At the Huawei 2021 Developer Conference, Huawei’s Executive Director, Consumer Business CEO, and Intelligent Automotive Solutions Bu CEO, Richard Yu, revealed new information about Huawei’s automotive layout. By the end of this year or early next year, the new generation of luxury mid-sized SUV to be released by Xiaokang Seres will be equipped with HarmonyOS smart cockpit. It is reported that this cooperation is different from the past and will be led by Huawei.

However, in September, Seres, as the cooperating party, just experienced a “leadership change” turmoil internally.

According to data from Qichacha, there has been a personnel change in Chongqing Jinbo New Energy Automobile Co., Ltd., the parent company of the Seres brand. The former CEO and director Yu Haikun has been adjusted to director, and the positions of manager and legal representative have been taken over by Cen Yuanchuan. This means that the rumor in June that “Yu Haikun lost his signature authority and was marginalized within Seres” has been basically confirmed.

Jinbo New Energy is a new energy vehicle and parts distributor, with the Seres brand under its umbrella. In April of this year, Seres and Huawei jointly launched the Huawei Select SF5 electric car at the Shanghai Auto Show, with a dual-drive version priced at RMB 216,800 and a four-drive version priced at RMB 246,800.

In addition to selling through Seres’ own online and offline channels, Huawei Experience Stores and Huawei Mall have also become its sales channels. As the first electric vehicle to enter Huawei’s sales network, the Seres SF5 did not generate much excitement.

Shortly after its launch, Seres announced that “three thousand orders were placed in two days” and “six thousand orders were placed in a week.” With a price of 200,000 yuan and an average of 850 orders per day, it seemed that Seres had the strength to compete with Tesla. After taking over the automotive business, Huawei’s Consumer Business CEO, Richard Yu, even said internally that “we will sell 300,000 vehicles next year.”

In addition, in April of this year, Huawei also released a self-driving video featuring the Huawei ADS system. The Alpha S Huawei HI Version of Jixiu was shown in the city demonstrating operational tasks such as left turns without protection, recognising traffic lights, and yielding to pedestrians, making people exclaim that although Huawei does not make cars, autonomous driving is already so mature.

Like Xiaokang Shares, Beiqi Blue Valley’s stock price also rose against the trend with Huawei’s “support.” However, can Huawei really save these automakers?

Only Hear About Stocks, Not Sales Figures

Half a year has passed, and to investigate the status of Seres and Jixiu, who joined hands with Huawei, several offline experience centers were visited by Photon Planet.Even on a weekend with good weather, we found very few customers visiting the Seres User Center and the Lynk & Co Space. We test drove the Seres SF5 for about an hour while the Lynk & Co staff did not offer any test drive and only allowed us to experience the car statically.

Despite the low traffic at Seres, many staff members were sitting inside the store. However, the sales personnel were still enthusiastic in explaining the features of the car, while the Lynk & Co sales were somewhat sluggish, with four or five people sitting around doing nothing, and our communication was limited to answering questions.

If visits can be accidental, the consumers’ genuine investments and votes are the best validation.

According to data from the China Passenger Car Association, from April to September, the sales of Seres SF5 were 129, 204, 1097, 507, 715, and 1117 respectively. Let’s take a look at the sales figures for the second-tier new forces. In October, NETA delivered 8107 units, and Leapmotor delivered 3654 units. Compared with them, Seres, which was “blessed” by Huawei, is still struggling.

Why did we say “still”? In fact, the car made its first appearance at the Shanghai Auto Show in 2019, and two versions, pure electric and range extension, were priced at RMB 278,000 to RMB 458,000 for pre-order. It was scheduled to be launched in the third quarter of 2019. Only in June 2020 did Seres officially announce the launch of the four-wheel drive high-performance version at the Chongqing Auto Show, with a market guide price of RMB 339,000 at the time.

Seres’ branding journey has also been rather tortuous. SF Motors was established in Silicon Valley in 2016, it was named Jin Guo EV in Chinese in 2018, and finally rebranded as Seres.

It is not difficult to see that Seres always wanted to create a high-end new energy brand, but it failed to achieve its goal. After a great deal of effort, Seres’ total sales in 2020 were only 791 units, which was mediocre.

On the other hand, Lynk & Co, which also targets the mid-to-high-end market, had equally disappointing sales. According to official data, Lynk & Co’s cumulative sales from January to August this year were about 2200 units. It seems that Liu Yu, chairman of BAIC Blue Valley, is still far from achieving his goal of selling 12,000 units of Lynk & Co in 2021.

Similarly, the Lynk & Co brand also had a similar tortuous experience before cooperating with Huawei. BAIC New Energy launched the brand in 2016 and introduced the ARCFOX LITE in 2017, which is very similar to the Wuling Hongguang MINI EV that has been dominating the sales charts for new energy vehicles.

Until the end of 2020, The Jihoo Alpha T was re-released by Jihoo, but it remained tepid until the appearance of the Alpha S, equipped with Huawei’s HI intelligent automotive solution, which brought some popularity. However, it is still a case of “all talk and no action”.

