Author: Super Charge Editor

As the last major auto show of the year – the Guangzhou Auto Show – comes to an end, the Chinese new energy vehicle (NEV) market in 2021 not only saw continually rising sales, but also witnessed the emergence of a new buzzword: “EV-making by internet companies.”

Having entered the fiercely competitive smartphone and mobile internet sector, NEVs have become a new arena for internet technology giants to expand their businesses. Famous Chinese tech companies such as Huawei, Baidu, Xiaomi, and 360 are all raring to go in different ways.

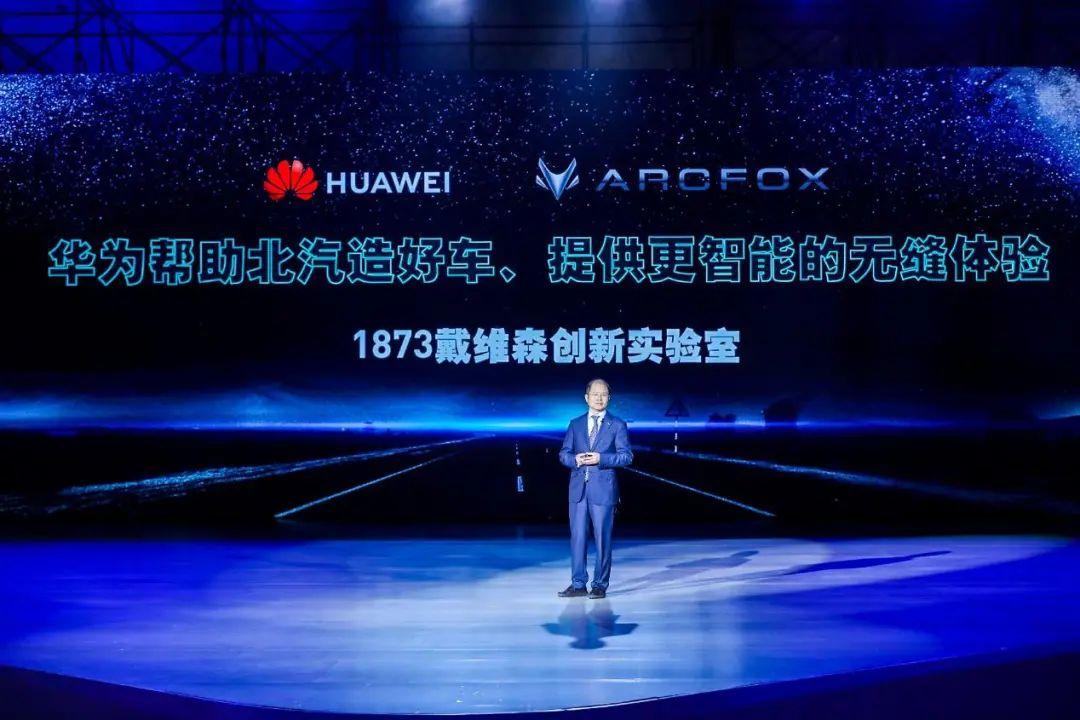

Recently, AVITA, a new EV brand, has attracted lots of media attention. Beyond its initial and slightly quirky-looking model “AVITA 11,” AVITA’s positioning and appeal also capitalizes on its three strategic partners: Changan, CATL, and the “no car-making” company, Huawei.

Almost as striking as Tesla, the word “Huawei” has also become a catchphrase for China’s NEV industry.

However, media hype does not necessarily guarantee bright prospects. For automakers, the challenges of transforming to electric vehicles and competing in the high-end market segment cannot be addressed solely by a partnership with Huawei.

This has become obvious with one of the Chinese brands that has also teamed up with Huawei – ARCFOX (or “ARCFOX” in English), the high-end brand of BAIC New Energy, a subsidiary of Beijing Automotive Group.

The Sales Enigma of ARCFOX

Those who are familiar with Chinese NEV start-ups may know BAIC New Energy’s subsidiary, ARCFOX, which has gained much attention since its launch with the help of Magna.

Especially the preview of the ARCFOX Alpha S Huawei HI version at the Shanghai Auto Show in April this year went viral on social media, showing off the prowess of Huawei’s self-driving technology.

With the abundant resources at their disposal and such confidence, BAIC aimed to sell an average of 1,000 ARCFOX vehicles per month and increase total annual sales to 12,000 units, which would match NIO’s level in its first year after the initial public offering.

