According to the latest data, the new energy vehicle market in the US has been rapidly growing in November: 43,600 pure electric vehicles, 16,400 plug-in hybrid electric vehicles, and 56,800 hybrid electric vehicles, resulting in a total of 116,600 electrified vehicles in a single month.

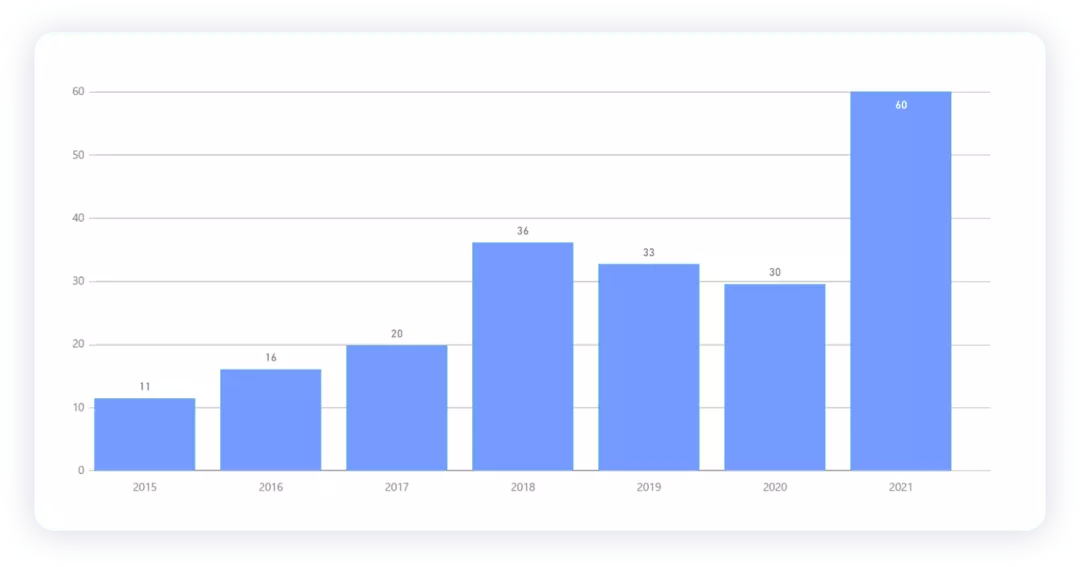

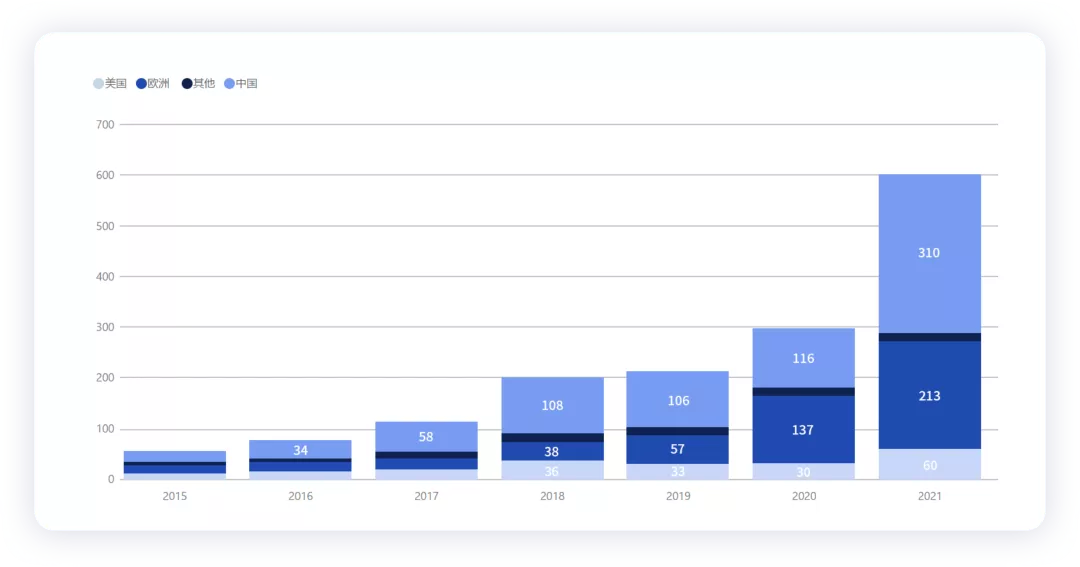

Based on monthly data compiled by Argonne National Laboratory, it is estimated that the number of new energy vehicles in the US will reach 620,000 in 2021, an 86.7% increase compared to 332,000 in 2020, and this data was recorded before the US started officially releasing subsidies, making it a relatively good number.

