Jia Haonan, posted from Copilot Temple

Intelligent cars have been on the rise in China’s auto industry, and by 2021, cars without intelligence are simply outdated.

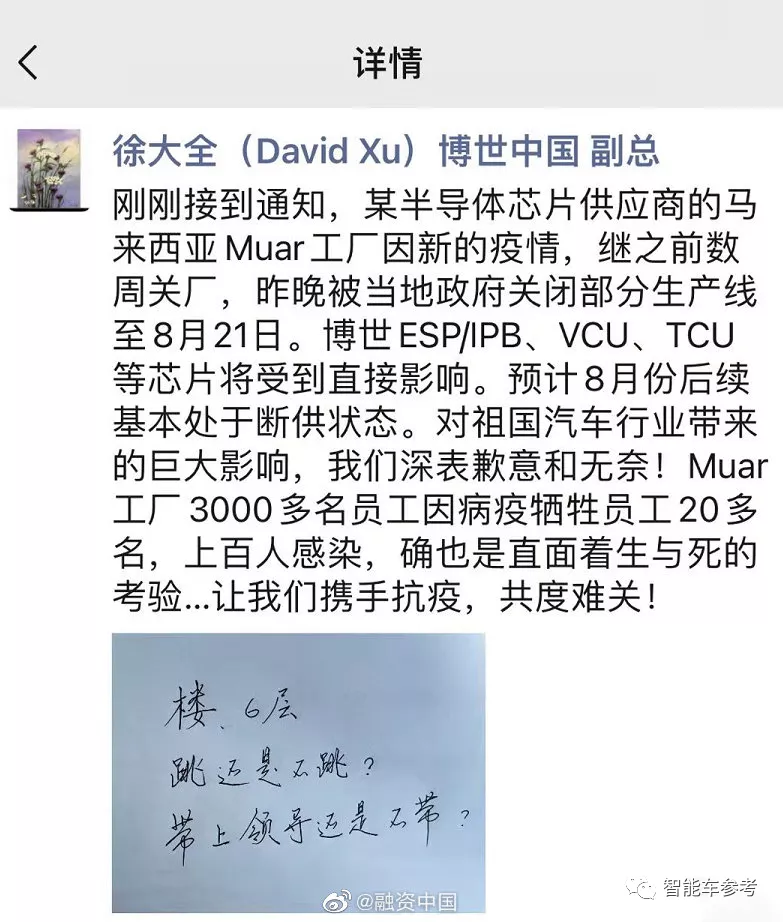

However, it wasn’t until August when the vice president of Bosch China posted on his WeChat Moments, that the entire Chinese auto industry was rocked:

Everyone then realized that without chips, everything was just empty talk.

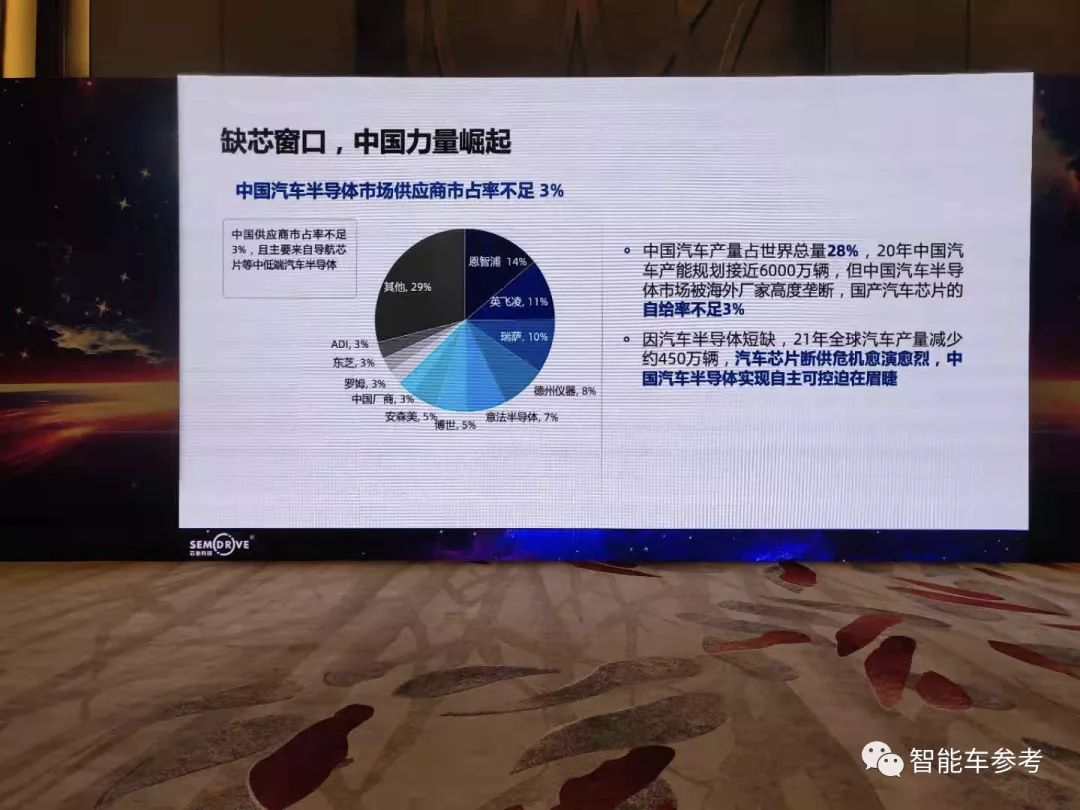

Another fact is that more than 90% of the chips required by China’s auto industry are monopolized by foreign manufacturers.

