This morning, Qualcomm officially released the new generation mobile platform, Snapdragon 8 Gen1. Just after the release, Xiaomi CEO Lei Jun announced on the spot that Xiaomi 12 will be the first smartphone brand in the world to launch the new generation Snapdragon 8 chip. Interestingly, not only Xiaomi, Realme also announced on Weibo that it will become the second smartphone brand to launch a Snapdragon 8 flagship globally. Motorola even dissed Xiaomi in a post, implying that it is the “true first launch”.

First release battle to become a norm in the automobile circle

The fierce competition among smartphone brands for the first release of Snapdragon mobile chips suddenly reminded me of a few days ago when Jidu Auto announced that its first mass-produced car model will debut in China with the Qualcomm 4th generation Snapdragon automotive digital cockpit platform 8295, and is expected to be officially unveiled at the Beijing Auto Show in April next year and go into mass production in 2023.

In fact, this is not the first time 8295 has made an appearance. General Motors’ Ultra Cruise and Mercedes-Benz have also announced the first release of Snapdragon 8295 in North America and Europe respectively.

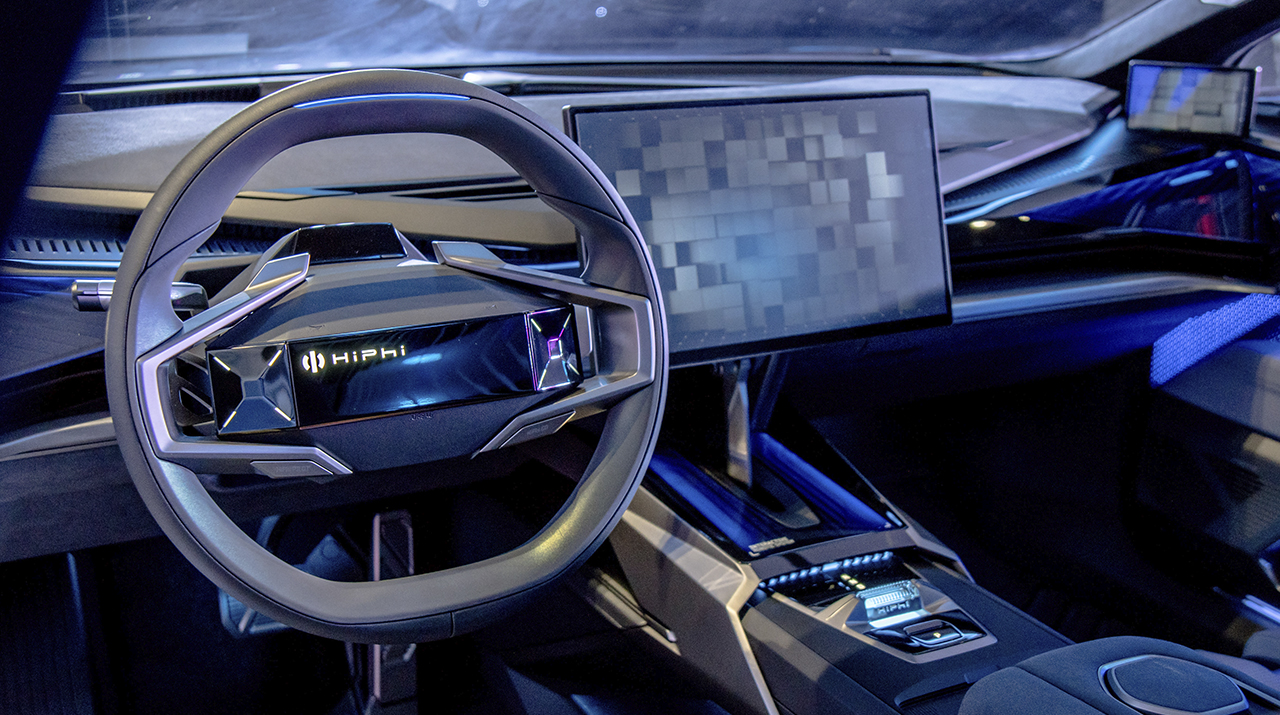

As the degree of electrification and networking in automobiles continues to deepen, cars have become the next important entry point in the era of the Internet of Everything. The time and energy originally used for driving will be freed up as assisted driving technology continues to evolve, and advanced digital cockpits are becoming a standard and important differentiating feature of the next generation of cars.

As the core hardware of the digital cockpit, the chip is responsible for processing a large amount of data in the cabin, including:

- Video input from multiple cameras

- Neural network accelerator NPU

- Audio processing of in-car voice commands

- Image rendering and output of multiple displays

- Cellular, Bluetooth, and WiFi data transmission

- Ethernet data exchange with other major ECU in the car

Facing the growing demand for in-car features, the ability of the chip has naturally become a key focus for various car brands.

