Plan Can’t Keep Up with Change. If You Were Waiting for A Year-End Bonus, Ready to Order a Basic Model Y at Tesla Store During the New Year Period, How Much Was Your Original Budget?

27,000? 28,000? Anyway, You Don’t Think It Will Be More Than 300,000, Right?

However, the Budget Needs to be Raised Again Because Tesla Has Adjusted Prices Again.

On the Last Day of 2021, Prices of Two Domestic Models of Tesla, Model 3 and Model Y, Changed Again on Tesla’s Official Website:

- Price of Rear-Wheel Drive Model 3 Increased by RMB 10,000, and the After-Subsidy Selling Price Increased to RMB 265,652.

- Price of Rear-Wheel Drive Model Y Increased by RMB 21,088. The Starting Price Increased to RMB 301,840. From Now on, All Models of Model Y Will No Longer Enjoy National New Energy Subsidies.

At the Same Time, the Expected Delivery Period of These Vehicles Has Been Extended to 12-16 Weeks. In Other Words, Even If You Pay for the Car Now, You Still Need to Wait for 3-4 Months to Get the Delivery.

In Addition to the Cars Themselves Becoming More Expensive, Additional Fees, Such as Insurance, Are Also Increasing. Recently, Shanghai Insurance Exchange Officially Implemented the “Exclusive Insurance for New Energy Vehicles.” Immediately, the News That the New Car Insurance Premium of Model Y Increased From Around RMB 8,000 a Year to RMB 14,000 Overnight Spread on the Internet.

Friends Who Are Familiar with Tesla May Still Remember the “Grand Occasion” in 2020 When the Domestic Model 3 Was Reduced in Price Five Times.

The Joking Saying “Old Car Owners Have Become Chinese Chives” Has Been Around for A Long Time, and “Wait a While and It Will Be Cheaper” Has Also Become a Reason for Many Consumers to Hold a Wait-and-See Attitude Toward New Energy Vehicles.

Now That the Price of the Vehicle Has Increased and the Premium Has Increased, It Seems to Be Indicating That the Cost of Purchasing New Energy Vehicles Will Be Soaring in 2022, and the “Wait-and-See Party” Will Fail?

Tesla Selling Price is “Jumping Back and Forth”As mentioned earlier, the main theme of domestic Tesla models has always been price reduction. The entry-level domestic Model 3 was priced at 328,000 yuan at first, and gradually decreased to a benchmark of 249,900 yuan in early 2021.

The reason for the price decrease is easy to understand: as the domestication rate of Tesla’s Shanghai plant components gradually increases, the cost reduction is reflected in the vehicle’s sale price.

Adjusting the vehicle price according to raw material and production costs is Tesla’s consistent promise to the public.

Tesla China’s high-level officials previously stated in an interview with the media that as the domestication rate of Shanghai plant components reached 90%, the prices of subsequent models would remain stable, and the possibility of a significant price reduction is unlikely.

Although there is no significant price reduction, domestic Tesla models still experienced multiple price fluctuations in 2021.

At the beginning of 2021, Tesla China’s official website launched the new Model 3, with a starting price of 249,900 yuan.

What’s more eye-catching is the launch of the domestic Model Y: the entry-level model has a starting price of 339,900 yuan, a price reduction of 148,100 yuan compared to the previous import model priced at RMB 488,000.

I believe many readers still remember that after the domestic Model Y was launched, it was precisely the apparent price difference of more than one hundred thousand yuan that caused countless attention. The news of “Model Y orders are scheduled for June” spread like wildfire at that time.

Subsequently, Tesla made minor adjustments to the prices of the two models: in March, the price of the Model Y increased by 8,000 yuan, and the entry-level model price reached 347,900 yuan; in May, the price of the entry-level Model 3 rose by 1,000 yuan.

Compared with the price of more than one hundred thousand yuan, these two price increases seem insignificant, so they did not trigger too many public interpretations at the time. It was generally believed that the price changes were due to fluctuations in raw material costs alone.

In July, a larger “price reduction” hit the domestic Tesla market:

The entry-level model of the Model 3 decreased by 15,000 yuan, reaching the historical lowest price of 235,900 yuan.

Meanwhile, a new standard range version of the domestic Model Y has been added, with a subsidized price drop to 276,000 yuan.