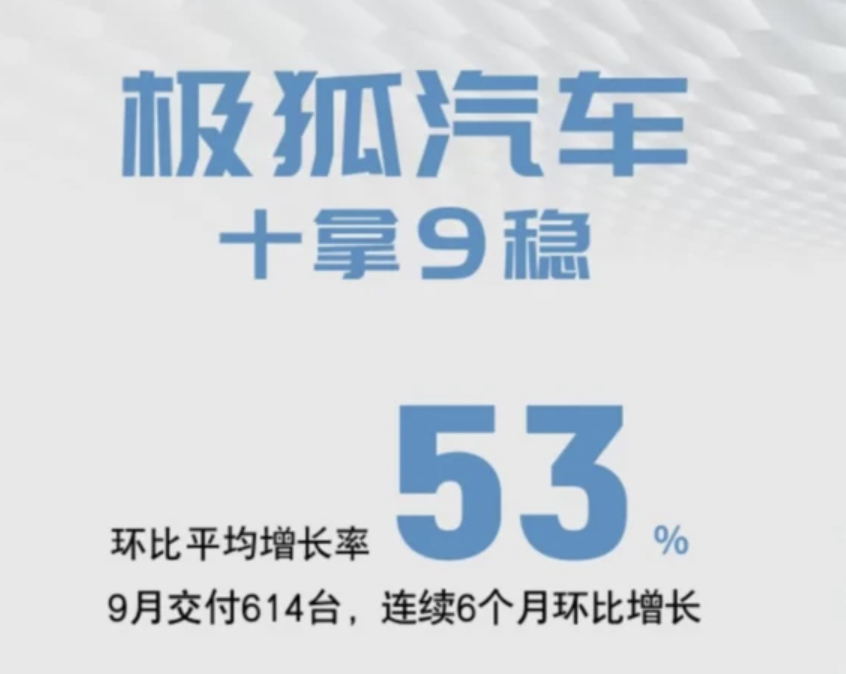

The ideal is full, but the reality is bony. As the end of the year approaches, the sales performance of Jixia’s models does not live up to its publicity heat.

According to data from the China Passenger Car Association, the cumulative wholesale volume of Jixia’s two models, Alpha S and Alpha T, from January to September this year was only 3296 units, with an average monthly sales volume of only 366 units.

In October, although Jixia’s official data has not been announced, judging from the total sales volume of 2484 units of Beijing Automotive New Energy in October, its monthly sales volume is unlikely to have exceeded 1000 units.

This performance makes it almost certain that Jixia will not achieve its sales target of 12,000 units this year, and it lags far behind new brands such as Tesla, Nio, XPeng, and Li Xiang, whose sales are constantly rising.

Even compared with the performance of new energy vehicle brands under other large domestic automakers, Jixia’s performance can only be described as “pathetic”:

Voyah, which belongs to Dongfeng, officially delivered its first model, Voyah FREE, in August, and in just three months, the accumulated delivery volume has reached 2322 units.

R Motors, which started earlier, has just been separated from the passenger car division of SAIC Group and established a new company, RisingAuto Automobiles, for market operations. However, its two pure electric vehicle models, RisingAuto ER6 and Marvel R, have already firmly established themselves in the market with their sales.

According to publicly available data, RisingAuto Automobiles sold about 3000 vehicles in October, with an overall order growth rate of 30%.

From January to September, RisingAuto Automobiles’ total sales volume was about 13,000 units, which is nearly a thousand units more than Jixia’s sales target of 12,000 units for this year.

So where is the crux of Jixia’s poor sales, which should have stronger competitiveness?

First, let’s look at the products themselves. Currently, Jixia’s models on sale include the mid-size SUV Alpha T and the mid-to-large-size sedan Alpha S, covering a price range of 2.4-3.5 million yuan.

In addition, the Alpha S Huawei HI version, equipped with Huawei’s high-end autonomous driving ADS system and Hongmeng car system, is priced at 3.889 million yuan/4.299 million yuan and will start delivery at the end of the year.In terms of product positioning, although the ARCFOX car seems to be priced high, in fact, the main selling models of high-end new energy vehicles are all in this price range.

As we all know, when the China Passenger Car Association announces monthly sales, it always includes the idiom “the trend of the strong rise of new energy at both ends is obvious”.

In other words, ARCFOX’s product layout and positioning have not shown significant deviations and basically meet market demand.

So, is the product strength of ARCFOX car not enough?

