Coverage by BaiRenHui, focus on the evolution of the automotive travel industry chain

Author: Zheng Wen

What has happened before will happen again, and what has been done will be done again; there is nothing new under the sun. Is there anything of which one can say, “Look! This is something new?”

Right, in the new energy market, the same story is happening again.

Let’s look back on June 29, 2010. Tesla was listed on Nasdaq with an IPO price of $17, and the only electric car the company had at that time, the Roadster with a price tag of $109,000, was displayed at Times Square.

But this did not stop the rookie Tesla from dominating the capital market. When trading ended that day, the S&P 500 index fell 3.1%, but Tesla’s stock rose against the trend, rising from $17 to $23.89, an increase of 41%.

After 11 years, the Nasdaq Stock Exchange in Washington D.C. has once again welcomed the frenzy of new energy race stocks.

Crazy Rivian

Maybe Americans really love pickups.

On November 10th, Eastern Time, the American electric vehicle manufacturer Rivian successfully went public on Nasdaq with a financing scale of more than $12 billion. What’s even more amazing is that just two days after going public, Rivian’s market value surpassed $100 billion, reaching $104.8 billion, once again mocking the pitiful market value of traditional car companies.

It is worth noting that Rivian, founded in 2009, has not sold a single car despite releasing the electric pickup R1T and has been “zero revenue” and continuously losing money for many years. However, this does not seem to affect the capital market’s attitude towards it, and Rivian is still considered Tesla’s strongest competitor.

The movement to “recreate the next Tesla” has become a fervent hope and a wave in the capital market.

As a holder of 22% of Rivian’s shares, Amazon clearly hopes it is a fast train that can ride the wind and waves. The prospectus shows that Amazon has full priority to purchase all trucks within six years from the delivery of Rivian’s first truck. Therefore, it seems that Amazon’s millions of Prime members and its vast delivery and logistics network could lead to a huge delivery volume. Amazon’s “Delivery Service Partner Program” is also conducive to Rivian’s sales and promotion in the future.

Everything looks so bright for the future.Unfortunately, the objective fact remains harsh. According to David Trainer, CEO of New Constructs, a stock research company, although Tesla, which began delivery as early as 2008, has only delivered less than 500,000 cars until 2020, Rivian may need to produce 1 million cars within 10 years to sustain its current high market value.

However, it is a pity that by the end of 2021, Rivian’s factory in Illinois will only produce about 1,200 cars, and Rivian is expected to deliver 1,000 cars this year. If everything goes according to Rivian’s expectations, the annual production capacity of the main factory will reach 150,000 cars by the end of 2023.

Indeed, as Musk mocked Rivian on social media, “Hope Rivian can achieve mass production and normal cash flow,” it has become the most pressing difficulty for Rivian. After all, these difficulties are well-known to Musk. With consecutive losses for more than a dozen quarters, Tesla was even rumored to be bankrupt in 2016, and surviving such challenges is not easy.

In fact, in addition to the important issues pointed out by Musk, from a market perspective, Rivian also faces huge competitive pressure. Although Tesla CyberTruck has received more than one million orders worldwide, it does not mean that Rivian can also receive so many orders.

For electric pickup truck manufacturers, in addition to the rival CyberTruck, making traditional truck enthusiasts pay for it is also a big challenge. This market has plenty of strong players.

Pierre Ferragu, an analyst at New Street Research, stated in a report that due to the high price, Rivian’s SUVs and pickups have a potential global market of less than 1.5 million vehicles and face a yearly natural limit of 300,000 to 400,000 vehicles. This could be fatal for Rivian.

Nevertheless, it seems that Rivian can only use time as magic to digest such a high market value, or stop midway…after all, there is nothing new under the sun.