Jidu’s high-profile announcement may indicate that the habit of grabbing the first release of Snapdragon in the smartphone industry has begun to spread to the automobile industry.

Nakul Duggal, Senior Vice President and General Manager of Qualcomm’s Automotive Business, said at the Qualcomm Technology Summit, “Today’s automotive architecture is changing to meet consumers’ needs for advanced computing and connectivity capabilities within the car, but also brings consumers demand for open and scalable platforms.”And Snapdragon 8295 is the foundation of the “open and expandable platform” for smart cars.

CPU performance makes way for power consumption

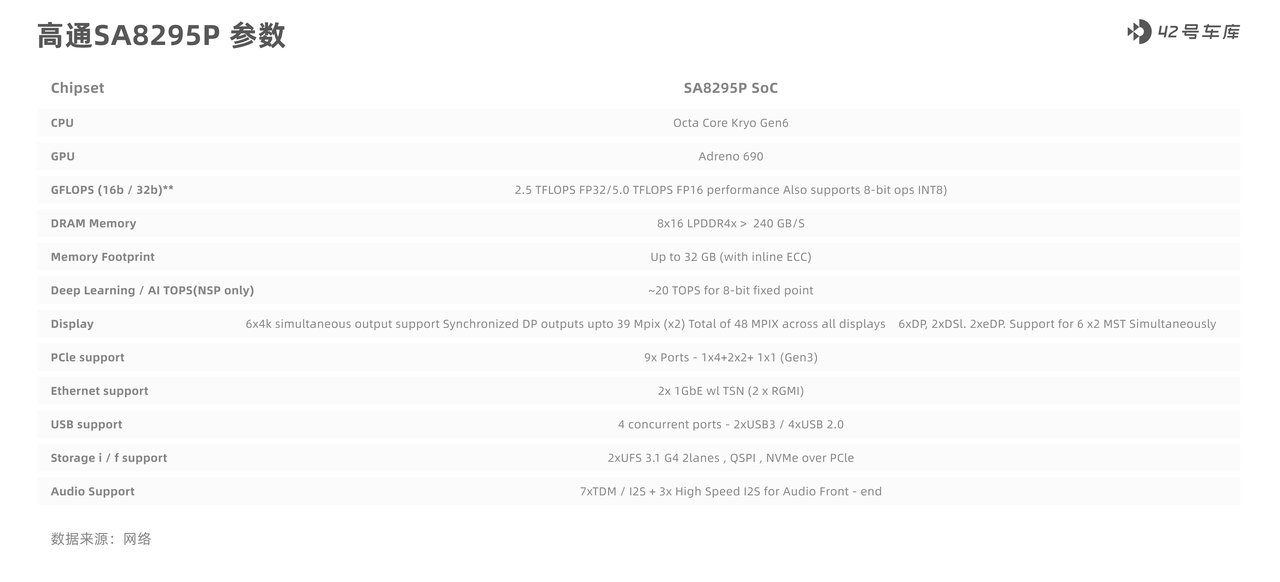

According to leaked specifications of the latest generation Snapdragon car digital cockpit platform 8295, the Snapdragon 8295 CPU section uses the same six-generation Kyro as the Qualcomm Snapdragon 888, which is a typical big.LITTLE architecture with one X1 ultra-large core + three A78 large cores + four A55 small cores.

For the six-generation Kyro, Qualcomm introduced the X1 ultra-large core last year, which increased single-core performance by about 50\% compared to the A76 used in the cockpit chip 8155, which was modified from Snapdragon 855 in the previous generation.

To reduce operating power consumption, Qualcomm lowered the frequency of the 8155’s ultra-large and large cores. The operating frequency of the A76 ultra-large core on the 8155 was lowered from 2840 MHz on the Snapdragon 855 to 2419 MHz. However, the operating frequency of the four small A55 cores remained unchanged.

Based on Qualcomm’s actions, we can also guess that the ultra-large core of 8295 will probably also be reduced in frequency. It is worth mentioning that the X1 ultra-large core used in Snapdragon 888 is already a neutered version, with L3 cache cut in half to only 4MB.

However, as a cockpit chip, its performance is still strong, with an estimated overall CPU computing power of 170K DMIPS. As a comparison, the CPU computing power of 8155 is 80K DMIPS.

It is also in a leading position among currently disclosed competitors, but there is still nearly two years before the official launch of 8295 in 2023. Whether the CPU performance of 8295 can still maintain its lead remains a big question mark.

