Author: Zhang Xiangwei

In the automotive industry, a monthly sales volume of over 10,000 units is considered a hit product. Zero Run Automobiles’ internal expectation for the C11 is 20,000 units per month.

For many years, hit products in traditional fuel cars, such as the Volkswagen Touareg and Toyota Corolla, have been deeply ingrained in people’s hearts. In recent years, some new hit products in new energy vehicles have also gradually achieved a foothold, such as Tesla Model Y and BYD Han EV.

This year, the Ideal ONE has also broken the monthly sales record of 10,000 units in a row. Next year, the XPeng P5 and NIO ET5 also have the potential to challenge the monthly sales volume of 10,000 units.

Beyond the “big three” of Tesla, BYD, and the newly emerging automakers, ZERO Run C11 is also a newcomer to the hit product competition, according to Autohome.

The Zero Run C11 began delivery in October 2020, with a cumulative delivery of more than 4,000 units in 2021. According to data recently released by Zero Run in early January, the company currently has orders for more than 100,000 vehicles, of which more than 20,000 are for C11.

Although delivery volume is limited by factory capacity and the supply chain, Zero Run insiders believe that these factors will not hinder the skyrocketing sales of the C11. Their internal target is to achieve a monthly sales volume of 20,000 units by the end of this year. The ambition is extraordinary.

ZERO Run: We Have a Strong Order Book

At the end of 2021, ZERO Run turned in an impressive full-year performance report:

Total deliveries of 43,121 vehicles, including 38,463 for T03 and 4,021 for C11.

It’s noteworthy that in the last month, ZERO Run set a new record for monthly deliveries, with 7,807 units, an increase of 39% month-on-month and 368% year-on-year.

Especially after the December delivery results were announced, Zero Run surpassed early leader WM Motor to become a rising star among new automakers, along with NIO.

A few days after the full-year delivery results were announced, Zhou Ying, the director of Zero Run’s marketing department, revealed at a media briefing that “in 2021, we have entered a relatively benign development stage. We have a strong order book, with over 90,000 orders for the entire year, including T03 and C11, of which more than 20,000 are for C11.”

As a class A00 pure electric vehicle with a price range of 60,000 to 90,000 yuan, the T03 itself has low profits. A Zero Run insider previously told Autohome that the T03 just breaks even under subsidy support.Founder Zhu Jiangming’s consideration for T03 is to expand the user base, and the next step is to convert more mid-to-high-end vehicle owners. The focus is on C11.

C11 is a mid-size pure electric SUV with a starting price between 150,000 and 200,000 yuan. This car is actually Zero Run’s third mass-produced car and the first mainstream model to enter the mass market.

Before this, Zero Run’s first mass-produced car, the Coupe S01, and the second car, T03, were both aimed at vertical niche markets.

Zero Run has great expectations for C11.

When asked how many sales are expected for this car, Jiang Tao, general manager of Zero Run’s automotive strategy and product planning department, revealed a number to “Auto Home”: “20,000 units.”

We confirmed again, “Do you mean that C11 will sell 20,000 units per month?”

Jiang Tao nodded firmly and said, “Our goal (for C11) is to achieve a monthly sales volume of 20,000 units, and we plan to achieve this by the end of 2022. Currently, the only restrictions are capacity and chip supply. Otherwise, we have already exceeded 10,000 (sales in December 2021). Currently, it takes six months for C11 customers to receive delivery.”

NOA and memory parking functions are currently in development, and an extended-range version of C11 will be launched later this year.

After the launch of C11, the industry consensus is that the car provides excellent value for the price. “Auto Home” also had a similar feeling after test-driving C11.