NIO’s Hidden Worries

For these emerging carmakers, they will face various problems for a long time.# NIO’s Third Quarter Performance

From the third quarter report, NIO’s overall performance is on a positive trend. During this period, NIO achieved a total revenue of over RMB 9.8 billion, an increase of more than 116% year-on-year, while the net loss decreased over 20% and amounted to RMB 840 million.

However, there are still some potential concerns to pay attention to.

Firstly, the delivery volume in the third quarter was not stable. According to official data, NIO delivered 24,400 new vehicles, with a year-on-year growth of 100.2% and a month-on-month growth of 11.6%.

In terms of domestic sales competition among new energy vehicle (NEV) start-ups, NIO, which usually ranks first, is facing changes. In July, NIO was surpassed by XPeng and Li Auto and dropped to the third place; in August, NIO’s sales continued to decline; in September, NIO’s monthly sales exceeded 10,000, regaining the first place; but in October, its ranking fell to fifth place, delivering only 3,667 vehicles.

The CEO of NIO, William Li, explained that the sharp decline in sales was due to a long stoppage from late September to mid-October to increase production capacity and prepare for new products, with some minor adjustments to follow.

According to the financial report, NIO is estimated to deliver 23,500-25,500 new vehicles in the fourth quarter. Calculating this, the monthly average sales volume of NIO in November and December is about 9,900-10,900 vehicles. Considering the momentum of competitors, there is still pressure to regain the first position.

Secondly, the R&D investment seems to fall short of expectations. Li previously mentioned a R&D investment target of RMB 5 billion in 2021. However, NIO’s cumulative R&D investment for the first three quarters was only around RMB 2.76 billion, with less than RMB 1.2 billion in Q3.

At the same time, sales, administrative, and general management expenses in Q3 reached a new high since Q1 2019, amounting to RMB 1.825 billion, a YoY increase of 94.1% and MoM increase of 21.8%, accounting for 18.61% of the company’s operating revenue.

This raises concerns about whether the ratio of R&D and sales investments is reasonable.

Li responded that R&D investments are a matter of long-termism, and the company will further increase investment in infrastructure, sales service networks, charging infrastructure as they are also part of the company’s competitiveness.## The Current Priorities for NIO: Infrastructure, Sales and Service Network, and Charging Network

For Li Bin, the founder of NIO, infrastructure, sales and service network, and charging network are the top priorities for NIO. Currently, NIO has 32 NIO Centers and 285 NIO Spaces in China. Regarding the charging network, in the third quarter, NIO built a total of 217 battery swap stations, 175 supercharging stations (766 chargers), and 159 destination charging stations (882 chargers).

It is well-known that R&D investment directly affects product competitiveness in the increasingly intelligent electric vehicle track. As the saying goes, “You’re either moving forward or falling behind.” With the ratio of sales investment to R&D investment, it is essential to be cautious as it may lead to a weakening of market competitiveness.

Another indicator that deserves attention is the gross profit margin. In the third quarter, NIO’s vehicle gross profit margin was 18%, a 3.5 percentage point year-on-year increase, but a 2.3 percentage point decrease from the second quarter’s 20.3%. Li Bin stated that NIO’s long-term vehicle gross profit margin target is 25%.

Although these indicators point to certain hidden concerns, a single quarter’s performance cannot explain much. The story continues…

Toyota Reduces Production Due to Chip Shortage but Achieves Record-High Profits

Surprisingly, traditional giants such as Toyota, which has always been a concern for many people for the dilemma of “A big ship is hard to turn around,” still seems to have some satisfaction with the current situation.

Toyota, which occupies a pivotal position in the traditional automotive manufacturing sector, is still quietly making a fortune. According to its financial report, Toyota’s revenue for the second quarter of this fiscal year (July to September 2021) increased by 11% to JPY 7.55 trillion, with a net profit of JPY 626.6 billion, a 33% year-on-year increase, setting a new historical record for the same period.