It seems not. Let’s put aside the Alpha S Huawei HI version, which has not yet been delivered and whose level of intelligence has not been tested practically. Friends around me who have test-driven the two models of ARCFOX cars currently on sale all have the impression of “crazy material stacking”.

In terms of body material selection, ARCFOX cars adopt a steel-aluminum hybrid body structure with steel on top and aluminum on the bottom. Currently, this kind of body structure is common in luxury brand cars such as Audi and Porsche, which can effectively reduce weight while ensuring sufficient body strength.

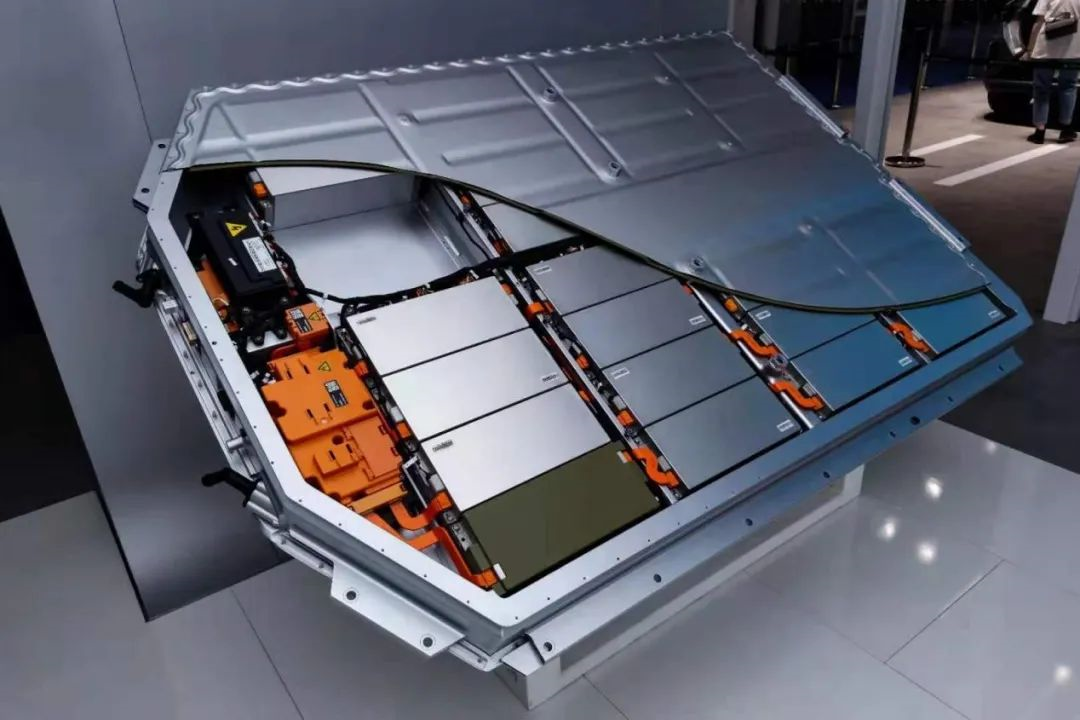

In terms of batteries, ARCFOX products are equipped with high-energy-density battery cells provided by SK in South Korea. The energy density of the battery pack can reach 194Wh/kg, which is currently the highest level of energy density for mainstream new energy passenger car battery packs. At the same time, through the use of wet membranes and double-sided ceramic layers and other safety measures, there has been no heat control safety accident to date.

