The automotive industry is experiencing the biggest transformation in the past century. The trends of electrification, networking, and intelligence have made the once stagnant automotive industry bustling with new attitudes.

Represented by the first batch of disruptors, such as “We Xiaoli,” they have received the most financing, attention and continuous growth despite the criticisms from consumers. Today, they have become the leaders of the intelligent automotive industry. Whether in terms of sales volume, brand awareness, or the accumulation of core intelligent technology, they have formed a “gap-style” lead with other companies.

With the joint efforts of the first batch of companies, the product strength of new energy vehicles has made significant progress and has now been widely recognized by the public. According to statistics from the China Passenger Car Association, the cumulative sales of new energy vehicles in the first half of 2021 reached 1.007 million, a year-on-year increase of 220\%. Just within the first half of the year, the sales volume has already exceeded the total of 2020. In November, the wholesale sales of new energy vehicles in the domestic market reached 429,000 units, a year-on-year increase of 131.7\%, and the wholesale penetration rate reached 19.9\%.

The vast market space is full of business opportunities and has continued to attract more companies to join. The second batch of companies have also begun their entry into the market.

The second batch of companies only has two choices: either to walk slowly alone or to cooperate and work together. As they have entered the market later than the first batch, most of the second batch of companies have chosen the latter after several years of development, due to the maturity of the intelligent automotive incremental parts supply chain.

As shown in the graph, most of the second batch of vehicle manufacturers whose first delivery was after 2020 have transformed from mature traditional self-owned brands. Compared with the first batch of companies, they not only have stable funding support but also inherit the industrial cooperation relationship of their parent companies. Among the second batch of companies, “Arteryta” may have the most luxurious lineup of industrial cooperation.

Arteryta unveiled the CHN platform and the first model, Arteryta 11, at last year’s technology day event. The name “CHN” comes from the first letter of the pinyin of Chang’an, Huawei, and CATL, the three partners of Arteryta. From the names of the three partners alone, the lightning speed of Arteryta can be felt. On one side is Chang’an, with over 60 years of car-making experience; on another side is CATL, the world’s number one global power battery installer for four consecutive years; and also, Huawei with ICT technology leadership and its own operating systems.No matter it is the recently released AITO AITO M5, or the Ji Hu Alpha S HI version, the Cyberelectric SF5, and the EVATAR 11, they are all seen as Huawei’s co-branded cars by consumers. However, in fact, there are significant differences between these models in terms of the depth, breadth, and strength of cooperation, and EVATAR is the first one to realize collaboration with Huawei from the bottom-up architecture, and jointly devote to software capability and sustainable iterative capability.

The collaboration on the CHN underlying architecture is the foundation of their cooperation. Based on this foundation, EVATAR is equipped with Huawei’s full-stack intelligent solution, which is Huawei’s current main recommended Huawei Inside mode with the abbreviation “HI”.

Last October, Huawei released the HI intelligent car solution, which is a collaboration mode with higher participation and collaborative definition compared with the supplier mode. Its full-stack intelligent car solution includes:

-

Three platform ecosystems: iDVP Intelligent Car Digital Platform, MDC Intelligent Driving Computing Platform Ecosystem, HarmonyOS Intelligent Cabin Ecosystem;

-

Three operating systems: the Hongmeng Cabin Operating System HOS, Intelligent Driving Operating System AOS, and Intelligent Vehicle Control Operating System VOS;

-

Five intelligent systems: intelligent driving, intelligent cabin, intelligent connected vehicle, intelligent electric vehicle, and intelligent vehicle cloud service;