November New Energy Vehicle Data in the US

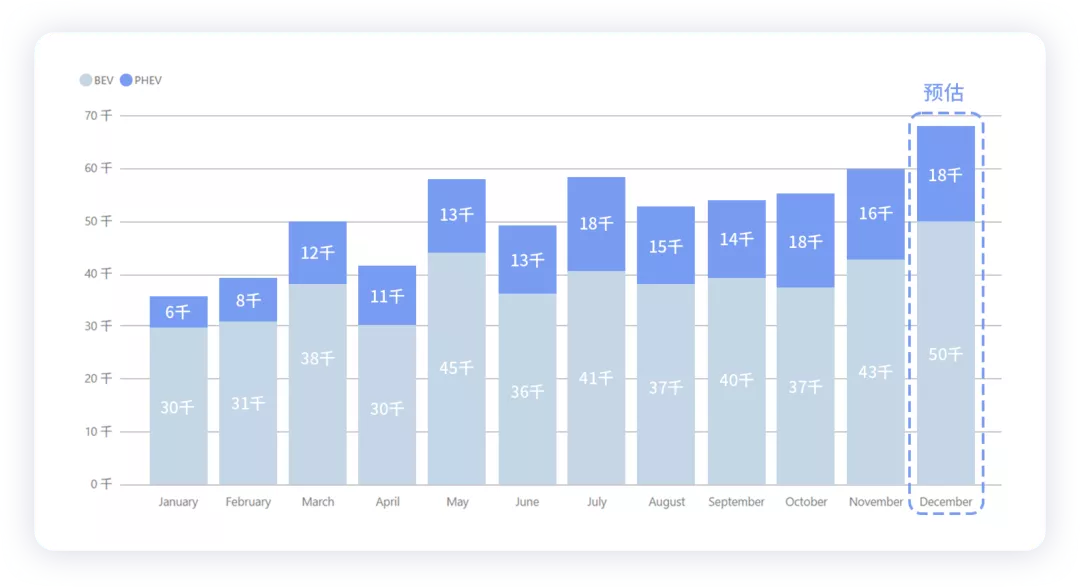

In November, the US recorded 43,367 pure electric vehicles, 16,498 plug-in hybrid electric vehicles, 56,802 hybrid electric vehicles, and 105 fuel cell vehicles. In terms of growth trajectory (Table 1), the growth of pure electric BEV has been relatively stable.

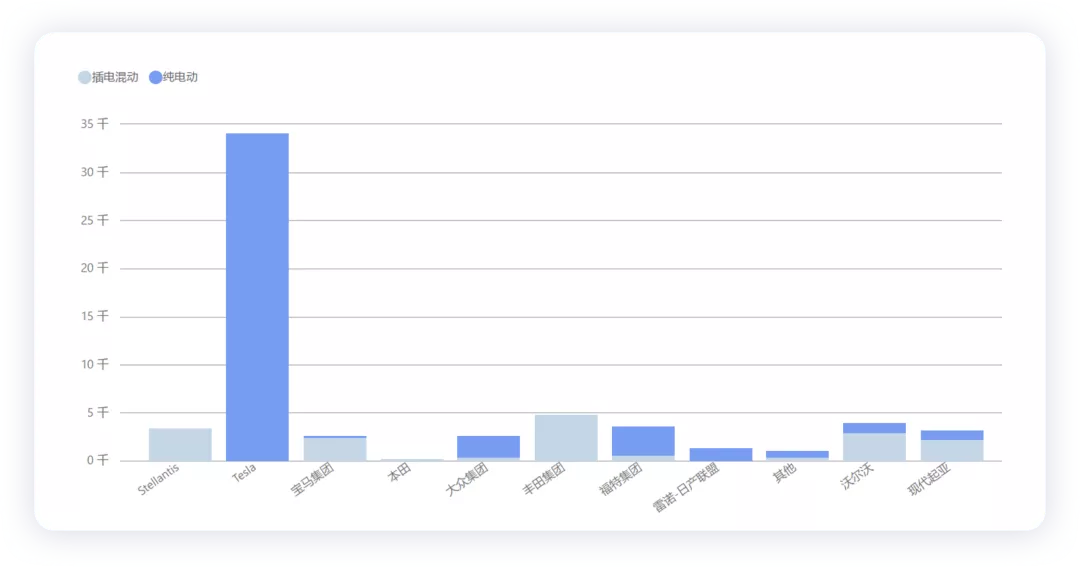

In terms of brands, Tesla dominates the pure electric vehicle market with an absolute market share of 78.35%. Ford ranks second with 7.12%, followed by Volkswagen at 5.21%.

