A Region’s Culture Affects Demand for Cars

One region’s climate and topography can shape the local population’s culinary preferences, and this is certainly true in Southwest China, where the subtropical monsoon climate and mountainous terrain create a humid environment that has led people to develop a taste for spicy food that helps drive away dampness. This has resulted in many of the country’s top-ranked proctology departments being located in this region, with the first publicly funded hospital specializing in anal and rectal diseases being established here after the founding of the People’s Republic of China. By contrast, in coastal regions such as Guangdong, the preference is for sweet and savory flavors.

Similarly, people’s automotive preferences are influenced by factors such as where they live. In the United States, there is a fondness for pickup trucks, while Europe leans more towards station wagons. In China, where there is a need for spacious, high-riding vehicles with good visibility, SUVs have become the darlings of the market.

As such, carmakers are responding to consumer demand, and many Chinese startups are launching their first models with a strong emphasis on SUVs, such as the NIO ES8, Li ONE, Xpeng G3, and NIO NO1.

Li Auto and NIO are two of the companies targeting customers in the over RMB 300,000 price range, a rare feat for a domestic brand. Li Auto’s average price is nearly RMB 3.3 million, while NIO’s is RMB 4.3 million. Although the differences in design and pricing between the two are small, particularly after the launch of Li’s 2021 Li ONE, the two companies’ sales territories are as region-specific as differences in taste for spicy foods.

Photon Planet observes that while NIO has a higher presence in tier-one cities such as Beijing, Shanghai, and Guangzhou, Li Auto is more popular in third- and fourth-tier cities. This can be attributed to a variety of factors, including regional differences, policy restrictions, and the culture and personalities of the two companies’ founders.

Li Auto Focuses on Non-Top-Tier Cities

According to Photon Planet’s analysis of new energy vehicle insurance policies by province from January to June of this year, the five major regions of Beijing, Shanghai, Guangdong, Jiangsu, and Zhejiang are the primary sales markets for new carmakers.

During these six months, NIO sold 29,564 new energy vehicles in these five regions, accounting for 71.9% of all new vehicles insured by the brand across the entire country. For Xpeng and Tesla, this percentage was 68.7% and 66.4%, respectively.

By contrast, Li Auto’s main sales regions were different. The five regions purchasing the most new energy vehicles from Li Auto were Shanghai, Guangdong, Jiangsu, Zhejiang, and Henan, with these five regions accounting for just 50.3% of all new Li Auto vehicles insured nationwide, significantly lower than the other brands.

However, this is in part due to uneven development in different regions. For example, Shanghai’s new energy vehicle penetration rate reached over 40% in September, while the national median was only 21.1%. Therefore, just using insurance policies as a metric cannot fully capture the respective sales rankings of different brands in a particular region. To address this, Photon Planet calculated each brand’s insurance policies as a proportion of the total local insurance policies to indicate their popularity in that particular region.