Compared to the long range version, the new Model Y model has a single motor plus lithium iron phosphate battery configuration, but the difference of 71,900 yuan still makes everyone exclaim “fantastic”.

However, this is also Tesla China’s final price cut in 2021, and subsequently Tesla products have only been getting more expensive.

On August 4th, the imported Model S long range version was raised by 30,000 yuan to 859,990 yuan. The price of the Model X was raised by 30,000 yuan, with a starting price of 909,990 yuan. One month later, the price of the Model Y high-performance version was raised by 10,000 yuan to 387,900 yuan.

More frequent price increases appeared in November.

On November 19th, the domestic Model 3 rear-wheel drive version was raised by 15,000 yuan to 250,900 yuan. The range increased from the original 468 kilometers (NEDC standard) to 556 kilometers (CLTC standard), but the acceleration time for every 100 kilometers dropped from 5.6 seconds to 6.1 seconds. The price increase and slower acceleration once again became a hot topic on the internet.

Just 6 days later, Tesla raised prices again. The starting prices of the Model 3 and Y models reached 255,652 yuan and 280,752 yuan respectively.

This price adjustment is generally interpreted by the outside world as a measure taken by Tesla in response to the 2022 national new energy subsidy retreat. Because at the time, booking users could only get the car in 2022, and the increase of 4,752 yuan was consistent with the reduction of the subsidy.On the last day of 2021, Tesla’s Model 3 has experienced a price increase of nearly 30,000 yuan since its lowest point, and the price of all Model Y models has exceeded 300,000 yuan, which is no longer eligible for national subsidies.

The logic behind the price increase

In fact, “relatively stable” is an appropriate description for Tesla’s products in the Chinese market in 2021. It is worth noting that in the United States, Tesla’s products have been raised in price more than ten times.

As for the reasons for the price increase, Tesla CEO Musk stated at the 2021 Annual Shareholders’ Meeting, “Our goal is to make cars as affordable as possible. However, our supply chain is facing huge cost pressures, so we have to temporarily raise car prices.”

Therefore, the greatest reason for Tesla’s price changes is still the fluctuation of raw material costs in the supply chain.

The chip shortage has become an industry-wide problem for the entire automotive industry in 2021. Naturally, Tesla was not spared. The rise in chip prices will inevitably have an impact on the selling price.

At the same time, as sales of new energy vehicles increase, the price of raw materials for power batteries is also continuously increasing. Even the impression of “good value” of lithium iron phosphate experienced a round of surges in 2021–the price of lithium iron phosphate in January was 37,000 yuan/ton, and as of December 27, the price was 99,000 yuan/ton, with a full-year increase of 167.57%, reaching a historical high in three years.

It is not surprising that the entry-level models of domestically produced Tesla have experienced a price increase since they are equipped with lithium iron phosphate batteries.

In addition to the increased cost of raw materials, the decline in national new energy subsidies is also another major factor in the price increase.

According to the “Notice of the Ministry of Finance, the Ministry of Industry and Information Technology, the Ministry of Science and Technology, and the National Development and Reform Commission on Further Improving the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles,”

In 2021, pure electric passenger cars with a range of less than 300 kilometers do not receive subsidies; pure electric passenger cars with a range of 300-400 kilometers (including 300 kilometers) receive a subsidy of 13,000 yuan; pure electric passenger cars with a range of over 400 kilometers (including 400 kilometers) receive a subsidy of 18,000 yuan.

According to regulations, subsidy standards in 2020-2022 will be reduced by 10%, 20%, and 30% respectively on the basis of the previous year.

The entry-level Tesla model has a range of over 500 km. Based on the formula, the new energy subsidy that can be enjoyed in 2022 is 1.26 million yuan, which is 1.8 multiplied by 70%.

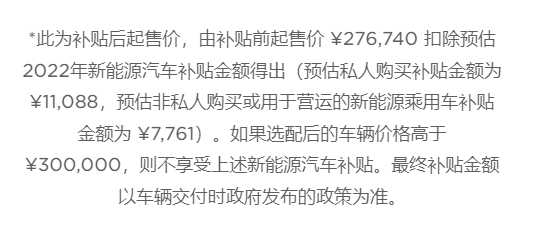

This also corresponds to the explanation of the estimated private car subsidy amount of 11,088 yuan on the Tesla official website booking page.

