Over the weekend, I carefully examined General Motors’ history of strategic and venture capital investments. As a veteran automotive company, General Motors, under the leadership of Mary Barra, has been very active in strategic transformation and venture capital investment. Logically speaking, General Motors has successfully combined the needs of engineering and research and development with venture capital. In July 2010, General Motors established a venture capital subsidiary, General Motors Ventures LLC, with an initial investment of $100 million, aimed at identifying and developing innovative technologies. Jon Lauckner, Vice President of Global Product Planning, was appointed as the head of the subsidiary. Note that General Motors mainly invests in the autonomous driving field.

GM Ventures Investment Overview

From an overall perspective, as an industrial capital in the automotive industry (with significant differences from BMW Ventures), GM Ventures mostly focuses on investing in innovative components, combining GM’s own development needs, and covering investment areas such as autonomous driving (Lidar, Radar), advanced batteries, software, cockpit (AR HUD), V2X, and high-precision maps.

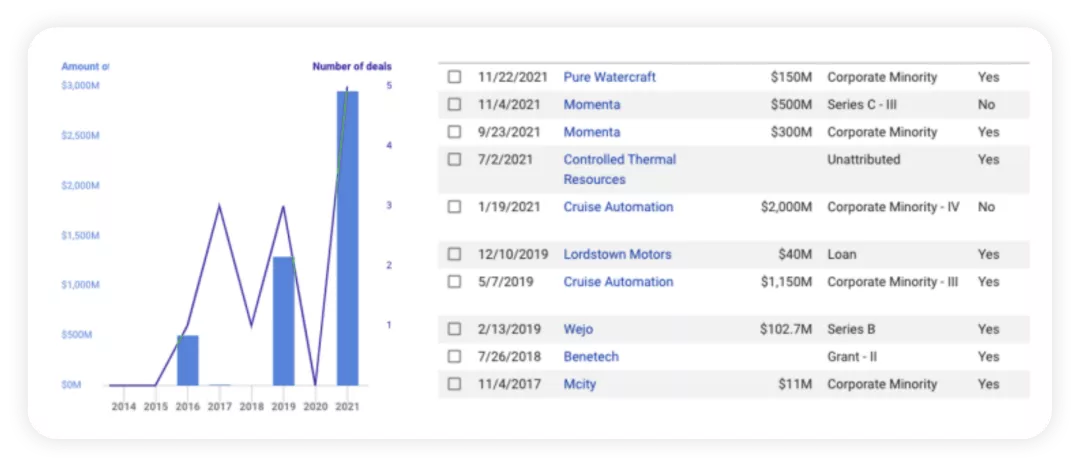

In terms of investment intensity, 2017-2018 saw a peak in investment. During this period, General Motors invested in projects like Lyft and Cruise Automation, which drove external demand for software and autonomous driving. However, there was a certain stagnation period in 2019-2020, and the investment scale only resumed growth in 2021.

Main Investment Targets

● Batteries.In my previous company, there was a project with external investment that influenced the development direction. Envia was a negative example. The positive aspect was that the project pushed GM to abandon the 100-mile range Bolt BEV and focus on the 200-mile range. Also, Envia’s stimulation prompted LG Chem to take on this more ambitious goal. However, SAKTI, in hindsight, was a failed project after Bosch took over.

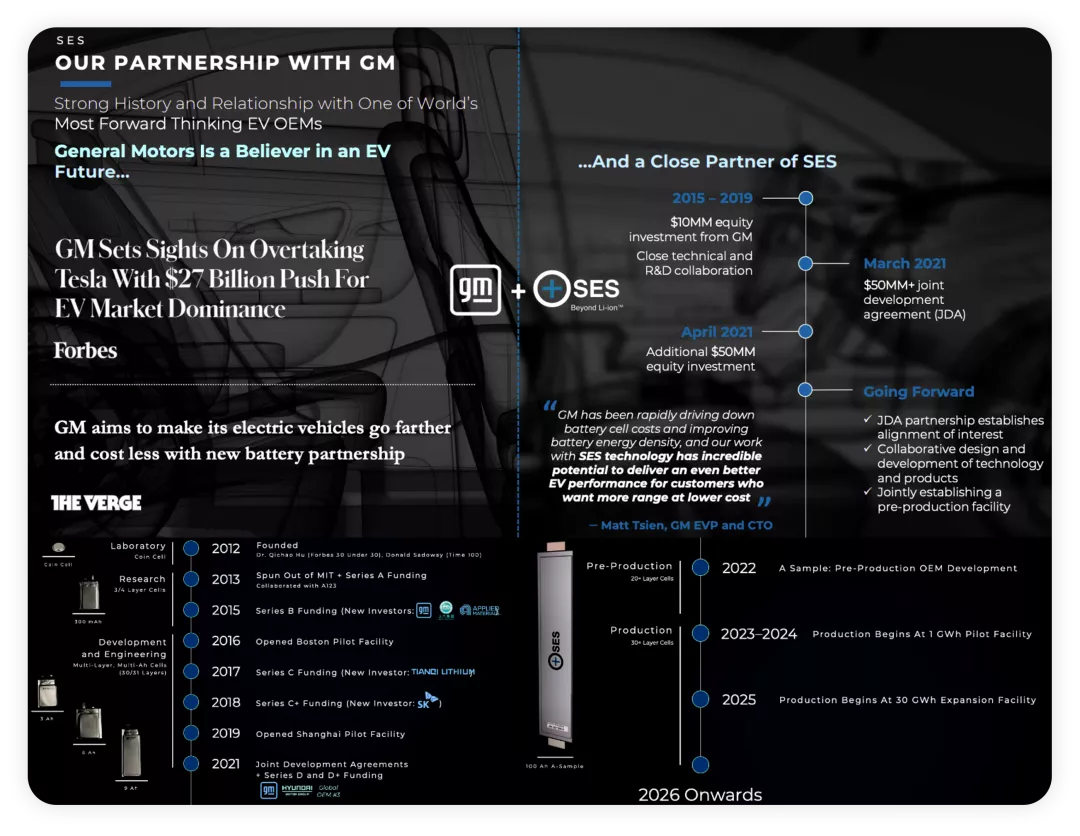

Regarding solid-state batteries, General Motors is mainly investing in SES. On the one hand, they invest and continue collaborative research and development to accumulate technological reserves. From the macro perspective, with the establishment of two battery factories in North America, investment in the next-generation battery technology is a clear demand.

In terms of autonomous driving, General Motors’ strategy is interesting. In developing Super Cruise, they invested in Ushr and Mapanything, followed by Algolux, GeoDigital and OCULii, which mainly focuses on software and algorithm development, and Spring for information security. Of course, these investments are based on a certain foundation, and can help to bridge the gap between business needs and evaluation to make judgments based on these foundations.

In summary, from my personal perspective, General Motors and GM Ventures’ efforts over the years have strategic significance. With increasing technological disruptions, it’s difficult to solve problems relying solely on traditional methods, as they cannot meet the requirements for timely solutions and quick changes in technology competition.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.