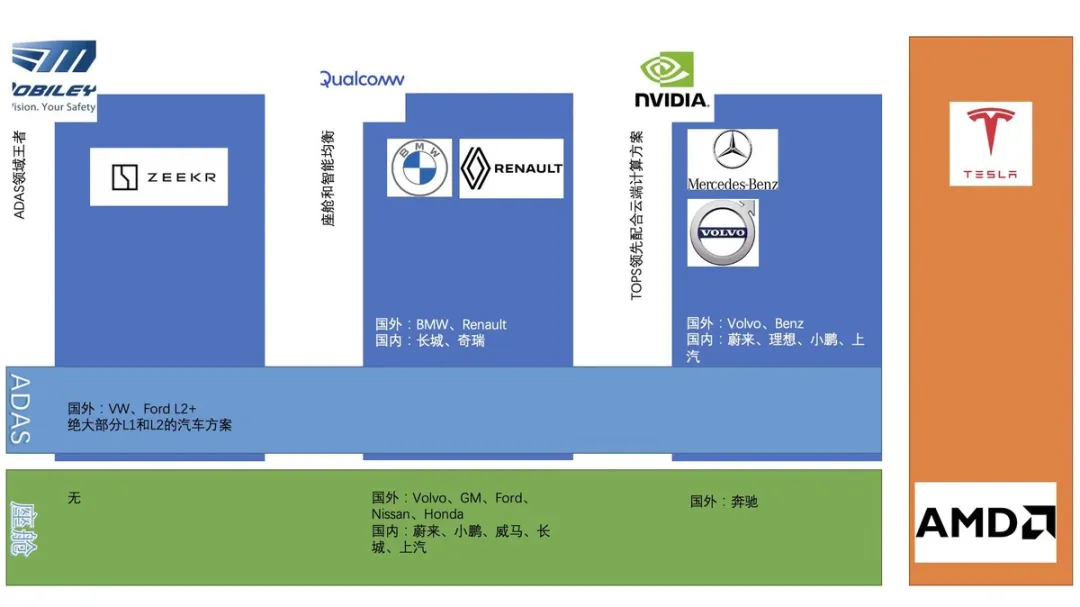

Qualcomm is the leading supplier and the bridge to intelligent driving, also known as Digital Chassis. Mobileye’s core nature is developing algorithms and proprietary solutions for chips, which seems somewhat outdated in the current competition. Meanwhile, Nvidia occupies the dominant position in this field, after launching TOPS War, and proposing the computing requirements of the server-side, which provides car manufacturers with a development path for edge computing and cloud computing collaboration similar to Tesla’s. Nvidia also provides high-end cockpit solutions.

On the Chinese side, alternatives are being developed around themselves. Currently, Huawei, Horizon Robotics, and Black Sesame are in the lead.

In the field of intelligence, whole vehicle companies are still experimenting and adapting, which is the most challenging. Without a very strong main structure, it is almost impossible to present good functions and software experience. Car manufacturers need more time to adapt to this change.

Conclusion: I personally think that 2022 is a recovery period for the automotive industry. After experiencing the chip crisis and the pandemic era, the automotive industry needs to take a break to polish its products. For electric vehicles, there may not be any particularly popular models in 2022, and we need to be more patient to see some changes.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.