Translation

Author: Chris Zheng

Tesla released its Q3 2021 earnings report on October 20th, California time.

But more important than the report itself is the fact that during the Q2 earnings call, Tesla CEO Elon Musk announced that it would be his last call and quarterly updates will, barring any exceptional circumstances, be taken over by the management team led by Tesla CFO Zachary Kirkhorn.

Q3 2021 marks Tesla’s 6th consecutive quarter breaking its record for highest sales. At the same time, Tesla’s gross margin, global car inventory, and free cash flow are all at historic highs. From this perspective, Q3 was undoubtedly a successful quarter.

But on the other hand, the plethora of issues resulting from “running too fast” remained unresolved for another quarter. Some of these issues are product-related, some are strategic, some span over 5 years, and some were launched just a day before the earnings report.

For example:

When will the 4680 battery, launched in September 2020, go into mass production?

Why is the upcoming next-generation vehicle priced at $25,000 and kept under wraps for so long?

Why is the progress of FSD Beta not faster?

How will Tesla achieve its long-term sales target of 20 million vehicles per year?

Why is Tesla entering the car insurance market?

Why does Tesla keep adjusting prices?

From the Q3 earnings call, the management transition at Tesla was very successful. Zach, along with Tesla’s Senior Vice President of Powertrain and Energy Engineering Drew Baglino and Vice President of Vehicle Engineering Lars Moravy, responded to these issues and more.

Therefore, Tesla’s earnings call has been summarized by Classy Channel, and we have excerpted the following Q&A for our readers.

About New Products & Experiences

Q: Do you still expect to start producing a new vehicle model priced at $25,000 in 2023, and what is the biggest obstacle from now until then?

Lars: Yes, we are developing a strategy to increase our production capacity as quickly as possible. We are doing this while trying to add the least amount of incremental complexity to the business.

When we are in an environment where battery production capacity is limited, we will not add any new products to our product line. While there is more room for development beyond our existing products, we have chosen to focus on increasing the production capacity of our existing products.Our next product to launch will be the Cybertruck. The specific timing and progress depend on our suppliers and Tesla’s proprietary battery production capacity, as well as many other challenges we face in the supply chain, to ultimately complete our complete product line that is already on the market.

Q: What is the progress of the Cybertruck?

Lars: We have manufactured many alpha models and are currently testing them to further perfect the design.

Although Elon has already announced some key updates, such as rear-wheel steering. There are other minor or less obvious improvements, and we will continue to work on them in our products currently in the testing phase and hope to launch the product next year.

Q: When can we deliver the first batch of models equipped with the 4680 battery?

Drew: Early next year. The structural battery (i.e. 4680 battery pack) crash, range and reliability testing is expected to be completed in Q4. So far, testing has progressed smoothly. The Fremont factory production line will provide support.

From the battery perspective, we are satisfied with the design maturity and manufacturing readiness, which matches the battery pack schedule I just mentioned.

Q: Can the long-term sales target of 20 million vehicles/year be achieved with only Model S/3/X/Y, Cybertruck, Semi, and a new car model priced at $25,000?

Lars: We will ultimately expand the car product line to achieve greater production capacity. I believe Tesla will need to cover all major segments of the small, medium, and large cars, SUVs, and trucks market. Of course, there is also a huge space for Robotaxi self-driving taxis.

Q: What is Tesla’s production capacity goal for Fremont, Shanghai, Texas, and Berlin by 2024?

Zach: Our goal is to grow at an average rate of 50% per year. So, you can infer it.

Q: What measures has Tesla taken to improve the Supercharger experience?

Drew: The Supercharger team plans expansion based on site congestion. We are implementing an accelerated expansion plan globally. The Supercharger network has doubled in the past 18 months, and we plan to double it again in the next two years.To solve the existing isolated and programmatic congestion problems more quickly, we are accelerating the deployment speed of rescue sites, deploying mobile supercharging stations, and trying to introduce dynamic pricing strategies to alleviate waiting.