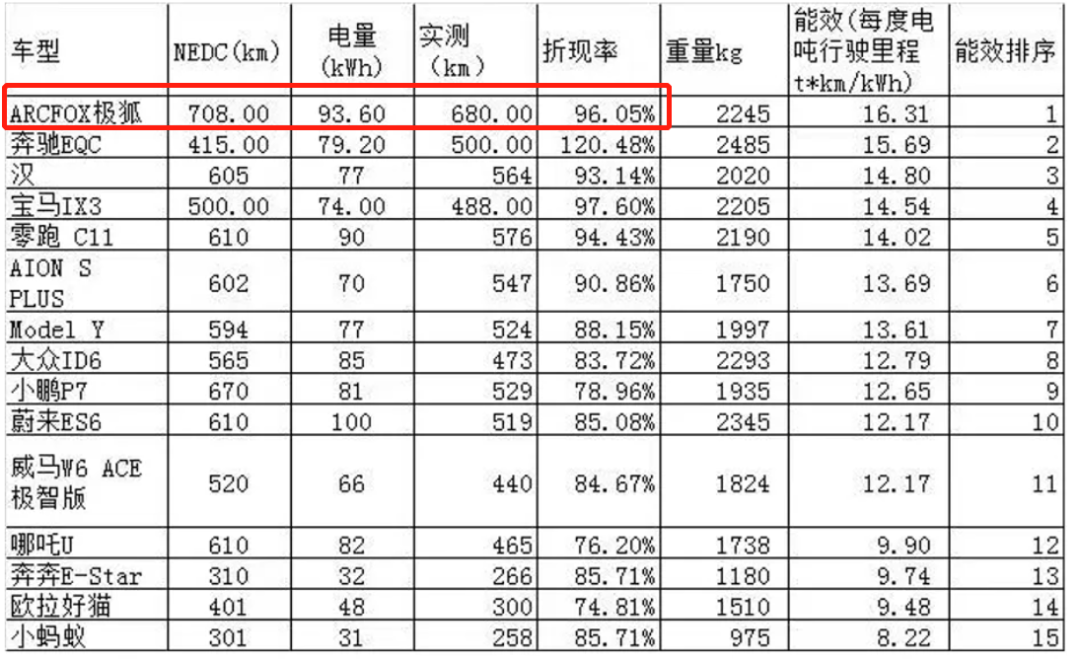

Supported by high-energy-density batteries, the Alpha S’s maximum range can reach 708 kilometers, and it is officially declared to be the production model with the highest range of domestic electric vehicles.

This eye-catching range has also been practically tested. In the “New Energy Vehicle Owners’ Range Run Out Challenge” held by Autohome before, the ARCFOX Alpha S 708km range version, under real driving conditions such as traffic congestion and air conditioning on, ranked first with a distance of 679.4 kilometers and a retention rate of 96%.

In addition, ARCFOX cars are also backed by contract manufacturer Magna. The latter has a history of over 100 years of high-end automobile manufacturing, having produced more than 3.79 million vehicles, including well-known luxury models such as the Mercedes-Benz G-Class, Aston Martin Rapide, and BMW 5 Series, all of which were produced in Magna’s factory in Austria.### North Benz Group and Magna have established a production base in Zhenjiang, which provides whole vehicle quality assurance to Jetour based on Magna’s manufacturing process standards. The base is Magna’s first joint venture whole vehicle manufacturing project in China, and also its first whole vehicle manufacturing factory established outside Graz, Austria. The planned annual production capacity is up to 150,000 vehicles.

Since the product positioning, competitiveness, and production capacity seem to have no major problems, is it because Jetour’s sales channels are not enough, making potential consumers unable to buy cars even if they want to?

The answer is still negative. It is reported that Jetour currently adopts three different forms of direct sales, distribution, and parallel distribution, which have stronger flexibility compared with the pure direct sales model.

In terms of quantity, as of October this year, Jetour has cumulatively completed the authorization and construction of more than 120 network stores, of which 78 have been landed, covering 15 key cities with sales accounting for more than 80% of the high-end pure electric market, and 21 potential cities.

By the end of this year, Jetour plans to expand to 40 cities nationwide and open 100 network stores.

This number is somewhat inferior compared to the top new forces in the car industry that have had several years of development time, but it should be noted that Jetour’s first product, Alpha T, was just launched at the end of last year, and its network expansion speed is relatively rapid.

So why can’t Jetour’s sales volume increase, despite its product positioning, competitiveness, production capacity, and channels being seemingly without any particularly obvious shortcomings?

The Elephant Sits Still

“The system is too traditional, the “big company disease” is rampant, and even the PPT for internal year-end awards has to be done by outsourcing companies.” This is a sentiment expressed by a former Jetour employee that I have heard this year.

Behind this simple quip, it actually reflects the quagmire that the entire North Benz Group is currently mired in, which is dragging down the development of the Jetour brand.