GPU and NPU full firepower

Qualcomm’s strategy on cockpit chips has always been to place more emphasis on GPU and NPU. The GPU section of Snapdragon 8295 uses Adreno 690, which is a model that debuted for the first time. From the naming point of view, the architecture of Adreno 690 has not changed, and it can basically be regarded as an overclocked version of the ashes of Adreno 685 embedded in Microsoft SQ1. The GPU computing power reaches an astonishing 3,100 GFLOPS. Compared with 8155, the increase is close to 200\%, and compared with Snapdragon 888, it has nearly 130\% of improvement. It is in an absolute leading position among current competitors.

The reason why Qualcomm is willing to invest so much in the GPU, and even raise the maximum memory support to 32 GB at once, may be related to Qualcomm’s proposal to “evolve towards the central processing center of the regional architecture.”

According to Qualcomm’s official propaganda, the Snapdragon 8295 can support the fusion of multiple ECUs and domains, and can simultaneously process multi-screen scenario requirements such as instrument panels, cockpit screens, AR-HUDs, rear seat displays, and electronic rearview mirrors.

In the process of the domain controller transitioning to the next generation of the area controller, the concentration of computing power will be an inevitable result. At the same time, more screens also means more pixel computing requirements and more memory usage, so Qualcomm has strengthened the GPU part of its previous generation cockpit platform chips, and the 8295 is certainly no exception.

The NPU is also one of Qualcomm’s cockpit chip strengths. The AI computing power of the current Snapdragon 8155 chip is 4 TOPS, while the AI computing power of the Snapdragon 8295 has directly increased 7.5 times to 30 TOPS. It is worth noting that this is a cockpit chip, and its NPU computing power has already exceeded that of many commercially available driving assistance chips.

Such high NPU computing power may be a bit of an overkill if it is only used for DMS driver monitoring and speech recognition. According to Qualcomm’s plan, the Snapdragon 8295 will support higher-level cross-domain fusion control. This also means that Qualcomm’s fourth-generation digital platform can be used as a processing chip for advanced driver assistance visual information in the future.

Why Qualcomm?

Qualcomm did not enter the cockpit chip market very early, but why did it surpass giants such as Infineon, NXP, Renesas, and STMicroelectronics later on?

The reason is that Qualcomm has an unmatched cost advantage in the cockpit chip market compared to other companies. And the secret to reducing costs is to use the same IP for development of both mobile device SoCs and automotive SoCs.

高通车载 SoC 产品更新规律

高通车载 SoC 的产品更迭规律已经非常明了,最新的技术在移动设备 SoC 上经过验证后再下放至车载 SoC 使用。就像现在的骁龙 820A 和骁龙 820,骁龙 8155 和骁龙 855、骁龙 8195 和骁龙 8C 以及骁龙 888 和骁龙 8295,而今早发布的最新移动 SoC 骁龙 8 Gen 1 相信在未来不久也会在车载平台上亮相。

两套平台套用同一 IP 的好处除了高通自身单一芯片出货量提高所带来的硬件研发成本大幅降低外,对于像集度这样使用骁龙平台的车企们来说,他们只需要关注上层应用软件即可,大大降低了开发难度。

并且高通丰富的不同价位芯片产品和全线 SKU 兼容也意味着,只要车企采用高通芯片的车型越多,软件开发的均摊成本越低。

而高通要做的也很简单,为客户们提供足够多的接口和足够高的性能来满足国内新势力车企们在座舱里整出的各种花里胡哨的功能。

得益于这样的合作模式,高通在车载 SoC 市场做到了一年一款旗舰产品,这样的迭代速度没有企业可以跟上。

个人计算设备领域的芯片竞争,将在汽车领域重演。智能座舱和辅助驾驶需求的蓬勃上涨让车载芯片的算力更新速度加快。在消费电子领域,移动终端一直都走在芯片发展的最前沿,而汽车领域,由于汽车对可靠性和稳定性的需求优先级要远高于能耗,所以只有等最先进的制程技术在其他领域先使用、并验证后可靠性后才会应用到车端。

高通、三星、华为、联发科、英特尔、英伟达和 AMD 这七家半导体巨头在车端的产品策略大致相同,都借着自己在半导体领域的长期积累和移动消费电子的成本优势在短时间内占领了大半市场,这其中高通更是遥遥领先,所以这也是为何大家都如此期待苹果进入汽车领域的原因。

Apple, as the most skilled player in chip-making for smartphones, and the one that knows the consumers best in chip-making, seems to have a natural advantage in the field of smart cars. However, Apple’s traditional practice of not selling chips outside the company seems to have extinguished the last hope of change in the cockpit chip market. As consumers, of course we hope that more and more players will join this game. After all, a monopoly is not good for anyone, and perhaps the only one that can beat Qualcomm is the next Qualcomm.