Until the end of 2020, The Jihoo Alpha T was re-released by Jihoo, but it remained tepid until the appearance of the Alpha S, equipped with Huawei’s HI intelligent automotive solution, which brought some popularity. However, it is still a case of “all talk and no action”.

“Soul” and Discourse Power

During this June’s SAIC shareholder meeting, SAIC Chairman Chen Hong used the relationship between the “soul” and the “body” to describe the status of cooperation between car companies and third-party companies such as Huawei in the field of autonomous driving.

As can be seen from the previous text, Jihoo and CELIS have similar situations, with troubled brand building and poor sales of their first mass-produced cars. An industry insider told Photon Planet that such companies co-operate with Huawei to meet each other’s needs. Car companies hope to obtain more orders through Huawei’s brand and channels, and Huawei can also gain more discourse power in this type of partnership.

How important is discourse power? Although Huawei entered the new energy field as a Tier 1 company and cooperated with many car companies, its biggest problem is that it started with communication technology and lacks products that have been grounded in the automotive field and experience of getting along with car companies. On the other hand, greater discourse power makes it easier for Huawei to establish standards in the industry.

According to Car Story’s report, CELIS was very open in its cooperation with Huawei, not only opening up all research and development, procurement and production data but also almost responding to all of Huawei’s requests.

An industry practitioner explained to us that this is a manifestation of car companies’ lack of confidence. Powerful traditional car companies usually will not be so open. Daimler and BYD did not want to use their most core technology in their cooperative new energy brand, DENZA Automobile, resulting in DENZA being considered “unique” in the industry by insiders.

The cooperation of DENZA started in 2012 and ended in 2019. Under the trend of the new energy market, DENZA, backed by two big brands, failed to gain a foothold. After the BYD executives who participated in operating DENZA returned to the original company, Daimler took over the brand operation completely. Daimler’s hope is placed on the Mercedes-Benz EQ series, while BYD created the Wangchao and Dolphin series.

More recently, both GAC Nio and Changan Nio have also ended up in similar situations.

For car companies, deeper cooperation can optimize product polishing capabilities, but the short-term disadvantages are also very obvious. It was reported that, due to the unpreparedness of CELIS’s Chongqing Liangjiang New Area factory, many standards were unable to meet Huawei’s requirements, resulting in shutdowns and renovations. Therefore, many users have responded that their delivery time, which should have been within 30-50 days, has been delayed for nearly three months.Why are car companies willing to entrust their “soul” to Huawei? Maybe we can glimpse some clues from their recent financial reports.

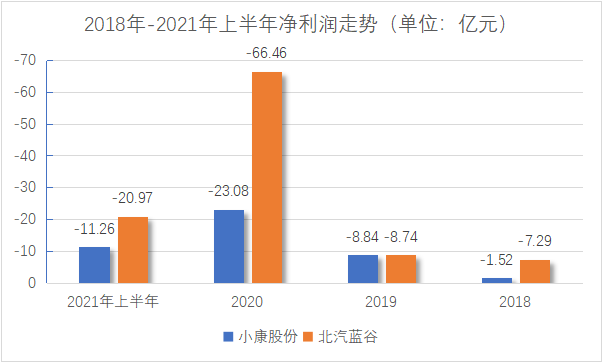

Xiaokang Group and BAIC Blue Valley have been losing money continuously in recent years, with BAIC Blue Valley’s losses increasing to 6.646 billion yuan last year. It can be said that the Saab and Jingo brands are the lifelines of their parent company, and Huawei is the lifeline of Saab and Jingo.

During our conversations with sales representatives from both companies, we found that they emphasized Huawei’s cooperation when introducing the cars.

Currently, the Saab SF5 is equipped with Huawei’s HiCar system, DriveOne three-in-one electric drive system, and Huawei Sound. According to Huawei’s Consumer Business Group CEO Richard Yu, as of the end of last year, Huawei HiCar had cooperated with more than 20 automakers, adapted to more than 30 popular apps, and been installed in over 150 models.

This means that Huawei HiCar, or Huawei’s layout in the new energy field, is not exclusive to any brand.

Huawei’s cooperation with Jingo is even more in-depth, creating the first Huawei-inside model, not the Huawei Select model launched earlier. The Jingo Alpha S Hi version has added three Huawei lidars matching Huawei’s autonomous driving algorithm on the original basis. In terms of the intelligent cockpit, it is also equipped with the HarmonyOS for the first time.

Of course, Huawei’s involvement has also significantly increased the price of the Jingo Alpha S Hi version, from the range of 250,000 to 350,000 to around 390,000 to 430,000. For reference, NIO, the domestic new energy vehicle brand with the highest average selling price, has an average selling price of about 430,000 yuan. From being ignored to challenging the highest average selling price, is it all just thanks to Huawei?

