Author: Huangshan

The trend of new energy vehicles has become unstoppable.

On September 25th, at the World Intelligent Connected Vehicles Conference, Liu Zhao, Deputy Minister of Public Security, mentioned that the current holding amount of China’s new energy vehicles has reached 6.78 million, with 1.87 million new registrations since the beginning of this year, accounting for 9.2% of the total new car registrations.

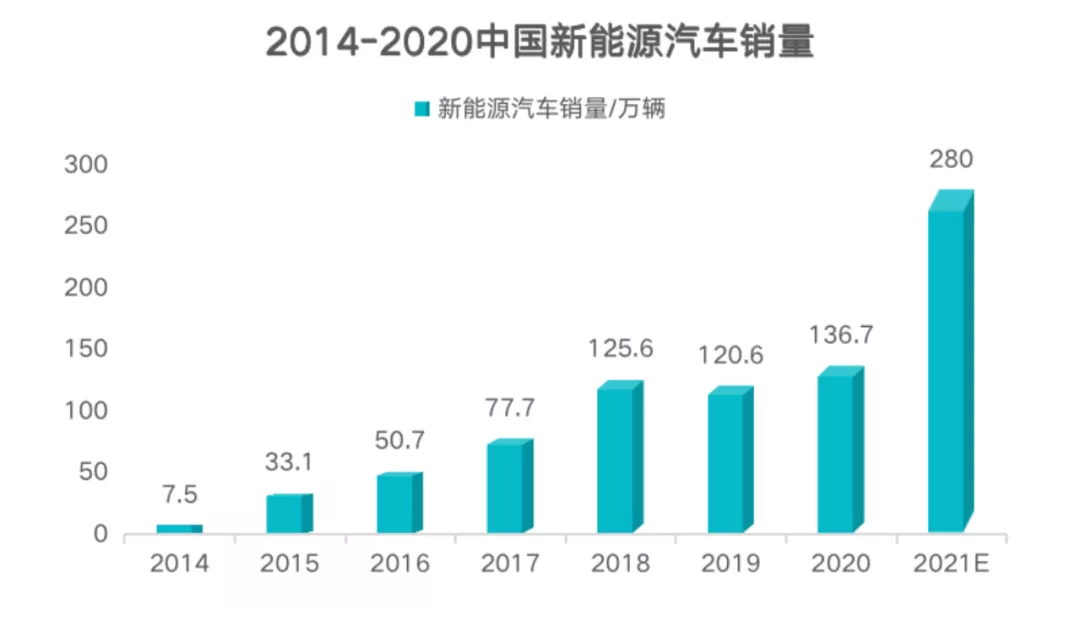

The annual sales volume is expected to reach a new high. According to sales volume predictions from January to August this year, the annual sales volume in 2021 is expected to exceed 2.5 million units, with a potential to even reach 2.8 million units.

The same goes for abroad. According to Bloomberg, global sales of new energy vehicles will reach 30 million units with a penetration rate of 28% by 2030, and sales volume is expected to reach 60 million units with a penetration rate of 55% by 2040. This will also drive the rapid development of related industries such as new energy batteries, charging facilities, and the automotive aftermarket, opening up a trillion-dollar market space.

As the number of cars increases, naturally there will be more after-sales problems. Is the aftermarket ready to meet the impending boom?

Currently, there are problems in the new energy vehicle aftermarket, such as incomplete service networks, unsound after-sales processes and standards, the need to improve the skills and abilities of maintenance technicians, and immature detection and repair equipment.

On September 25th, “Auto Intelligent Diagnosis” system leader DaoTong Tech (stock code: 688208) officially announced its strategic layout in the new energy vehicle aftermarket and launched a power battery diagnostic, testing, and maintenance full-process toolchain, as well as a charging station product with battery detection technology.

Why did DaoTong Tech enter the new energy vehicle aftermarket? What problems can they solve in the industry?

Three-step strategy

In the new energy vehicle circle, DaoTong Tech is relatively unknown, but in the automotive intelligent diagnosis and testing market, it is a global leader competing with Bosch, Snap-on, and Italy’s TEXA, with 500,000 automotive repair channels worldwide.