Finally, we should not forget that the configuration of domestically produced Model 3/Y models delivered in 2022 will be upgraded.

Previously, the domestically delivered Model Y Performance version was equipped with the MCU3 infotainment system supported by AMD Ryzen chip and a lithium-ion small battery. It is believed that this will become the standard configuration for the new domestic Model 3 and Model Y next year.

In addition, some analysts believe that due to the uncertain production time of Tesla’s super factory in Berlin, Germany, the Shanghai factory will still face severe overseas export tasks in the first quarter of 2022.

Controlling the growth of Chinese market orders through price increases may also be one of the motivations for Tesla’s price increase at the end of the year.

However, due to the self-operated and cost-pricing model adopted, slight fluctuations in Tesla product prices are always under the spotlight of public opinion.

It should be noted that the phenomena of “price hike before delivery” and other issues commonly seen in traditional automobile dealer channels due to chip shortages and other issues are even more harmful to consumer interests.

Conclusion

Tesla’s inherent “Internet celebrity” attribute has made this price increase widely noticed. And this seems to be a prelude to the general increase in the prices of new energy models in 2022.

The reason behind it is actually the same as Tesla’s price increase: subsidy reduction + rise in raw material costs.

For example, FAW-Volkswagen began to create an atmosphere of declining subsidies in early December and released the following poster.

###

###

The subsidy decline seems to have become a common sales pitch for urging customers to place orders as soon as possible for new energy vehicles.

Meanwhile, some manufacturers have also launched “limited-time price guarantee policies” for the subsidy decline to attract more orders. For example, XPeng Motors recently released a notice: from January 1 to January 10, 2022, customers who complete the down payment can enjoy a recommended retail price after comprehensive subsidy that is the same as in 2021.

In addition to the possibility that the price of new energy vehicles themselves may rise in 2022, there is another hot topic recently, which is the increase in insurance costs.

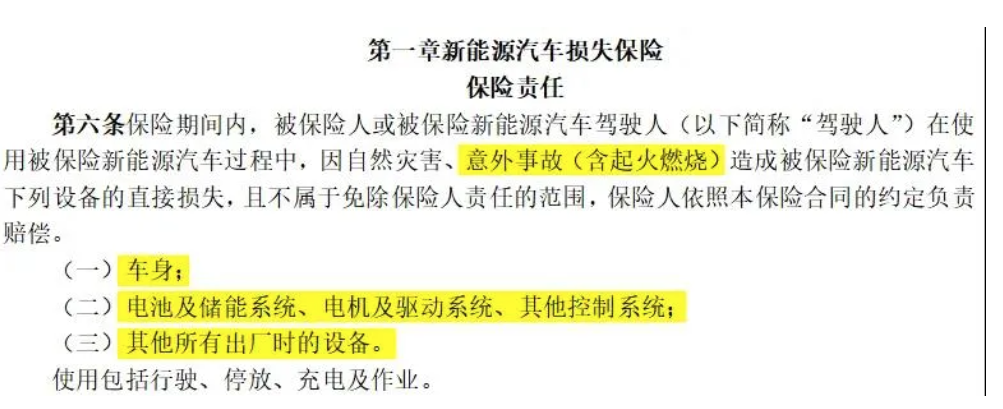

However, if we carefully study the reasons for the change in insurance costs, we can find that insurance agencies have actually removed items that were once only applicable to fuel vehicles, such as “engine water intake,” and added special insurance for the unique technical features of new energy vehicles, such as damage to the three-electric system, external power grid failures, and accidents involving self-use charging piles.

The subsidy decline means that the “visible hand” of the state is gradually giving way to the “invisible hand” of the market.

Rising costs mean that the surge in sales of new energy vehicles has increased demand for upstream and downstream raw materials in the supply chain.

The addition of insurance types means that consumers have more clear and detailed protection when using new energy vehicles.

All in all, it is actually verifying the old saying that China’s new energy vehicle market is transitioning from “policy-driven” to “market-driven”.

In other words, only in this way can the entire new energy vehicle market break out of the sweet “policy cradle” and become bigger and stronger. The process of new energy vehicles truly replacing fuel vehicles is a necessary road to take.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.