-

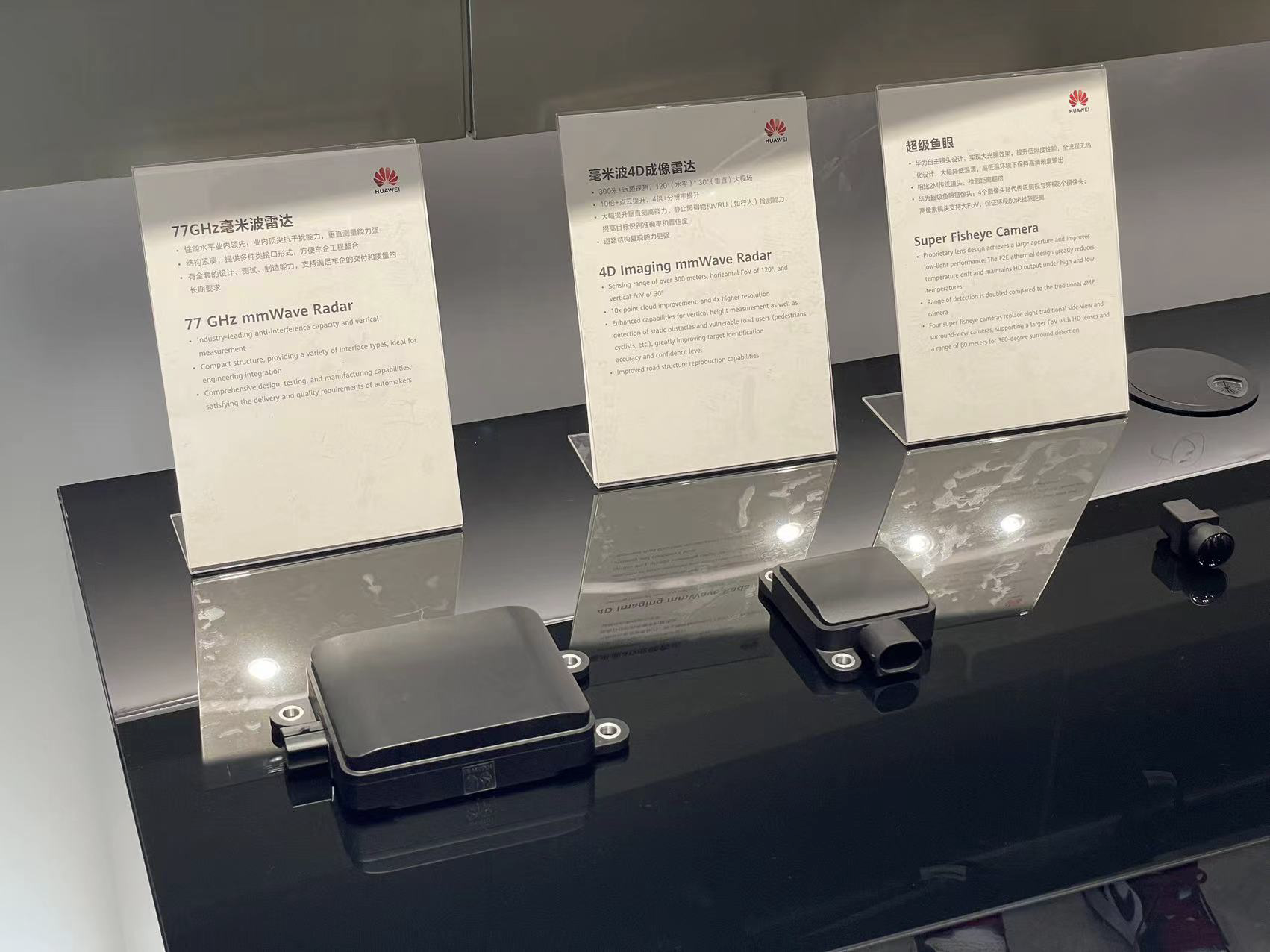

More than 30 intelligent components: MDC intelligent driving computing platform, LIDAR, and others.

The models born based on the HI mode will also have unique HI logos on their bodies to distinguish them. Currently, only the HI version of the Ji Hu Alpha S has the above-mentioned logo on its body.

In the EVATAR 11 project, the work of the three CHN parties was not in the mode of working on their own. Instead, there was a large amount of collaborative creation in every link to consider more optimal solutions from multiple dimensions of group effort in terms of overall and systematic perspectives.

Avita Technology’s chairman and CEO, Tan Benhong, also said that the CHN consortium is not a “transactional relationship” where one party pays and the other delivers; during the joint development process, everyone monitors each other and makes progress together, maximizing product potential.

