On the first day of December 2021, the top three new forces in the automobile industry announced their delivery data for November in an orderly manner. Li Auto delivered 10,878 vehicles, XPeng delivered 15,613 vehicles, and NIO delivered 13,485 vehicles.

Finally, these three companies simultaneously achieved delivery figures starting with ten thousand, officially raising the monthly sales threshold of “TOP 3” new forces to five digits, while also setting a series of records.

Joyful Moment for Each of the Three

XPeng: Three Consecutive Months

In November, XPeng delivered a total of 15,613 vehicles, setting a new high for single-month deliveries. The goal set by He XPeng, “15,000 monthly deliveries in Q4,” stated on the Q2 financial report of XPeng Motors has finally been achieved. The breakdown of the deliveries is as follows:

- G3i: 5,620

- P7: 7,839

- P5: 2,154

Since the remodel, XPeng G3i’s delivery volume has increased significantly, doubling from just over 2,000 units to 5,620 units in November. From this result, it can be seen that the “P7 Face” redesign and new configuration have been recognized by users. Currently, among the 150,000-180,000 RMB electric SUVs, the intelligent level of G3i still holds a leading position. However, with the delivery of the Leading Ideal One, which is superior in size, configuration, and cost-effectiveness, G3i’s sales may be diverted to some extent.

As the main selling model, P7 supported half of XPeng’s deliveries in November, setting a new high of 7,839 vehicles delivered in a single month. Since July, P7 has delivered more than 6,000 units for four consecutive months, showing some degree of sustainability in sales.

Newcomer P5’s delivery data of 2,154 vehicles in the second month met expectations. On the one hand, P5 is still in the ramp-up phase of production, and the fifth-generation millimeter-wave radar used in P5 from Bosch is currently in short supply, which will continue until the first quarter of next year, and therefore, P5’s production will still be limited in the near future. As the supply of fifth-generation millimeter-wave radar improves gradually and the backlog of orders is gradually released, P5’s deliveries will further increase in the future.

For XPeng Motors, November was the third consecutive month of delivery exceeding 10,000 units and the second consecutive month of topping the monthly sales chart among new forces. This momentum is worth paying attention to.

LI Auto: Late to Break Ten Thousand, But Finally There

In August, Li Auto, which had delivered more than 9,000 units, was restricted by the shortage of millimeter-wave radar in the following two months. After lying low for two months, Li Auto finally broke through the 10,000-vehicle mark in November with a monthly delivery of 10,878 vehicles of LI ONE.Unlike NIO and XPeng, IDEAL has achieved a sales volume of over 10,000 units with only one product, making it the first domestic new energy vehicle startup to achieve this milestone.