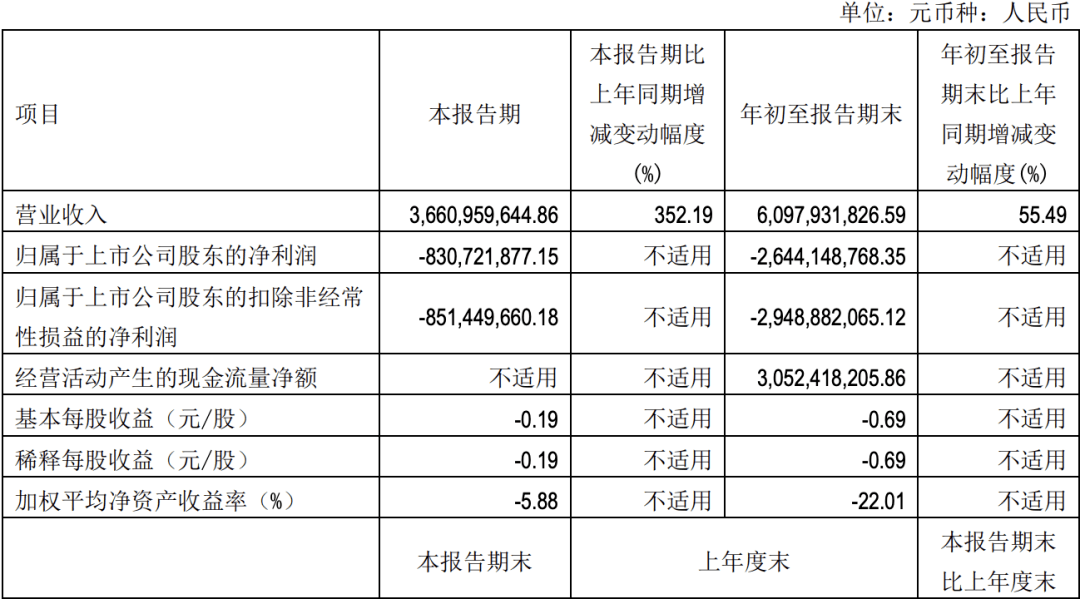

According to the third quarter financial report of Beijing Automotive New Energy’s parent company Beijing Blue Valley, in 2021, the company achieved a revenue of RMB 6.098 billion, with a net loss attributable to shareholders of the listed company of RMB 2.644 billion. In terms of sales, the cumulative sales volume of Beijing Automotive’s new energy products in the first three quarters was 16,974 vehicles, a year-on-year decrease of 19.50%.

Everyone says that even pigs can fly when they stand on the windward side. When the country just started to vigorously subsidize new energy vehicles, BAIC New Energy also stepped on the windward side – quickly launched many “oil-to-electricity” models, targeted the B-side online ride-hailing market in a simple and rough way, exchanged considerable subsidy income, and created a “seven consecutive champions” in the domestic sales of pure electric vehicles.

Everyone says that even pigs can fly when they stand on the windward side. When the country just started to vigorously subsidize new energy vehicles, BAIC New Energy also stepped on the windward side – quickly launched many “oil-to-electricity” models, targeted the B-side online ride-hailing market in a simple and rough way, exchanged considerable subsidy income, and created a “seven consecutive champions” in the domestic sales of pure electric vehicles.

To quote a digression, “mileage anxiety” as a still popular topic in the field of new energy vehicles, its instigator is suspected to be the early BAIC New Energy electric vehicle – the already stretched cruising range plus extremely unstable cruising estimate left deep psychological shadows on the owners and online ride-hail drivers who bought these “oil-to-electricity” models at that time.

Only when the tide recedes can we see who is swimming naked. With the national subsidy declining and the market transforming from policy-driven to demand-driven, BAIC New Energy, which has always relied too much on the B-side market, quickly fell behind.

In 2020, due to the epidemic and changes in the market environment, BAIC New Energy sales began to plummet, with a total sales volume of only 25,914, a year-on-year decrease of 82.79%. In the first half of this year, its sales performance was still not optimistic. Under the influence of the low base caused by the epidemic last year, sales further declined, and the loss amounted to 2.6 billion yuan.

Even more severe is that according to the rules of listing on the Shanghai and Shenzhen stock exchanges, domestic listed companies that have been losing money for two consecutive years will be subject to delisting risk warnings.

The net loss attributable to shareholders of listed companies of BAIC Blue Valley in 2020 has reached 6.482 billion yuan. Therefore, if BAIC Blue Valley cannot turn losses into profits in the fourth quarter of this year, it may be subject to ST treatment next year.