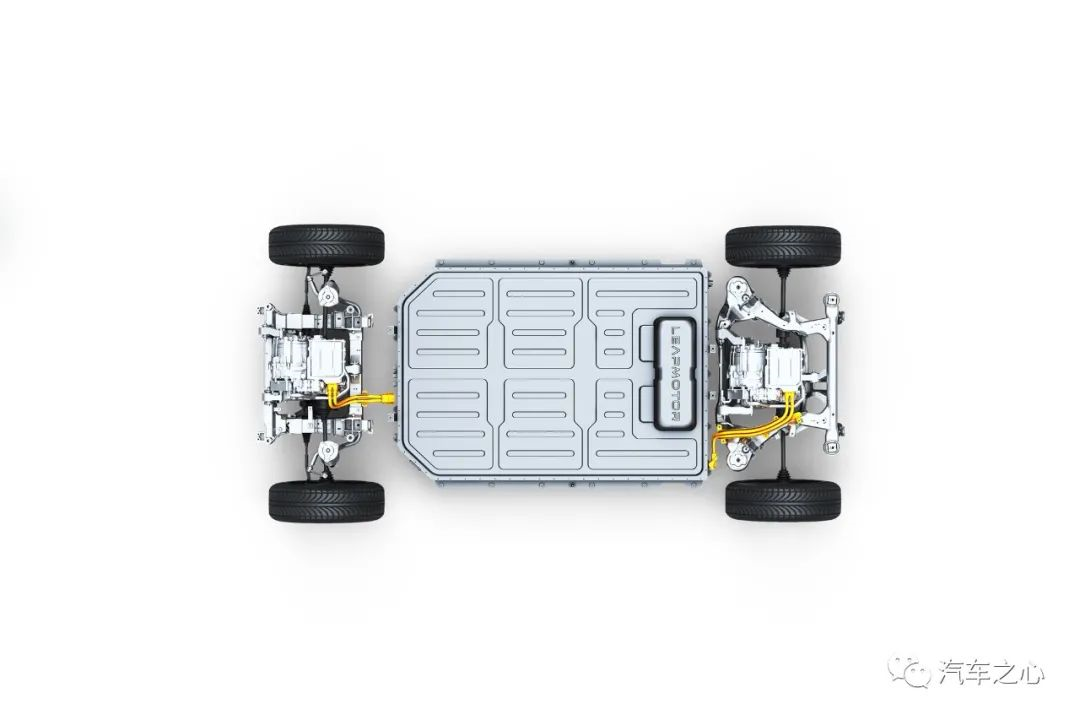

C11’s biggest feature is its “overwhelming” configuration, such as front double wishbone suspension, rear multi-link suspension, 2930mm ultra-long wheelbase, extensively used Nappa leather seats, and the strongest production car cockpit chip, the Qualcomm 8155.

According to Zero Run, this car fully competes with Tesla Model Y in terms of product level.

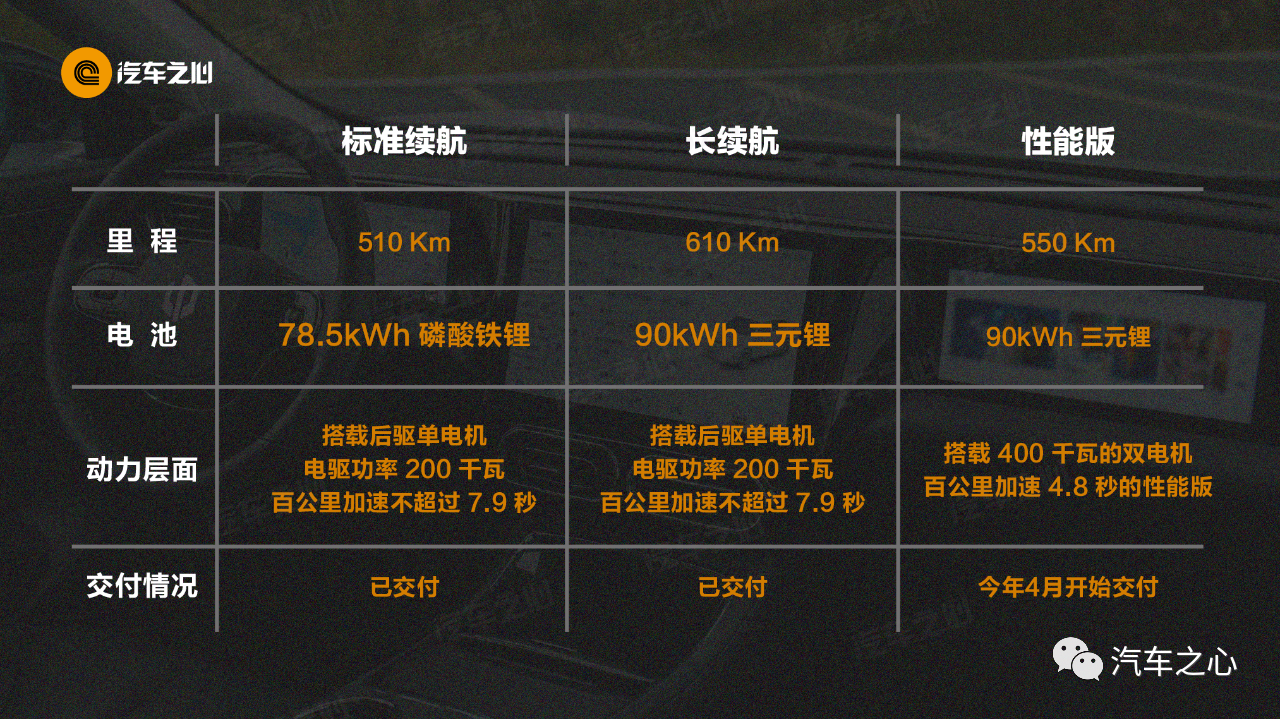

Zero Run also provides sufficient configurations for endurance and power. To put it simply, there are three versions:

As planned, Zero Run will launch an extended-range version of C11 later this year to further address user’s mileage anxiety.

