Author: Tianhui

As soon as we finished work on November 30th, Voyah Automotive quickly announced its sales for the month.

After one night, the official WeChat accounts of various car companies became lively, with nearly 10 car companies announcing their November sales from morning till night. Originally, only new energy vehicle companies would announce their sales on the first of each month, but now this has become a common choice for all car companies, and even has a sense of competition.

From the data of various companies, we can describe November’s new energy vehicle sales as a carnival. Chinese EV companies such as XPeng, Aiways, Guangzhou Automobile Aion, and Volkswagen ID, and NIO’s ES6 Pro, reached a new high in monthly sales. Especially for the pure electric vehicle brands of traditional automakers like Guangzhou Automobile Aion and Volkswagen ID, their sales are particularly strong, and have continued to rise for several months.

The top three new energy vehicle companies in terms of sales, BYD, and SAIC-GM-Wuling have not yet announced their November sales figures. In the overall market trend of rising sales, their sales are believed to have grown significantly compared to October. Also in the overall trend of rising sales, it is expected that SAIC Passenger Vehicle and Chery New Energy will also break through 10,000 vehicles sold.

Overall, it is expected that more than 10 car companies will break through 10,000 vehicle sales in November.

Chip shortage eased, sales reached a new high

The well-known industry expert Zhu Yulong predicted this morning: “After the chip shortage is resolved, the top four new car manufacturers will all exceed 10,000.”

As expected, XPeng, NIO, Li Auto, and WM Motor all surpassed 10,000 units in November, becoming the first echelon of new car manufacturers.

The chip shortage that Zhu Yulong mentioned refers to the shortage of chips that has been going on for many months, which has had a significant impact on the production capacity of many car companies. At the beginning of this year, car companies were in a panic to buy MCU chips. It wasn’t until the country took action to regulate the chip market and punished some distributors who hoarded chips that the MCU chip shortage eased.

After the summer, the production capacity of mmWave radar chips became a problem. Due to the interruption of production capacity at a Bosch factory in Malaysia that packaged chips, many new energy vehicle companies encountered production bottlenecks. Sales of vehicles increased from the beginning of the year but began to decline.The sales figures released by Li Xiang Auto imply this point perfectly.

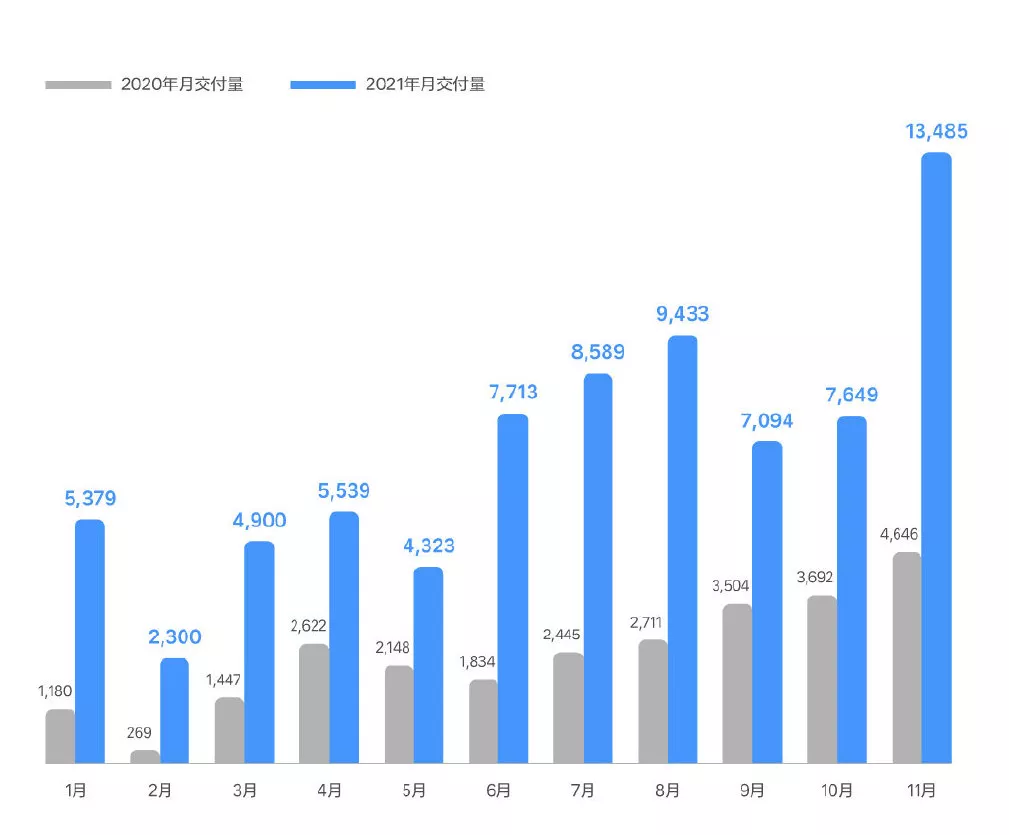

After Li Xiang Auto released their new model, Ideal ONE, in late May, their sales figures skyrocketed. However, they were affected by the chip shortage in September and October, resulting in a significant drop in monthly deliveries. In mid-October, Li Xiang Auto released a new delivery plan, and sales figures once again resumed their upward trend.

