Introduction: Whether in the Chinese market or in its homeland market of Germany, Volkswagen is facing pressure from Tesla and a number of emerging Chinese electric vehicle manufacturers. In the face of poor sales, Volkswagen should look for problems in its product strength itself, with criticism over software design and outdated exterior and interior designs. The current hot trend towards intelligent cabins and intelligent driving assistance is also lacking.

SAIC Volkswagen’s ID series electric vehicle models have frequently offered discounts of 40-50% to internal employees, and now they have launched a battery leasing plan, which is a disguised installment discount. Faced with lukewarm domestic sales of electric vehicles, Volkswagen China has been rumored to have a change of leadership, and its home market in Germany has also been “invaded” by Tesla. Will Volkswagen’s main fortress also be breached?

Frequent small actions to boost sales

First, there was a screenshot of an internal notice circulating online at SAIC Volkswagen: “In order to better motivate employees to work hard for the development of the automotive industry, enhance the influence of SAIC Volkswagen brand, and promote the growth of SAIC Volkswagen brand sales, a MEB comprehensive (ID.3/ID.4/ID.6) vehicle purchase subsidy plan has been developed, which has been increased from the original 30,000 yuan to 60,000 yuan.”

There are also SAIC Volkswagen internal employees who say that there are indeed significant discounts for purchasing the newly launched ID.3, with employee purchase subsidies of 40,500 yuan and the right to repurchase at 80% for two years or 70% for three years.

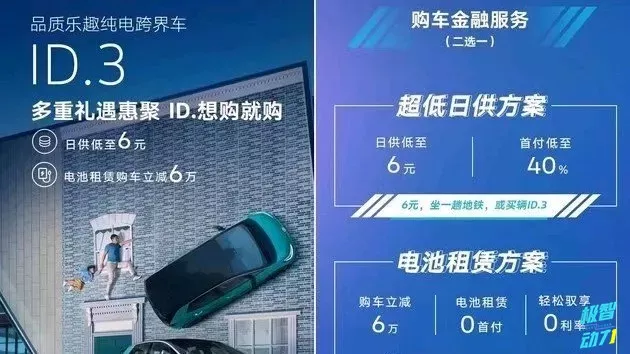

In addition to internal employees, SAIC Volkswagen has also launched multiple punches for ordinary consumers. Recently, SAIC Volkswagen has also followed suit with domestic new energy vehicle start-ups, introducing a battery leasing plan for its ID series new energy vehicle models with a discount of 120,000 yuan for ID.6 X and 60,000 yuan for ID.3.

The battery leasing plan launched by SAIC Volkswagen is actually similar to the “5-year interest-free 60,000 yuan fixed loan” program it launched previously. Obviously, the purpose of SAIC Volkswagen’s move is to reduce the purchase threshold for ID series vehicles and to hope to attract target consumer groups to those with a down payment budget of around 100,000 yuan.

According to the promotion in SAIC Volkswagen advertisement, purchasing ID.3 by renting batteries can directly reduce the purchase cost by 60,000 CNY, but a monthly rental fee of 1,000 CNY is required. After renting for five years, the ownership of the battery and the vehicle belongs to the car owner, and the rent happens to be 60,000 CNY. Taking ID.3 minimum price of 159,800 CNY as an example, it is indeed possible to buy ID.3 for less than 100,000 CNY by renting batteries, and ID.6X can be purchased for 120,000 CNY.

According to the promotion in SAIC Volkswagen advertisement, purchasing ID.3 by renting batteries can directly reduce the purchase cost by 60,000 CNY, but a monthly rental fee of 1,000 CNY is required. After renting for five years, the ownership of the battery and the vehicle belongs to the car owner, and the rent happens to be 60,000 CNY. Taking ID.3 minimum price of 159,800 CNY as an example, it is indeed possible to buy ID.3 for less than 100,000 CNY by renting batteries, and ID.6X can be purchased for 120,000 CNY.

Implementing the battery renting plan can indeed attract some customers who are reluctant to make purchases due to high down payment, but why SAIC Volkswagen introduced the battery renting plan, the first reaction on the internet is that SAIC Volkswagen’s ID. series of electric vehicles are not selling well and need promotional measures, such as this disguised price reduction, to boost sales.

In terms of effect, it is far from the sensation and positivity triggered by Tesla’s zero down payment car purchasing policy three days after its release, which was forced to stop because customers were too enthusiastic about placing orders.

