Yesterday I saw two pictures posted by Dongwu Securities, which presented the data statistics of the production and installation of power batteries from both the automotive and battery industries from January to September.

As the tables have a certain degree of abstraction, I wanted to make a comparison based on this data.

It is noteworthy that apart from the data of 134.7GWh production from January to September, only the installation data in the picture should be considered. The cumulative installation of power batteries from January to September was 92GWh, which is 10GWh more than the estimated value of 82GWh based on insurance calculations. Therefore, there is some deviation in this data.

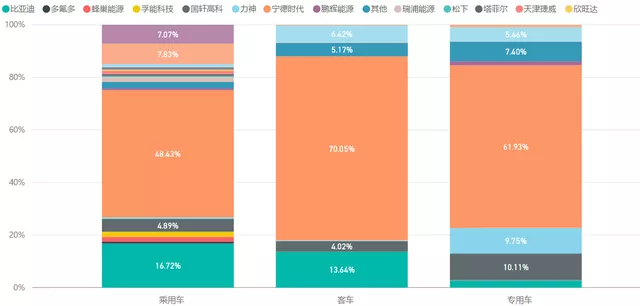

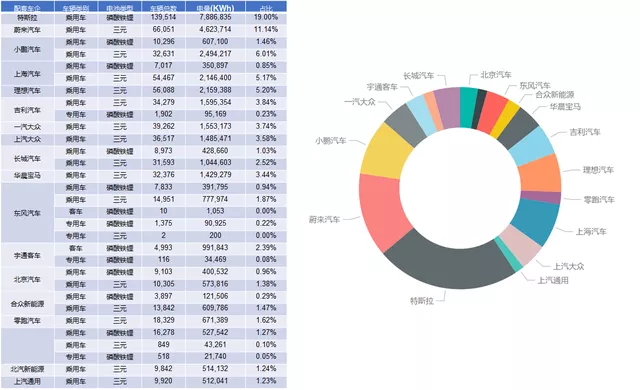

Supply from the perspective of automobile manufacturers

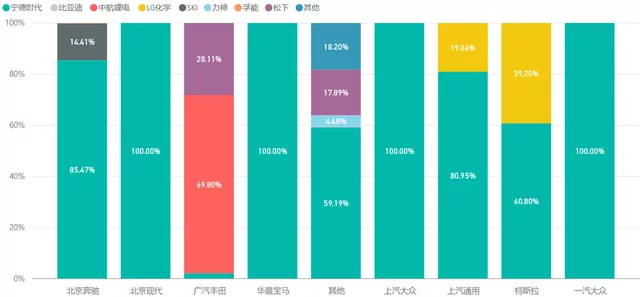

(1) Tesla and foreign brands

From the overall situation, most foreign brands use CATL as their main supplier, except for GAC Toyota, mainly due to the relationship with GAC. According to insurance data, the proportion of Tesla’s use of CATL is 60.8%.

It can be seen that foreign companies still import Japanese and Korean suppliers to a certain extent based on their previous global market selection strategies, but the proportion is not significant.

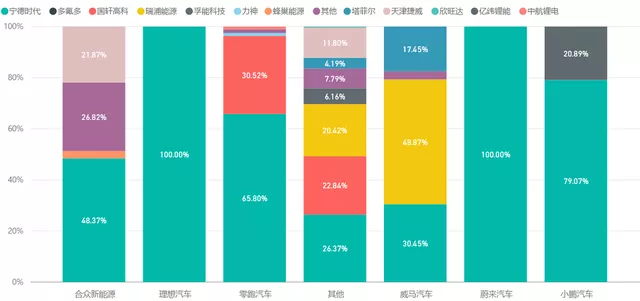

(2) New forces in automobile manufacturing

Among the new forces in automobile manufacturing, NIO and IDEAL have not chosen battery suppliers other than CATL in the short term, and XPeng has given EnerVea 21% market share. ZERORUN uses a combination of CATL and Guoxuan High-tech; Hozon chooses CATL and JWEI and other battery cells; and WM Motor divides its demand among three suppliers, namely, CATL, Lepower, and Tafel.

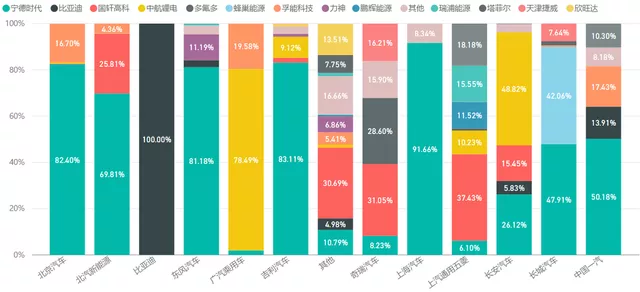

(3) Main battery choices of domestic automakers

Among domestic automakers, BAIC, Geely, Dongfeng, and SAIC still mainly rely on CATL’s battery cells. GAC Passenger Vehicle and Changan Automobile have mainly switched from CATL to AVIC Lithium Battery.

Great Wall Motor divides its battery cells into two halves, with half going to CATL and half going to Beijing Pride Power.

BYD mainly made breakthroughs in FAW, Changan, and Dongfeng, but is not yet mainstream.

Currently, the use of batteries in SAIC-GM-Wuling and Chery is very scattered.

Major Battery SuppliersHere goes the English Markdown with HTML tags preserved:

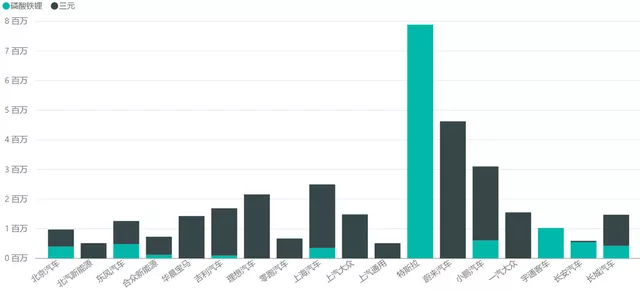

I won’t say much here, you can refer to the pictures for details. This table contains a lot of information, and the focus should be on the allocation situation between lithium iron phosphate and ternary materials.

(1) CATL

The following table provides detailed information on CATL’s existing top-three customers, which are Tesla, NIO, and XPeng. Overall, the demand from foreign brands for this year is not high, which is actually lower than expected.

From the perspective of insights, except for Tesla and Changan, the progress of lithium iron phosphate is not fast among various automakers, and there is still plenty of room for improvement in the future.

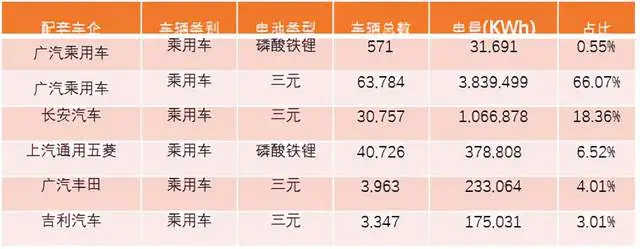

(2) CALB

CALB’s foray into lithium iron phosphate with Wuling has been relatively successful, and is currently mainly focused on supplying ternary batteries to GAC and Changan, and lithium iron phosphate is also being tried out in GAC passenger cars.

In summary, I think that the data display can still reveal some content and is easier to understand than pure tables, and is provided for your reference.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.