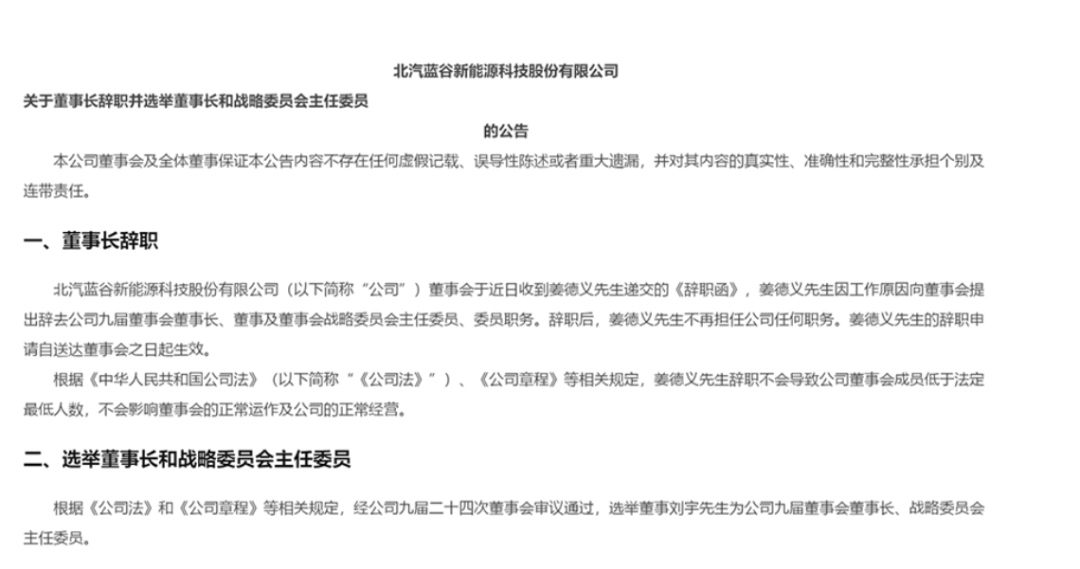

The external sales and capital market performance is not optimistic, and there are frequent personnel changes within BAIC, and the management level is showing violent volatility.

In July 2020, the head of BAIC Group changed, and Jiang Deyi took over as Chairman of BAIC Group from Xu Heyi, followed by taking over as Chairman of BAIC Blue Valley in September.

Unexpectedly, just four months later, Jiang Deyi resigned as Chairman of BAIC Blue Valley. In January of this year, Liu Yu, the then Executive Vice President of Beijing Hyundai Motor, took over as Chairman of Blue Valley and concurrently as General Manager, leading the company’s daily operations.

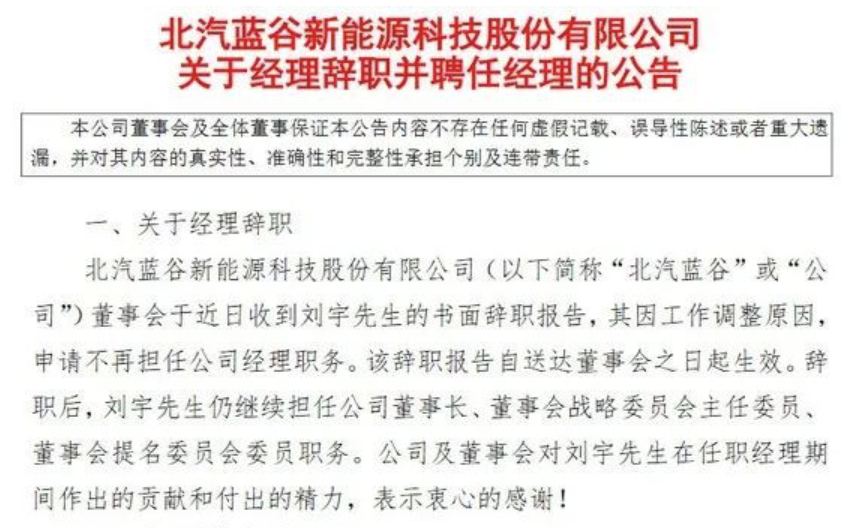

Only a few days after Liu Yu took over as Chairman, news broke that BAIC New Energy was laying off 20%.

However, this did not seem to straighten out the internal operational system of BJEV. Less than six months later, Liu Yu resigned as the BJEV manager, leaving the company’s specific operations and only retaining his positions as chairman, etc.

