New Energy Vehicle Sales Hit New Highs in Wholesale and Retail

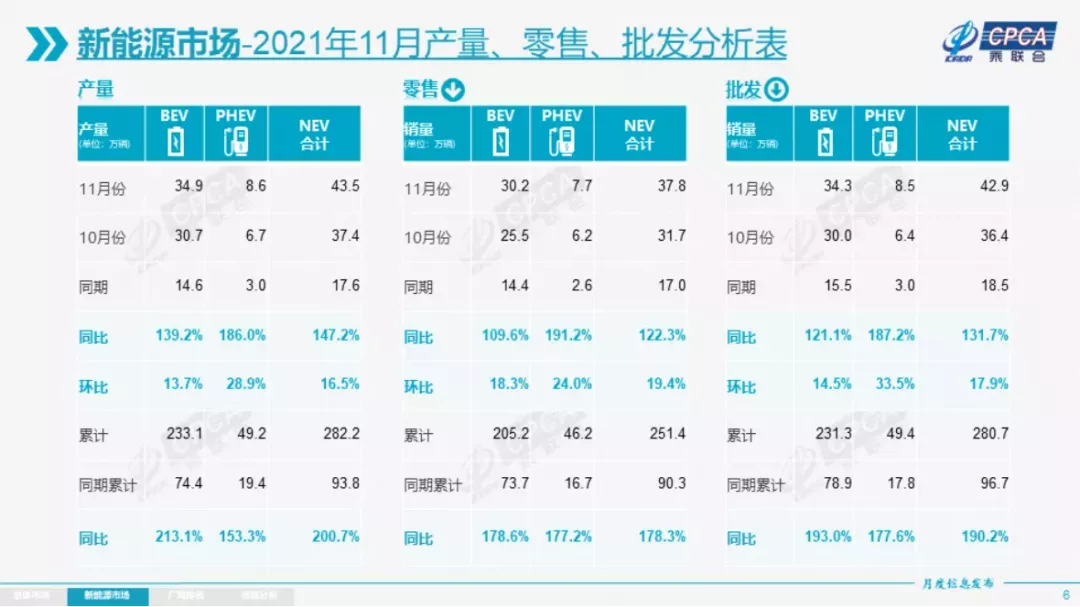

In November, new energy vehicle (NEV) wholesale sales reached 429,000, an increase of 17.9% on a month-on-month basis and a 131.7% increase year-on-year. Retail sales reached 378,000, a 19.8% increase on a month-on-month basis and a 122.3% increase year-on-year. These figures were released in the November NEV sales report by the China Association of Automobile Manufacturers on December 8.

Cumulatively, from January to November, the wholesale sales of NEVs reached 2.807 million, a 190.2% increase year-on-year, with a full-year sales target of 3.3 million. Over the same period, the cumulative retail sales of NEVs reached 2.514 million, a 178.3% increase year-on-year, with a full-year sales target of 3 million.

The NEV penetration rate for November reached 20.8%. From January to November, the cumulative penetration rate of NEVs reached 13.9%, showing a significant increase from 5.8% in 2020. In November, the penetration rate for NEVs in the domestic market was 37.4% for independent brands, 19.4% for luxury brands, and only 3.6% for mainstream joint venture brands.

In November, the wholesale penetration rate for NEVs reached 19.9%, and the cumulative penetration rate for January to November was 15.0%, significantly higher than the 5.8% achieved in 2020. In November, the penetration rate for NEVs in the wholesale market was 33.2% for independent brands, 24.6% for luxury brands, and only 3.9% for mainstream joint venture brands.

Currently, the NEV penetration rate for passenger vehicles has reached about 15% from January to November, and it is continuously increasing based on market demand instead of subsidies. The penetration rate of NEVs in the passenger vehicle market has been increasing continuously, from 2.1% in 2017 to 4% in 2018, and is now at 15%.