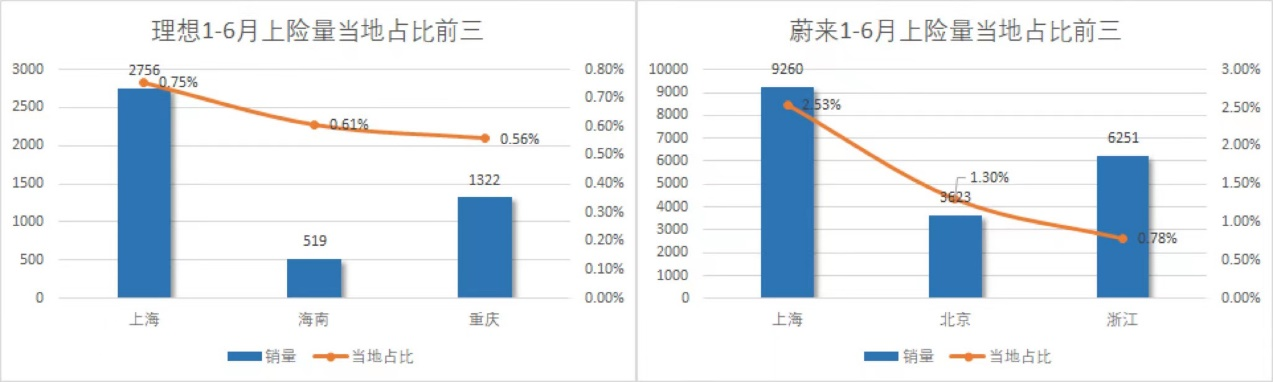

From the above chart, we can see that the top three provinces/cities in terms of NIO’s insurance share ratio are Shanghai, Beijing, and Zhejiang, which is basically in line with the sales. The top three provinces/cities in terms of Li Auto’s insurance share ratio are Shanghai, Hainan, and Chongqing, in which only Shanghai remains in the top three, while the rest are occupied by regions with slightly lower economic development.

Comparing the two companies, NIO has a particularly high share ratio in regions where sales are good. For example, NIO’s insurance share ratio from January to June in Shanghai was 2.53%, while Li Auto’s was 0.75%, which was even lower than NIO’s third-place share ratio.

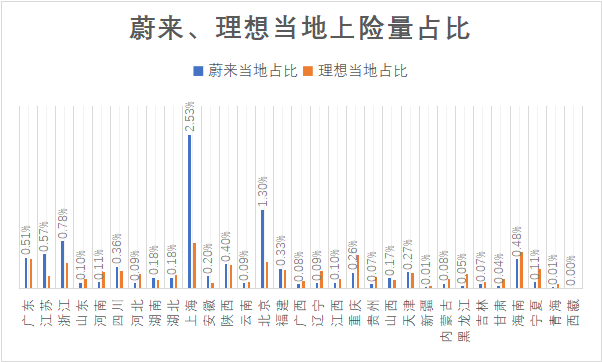

Looking at it from another perspective, only three of China’s 31 provinces/cities/autonomous regions account for less than 0.1% of Li Auto’s insurance share ratio, while NIO’s is four times that amount.

This means that unlike our imagination that the audience for cars priced at over 300,000 RMB is primarily located in first-tier cities with stronger economic consumption ability, the popularity of Li Auto in first-tier cities is not particularly high. Instead, it has been more sought after in second- and third-tier cities and even smaller ones, showing overall relative uniformity. NIO’s sales, on the other hand, show a “reverse pyramid” structure, with a majority of sales coming from first-tier cities while being difficult to find in third-, fourth-, and fifth-tier cities.

The most direct external factor is policy influence. Firstly, Beijing’s extended-range and plug-in hybrid vehicles cannot enjoy new energy vehicle license plate quotas or subsidies, and secondly, Shanghai, as a benchmark new energy city, will stop the issuance of special license plate quotas for these two types of vehicles from 2023.

It is not difficult to predict that new energy policies will further compress space in the future, with extended-range vehicles facing the brunt of it.

As an extended-range car, the biggest advantage of the Li Auto ONE lies in its endurance capability. The latest Li Auto ONE has a comprehensive endurance capability of more than 1000 kilometers, and its characteristic of being both fueled and electric eliminates range anxiety caused by insufficient charging facilities, which is the reason why it is being sought after in non-first-tier cities.

At present, the uneven development of public charging piles in China may continue for some time. It is undeniable that Beijing, Shanghai, and Guangzhou hold the top three spots, while the top ten provinces/cities are also basically in a better state. They occupy 72% of the public charging piles nationwide, which limits the choices of new energy car owners in lower-tier cities.

In addition, extended-range vehicles have a greater advantage in winter endurance. The fact that battery endurance decreases in the winter has become common knowledge, which is why northern regions have always been a challenge for new energy car companies. According to statistics from Guangxinnengxing, NIO only has six offline stores in northeastern China, while Li Auto has aggressively expanded by opening 22 retail centers and showrooms in the region.Due to historical reasons, the overall economy of China has shifted to the southeast coastal areas, and the acceptance of new products and technologies is faster than in the inland areas. There are still vast markets that have not been fully developed and reached. Although range extension is not a new technology or a “black technology”, the appearance of the ideal ONE just fills this gap.