In addition to the continuous personnel changes at the group level, friends who pay attention to Jidu Auto may also remember another bloody drama caused by the “slip of the tongue” of its executives this year:

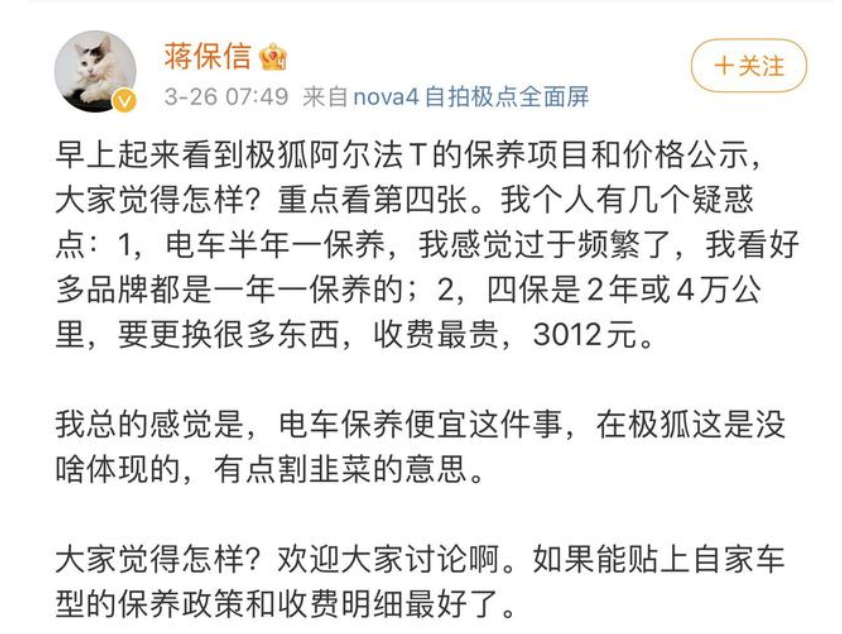

In March of this year, as an owner, the automotive self-media personality Jiang Baoxin posted on social media, complaining about Jidu Auto’s maintenance rules and community operation issues on Jidu’s APP.

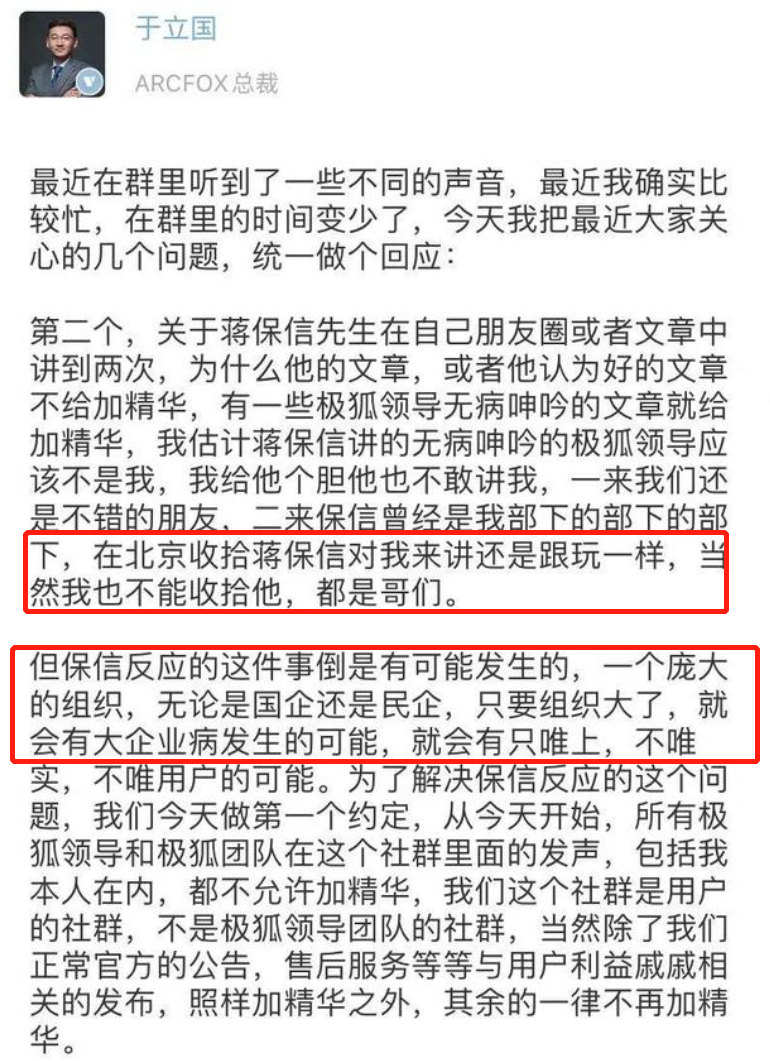

Subsequently, Yong Liguo, the CEO of Jidu Auto, responded to the post on Jidu’s APP. In the response, with threatening language, Yong said that Jiang Baoxin had been his subordinate and “dealing with Jiang Baoxin in Beijing would be as easy as playing”.