But it was only in 2021, the year of the chip shortage, that the situation began to change.

Who’s got the 3 million orders?

Despite Chinese-made chips still accounting for only 3% of the market share of auto chips, different trends have emerged in 2021.

The domestic chip manufacturer that ships the most has already signed an order for over 3 million chips.

Moreover, different from the low-end chips commonly seen from domestic manufacturers in the past, about 40% of these 3 million chips are dedicated to intelligent cockpit.

Furthermore, according to AI4Auto, this intelligent cockpit chip defeated the mainstream product Qualcomm 8155 in a popular joint venture brand’s vehicle project.

The manufacturer behind it is called Xinchiji Technology.

Xinchiji Technology was founded in 2018 by Chou Yujing, who had worked in the semiconductor industry in North America for more than 10 years. Her goal was to develop high-performance automotive-grade chips, including for intelligent cockpit, autonomous driving, and more.

Her work experiences covered R&D and production stages of the integrated circuit.

This also explains why, after Chou Yujing founded Xinchiji Technology, she was able to develop mass production products in just 3 years.

In addition to the X-series intelligent cockpit chips mentioned above, Xinchiji Technology’s mass-produced products also include V-series autonomous driving chips and G-series gateway chips.

The chip process uses the mainstream automotive-grade 16nm process, which is currently the most advanced process to obtain automotive certification.

Currently, in addition to the intelligent cockpit chips, Xinchiji Technology’s other main product is the gateway processor, which the company claims has far better performance than competitors such as Renesas and Infineon.What is the position of ChipRay in the entire automotive semiconductor supply chain based on the production order situation of ChipRay?

What does this phenomenon reflect about China’s car chip industry?

What is the position of ChipRay in the ecosystem?

This can be viewed from two perspectives: “products” and “funding.”

In terms of products, ChipRay has deployed several major key “centrals” required by smart cars, such as interaction, intelligent driving, and data communication, all of which have mass-produced products.

In addition, in terms of the car body control MCU, ChipRay will also announce mass-produced products in March this year, and according to estimates from official sources, MCUs will almost certainly become the main order.

And who has bought the already ordered 3 million chips?

ChipRay said that customers cover more than 250 upstream and downstream enterprises in the industry chain, including more than 70% of Chinese car factories.

Among them, mass-produced chips have obtained 50 “design-in” points.

The so-called “design-in” means that the manufacturer has almost confirmed the choice of mass production and is in the adaptation and debugging stage, which generally takes about 6 months.

Combining ChipRay’s own shipping characteristics, it can be seen that its products currently cover a wide range, but autonomous driving chips are not the main focus.

Therefore, comparing ChipRay with domestic AI chip vendors such as Horizon and Black Sesame is somewhat biased.