Of course, we only see the policies and number of charging stations in major cities, but it is difficult to see the dilemma of electric cars in non-first-tier cities. This is also why the ideal X01 model is still positioned as a range extender.

Coexistence of Exam-oriented Education and Quality-oriented Education

If new energy vehicles are an exam, then sales volume is the report card. Although Ideal and NIO have both achieved good results, their paths are quite different. Ideal is like a “small-town test-taker”, accepting exam-oriented education, while NIO has been developing comprehensively in morals, intellect, physique, aesthetics, and labor, following the path of quality-oriented education.

The goal of small-town test-takers has always been clear, and the methods are relatively direct. If we look back at the development of Ideal cars, three words are enough to summarize: simple, rough, and effective.

Chassis development is time-consuming and laborious, so reverse it; there are many car parts, and the difficulty of supply chain management is great, so make them standard across the board; intelligent driving is not mature, so reduce research and development; the trademark even removed two words to save money.

According to sales staff who spoke with Phison Planet, in 2019, Ideal adopted the OKR working method (at that time, the Ideal ONE had not been officially delivered yet), and by 2020, the company’s so-called OKR working method was directly converted to KPI (mainly in the sales department, but other departments continued to implement OKR). The salaries and performance evaluations of salespeople at various outlets were closely tied together.

In Phison Planet’s experience, Ideal salespeople are more proactive than the sales staff of the other two new car makers. When registering an account on each APP, Phison Planet filled in their own mobile phone number.

NIO staff called and briefly introduced the car and store information, then invited us to test drive. After declining the invitation, the NIO staff did not get too entangled and said goodbye after expressing their welcome. The process was similar with XPeng Motors.

Ideal’s sales are obviously much more proactive. After the first phone call failed, they called several times in the following weeks and added a personal WeChat account to invite us to participate in offline activities.

However, no matter how hard the sales staff try, the supply problem cannot be solved. This year, chip shortages have become the norm in the entire industry, and Ideal is no exception.

After the launch of the 2021 Ideal ONE in May, the delivery volume continued to increase, surpassing NIO and XPeng in August, ranking first among new car makers with 9,433 vehicles. However, after the other two companies broke the 10,000 mark the following month, Ideal’s delivery volume plummeted due to chip supply issues.

Ideal has proposed a “deliver the car first and provide the ticket later” delivery plan, delivering the three-radar model first and then providing users with supplementary equipment between December and the Chinese New Year.# Translation

In all these aspects, Ideal adopts the most direct approach to make money without any pretense.

The route of quality education is often more complicated. In addition to ensuring good grades, the development, operation, and after-sales system must also be comprehensively blossomed. The investment of energy and time is much more. At the same time, the effect is also slow.

NIO is proficient in operation, which has become its differentiated competitive label. How much does NIO value operation? We found the answer in its recruitment positions.

In the 1,071 positions that Ideal is recruiting for, only 15 are related to operation, and less than half of them are related to users. In the 1,574 positions that NIO is recruiting for, 108 positions are related to operation. From the job descriptions, we can see that most of the positions are focused on users.

Ideal has a clear idea. Third- and fourth-tier cities do not need too much operation. Although they cannot reach the level of NIO, they can at least exceed that of traditional car companies and also meet the passing line.

In terms of cost, too scattered sales areas are not suitable for carrying out owner activities, and too much indulging of users can also easily bring negative impact.

Before, the NIO seat incident was questioned because some car owners felt uncomfortable in the waist and back after driving NIO’s three models for a long time, and suspected that there are defects in the seat design. Although NIO has taken measures for paid upgrades, it is still questioned whether the company’s service is up to standard.

In contrast, Ideal is much more stable. Their degree of importance for owner needs is lower than that of NIO.

In the first half of this year, Ideal was exposed by car owners for concealing the launch of the new Ideal ONE and still selling the old Ideal ONE, suspecting that it was clearing inventory. However, the Ideal official did not give a reply for a long time. After the new model was launched, the delivery volume was not affected, but on the contrary, it continued to rise.