The response quickly fermented on social media, even arousing doubts among netizens about the brand’s regional discrimination. The incident ended with an apology from Yong Liguo.

Later on, Yong Liguo also left Jidu with regret and joined the new car player Xiaomi Auto. But thinking back to the sentence he wrote in his post, “as long as the organization is large enough, there is a possibility of a big company disease”, it is still deeply moving.

Today, “the elephant turning around” is often used to describe the new energy transformation of auto giants, but in the case of BJEV, we can only see the state of “the elephant sitting on the ground”.

Regarding whether to cooperate with Huawei, SAIC Group Chairman made a famous “soul theory” this year:

“SAIC cannot accept cooperation with third-party companies such as Huawei in autonomous driving. This is like a company providing us with overall solutions. In this way, it becomes the soul, and SAIC becomes the shell. SAIC needs to control the soul in its own hands.”

In contrast, Jidu seems to be neither the soul nor the body of BAIC itself- the production and manufacturing of vehicle hardware is handled by Magna, and software for autonomous driving and intelligent cabin is transmitted to technology companies such as Baidu and Huawei.

This lying-flat state seems beautiful, but in fact there are hidden currents.

At the product development level, the integration of different technologies naturally brings higher communication costs. A friend who participated in an experiential event jointly held by JIHE and Huawei once told me: “When communicating separately with staff from both sides, you can often hear each of them complaining about the other.”

Moreover, Huawei, which “does not make cars,” has almost become a “sea king of the automotive industry” that outputs technology and solutions:

Teaming up with Tesla, which has a higher degree of coordination than JIHE, Huawei has not only opened up its technology, but also its sales channels. At the same time, the two will also jointly launch a brand-new intelligent electric vehicle brand at the end of the year, and release new models with Huawei’s latest electric drive, intelligent cockpit and autonomous driving system.

The new salon model to be released by AVITA and Great Wall will also be equipped with updated Huawei’s full set of autonomous driving solutions.

In other words, although JIHE gained a great deal of attention through its cooperation with Huawei at the beginning of this year, it now seems to face the embarrassment of lagging behind in technology with the delivery of the Alpha S Huawei HI edition.

On the marketing level, JIHE, despite having good products and sufficient channels, still cannot find its own story to tell consumers—whether it is emphasizing Magna’s quality or highlighting Huawei’s technology. For the management of BAIC, neither seems to be easily acceptable.

While JIHE is still in a state of confusion about its own brand image, other domestic competitors have already clearly defined their brand labels:

NIO emphasizes high-end luxury, XPeng focuses on intelligent technology, and Ideal is fully committed to using intelligent SUVs to create a “smart mobile home.”

Apart from the three new forces, BYD emphasizes “national trendiness,” Voyah continues to highlight performance and luxury, and R Automotive has finally changed its awkward English name and clearly aimed to create “extraordinary experiences” for its customers.

Even Wey and NIO, whose name recognition and size are still somewhat lagging behind, have deeply imprinted concepts such as “technology benefits everyone” and “making cars for the people” in their brand slogans.

For JIHE, consumers who have a certain understanding of new energy vehicles may think of Magna and Huawei, but for more consumers who encounter this brand for the first time, the first thing they perceive is still the name of BAIC.

During the Guangzhou Auto Show, the Jihoo Alpha S Huawei HI edition, which starts at 388,900 yuan, officially announced that it will begin small-scale delivery in December. This higher-end car model with Huawei technology undoubtedly carries Jihoo’s hope to boost sales. However, as the saying goes, it is never easy to produce good products, but developing a new brand and guiding the diverse operations of a large company is actually a more challenging task.

During the Guangzhou Auto Show, the Jihoo Alpha S Huawei HI edition, which starts at 388,900 yuan, officially announced that it will begin small-scale delivery in December. This higher-end car model with Huawei technology undoubtedly carries Jihoo’s hope to boost sales. However, as the saying goes, it is never easy to produce good products, but developing a new brand and guiding the diverse operations of a large company is actually a more challenging task.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.