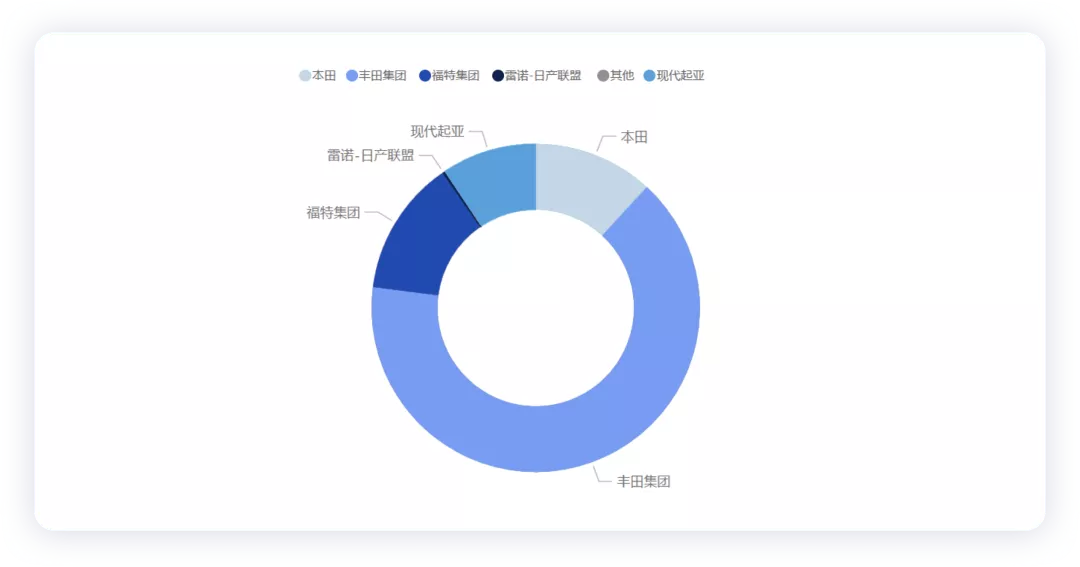

In the plug-in hybrid market, due to the relatively low market base, the landscape is still relatively chaotic. Toyota accounts for 28.66% of the market, followed by Stellantis at 20%, BMW at 14.2%, and Hyundai-Kia, which is transitioning into BEV, together holds a 12.67% market share. This is clearly shown in the visualization of Figure 2 below.

The plug-in hybrid market is actually somewhat inheritable from the hybrid domain. In this field, Toyota accounts for 65.16% of the market, followed by Honda, Ford, and Hyundai-Kia, each maintaining a market share of nearly 10-13%.

The Structure of Pure Electric Vehicles in the US Market

The market for fuel cell vehicles is not particularly noteworthy in the short term, with a total of 105 vehicles, including 27 from Toyota, 48 from Hyundai Kia, and 30 from Honda.