We also make great use of software improvements and dynamic routing to avoid busy supercharging stations, which is actually very helpful. We will continue to improve the Trip Planner itself and how it estimates how much electricity people use, taking into account the real-time busyness of the supercharging stations.

About FSD Beta

Q: Will Tesla allow users to transfer FSD at a cost lower than $10,000 (the price for new car options) to a new Tesla? Otherwise, early FSD option users have paid too much.

Zach: We are already paying a premium for buying back FSD. If you sell your old Tesla to Tesla and upgrade to a new one, the buyback prices for FSD-equipped and non-FSD-equipped vehicle models will differ. We have raised the buyback price for your old vehicle models upgraded to a new one. We hope this can solve the problem.

Q: With the expansion of the FSD beta public test scale, is there any hope that the version release frequency will increase from biweekly to weekly or even daily?

Lars: Regarding this question, what’s important is not how much data we can collect, but how quickly we can process the data we collect. This is where Dojo (Tesla’s self-developed machine learning training cluster) comes in handy.

As we mentioned at AI Day, Dojo computers are significantly faster. In Dojo, we will be able to iterate more frequently than we currently do. For example, if training takes a day instead of a week, the ability to push more updates will make a huge difference.

However, in fact, there is more at play when iterating software updates. The entire infrastructure from top to bottom, including testing and verification, needs to be set up for faster iterations. Therefore, daily updates are not currently realistic.

Q: NHTSA is investigating Tesla, and the regulatory environment for FSD is tightening. How does Tesla view this?

Lars: We always collaborate with NHTSA and other global regulatory agencies, share our knowledge, and work with them to study our approaches to active and passive safety.

We prioritize safety in all designs. We will continue to be transparent to the public about how our technology has evolved from autonomous driving safety data, and we have just shared our latest data in our earnings update.

Zach: At a macro level, this is entirely understandable and expected. The automotive industry is transitioning from what we know about traditional automobiles to a more computer software-driven sensor suite that can monitor things beyond the driver’s supervisory range.## About Tesla Insurance

*On October 14th, Tesla officially launched Tesla Insurance based on driver behavior data in Texas. For the following questions, we recommend reading “Tesla: Data-Driven Serendipity” as background. Enjoy.

Q: Can you share anything about insurance based on driver behavior data?

Zach: We have a great team at Tesla that has spent a lot of time developing this product and we are very excited about it. At the highest levels of Tesla, I can say that we inadvertently entered the insurance market.

Our users came to us complaining about the high prices of traditional insurance. It was lowering the affordability of Tesla cars. Part of our journey at Tesla is that we want as many people as possible to be able to afford our products. This is critical to achieving the company’s mission.

We have made tremendous efforts on the manufacturing side, with costs reduced by $5 here and $10 there.

If you look at the percentage of insurance prices in someone’s monthly payments, it is quite high. If we can reduce it by $5, $10, $20, or $30 from the monthly payment, you can imagine the leverage in improving affordability by reducing insurance costs. This is the background of our entry into car insurance.

As we began doing more research, fundamentally traditional insurance pricing tools were optimized based on existing data. But existing data is limited. So, they put an emphasis on things like marital status or age or other similar attributes. Accident history is good, etc.

What’s happening here, fundamentally, is that low-risk users who are not actually making a lot of claims are paying a disproportionately high amount of money relative to their costs. Then, these costs are overpaid to high-risk customers, who are essentially being subsidized. When we learned about this, we thought it seemed unfair.

At Tesla, because our cars are connected, they’re essentially computers on wheels and we can use a lot of data to evaluate the attributes of the driver who is driving this car and whether those attributes are related to safety. When a car has an accident, we get a signal.