Avita Technology’s chairman and CEO, Tan Benhong, also said that the CHN consortium is not a “transactional relationship” where one party pays and the other delivers; during the joint development process, everyone monitors each other and makes progress together, maximizing product potential.

In the previous HI collaboration, Huawei provided more vertical business solutions, such as intelligent cockpits and intelligent driving, and the OEMs still have a leading role in the design process of the whole vehicle. Huawei couldn’t do much in that regard.

However, Huawei played a different role in the Avita 11 model. Huawei was involved in the planning and design of the entire vehicle from the beginning of the birth of the Avita 11 platform, whether it was the layout of assisted driving hardware and architecture, the design of the underlying technology platform, the matching of software architecture, the selection of the supply chain, the coordination of production and manufacturing, etc. In short, the Avita 11 can be said to be the car with the highest “Huawei content” at present.

In addition, thanks to deep involvement in the early planning stages, Huawei’s automotive business ideas and capabilities have been maximized.

We can see the effect of this change from a detail.

The Alpha S Huawei HI version of the Jiqihuyu is equipped with a front three-laser solution, and its powerful sensing capabilities need no introduction. However, objectively speaking, it is not difficult to see from the pictures that the sensor arrangement of the entire vehicle does not optimize the styling design of the vehicle and is rather abrupt to look at under light-colored paint.

Now let’s look at the Avita 11, which also has a laser radar sensor, but this time the laser radar is cleverly designed to “hide” in a design similar to the protective coloration of animals, in the location of the side steering light. Unless you are an industry insider, it is almost impossible to notice that the overall design of the vehicle has not been compromised while ensuring functionality.

And this is just the detail we can see. In the underlying architecture and cockpit design that we cannot see, we believe there will be many such optimized designs.

Huawei’s Smart Car Solution Business Unit President Wang Jun said, “Huawei’s advantage is in ICT technology, and its weakness is in mechanical manufacturing. China and even the world don’t lack car manufacturers; what they lack are fundamental suppliers that can really do a good job in intelligentization.”

So in addition to the HI mode, Huawei can also participate in cooperation as a traditional Tier 1 or Tier 2 component supplier.The advantage of this model is that both parties can more quickly adopt new technologies, meeting the needs of traditional car manufacturers to make up for certain shortcomings in their products. The AITO Wanjie M5 and Seres SF5 are examples of this type of collaboration, but in this model, Huawei can only play a supporting role, and compared to the HI collaboration model, the overall capability and final performance of the vehicle will be more limited by various factors.