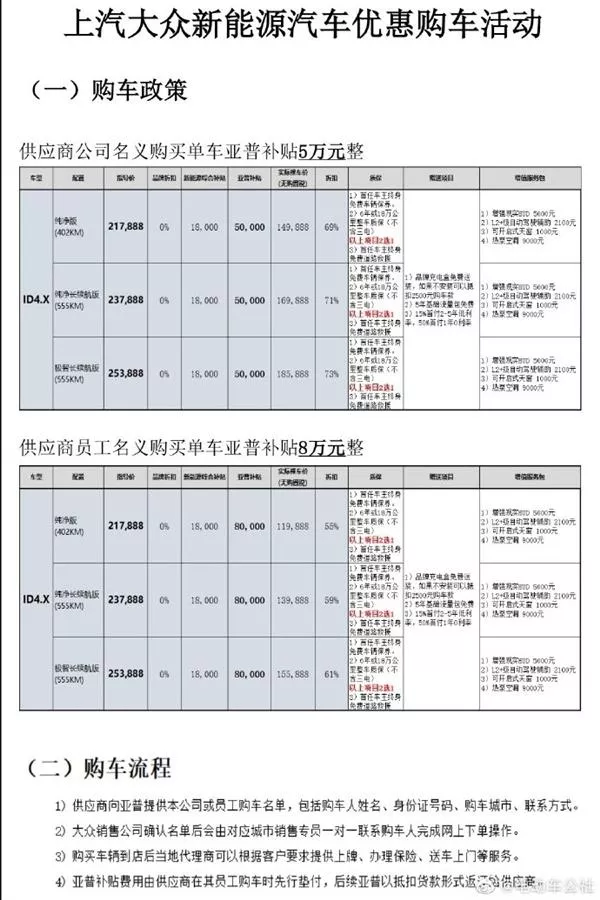

In fact, in June of this year, it was also reported on the internet that “Due to inventory pressure, SAIC Volkswagen ID.4X was exposed to sales at a loss, and employees could enjoy a maximum subsidy of 80,000 CNY for buying it!”

According to the circulating news, if purchasing ID.4X individually in the name of a supplier company, the Apilus company will subsidize 50,000 CNY, and the discount of the three models is about 30% off. The crazier thing is that if purchasing individually in the name of a supplier employee, Apilus company directly subsidizes a maximum of 80,000 CNY, which is equivalent to a 40% off discount. Although afterwards, SAIC Volkswagen’s supplier Apilus company clarified that the online rumors were not true, it is still thought-provoking.

Another incident was the punishment of “Shanghai Hualong Automobile Sales Co., Ltd.” by SAIC Volkswagen in October. The notice shows: “The dealer is punished with deducting all commission this month and a yellow card warning. I hope all agents learn from this and standardize operations and work better to improve service quality. Resolutely eliminate all kinds of market behaviors that may cause adverse consequences and maintain brand image and product reputation.”

From the notice, it can be found that the dealer violated the price norms in the contract between SAIC Volkswagen and the dealer. It can be seen from the promotional poster that the dealer made a promotional offer of a maximum direct discount of 37,000 CNY on its own, which caused a one-sided public opinion on the internet and put SAIC Volkswagen in the center of the storm. Therefore, in addition to publicly denying a substantial price reduction promotion and claiming it is non-SAIC Volkswagen official action, SAIC Volkswagen also took corresponding punishment measures against the dealer who started it.

Sales have not been lukewarm, and the pressure has doubled.The statement above mentioned the unauthorized massive discounts by dealers, which have affected the reputation of SAIC Volkswagen, reflecting that as dealers of the ID. electric vehicles of SAIC Volkswagen, they risk being fined for the entire month’s commission by releasing posters promoting discounted promotions in order to boost sales, clear inventory, and generate cash flow.

Although SAIC Volkswagen has repeatedly denied that it has not lowered prices for sales reasons or given disguised preferential treatment, whether it is the employee purchase discount of SAIC Volkswagen’s internal staff, the employee purchase discount of suppliers, the “5-year interest-free car purchase”, or the recently launched battery leasing plan, all prove that SAIC Volkswagen has frequently taken action and made efforts to boost sales.