In the area where Tesla excels in intelligence, C11 is also making efforts. In July last year, Zero Run’s 2.0 strategy proposed to surpass Tesla in the field of intelligent driving within three years.C11 is equipped with LeapPilot 3.0 intelligent driving system, including two self-developed automatic driving chips, Lingxin 01, with a total computing power of 8.4 Tops.

The perception hardware includes a set of binocular cameras, four panoramic cameras, four blind spot cameras, five millimeter-wave radars, and twelve ultrasonic sensors.

At the end of December last year, Leapmotor has pushed several advanced driving assistance functions such as LCC lane centering assistance, LCA lane change warning, and BSD blind spot monitoring through vehicle OTA updates.

A Leapmotor car product manager told Autohome that C11 is equipped with 22 advanced driving assistance functions, and currently 10 of them are online.

By March of this year, the remaining advanced driving assistance such as ALC automatic lane changing assistance will be pushed through OTA.

In addition, in the second quarter of this year, Leapmotor is expected to push the NOA function of highway navigation assistance to a small number of car owners. Similar advanced driving assistance functions such as parking memory parking are also under research and development planning.

In 2022, with the competitiveness of smart electric vehicles, smart driving has obviously become an essential competitive point for various automakers.

If Leapmotor can launch mature advanced driving assistance functions as soon as possible, it will have a greater certainty of becoming a popular car target.

Competing for popular cars in the market

Leapmotor C11 should sell well, even up to 20,000 units per month, but there are actually many challenges ahead.

The most direct factors are: the cost of power batteries is rising, the subsidy for new energy is declining, and the chip supply is full of variables.

In 2022, the subsidy for new energy vehicles will be reduced by 30%. In addition, the rising cost of power batteries in the industry will also put pressure on C11.

Jiang Tao bluntly said, “In 2022, all car manufacturers are under a lot of pressure, and the cost of batteries is expected to increase by 30%. Battery cell suppliers are coming to raise prices. For the battery pack of C11, which costs about 80-90 thousand yuan, if it rises by 30%, you can imagine how much more money it will be.”

As for chip supply, international suppliers have stated that “any market disruption will have an impact on primary suppliers and our customers, as chip inventory has been depleted. For example, if a wire frame factory in Malaysia suddenly shuts down, it will immediately cause a chain reaction and disrupt every link in the supply chain.”

But the good news is that C11 is in a vast market.It is predicted that by 2025, the penetration rate of new energy vehicles in the market is expected to exceed 50%. In addition, the consumer market for new energy vehicles will shift from the previous “dumbbell-shaped” to a “spindle-shaped” market, with products in the 150,000-250,000 yuan price range becoming mainstream, and there is huge market space for the LI ONE.

Furthermore, with the passage of time, the full-domain self-research of the C11 will gradually demonstrate its power. For LI itself, “Dahua makes cameras, and basically all of our hardware is Dahua’s hardware. The ADAS algorithms involved are also developed by LI’s own team.”

It is worth noting that LI’s smart driving development route will be adjusted. Jiang Tao told Autohome that LI will not continue to develop autonomous driving chips on its own, but will cooperate with third-party chip suppliers, and plans to launch an autonomous driving system with high-performance chips and lidars in 2024.

LI announced at last year’s 2.0 strategy conference that it will launch eight new models before the end of 2025, and these eight new models will “cover the price range within 350,000 yuan.” The total sales volume in 2025 will reach 800,000 units.

Including the existing two cars, T03 and C11, there are probably a total of 10 cars.

If the sales target for 2025 is to be achieved, the average annual sales volume of each car needs to reach 80,000 units. Converted, the monthly sales volume of each car in the next few years needs to reach more than 6,000 units, which is already a significant goal.

At present, new carmakers have entered the stage of competing for “hot-selling models”. When the brand awareness of auto brands is not as deeply rooted in people’s minds as Volkswagen, Toyota and other brands, it is indeed necessary to launch some popular models in order to quickly occupy the market and ultimately truly spread their own production and research and development costs.

NIO has the ET5, XPeng has the P5, and Ideal has the ONE, now it remains to be seen whether the LI C11 can fulfill its goals and become another hot-selling car in the new car market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.