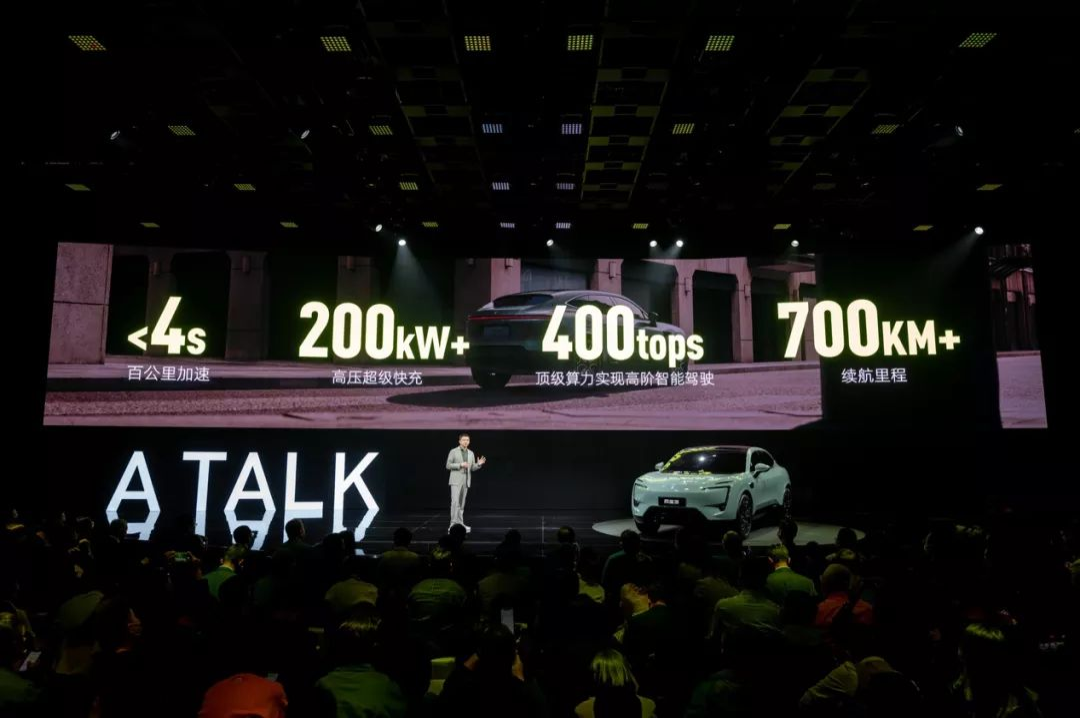

If we shift our focus back to the Avita 11 product itself, the on-paper data of the Avita 11 is also impressive:

- Zero to 100 km/h acceleration time of under 4 seconds

- 200 kW high-voltage fast charging

- 400 TOPS of autonomous driving computing power

- Range of over 700 km

The two aspects of the data that are currently in question are whether the “zero to 100 km/h acceleration time of under 4 seconds” and the “range of over 700 km” can be achieved at the same time. If the answer is yes, then as an electric vehicle, the Avita 11 will be a top-tier product in 2022. As for the “200 kW high-voltage fast charging” and “400 TOPS of autonomous driving computing power,” we have already heard about them in the previous HI collaboration vehicle, and we witnessed the strength of Huawei’s “urban navigation driving” system in April of this year.