As of this fiscal year (April 2021 to September 2021), Toyota’s operating income was JPY 15.4812 trillion, an increase of 35%, and its net profit reached JPY 1.5244 trillion, which is 2.4 times that of the same period last year. This is a report card that exceeds the performance before the epidemic.

It is worth noting that this achievement was accomplished in the context of chip shortages and reduced production. Due to the impact of semiconductor shortages and power shortages in some regions of Japan, Toyota’s global automobile production in November this year will be reduced by 15% compared to the original plan.

In addition, Toyota also announced its performance forecast for the next fiscal year (ending in March 2022): It maintains the revenue forecast of JPY 30 trillion, a year-on-year increase of 10%, and the net profit will increase by 11% year-on-year to JPY 2.49 trillion, which is higher than the previous forecast of JPY 190 billion, and is equivalent to JPY 2.4939 trillion, the highest profit ever achieved in the 2017 fiscal year.Regarding this outstanding answer sheet, the devaluation of the Japanese Yen and the high-demand for profit-earning SUV models are important reasons. “The strong demand in new car markets coupled with supply constraints, resulting in a rise in second-hand prices, has caused us to reduce promotional discounts,” said Kenta Kon, chief financial officer of Toyota, at the financial performance conference. This factor has also enabled Toyota to exceed its potential in its performance.

It is worth mentioning that unlike other companies who use electric vehicles as “futures” to cash in, Toyota’s clean energy has started to support its livelihood early on.

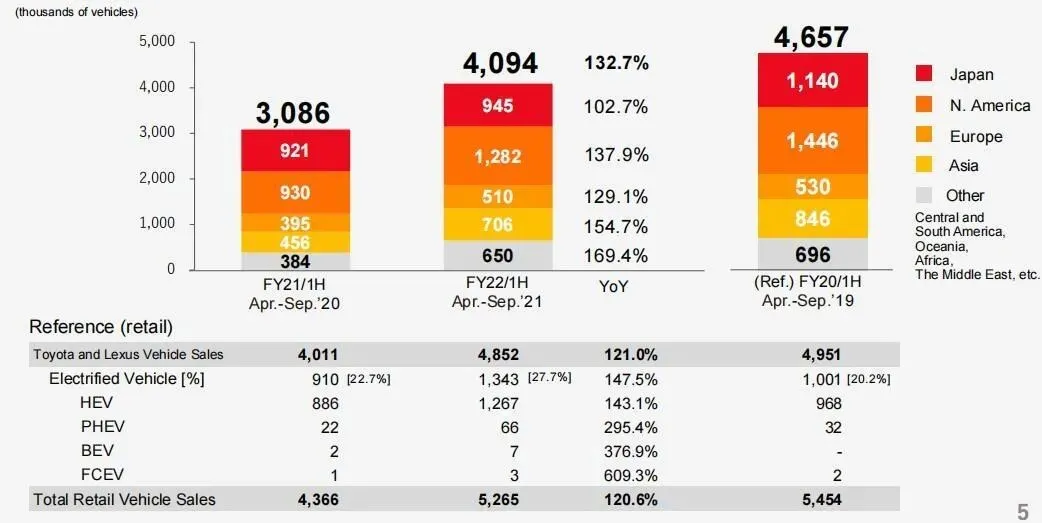

Toyota’s global retail sales (Toyota and Lexus brands) reached 4.852 million vehicles, with electrified models reaching 1.343 million vehicles, accounting for 27.7% of total sales, a 5 percentage point increase compared to the same period last year.

In Toyota’s electrified models, hybrid electric vehicles have the absolute advantage, with sales of 1.267 million vehicles, accounting for 94% of the total, while plug-in hybrid vehicles sales were 66,000 vehicles, battery electric vehicles were 7,000 vehicles, and hydrogen fuel cell vehicles were 3,000 vehicles.

Whether it is a traditional automaker, a new car manufacturer or a new new force, everyone is still in the sowing period, and what fruits will be harvested in the autumn depend on the present.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.