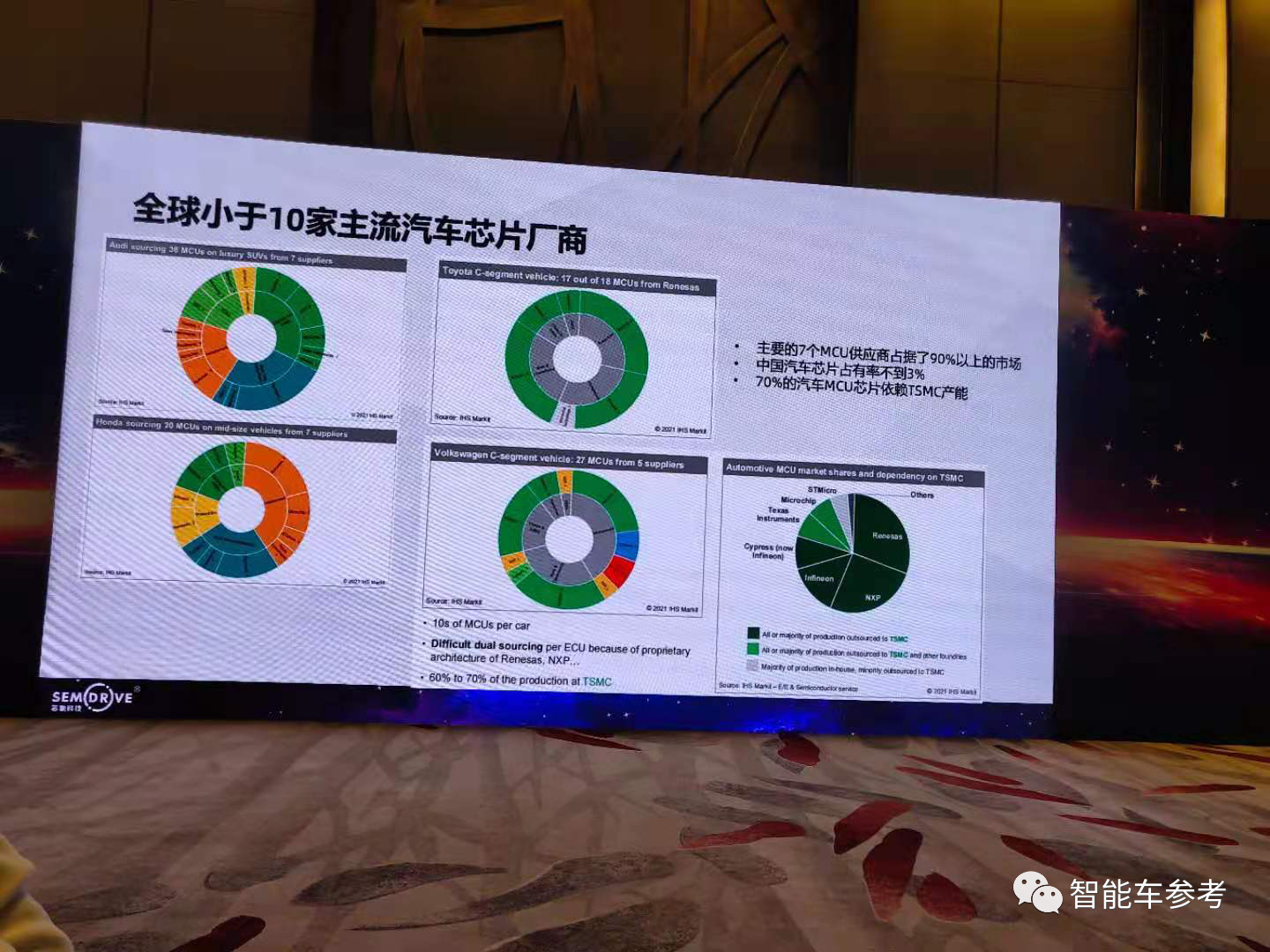

At least for now, ChipRay’s main competitors are international giants, including Renesas Electronics, Infineon, NXP, and Qualcomm.

As for funding, ChipRay has been established for 3 years and has already completed Series B financing, with a confirmed amount of 1.5-1.6 billion yuan and several hundred million yuan in pre-Series A financing.

Calculated in this way, ChipRay has raised almost or even more than 2 billion yuan so far.

The investment comes from venture capital funds such as Sequoia Capital China and Lightspeed China, industry players such as Legend Capital and Contemporary Amperex Technology, and “national-level” funds with semiconductor and other high-tech investment as the main direction, such as Pro Capital.

ChipRay officials also revealed that a new round of financing will begin after the Spring Festival, and there is a high probability that major automakers will be invited this time.

The pursuit of capital reflects the scarcity of the market.

A bottom intelligent platform that is autonomous and flexible is indeed what the Chinese automotive industry is looking forward to.

What is the current situation of China’s car chips?

The Chinese car semiconductor market has tempting prospects but faces difficulties.

How so?

According to Strategy Analytics’ analysis, from 2018 to 2025, China’s automotive semiconductor market will grow from 60 billion to over 120 billion.

The pace of development of the Chinese automotive semiconductor market far exceeds the global average level.

As the cake is huge, it is indeed tempting.

However, from the past until now, the Chinese automotive semiconductor market has been monopolized by the “Seven Major” companies.

The market share of domestic products is only around 3%, and most of them are low-end products such as navigation chips.

The difficulty lies here.

Without proving absolute strength, car manufacturers still prefer using their original suppliers for major products, which is understandable.

At the same time, domestic enterprises are becoming more and more anxious about the sensitivity of chip products, and this year’s chip shortage has intensified this trend.

The demand for self-controlled and supply chain safe chip suppliers is becoming more urgent.

Therefore, domestic chip manufacturers such as Horizon Robotics, Chipsee, and Black Sesame have developed rapidly in recent years due to this factor.

Signing orders solves urgent problems, while investment is for long-term planning.

In addition, domestic chip manufacturers have another advantage that the “Seven Major” companies cannot match, which is the ability to catch up quickly despite being late to the market.

For new technologies, architectures, and technological routes, domestic manufacturers can quickly catch up and adjust their strategies according to the market. However, established conglomerates are having a hard time making the transition due to years of established R&D investment and a complex and large volume.

For example, changing from X86 architecture to ARM architecture that is more cost-effective and energy-efficient for automotive standards is almost debilitating for these traditional automotive semiconductor giants.

This has also given domestic manufacturers the opportunity to target global leaders rather than just replacing low-end products.

The transformation of intelligent automobiles is comprehensive, three-dimensional, and complex. In 2021, various profound trends emerged, including the trial operation of RoboTaxi, the expansion of automatic driving capabilities of mass-produced cars, and the rapid development of commercial logistics…

Today, we have also learned about the hidden currents of chips at the software and algorithm level of intelligent automotive technology.

What other intelligent automobile trends are worth paying attention to? Let’s share and discuss!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.