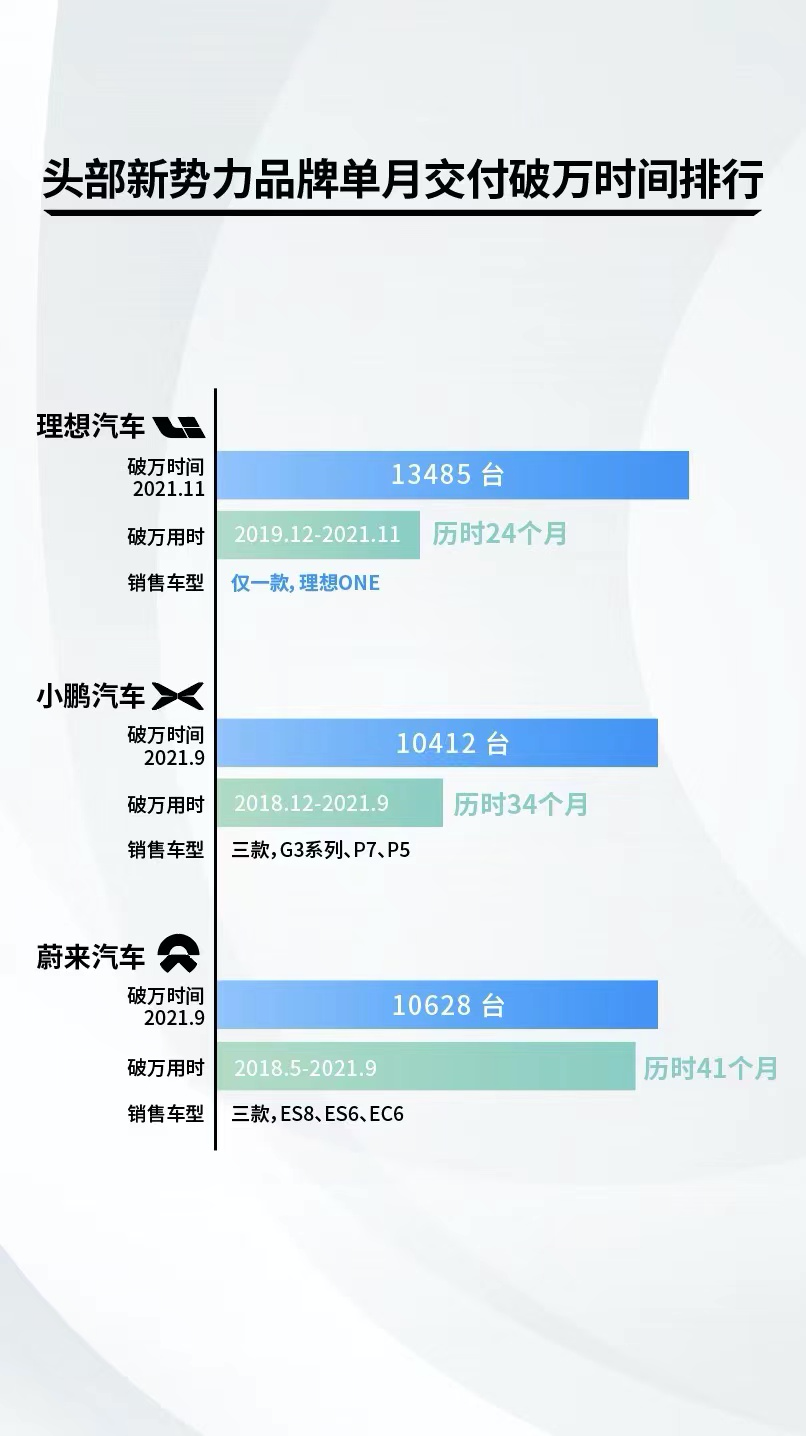

In terms of the time required to achieve a monthly sales volume of over 10,000 units, IDEAL only took 24 months, while XPeng and NIO took 34 and 41 months respectively. Therefore, IDEAL stands out among the top three new energy vehicle startups with the fewest models and the fastest achievement of monthly sales volume of over 10,000 units.

Throughout the history of domestic independent brands, IDEAL ONE has also become the first model with a price of over RMB 300,000 to achieve a monthly sales volume of over 10,000 units.

Regarding supply, the shortage of Bosch 5th generation millimeter-wave radar on the 2021 IDEAL ONE will continue into the first quarter of next year, and production capacity during this period will still be limited. Excluding backlogged orders, the demand for new orders remains strong, with approximately 14,000 new orders in October and 13,485 units in November. The latter figure will be refreshed after the radar supply is eased.

NIO: Production Resumes, Returns to Selling Over 10,000 Units

From September 28 to October 15, NIO stopped production to prepare for subsequent mass production of new models, resulting in a delivery of only 3,667 units in October.

After production resumed, NIO delivered 10,878 units in November, reaching a new high in monthly sales, including:

- 2,683 units of ES8

- 4,713 units of ES6

- 3,482 units of EC6

Whether in terms of overall sales or sales by model, NIO’s performance in November lived up to expectations. However, with a monthly sales volume of nearly 11,000 units, NIO fell from being the top seller in September to the third place in November. The impact of chip shortages on production capacity and the strong demand growth in the market were evident in the past two months.

As the end of the year approaches, NIO DAY is coming soon, and the pre-production of the ET7 is already offline. Deliveries of the ET7, as well as the rumored “ET5,” will be NIO’s main focus in the first quarter of next year. Before that, there should be no problem maintaining a monthly sales volume of 10,000 units with the current product line. According to official NIO news, NIO’s monthly new orders in October set a historic record.## New Chapter: The Popularization of New Forces

From June last year to now, excluding February this year, the growth of China’s new energy vehicle market has continued from beginning to end, as shown in the sales trends of the top three new forces in the above figure.

Different Growth

Excluding the incomplete data of November, from January to October this year, the retail sales of China’s new energy vehicles have reached 2.139 million units, a year-on-year growth of 191.9%.

The cumulative year-on-year growth data for the new forces from January to October is as follows:

- XPeng has delivered 66,542 vehicles, a year-on-year increase of 289%;

- NIO has delivered 70,062 vehicles, a year-on-year increase of 123%;

- Ideal has delivered 62,919 vehicles, a year-on-year increase of 188%.