The interim delivery plan offered by Li Xiang Auto meant that customers could choose to wait for the full-featured model to be delivered or opt for delivery of a single millimeter wave radar-equipped vehicle with the rest of the millimeter wave radar systems installed after delivery.

Many other automakers have also introduced similar interim delivery plans.

After the P5 model was launched by XPeng Motors in September, they too released an interim delivery plan in October. Owners could choose to delay delivery of the full-featured vehicle or choose from two options where the car was delivered first, and the millimeter wave radar system was later installed.

Therefore, the increase in sales figures in November was closely related to the recovery of chip supply, and the flexible delivery policies of new energy vehicle manufacturers.

Before the end of the year, the chip shortage is expected to continue to ease, and it is anticipated that the sales figures of various automakers will further increase.

Reorganization of New Energy Vehicle Industry

After NIO successfully entered the club of automakers selling over 10,000 cars monthly, another new company has joined the first tier of new energy vehicle manufacturers where selling over 10,000 cars monthly has become the threshold requirement.

In the first tier, each brand has found its positioning and started to develop itself in its target area.

NIO is positioned in luxury and service. As the first-tier new energy vehicle brand to release new models, NIO places emphasis on the entire industrial chain and provides unique services, such as battery swapping, to high-end car owners. However, this year, NIO sold only old models such as the ES8/ES6/EC6, and the new product ET7 is not due for delivery until 2022. Therefore, maintaining sales figures of over 10,000 cars monthly will be challenging for NIO. Nevertheless, NIO has proven that fast recharge technologies can support luxury brand image.

XPeng is positioned in intelligent technology. At this year’s Guangzhou Auto Show, XPeng Motors released its new brand logo and enterprise strategy, emphasizing the intelligent technology attributes of its products. XPeng insists on self-development of software and is a pioneer in the application of lidar technology. Its technology application is more advanced.

Li Xiang Auto is in the midst of strategic adjustments. Ideal ONE, its first vehicle model, experienced a significant rise in sales figures after its redesign, which was no easy feat.

By releasing their small pure electric SUV model NETA V, NETA Auto quickly made it into the first tier of new energy vehicle manufacturers. As electric cars enter households, pure electric vehicles below 100,000 yuan are gradually beginning to replace traditional gasoline cars, and NETA Auto has planted itself in this market, achieving impressive sales figures.

Following the first tier is the second tier, where selling over 5,000 cars monthly is the threshold requirement. Representing automakers in this group are LIjia and WM Motor.Early player WM has been lukewarm in terms of sales performance. After multiple rounds of financing, WM is about to release its new car, the M7, and will further collaborate with Baidu in the field of intelligence.

Leading the charged self-developed claim, Zero Run hopes to self-develop and self-produce everything, including autonomous driving chips. However, whether Zero Run, which has ranked in the second-tier league through its mini electric vehicle T03 sales volume, can maintain its position above the second-tier league remains to be seen.

Regardless of the players in the first and second-tier leagues of the new car-making forces, an undisputed fact is that the threshold for the first-tier league will further increase. NIO, Ideal, and XPeng still have a large room for growth, while carmakers ranking lower must accelerate their development to avoid being left behind by the leading companies.

Economies of Scale May Become an Invisible Moat

Since the top three new energy carmakers, BYD, Wuling, and Tesla, have not yet disclosed their sales performance, the sales performance of various carmakers is basically at the same level with a monthly sales volume of 10,000 vehicles still being an important threshold based on the existing data.

However, if the estimated sales performance of the top three carmakers is compared, an obvious trend can be seen. The gathering effect of leading carmakers is further surfacing, and economies of scale will become the focus of competition among various carmakers in the next step, with a possibility of becoming an invisible moat.

New energy carmaker sales performance in November, including estimated data, as of 24:00 on December 1

Based on estimated sales volumes of 90,000, 60,000, and 30,000 for BYD, Wuling, and Tesla respectively, it can be seen that only BYD’s monthly sales volume is close to the total sales volume of several tail-end carmakers. Rumors have it that BYD is expected to achieve a breakthrough in monthly sales of over 100,000 vehicles.

The same goes for annual sales performance ranking.