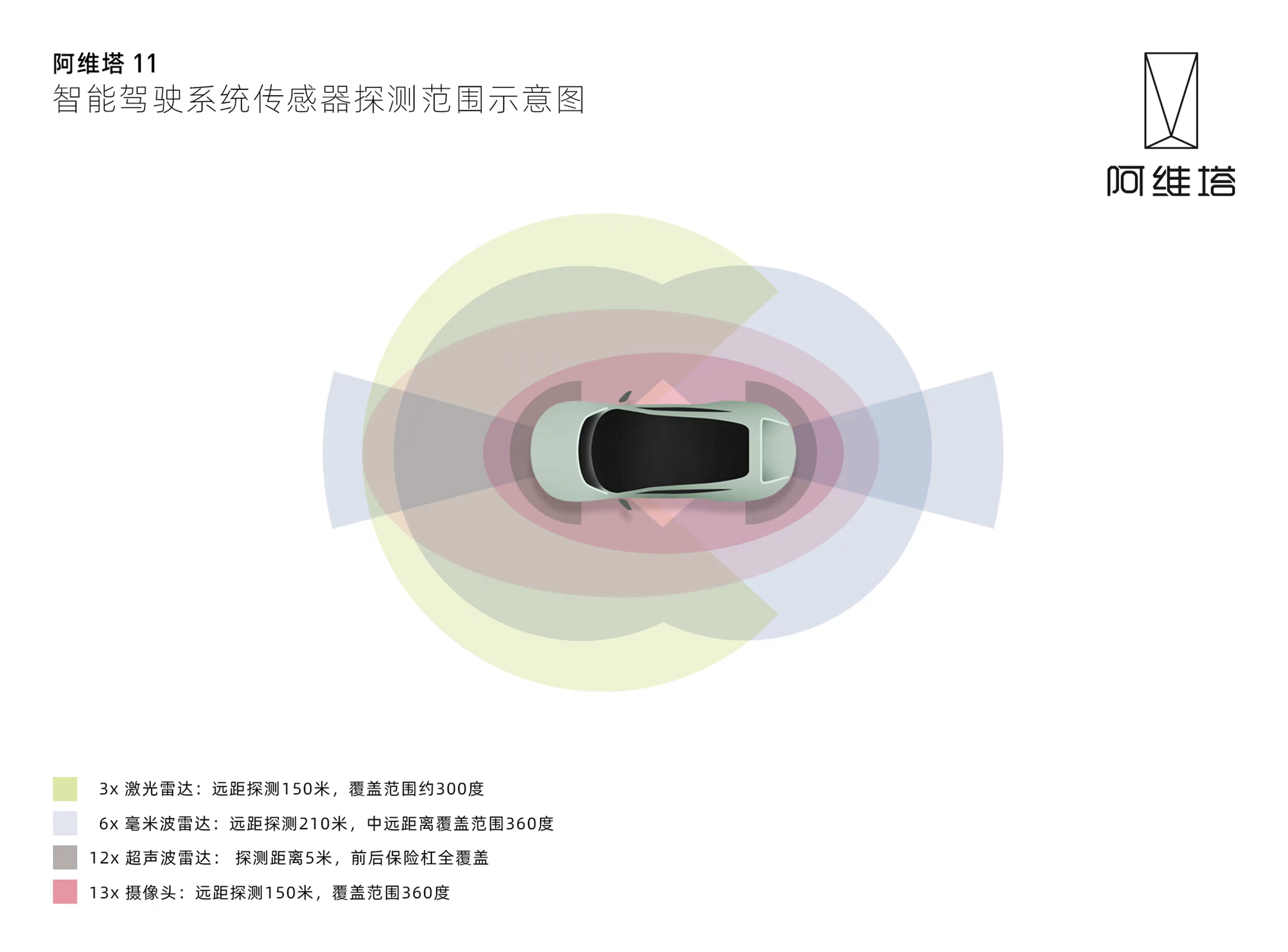

With 3 LiDARs, 6 mmWave radars, 12 ultrasonic radars, 13 cameras, and the MDC 810 platform, the intelligent driving system used in the Avita 11 is still Huawei’s top-notch solution.

Although the information disclosed about the Avita 11 so far is limited, considering the collaboration with Huawei’s previous vehicles and their deep involvement from the early stages, there is no need to have too many doubts about the expectations for the product.

Mobile and automotive, deep and boundless.No matter how intelligent technology becomes and how cars iterate, its ultimate goal is always to meet people’s needs. “For consumers, unsatisfied needs always exist,” said Tan Benhong, CEO of Avita Technology.

However, even as a consumer, one may not be aware of its existence until the business that sees the need develops a differentiated product that meets the need and presents it to the consumer. Only then will the consumer sincerely exclaim how easy and useful it is.

The same is true for smart cars. After performance and cost reach a balance, the experience of the smart cockpit will become an important differentiating factor for high-end brands and an important carrier for meeting potential user needs.

We can imagine a simple scenario. Suppose you ordered a group-buying coupon from a restaurant on Sunday evening. When you get into your car ready to drive to the restaurant, the car’s map automatically pops up with the restaurant’s address and asks if you want to go there, saving you the steps of taking out your phone, opening Meituan, clicking on the order, clicking on the restaurant address, and entering it into the car’s system.

The prerequisite for this experience is complete integration of the car and phone accounts so that the car can perceive your potential needs. Existing smart car brands have their intersection with users limited to their own apps on their phones, and car companies cannot break down the barriers between car and phone accounts or exchange data, let alone explore potential needs.

However, the Hongmeng smart cockpit on Avita 11, based on the Huawei account system and the turnover function of the atomic services in Hongmeng, has the ability to extract Meituan restaurant addresses from the phone and transfer them to the car’s system seamlessly, while other car companies may only be able to find ways to cooperate with Meituan to achieve this. This is the ability bestowed on Avita by the Hongmeng smart cockpit, but the actual performance of the car after the fact depends on how Avita uses this ability.

Design is also an irreplaceable product force

The design of Avita 11 is handled by the Avita Global Design Center in Munich, Germany, and the chief designer, Nader Faghihzadeh, previously worked on designing the BMW 7 Series, BMW iNEXT concept car, BMW i8 convertible sports car, and other models.

