Author: Michelin

He’s back.

“I’m not likely to participate in earnings calls in the future unless there’s something really important to say,” Musk said at the Q2 2021 earnings call. However, only half a year later, he appeared at the Q4 2021 earnings call.

So, is there something “really important” to announce this time?

If you are expecting news about new models, you may be disappointed. Tesla revealed during the earnings call that there are no “new products” in its 2022 plan, meaning that the Roadster, Cybertruck, Semi, and the $25,000 compact car that everyone has been eagerly anticipating will have to wait another year.

However, in Musk’s eyes, there seems to be something more important than new models.

“For Tesla, 2021 was a groundbreaking year, and every major development significantly strengthened people’s confidence in the market feasibility and profitability of electric vehicles,” Musk described the past year in this way.

From Musk becoming the world’s richest person at the beginning of the year to Tesla’s market value surpassing $1 trillion, Musk and Tesla responded to the world’s doubts about electric vehicles in 2021. Words such as “best in history” and “all-time high” repeatedly appeared in Tesla’s earnings reports over the past year, which may no longer be stimulating people’s interest.

The Q4 earnings report was also “as usual”: in the fourth quarter of 2021, Tesla’s total revenue reached $17.7 billion, a year-over-year increase of 65%; of which, the automotive business contributed more than 90%, or approximately $15.97 billion. GAAP net profit was $2.3 billion, a near 8-fold increase year over year, and once again created a new historical high for itself.

I took out a calculator and calculated Tesla’s net profit per day in the fourth quarter, which was equivalent to 1.59 small goals.

Capacity Expansion: An Annual Average Increase in Deliveries of 50%

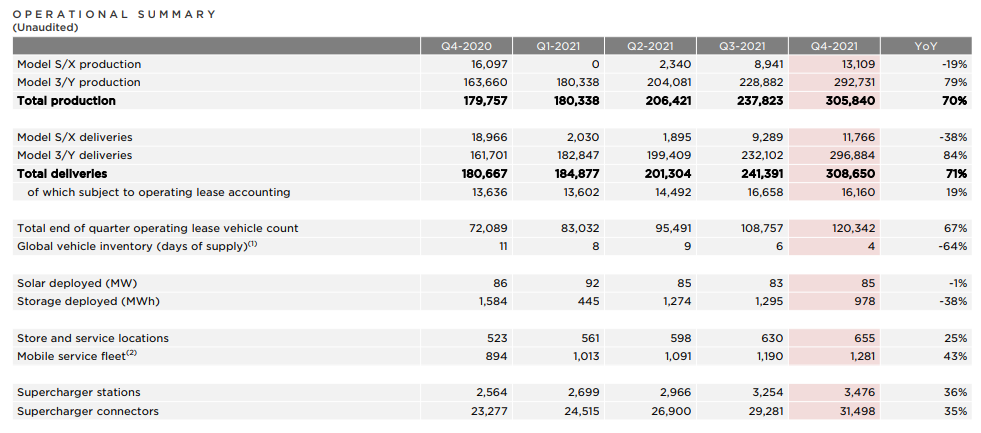

At the beginning of January, Tesla released its production and delivery numbers for the entire year of 2021. Approximately 940,000 vehicles were delivered throughout the year, an 87% year-over-year increase, which was only one step away from producing a million vehicles per year. The delivery volume for Q4 was 308,700, an increase of 71% year-over-year.

For 2021, Model 3 and Model Y were still the main stays, with a total of 911,242 vehicles delivered throughout the year, accounting for more than 97% of the total delivered, a year-over-year growth of 106%. In contrast, Model S and Model X had a combined delivery volume of 24,980 vehicles throughout the entire year, accounting for less than 3% of the total deliveries.

Despite Tesla’s statement that the supply chain, chip shortage, and labor shortage are common problems in the automotive industry that have affected the full production capacity of its factories, expanding its own production capacity remains a top priority.

In the fourth quarter, both the fully operational Fremont factory in California and the Shanghai Gigafactory were operating at full capacity, achieving a record production efficiency of over 1.22 million annual capacities. The inventory turnover days have also been reduced from 6 days in the previous quarter to 4 days.

“The average annual growth rate of vehicle deliveries is 50%,” which is Tesla’s forecast for the next few years. The 87% year-on-year increase in deliveries in 2021 makes the 50% forecast seem not exaggerated. The production capacity of the two Gigafactories is obviously insufficient to meet future demand, and the previously delayed Texas and Berlin Gigafactories have finally begun testing.

The Texas Gigafactory began production of the Model Y at the end of 2021, and the first batch of Model Ys will be delivered in the first quarter. The Model Y with the 4680 battery cells and structural battery pack system will begin production in the Austin factory after obtaining official approval. The Berlin Gigafactory has also launched vehicle production equipment testing during the same period, and the first batch of Model Ys produced will not use the 4680 batteries and will continue to use the 2170 cells. While the California and Shanghai factories are running at near full capacity, the Texas and Berlin factories still need to climb a steep production capacity hill, and Tesla’s production capacity remains tight in 2022.