For Ideal, the most direct and effective way to achieve a beautiful report card is the method it will adopt.

The Difference in Path between Straight Men and Friends

Li Xiang is more like a steel-straight male leader, telling you what to do, often with no choice but to choose between believing or ignoring it; while Li Bin is often described by car owners as a friend, good at networking and drinking.

Why is Li Xiang a leader? We can see some clues from his personal Weibo. Unlike the founders of the other two top newcomers, Li Xiang likes to express opinions online, such as the mercury incident, the female journalist incident, and even the comments on social news can be found on his Weibo.

However, such opinions are often conflicting, and the comments under his Weibo often fall into two camps. One side thinks that Li Xiang is outspoken, while the other side thinks that Li Xiang is too much of a straight man.Does Li Xiang need this group that doesn’t agree? At least not for now. The positioning of the Ideal ONE car was very clear from the beginning, “second child car” and “dad car”. NIO had already developed the NIO Pilot system early on, but Li Xiang believed it was not mature enough, and maybe not suitable for the audience of Ideal ONE, so he directly told you that it was not needed.

Data shows that the ideal target audience is slightly older than NIO car owners, and for this group, more opinionated words can often arouse their passion. In other words, it is about mastering the traffic password.

However, when faced with another group of people, Li Xiang’s high emotional intelligence character is more easily popular.

In the early days, Li Bin had two main tasks in NIO, one was fundraising, and the other was interacting with users. In 2019, when NIO was in the most difficult period, Li Bin visited more than 40 cities to meet with users. Even though it improved the following year, Li Bin still spent more than 30 weekends with car enthusiasts in different cities.

As a friend, Li Bin won’t tell you what to do, but will provide as many options as possible for you to choose from.

Qin Lihong, co-founder and president of NIO, once talked about Photon Planet, and said that the best thing NIO has done is to delegate power. For example, at the 2020 NIO DAY in Chengdu, all the opening videos were made by local NIO users in Chengdu, and many NIO activities were also organized by users.

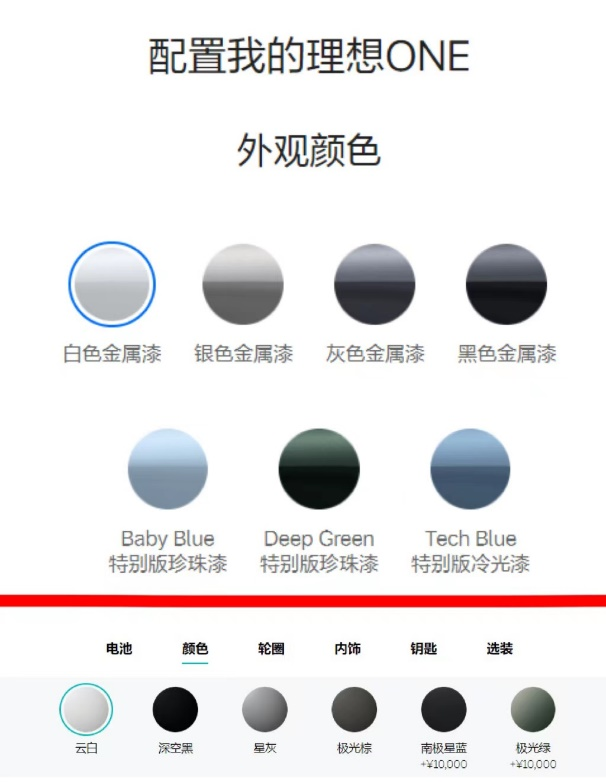

From the product side, NIO also follows this mindset. After selecting additional equipment options, the price of the cars increases from 300,000 yuan to more than 500,000 yuan. For Ideal ONE, which costs just over 300,000 yuan, only three colors need to be paid for, and the rest are all standard.

Li Xiang once commented on himself as “too straight” about car colors. Baby Blue was Han Han’s suggestion, Deep Green was the idea of the product strategy leader Zhang Xiao, and the name chosen by Li Xiang himself was only “X-color metallic paint.” Except for the brand name, Li Xiang’s ability to name things is quite scary.