According to Cui Dongshu, Secretary-General of the China Passenger Car Association, there is a huge difference in the penetration rate of NEVs among different vehicle levels. Currently, the penetration rate is relatively high for A00 and B-level vehicles. This is because of the different usage scenarios. In some scenarios, particularly for short-distance commuting and as a second family car, NEVs have shown relatively outstanding performance. Therefore, the penetration rate in some segmented markets is relatively high, especially for A00-level vehicles, which have a penetration rate of 99%.In the A-class car field with a higher proportion of mainstream families, the penetration rate of new energy in November was only around 7%. This is because the models they purchase need to meet the needs of all scenarios, including short and long distances. Moreover, the living conditions of ordinary families are also somewhat limited, so traditional fuel vehicles are still the main type of A-class cars, and the increase in penetration rate is not very fast.

Regarding the improvement of future penetration rate, Cui Dongshu believes that due to seasonal and product differences, the penetration rate will not be a smooth linear growth, and it will be difficult to continue to increase substantially in the future. “We judge that the penetration rate of new energy passenger cars next year should be able to exceed 20%.”

“Part of the institutions also believe that it is difficult for the penetration rate of new energy to increase substantially in the future, mainly reflected in differentiated growth. That is to say, currently, there is a huge room for improvement in A-class, B-class, and A0-class, but A00-class has a relatively high penetration rate, mainly relying on exploring and expanding into non-traditional motor vehicle markets such as electric three-wheelers and electric bicycles.”

Strong Momentum of Plug-in Hybrid

In November, the wholesale sales of pure electric vehicles were 343,000 units, a year-on-year increase of 121.1%; the sales of plug-in hybrids were 85,000 units, a year-on-year increase of 187.2%, accounting for 20%.

In Cui Dongshu’s view, the growth momentum of plug-in hybrids this year is very strong, mainly driven by BYD, and other automakers’ plug-in hybrid models have also recovered to some extent.

In November, the sales of high-end electric vehicle models increased strongly, while the trend of mid-to-low-end models was strong. Among them, the wholesale sales of A00-class were 108,000 units, accounting for 31% of pure electric vehicles; the wholesale sales of A0-class were 53,000 units, accounting for 15% of pure electric vehicles; the A-class electric vehicles accounted for 25% of pure electric vehicle market share, rebounding from the bottom; the B-class electric vehicle reached 91,000 units, a month-on-month increase of 15%, accounting for 26% of pure electric vehicle market share.

Cui Dongshu believes that there is a significant differentiation in trend between new energy vehicles and traditional fuel vehicles. New energy vehicles have already had a replacement effect on the fuel vehicle market and have driven the automotive market to accelerate its transformation to new energy.

Strong performance of traditional automakers

In November, SAIC and GAC performed relatively well, and traditional automakers had outstanding highlights. BYD’s pure electric and plug-in hybrid two-wheel drive performed strongly.According to the data released by the China Association of Automobile Manufacturers (CAAM), there are 14 manufacturers whose wholesale sales of new energy passenger cars exceeded 10,000 units, significantly increasing from the previous period, including: BYD with 90,546 units, Tesla China with 52,859 units, SAIC-GM-Wuling with 50,141 units, Great Wall Motors with 16,136 units, XPeng with 15,613 units, GAC Aion with 15,035 units, Chery Automobile with 14,482 units, Li Auto with 13,485 units, Geely Automobile with 13,090 units, SAIC Motor Passenger Vehicle with 12,225 units, SAIC Volkswagen with 11,986 units, NIO with 10,878 units, FAW-Volkswagen with 10,705 units, and JMEV with 10,013 units.

In November, new energy vehicle startups such as XPeng, Li Auto, NIO, Neta, Leapmotor, and WM Motor performed well in year-on-year and month-on-month sales, especially Neta with sales exceeding 10,000 units. Second-tier new energy vehicle startups like WM Motor and Leapmotor also achieved monthly sales of over 5,000 vehicles in Zhejiang Province. Among mainstream joint venture brands, the new energy vehicle wholesale sales of Volkswagen North and South totaled 22,691 units, accounting for 62% of the market share. Among luxury brands, BMW reached 5,194 units in new energy vehicle wholesale sales, while other joint venture and luxury brands still need to catch up.

In terms of exports, China’s new energy vehicle exports maintained a strong growth in November, with Tesla China exporting 21,127 units, SAIC Motor Passenger Vehicle exporting 6,110 units of new energy vehicles, Geely Automobile exporting 470 units, Great Wall Motors exporting 426 units, BYD exporting 404 units, and other vehicle manufacturers’ new energy vehicle exports are also poised for growth.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.