After its debut at the press conference, the reviews of it were mixed. Some people thought that the design was bold and futuristic, while others found it too exaggerated and excessive.

The closed front face of the Avita 11 does not have too many complex elements. The F-shaped headlights on both sides only serve to outline the vehicle’s contours.

The slight bulges on either side of the hood, combined with the black convexity under the license plate frame, make the front of the vehicle appear flatter visually. The same design technique in the black underlay of the lower part of the body creates a floating effect.

Although the Avita 11 is a high vehicle, the designer still wanted to create a coupe-like feeling on it and reduce its visual weight as much as possible.

The design of the car’s rear windshield is also quite unique. It is rare to see an SUV’s rear window using a piece of glass with such a vertical angle and slender shape. The rear end uses a design similar to a yacht porthole.

What can be certain is that the designer did follow a futuristic mindset when designing this vehicle, and this design has enough recognition, so you can recognize it as an Avita at a glance on the street.

Behind Avita is also them

The power battery is undoubtedly the most important single component on an electric car, and cooperation with battery suppliers is therefore of great significance. As the supplier that has been ranked first in the world for four consecutive years in terms of global power battery installation, CATL’s industry position is self-evident. There were even rumors in the early days that the head of a car company stayed outside CATL overnight just to get the news about battery supply.

As the car manufacturer with the highest shareholding percentage in NIO, AVISTA has reached an unprecedented 23.99\%. In AVISTA’s share structure, it ranks second only to Changan Automobile’s 39.02\%, while the remaining shares are held by local government-backed funds in Chongqing and Southern series funds.

Also, AVISTA’s board of directors also holds a seat. The three members of the board of directors are from NIO, Changan Automobile, and AVISTA Employee Team, respectively. It shows the importance that NIO has attached to AVISTA. The support from NIO has guaranteed AVISTA’s three-electric systems, energy management, charging networks, etc. While ensuring this, NIO’s cutting-edge battery technology may also be shared with AVISTA.

After all, electric cars have not completely eliminated the concern of mileage. Battery life is still one of the main factors that most consumers consider when buying electric cars. For this reason, the officially advertised mileage of AVISTA 11 has exceeded 700 kilometers.

Final Words

On the road of high-end development of independent brands, we have seen too many predecessors fall, including some products with strong technical strength. In the electric vehicle market, which is mainly based on the purchase and replacement of existing cars, users who are buying cars for the second time are not satisfied with simply satisfying their needs. Meanwhile, traditional luxury vehicle brands have a weak product lineup for electric vehicles. Therefore, a historical phenomenon in the automotive industry emerged, which is that it is easier for high-end brands to be established than low-end brands.

However, under the influence of new forces, service experience has also become an indispensable part of the brand’s high-end positioning. In addition to appearance, performance, and intelligentization mentioned above, users also hope that car manufacturers can provide high-quality services throughout the entire life cycle from pre-sale to after-sale, online to offline. And one of the biggest selling points of AVISTA now is its current half-hidden service content.

Wang Lin, AVISTA’s chief marketing officer, is responsible for the brand, marketing, public relations, and sales channels of AVISTA. Many of the departments she is responsible for involve user service.

As the person in charge of this business, Wang Lin, AVISTA’s chief marketing officer, previously worked for the InterContinental Hotels Group and was also the first local employee of Apple Retail Greater China. She has rich work experience in service and user operations.

At the HI DAY in Suzhou, Wang Lin stated that the ultimate end-users of all products are users. In all her thoughts, the first thing she thinks of is how users would feel and what they would think.It has to be said that “user thinking” is already a frequent term in the new car industry, but each company has different understandings and execution strategies for these four words. How this kind of thinking will be implemented and what effect it will have in the Wang Lin and Avita system remains to be seen, and it may have an important impact on the market performance of Avita 11.

In the upcoming Q2 of 2022, Avita 11 will officially launch its product. At that time, the true product strength of Avita 11 will also be fully revealed. As for whether Wang Lin’s “think what the user thinks” can be realized or not, we will also wait and see.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.