In the case of a red light on production capacity, despite the recent frequent sightings of the Cybertruck prototype, and the looming Tesla competitors such as Rivian, the Cybertruck is clearly giving way to the currently “out of stock” Model Y and will begin production at the Austin Gigafactory after the Model Y.

Recently, foreign media captured footage from a drone of the 8000-ton Giga Press giant die-casting machine at the Berlin Super Factory where the Cybertruck is being produced. The machine is already ready and will start operations next month, entering the preparation phase. It seems that although the release date of the Cybertruck has been delayed, it is not too far away. Before the mass production of the Cybertruck, Tesla needs to solve issues such as reasonable pricing and achieving an annual production capacity of 250,000 vehicles.

Recently, foreign media captured footage from a drone of the 8000-ton Giga Press giant die-casting machine at the Berlin Super Factory where the Cybertruck is being produced. The machine is already ready and will start operations next month, entering the preparation phase. It seems that although the release date of the Cybertruck has been delayed, it is not too far away. Before the mass production of the Cybertruck, Tesla needs to solve issues such as reasonable pricing and achieving an annual production capacity of 250,000 vehicles.

Faced with the current supply shortage of Model 3/Y, Tesla and Musk, who have experienced the “production hell”, clearly do not want to experience another nightmare. Capacity and supply chain are obviously the biggest challenges that Tesla currently needs to solve. As for the Roadster, Semi, and the widely speculated $25,000 compact car, they have all been indefinitely postponed.

Therefore, now that all four Super Factories are finally on track, Tesla is starting to prepare for the future.

Tesla announced that it will select new factory locations globally in 2022 and may disclose them to the public before the end of the year. After abandoning the expansion site next to the Shanghai Super Factory last year, who will win the bid for the fifth Super Factory could be a new problem facing Tesla in 2022.

Redefining the Gross Profit Margin Ceiling

In the Q3 financial report three months ago, Tesla’s gross profit margin was 30.5%, which many considered to be the ceiling for single-vehicle gross profit margins. Just three months later, Tesla has redefined the ceiling and increased it by 0.1%, with a gross profit margin of 30.6%.

This number not only makes new energy vehicle companies that strive to control costs envious, but even mainstream traditional car companies with more obvious economies of scale are left trailing behind.

Tesla’s cost-cutting efforts come from both the economies of scale brought by popular models and the localization provided by the Shanghai Super Factory.At the inception of the Shanghai Gigafactory, research institutions have shown that fully localized supply chains in Shanghai for Model 3 can reduce costs by 6%. Currently, over 90% of the supply chain for the Shanghai Gigafactory has been localized, and the average unit cost of Tesla vehicles in the third and fourth quarters has dropped to $36,000, including both Model 3/Y and the more expensive Model S/X. The remaining less than 10% of localized components provides further room for reducing unit costs.

Coupled with investments in future projects such as the giant integrated casting machine, structural battery packs, and 4680 batteries, it remains to be seen how far Tesla’s profitability per unit can rise.

Furthermore, in Musk’s eyes, the sale and profits made from hardware are just the beginning, with the profit generated by software subscriptions being the key to future accelerated growth.

What Matters More than Vehicles to Musk

What is more important to Musk than new vehicles at present? One is fully autonomous driving, and the other is the humanoid robot Optimus.

In the fourth quarter of 2021, the number of vehicles participating in FSD Beta testing in the United States increased to nearly 60,000. Musk announced that all vehicles with the system worldwide will be equipped with it by 2022.

Half a year ago, Tesla unveiled the humanoid robot at AI Day. At the time, people had more questions about how the robot could be used and what its commercial prospects were, in addition to questions about the product and technology itself. During the Q4 earnings call, Musk gave an example of how the Optimus robot will be initially used by Tesla, as a handler of auto parts in factories.

With the use of humanoid robots to replace manual labor, can Tesla significantly lower unit costs again?

To Musk, Optimus may be more important than Tesla’s automotive business and might be the “most important product,” solving labor shortages. However, in a future with high levels of automation and integration, where machines liberate human labor endlessly, surplus labor may bring new problems…But, let Optimus land and then we’ll see.

Finally,Compared to the previous financial reports that were overshadowed by Bitcoin and carbon credits, the 2021 Q4 financial report is surprisingly pragmatic, even though it did not announce any new car models or products. Cars were still the absolute protagonists.

In 2021, Tesla made a lot of money, and in 2022, its goals seem to be only three: capacity, capacity, and capacity.

Tesla’s approach brings the standardization and scaling of the traditional auto industry into the smart car race, “using their tactics against them”.

As for the results, we’ll have to wait and see how the new year unfolds.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.