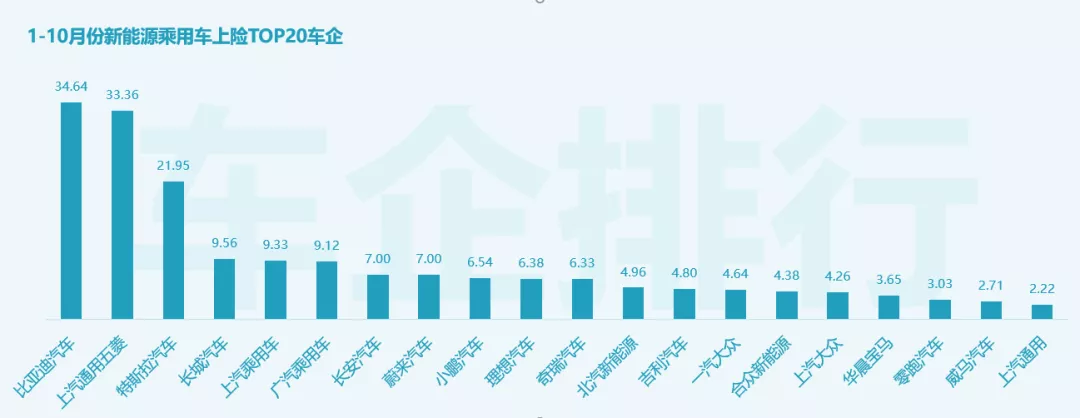

In a more accurate ranking of vehicle insurance numbers, BYD, Shangtong Wu, and Tesla are the top three carmakers with 900,000 units sold from January to October, accounting for 35% of total sales.

In terms of production capacity planning, the top three carmakers BYD, Wuling, and Tesla all have huge production capacity planned for the next few years. According to public reports, Tesla has already begun to expand its Shanghai factory, while BYD has planned production bases in multiple regions, with a projected production capacity of over 1.5 million vehicles in 2022.

Wuling Motors has just completed the expansion of its Chongqing factory and will produce the extended-range version of Hongguang MINI EV next, which has already been included in the MIIT announcement and is ready to launch.

Outside the three carmakers, production capacity planning for leading carmakers is equally aggressive.

By the end of 2023, Ideal Car expects to reach an annual standard design capacity of 500,000 vehicles, which will increase to nearly 700,000 vehicles per year with two-shift production.Guangqi Aiyuan announced at the Guangzhou Auto Show that its production capacity has expanded to 200,000/year and is expected to reach 400,000/year by the end of 2022.

XPeng Motors currently has a production capacity of 100,000/year and is expanding its Guangzhou-Zhaoqing factory. Its Guangzhou and Wuhan factories are also under construction, and its production capacity is expected to exceed 400,000/year by 2023.

NIO has planned a new 1 million scale Xinqiao intelligent electric vehicle industrial park in Hefei, Anhui.

After the top car companies have planned so much production capacity, electric vehicles are entering the stage of scale effect cost reduction, and new players in the market may face the invisible threshold of scale effects.

Who Will Be the Annual Sales Champion

After the November sales figures were released, the competition for the annual sales leaderboard entered a white-hot stage.

But based on current achievements, BYD is expected to win the crown of annual new energy vehicle sales champion. In the new force of car manufacturing, the competition between NIO, Li Auto, and XPeng is still uncertain.

As of November, NIO delivered 80,940 vehicles, Li Auto delivered 76,404 vehicles, and XPeng delivered 82,155 vehicles, with little difference in delivery volume among the three automakers. In December, the three leading new forces are expected to compete for the annual sales crown.

In the traditional car companies’ pure electric vehicle brands, competition is also intense.

EA brand has stabilized its monthly sales volume at above 10,000 vehicles, and its annual sales volume has reached 100,000. Ora, a brand owned by Great Wall Motors, has roughly the same sales volume as EA, but whether it can maintain a significant increase in sales volume in December due to the chip shortage of Haomao and Heimao remains to be seen.

Volkswagen’s ID. brand of pure electric vehicles is quickly catching up. This month, sales of the ID. series reached 14,000 vehicles. Compared with Volkswagen’s market scale of 3 million vehicles/year in China, it is still relatively small. However, the rapid increase in ID. series sales is obvious, and it is expected to win the annual new energy vehicle sales championship among joint venture brands.

Among many highlights, the most noteworthy are still BYD and Tesla.

There is no question that the pure electric vehicle sales champion this year will belong to Wuling Brand, but the competition for second place in pure electric vehicle sales has entered a white-hot stage, and BYD and Tesla will compete for this.

Tesla Chairman Musk has released news through media outlets that he intends to change the practice of disregarding costs and pushing sales in the last month of the quarter. Therefore, situations where 50,000 vehicles were sold in a single month like in September may not appear in December. Regarding BYD, its pure electric vehicle production and sales volume is steadily increasing, and there is a possibility of a monthly sales volume breakthrough of 50,000 vehicles. Looking at the number of insurance policies, Tesla is slightly ahead of BYD from January to October this year, with a gap of less than 20,000 vehicles.

In conclusion, the Chinese new energy vehicle market still has many uncertainties to be resolved in the last month of 2021.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.