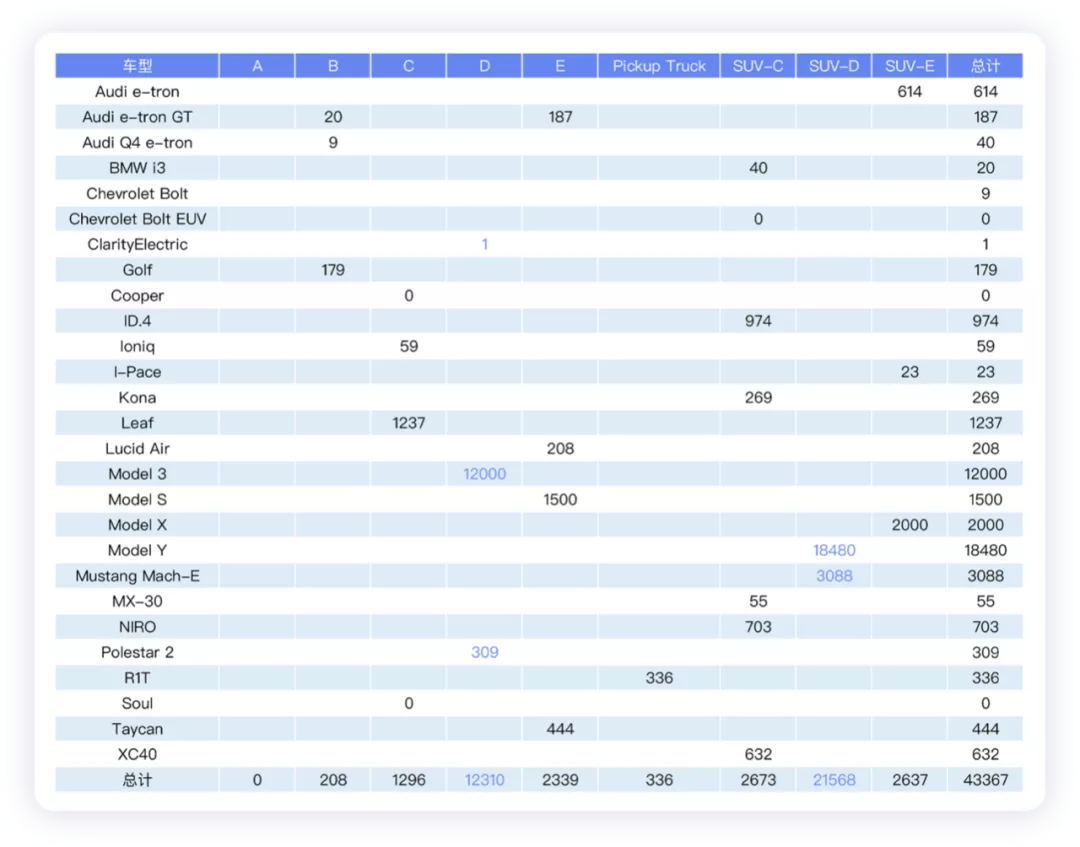

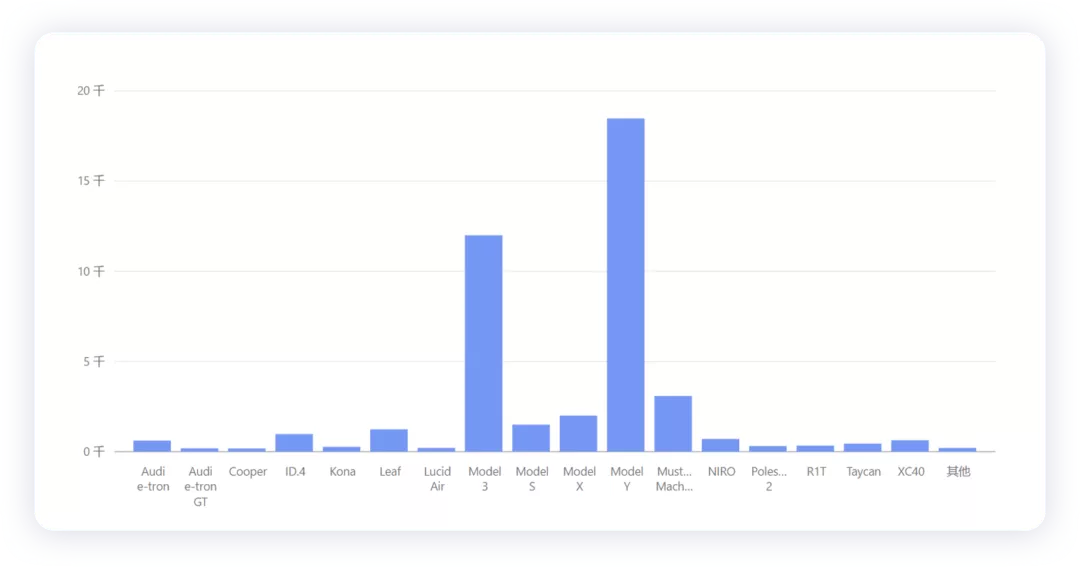

The following Table 2 illustrates the main market structure of pure electric vehicles, which are mainly concentrated in the car segment of the Model 3 and the SUV market of the Model Y.

It is noteworthy that the market sales of Mach-E are quite successful in the United States, with sales volume higher than the previous Bolt. On the other hand, Lucid Air delivered 208 units in a single month, while Rivian delivered 336 units. Next month is expected to be a crucial time for the two new car forces in the United States to push for more sales.

The following Figure 4 shows the effect more clearly, but the sales of Model X are somewhat strange.

If the overall data is listed, there is an interesting point: 2021 is very important for the development of new energy vehicles in the United States. With the support of tax policies, the US market for new energy vehicles has re-entered the track, and the trend of global triad in the future is expected.

Without this strategic adjustment, the US regional market would have lost its presence in the global new energy vehicle market, as the US market was not important before. However, this change in the US market has a significant driving force for Tesla (see Figure 6).

Conclusion: The US new energy vehicle market will be the fastest growing market in the world next year and is a place worthy of attention and digestion every month. Whether the new car forces in the United States can lurk for a period of time like those in China and then go all out to push for more sales is also a point that needs special attention next year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.