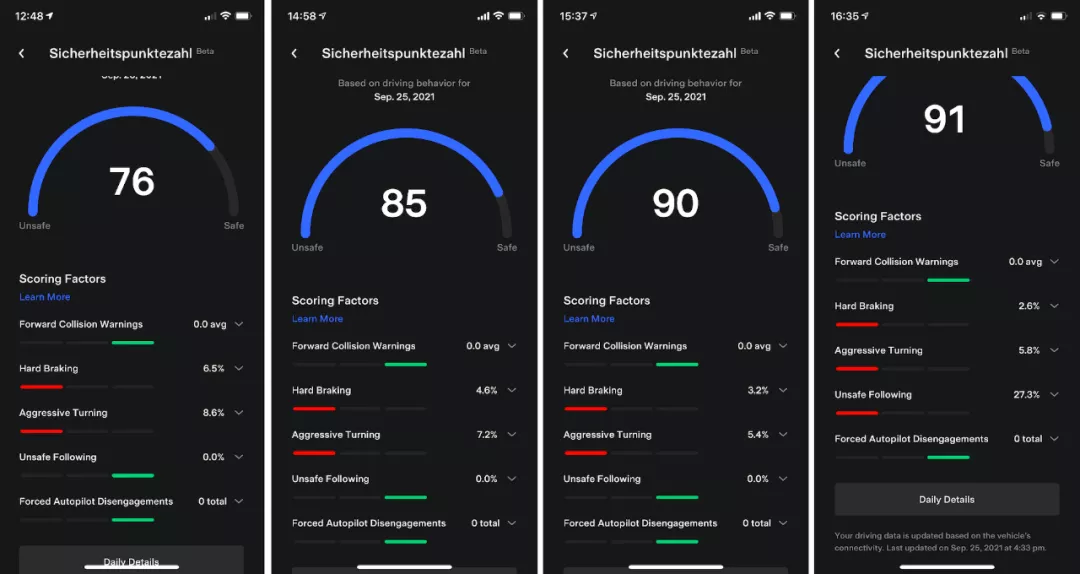

So, we have been spending time studying hundreds of different variables and studying billions of miles of driving history. We have been able to fit a model that predicts the probability of a collision happening within a certain period of time with considerable accuracy. But this model is not perfect.The model is a function of our available data. The dataset is still growing and we continue to try new variables, but we do have a well-performing model to predict collision frequency that aligns with the (insurance) price curve.

We can integrate personalized pricing into cars, into apps, and into the user experience. We can provide statistical feedback to customers about their driving behavior, good or bad attributes after each drive, and what actions they can take to improve safety.

That’s what we’ve developed. Then we incorporate “safety score” as part of the FSD Beta registration program. Currently, almost 150,000 Teslas are using the “safety score,” and the latest data shows over 100 million miles of driving.

We’ve been able to analyze this data and learned two things. First, the probability of collision decreases by 30% for users who use the “safety score” compared to those who don’t. This is a significant difference. It means the product is effective and users are reacting to its rules.

The second thing we’ve learned is that the probability of collision according to actual data corresponds to the function of driver “safety score” compared to our model. Most notably, there are multiple differences in collision probabilities according to actual data, depending on whether the driver is at the highest safety rating or lower.

This is a very new and exciting frontier for us. I know it’s a bit wordy, but we’ve put a lot of time and effort into it.

As far as the rollout is concerned, the US insurance industry is strictly regulated and state-by-state. This means we need regulatory approval from every state insurance department.

Texas is the first state we’re rolling out in. We have a roadmap for other states and will launch the product in those states after receiving regulatory approval. Our goal is to enter every major market where we sell cars.

We’re happy to make people safer and save money as a result. Tesla’s primary mission is to build the safest product in the world.