By comparison, NIO has to put more thought into its design and naming, such as naming its car colors the “stratospheric blue”, “morning mist green”, “aurora brown”, “dawn orange”, “martian red”, etc.

Ideal ONE’s app store is called Ideal Store, while NIO’s app store brand is called NIO Life. Ideal Store has only three categories of car accessories, life, and services, while NIO Store has eight categories covering food, clothing, housing, and transportation, and it is described as “selling everything except cars”.

Not only that, NIO is not satisfied with just providing a shopping channel, but also incubates brands within the brand. Earlier this month, NIO’s environmental brand BLUE SKY LAB debuted at Shanghai Fashion Week. Prior to that, NIO also signed up a French winery to sell wine and collaborated with the Central Saint Martins College of Art and Design to train designers.

Not only that, NIO is not satisfied with just providing a shopping channel, but also incubates brands within the brand. Earlier this month, NIO’s environmental brand BLUE SKY LAB debuted at Shanghai Fashion Week. Prior to that, NIO also signed up a French winery to sell wine and collaborated with the Central Saint Martins College of Art and Design to train designers.

However, while NIO continues to elevate its “cool factor,” it also limits its user base to elite gatherings in first- and second-tier cities. Even if we do not discuss fourth- and fifth-tier cities, how many people in first- and second-tier cities drink red wine or watch fashion weeks?

The high-handed attitude may become a constraint for future lowering of the stance. First-tier cities are by no means an end in themselves, which is why NIO has a sub-brand positioned toward the middle and low end.

In contrast, the IDEAL caters to many middle-aged men’s “straight guy aesthetic,” who do not need any sense of ceremony or fancy packaging. A direct, one-step approach is enough. This is a style that some elite urbanites in first-tier cities find difficult to accept.

Many IDEAL car owners criticize NIO for being “overly pretentious,” while many NIO car owners criticize IDEAL for being “too down-to-earth.”

Conclusion

In the 2018 program “New Comedians Talk About Cross Talk,” Guo Degang sat on the judge’s stage and looked tired as he watched two PhD students from Jiaotong University perform “formulaic cross talk.” Perhaps he did not expect that cross talk, which draws on the lives of common people and is rooted in grassroots culture, would now be analyzed by intellectuals using numbers and formulas.

Cross talk emphasizes the relationship between teachers and disciples and emphasizes the four basic skills of speaking, learning, teasing, and singing. Often, a cross talk actor needs to undergo long-term training from a young age to have a chance to perform. The starting point of the cross talk PhDs was not wrong, and they wanted to popularize cross talk through formulas, but the problem was that they raised cross talk too high and lost its essential nature. In the end, the debate between Guo and the PhDs could not continue, and they parted ways.

Li Xiang once believed that NIO actually split itself with several car models and that NIO should not spend so much money on the “cow shed” (the NIO center opened in core areas of first- and second-tier cities). In the end, they were never the same type of person, and they had different paths.

In 1999, an 18-year-old Li Xiang gave up taking the college entrance exam, dropped out of school, and caught up with the tide of going into business in the southern coastal regions of China. Even now, he still has the “daring spirit” of those who went into business during that time. He dared to bet on the SEV project when policies were not set and adopted range-extender technology when it was rejected by insiders of the company and investors.

Meanwhile, Li Bin, a sociology graduate from Peking University, had a completely different network, resources, and vision. At the time, he was approached by his undergraduate friend, Li Guoqing, and together they founded the predecessor of dangdang.com, “Ke Wen Book Industry.” Therefore, in a sense, Li Bin did not need to work as hard as Li Xiang.

The audiences of the two companies seem to be shadows of their respective founders, and in the short term, they cannot penetrate each other’s territory.We cannot criticize the choices of ideals and NIO, just as we cannot criticize the difference between traditional and quality education. Why not let everyone follow their own path? Being good at solving problems in small towns does not mean having no future, and the quality education route is not always capable of cultivating talents. In the tide of development, both have their own applicable population.

And NIO and Ideal have also found their respective populations in their own styles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.