XPeng’s growth speed this year has significantly outperformed the market, but considering that the P7 was not delivered throughout the whole year last year, such data is not comparable enough. However, in terms of XPeng itself, this year’s growth speed is comparable to taking an elevator. The sustained efforts of the P7 in recent months have also allowed more people to see the positive impact of intelligence on the long-term growth of an automotive product.

Ideal has updated its models this year, but it is still a product. In a market where there are more new energy vehicles and more competitors with significantly improved overall standards than last year, its year-on-year growth rate is almost on par with the overall market growth rate. This is not easy, and it also shows that the introduction of new car models has not caused too much diversion for Ideal ONE’s growth.

NIO did not update its products this year. Despite the strong competition from the Model Y, which is its main selling model, it still achieved a year-on-year increase of 123% compared to last year. Such data once again proves that among mainstream competing new energy vehicle models in the current incremental market, it is not a matter of life or death, but who is faster and who is slower.

Looking ahead, the top three new forces have more exciting things to offer.

More Exciting Things Ahead

In terms of plans and expectations for next year, we can look at the information from the Q3 meetings of the three companies.

XPeng

Orders for the P5 have been booked for four months, and 50% of users have chosen the XPILOT 3.0 or 3.5 models. This ratio has already exceeded that of the P7. In terms of orders, XPeng predicts that the number of new monthly orders will exceed 15,000 in the next two months.In terms of market expectations, XPeng expects 50% of its sales to come from overseas markets after becoming an international brand. They plan to establish an international team before 2022, and cars produced between 2023 to 2025 will support safety and data standards in China, Europe, and other countries.

The flagship model G9 will adopt an 800V electrical platform next year, and XPeng will upgrade to a 360kW high-voltage fast charging pile in the second quarter, followed by a 480kW fast charging pile. The all-new XPILOT 4.0 will be significantly upgraded in perception, computing power, and electronic architecture for the platform.

XPeng is also considering using XPILOT 3.5/4.0 production models to develop Robotaxi. However, the goal of this project is not to enter the transportation market, but to test the closed-loop capabilities of software, hardware, and data for long-term use in a city, and to improve the ability of future XPILOT versions.

In December this year, Ideal Automotive will launch NOA, and in the second quarter of next year, they plan to release full-size extended-range SUV X01, which will be delivered by the third quarter of next year. During the Spring Festival, their production capacity will reach 16,000 units per month. The gross profit target is 25%, which is an important factor in supporting the continued 10% R&D investment in the long term. By 2023, Ideal Automotive’s total planned annual capacity will reach 500,000 units, and could potentially reach 700,000 units with double shifts. The Beijing factory can achieve flexible production of 4 models. The development of the 4C battery is progressing normally, and the delivery time for high-voltage pure electric models is planned for the end of 2023.

The main event for NIO next year is the mass production and delivery of ET7, which is currently planned for showroom demonstration before the Chinese New Year and delivery in the first quarter. The gross profit margin of the ET7 is currently good, and NIO’s target gross profit margin is 25%, which can be achieved when NT2.0 achieves an annual output of 300,000 units. In addition to ET7, the other two new models on the NT2.0 platform are expected to begin delivery in the second half of next year. The second base of the Xin Qiao industrial park will start production in the third quarter of next year, and NIO’s maximum annual output with double shifts in its two factories can reach 600,000 units. NIO will enter at least five European countries next year, and the overseas sales volume is expected to reach 50% of the total sales in the future. After NT2.0 is launched, they will introduce a corresponding hardware upgrade plan for NT1.0 users, and the 150-degree battery will be delivered in the fourth quarter of next year.

Final ThoughtsThe news that the top three new forces have all surpassed 10,000 sales in November for the first time is unprecedented. However, in the following period, unless a factory of a certain company undergoes construction and production suspension, it is likely that achieving this milestone simultaneously will be an unattainable situation. It is difficult to imagine that the current top three new forces, who are still enjoying great popularity today, were once hovering on the brink of death in 2019.

Nevertheless, how to successfully move forward during this period of high-speed growth will be a more challenging test. After all, the penetration rate of new energy has not yet reached half of the market, and Tesla is still moving forward at an astonishing speed and exerting tremendous pressure on everyone. November was great, but it is not time to celebrate just yet.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.