When we asked the sales representative about the Jingo Alpha S Hi version, they seemed to lack confidence and didn’t explain the differences between the two models clearly; they just mentioned that it had autonomous driving function. And with frequent accidents related to autonomous driving technology recently, it is difficult for consumers to regain their confidence in a short period of time. Is it worth spending an extra 100,000 yuan to upgrade to the Hi version? This is still uncertain.

An autonomous driving practitioner told Photon Planet that the current autonomous driving technology has not yet reached generalization, even if it is shown in some videos or test drives, it can only be done in fixed areas. They call it “single practice”, repeatedly practicing in a fixed area to achieve better autonomous driving capabilities, but once switched to an unfamiliar area, most of the autonomous driving capabilities demonstrated will not be available.As a Tier 1 company, Huawei can work with multiple automakers, and in fact, it does. In July, Huawei partnered with GAC Aion to develop a mid-large SUV, in August, a vehicle with Avita was released with a side profile conducive to premium design, and in September, the Ministry of Industry and Information Technology of China released a declaration image of the Saixairu M5, with the words “Huawei Select” in the back.

The Hongmeng operating system is destined to branch out, and Huawei has many choices, while automakers can only have “one-way love”.

Mobile phone distributors transformed into car sellers.

In addition to Huawei’s software and hardware support, another thing that automakers value is Huawei’s massive offline channels.

As early as the end of April, the Saixairu SF5 was placed in the lobby of the Huawei flagship store, and Yu Chengdong even posted 8 Weibo posts to promote Huawei’s car sales. On September 26th, Huawei signed a comprehensive business deepening cooperation agreement with Beiqi New Energy, and by the end of the year, it will achieve online and offline channel sales cooperation for the ARCFOXx Alpha S (Hi version). This means that consumers will be able to experience and purchase the ARCFOXx Alpha S (Hi version) in Huawei’s offline stores.

According to Yu Chengdong’s previous statement, Huawei plans to sell cars in 200 experience stores before the end of July, and will expand to 1,000 by the end of the year.

A Huawei offline dealer told Photon Planet that, although some Huawei mobile phone channel distributors have turned to selling phones of other brands due to shortage of Huawei phones in recent times, a large number of dealers continue to cooperate with Huawei and start selling new energy vehicles. The current situation is still good because the unit price of vehicles is high, and selling one can generate huge profits.

We actually visited a Huawei flagship store that had the Saixairu SF5 on display. On weekends, there was a continuous flow of people, but most of the users just stopped to look and then left, with few enquiring about the detailed information of the vehicle. And the salesperson just discreetly told us that the heat has decreased compared to the initial period.

The aforementioned Huawei dealer revealed to Photon Planet that Huawei’s channels are actually selling better than Saixairu’s own channels, and some first-tier cities can sell more than five units a day.

However, if Saixairu, ARCFOXx, and other automakers want to truly establish their brands and improve their channel capabilities, it is essential. According to an official website query, ARCFOXx has a total of 60 stores in business or upcoming status, while Saixairu has only 66.

Among the new forces in car-making, NIO’s store numbers in 2021 will reach 336, LI will reach 200, and XPeng will also have 350 sales stores. Among second-tier forces, NETA’s offline store numbers will also reach 270 by the end of this year.

In contrast, ARCFOXx and Saixairu lack brand strength, and their offline sales networks are not strong enough.The above Huawei dealer revealed to Photon Planet that in the limited offline channels and store areas, Huawei will cooperate with car companies such as BYD, Changan, and Mercedes-Benz to sell which models may not be in the hands of the car companies themselves.

It is estimated that a general store can receive a commission of nearly 20,000 yuan for selling one Seres SF5, and can earn tens of thousands of yuan per month by selling three cars. Compared with selling mobile phones, it is much more cost-effective. If we calculate based on the price of the four-wheel drive version of 246,800 yuan, Seres has lost 7.7% of its profit. By contrast, Xpeng’s gross profit margin per car in the second quarter was only 11%.

It can be said that Huawei has now taken the initiative at the channel level, and it will take time for these brands to build their own channels.

Conclusion

At the end of September, when we consulted Seres for sales, we were told that only the four-wheel drive version is currently available for sale and the shortest delivery time is 60 days. By mid-October, the delivery time had been shortened to one month, and by November, sales staff told us that we could get the car in just 10 days.

Combined with the answer given by XPeng Motors to investors before, the production capacity of Seres has been solved, but this also means that the sales data of Seres will be truly compared with other companies in the future.

The process of electric vehicles is as quiet and rapid as the start of an electric vehicle, without any jerky feeling. Even veteran drivers of fuel vehicles may not react in time.

Both new forces in the car-making industry and old fuel vehicle companies are vulnerable to losing themselves in such acceleration. Whether relying on external forces or taking shortcuts, they all want to speed up, but just like the use of electric cars, the goal on the road is not acceleration, but endurance.

It seems that Huawei’s first support did not save brands such as Seres. However, as Huawei begins to take the lead in the situation and gets involved in more fields, the situation may change to some extent.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.