SAIC Volkswagen has already launched multiple models in China, such as the ID.3, ID.4, and ID.6. As of October this year, the sales volume of pure electric cars shows that the sales volume of SAIC Volkswagen’s ID.4X and ID.6X, plus the just-launched ID.3, is less than 20,000 units. Combined with the sister models of FAW-Volkswagen, which are only a little over 30,000 units, it is equivalent to the sales volume of NIO ES6. This may be the reason why SAIC Volkswagen has been constantly looking for sales.

However, SAIC Volkswagen is also facing pressure from carbon credits, so it is understandable that they have no choice but to give disguised preferential treatment.

Poor sales, Volkswagen China may change leadership

According to German media reports, due to the lower-than-expected sales of Volkswagen’s ID. series of pure electric cars in the Chinese market, Volkswagen Group will replace the head of the Chinese business. Feng Sihan, the current CEO of Volkswagen Group (China), will resign in February next year.

Feng Sihan officially became the CEO of Volkswagen China in early 2019, responsible for the business operations in China. In 2019, the Chinese market contributed nearly 40% of Volkswagen Group’s sales, reaching a historic high of 4.23 million units, and the market share of Volkswagen Group in China rose to 20%.

However, from 2020, under the background of the epidemic, Volkswagen Group’s sales in China have declined. Public data shows that in the first three quarters of this year, Volkswagen Group’s cumulative sales in China were 2.55 million units, a year-on-year decrease of 4%.

In a statement issued on October 15, Volkswagen Group said that it plans to sell 80,000 to 100,000 units of the ID. series in the Chinese market this year. However, as of the end of October, the sales volume of the ID. series of electric vehicles of Volkswagen Group in China was about 47,200 units.

Although Volkswagen China has denied rumors of a change of leadership, the decline in sales data is undeniable, and only Volkswagen knows whether there is a connection between the two.

Tesla’s attack, the stronghold is lost

“The next Golf must not be a Tesla! The next Golf must not come from China! The next lighthouse product must be from Wolfsburg!” Volkswagen’s global CEO Diess shouted at the employee conference on November 4th.At the end of November, it was reported online that Tesla’s super factory in Berlin, Germany will receive full approval from the German side in a few days and will begin mass production in December. If the news is confirmed, the long-stalled Tesla Berlin factory will officially enter the production process, undoubtedly penetrating the stronghold of Volkswagen.

The Berlin factory, with an annual output of 500,000 vehicles, will supply the entire European market in the future, reducing the manufacturing and transportation costs currently exported from the Tesla Shanghai factory. Tesla’s models will be more cost-effective, intelligent, and perform better in Germany and even more popular with European consumers.

According to EV Volumes, Tesla’s strong performance in the Chinese market also continued in Germany, which is the stronghold of Volkswagen and BBA. Currently, the Tesla Model 3, which has not yet been put into production in Europe, has become the best-selling car in Europe.

In September, sales of the Tesla Model 3 reached 6,828 vehicles in the German market, not only ranking first in new energy vehicle sales in Germany but also exceeding the combined sales of BMW, Audi, and Mercedes-Benz cars in the same category (6,100 vehicles). At the same time, with sales of 1,073 vehicles, the Tesla Model Y ranks 12th in the new energy vehicle sales ranking in Germany.

Tesla’s strong performance in the global market has already made traditional car manufacturers such as Volkswagen feel the crisis.

On October 14th, foreign media reported that Volkswagen CEO Diess told the company’s board of directors that Volkswagen is considering cutting up to 30,000 jobs to reduce costs and improve market competitiveness, in order to better compete with opponents such as Tesla.

On October 16th, Diess said at a previous senior management meeting, he invited Tesla CEO Elon Musk to speak to 200 executives to motivate senior executives of Volkswagen to accelerate the pace of transformation into electric vehicles.

Volkswagen CEO Diess said that in the competition with Tesla, manufacturing capability will become Tesla’s main advantage. Tesla is today’s benchmark for electric vehicles, while other powerful Chinese new forces in car manufacturing have already begun to enter our market.

Whether it is the Chinese market or the German market, Volkswagen is facing pressure from Tesla and a group of emerging Chinese electric vehicle manufacturers. in the face of poor sales, Volkswagen should look for its own problems in product strength, the criticized software design, and outdated exterior and interior designs. The currently popular intelligent cockpit and intelligent assisted driving are also a weak point.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.