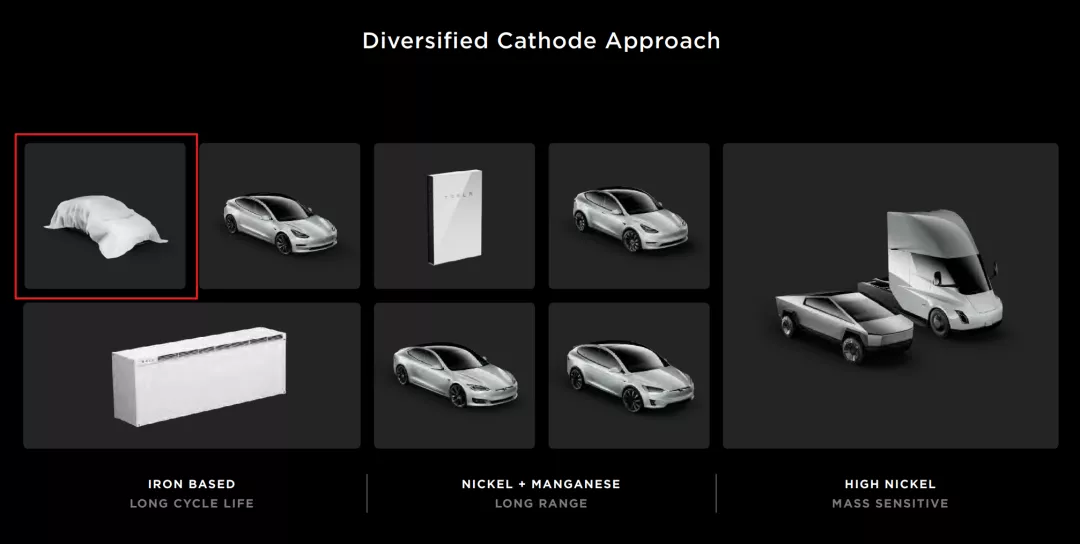

Q: Tesla’s LFP lithium phosphate batteries currently come from China. Is this a long-term plan or will Tesla eventually establish LFP capabilities in factories around the world?

Zach: Our goal is to localize all critical components of vehicles on the same continent, at least on the same continent, if not closer to where the vehicles are produced. That’s our goal. We’re working internally or with our suppliers to achieve this goal. It’s not just at the final assembly level, but as much upstream in the supply chain as possible.

About Pricing StrategyQ: Are some Tesla owners troubled by the company’s repeated price adjustments?

Zach: Pricing has been a very challenging issue for us over the past few quarters. One of the challenges we face is that the best thing we’re seeing in this space right now is that consumers seem to have had a profound awakening around their desire for electric vehicles.

To be honest, it’s caught us a little bit off guard. There are, I believe, many reasons for this consumer sentiment awakening and change, but people want to buy electric cars, and they want to buy Teslas right now.

It’s very exciting for us, and we’re adding more capacity, but we’re limited by some dynamic factors that we’ve talked about in detail. We’re making extreme efforts to manufacture as many cars as possible. It’s hard to overstate how extreme those efforts are.

It’s been quite a challenge, but we’re doing everything we can to maximize production and meet the demand we’re seeing. However, the ultimate issue is that we can’t increase production fast enough. We’ve also seen that macroeconomic costs have an impact on our structure, as we discussed on previous earnings calls.

So, we’re working hard to think about how if someone orders a car now, in some cases, it might be delivered in a few months, or even a few quarters, depending on the model and which factory it’s coming from. And we’re manufacturing that car before it’s delivered.

Another thing on pricing, I just want to point out that Tesla is always changing prices. The difference is when Tesla changes its pricing, it’s very transparent, which is not always the case with other companies. And sometimes our prices go up, and sometimes they go down.

Sometimes the changes in our pricing may not seem logical to the public, but there’s a strategy behind it that we’re working on behind the scenes because we’re balancing supply and demand, we’re also working on balancing various component shortages, we’re working on managing the wait times for our customers. All of that is being optimized here.

*Deferred revenue is a financial concept that arises when a customer pays upfront for a product or service that Tesla has yet to deliver.

Q: What is Tesla’s standard for recognizing deferred revenue?

Zach: The way it works with recognizing deferred revenue is, when a customer orders a product that’s not yet delivered, we make certain promises about what that product will be able to do.

So what we have to evaluate is whether we’ve fulfilled those promises and that the software is widely available to the people who made those promises in that region. Given FSD is currently in testing and invitation-only, with a limited quantity, we don’t think it’s appropriate to recognize deferred revenue at this time.

We’ll continue to expand the program, and our finance team will monitor it to see when we hit the milestones where we’re willing to recognize deferred revenue.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.