What does a company that specializes in automotive intelligent diagnosis and testing systems do when they enter the new energy vehicle field? What are they trying to accomplish and how will they do it?

In fact, with the thriving momentum of the new energy vehicle market, it is natural for DaoTong Tech to strategically layout the new energy vehicle aftermarket.

As Nong Yingbin, Executive Vice President of DaoTong Tech, said in an interview, “We need to do the right thing first, then do it right.”## In the strategy of new energy, Chairman Li Hongjing of Dao Tong Technology pointed out at the conference held in Sanya on September 25 that the company will develop a digital integrated solution strategy for diagnosis, inspection, charging, and storage in the field of new energy vehicles under the foundation of the traditional market, and has planned three development stages:

- Accelerate the first flywheel: build a new energy diagnosis and testing system tool ecosystem.

Targeting the after-sales market of new energy vehicles, we provide specialized tools with good safety, strong professionalism, high integration, simple and intelligent operation to meet the needs of the transformation and upgrading of the after-sales market of new energy, help stores accelerate upgrading, and increase the coverage of maintenance outlets.

- Breakthrough the second flywheel and build an intelligent charging and inspection system ecosystem.

For automobile maintenance, household charging, operating fleets, work/business places, and fast charging stations, we have launched a safe, reliable, stable, and dependable intelligent charging and inspection system, which includes 7/11/21 kW AC series and 20/120/240/480 kW DC series products. Through the O2O closed loop of offline charging equipment + online charging APP + cloud services, we connect people, cars, and charging piles, expand business in the charging operation field, and build a charging service ecosystem.

- Transform the third flywheel: extend the iterative utilization, energy management ecosystem.

Relying on offline channels + AI + big data + cloud algorithms, we establish power battery sorting standards and construct a power battery lifecycle testing system, non-destructively predict battery life, and help retired power batteries apply to energy storage, base stations, backup energy, and other fields.

Two Key Points

Nong Yingbin said they believe that the after-sales market opportunities for new energy vehicles are mainly concentrated in the two major parts of power batteries and charging, and power batteries can be further divided into links such as diagnosis, testing, maintenance, and recycling.

Due to the structural differences in the power of electric vehicles and traditional fuel vehicles, in addition to the after-sales service of conventional systems for fuel vehicles, the biggest difference lies in the three-electric system, of which the most important is the power battery that can be compared to the engine.

Previously, after-sales projects often focused on components such as engines and transmissions, but now the main focus is checking the power battery.

The DC high-voltage characteristics of the power battery system have higher technical requirements for after-sales service. At the same time, the software complexity brought by the electronic and electrical architecture of the entire vehicle is far higher than that of traditional fuel vehicles.

Also, because of differences in energy supply, the charging pile and charging operation market are another major after-sales market for new energy vehicles.

According to the “2020 China Auto Aftermarket Maintenance Industry White Paper” report, in the next 10 years, the output value of new energy vehicle after-sales maintenance services in the after-sales market is likely to exceed 100 billion yuan, and the charging pile and charging operation market will exceed one trillion yuan.In the context of traditional fuel vehicles experiencing a decelerating increase and the aftermarket gradually stabilizing, the aftermarket for new energy vehicles will experience explosive growth.

Currently, the aftermarket for new energy vehicles is still in the early stages of development. OEMs’ priority goal is to establish sales channels and gradually match them with after-sales services based on the number of vehicles in use, mainly by using a combination of self-built and authorized cooperative methods.

As an example, NIO currently has 15 NIO House or NIO Space front-end sales networks and 5 NIO Service centers for after-sales services in Beijing, in addition to authorized cooperation repair shops of a certain scale. For many third- and fourth-tier cities, it is not cost-effective for OEMs to build their own aftermarket maintenance networks, so authorized cooperation is the preferred choice.

The charging pole and charging operation market have grown explosively in recent years and are becoming more and more mature. According to the August statistics of the China Charging Alliance, the cumulative number of charging infrastructure in China is 2.105 million units, of which public charging poles account for 0.985 million units, and the total national charging volume in August was about 989 million kWh.

According to Lin Jie, Senior Manager of New Energy Research Department of CITIC Securities, the current car-to-pole ratio in China is about 3:1. They expect that by 2025, the number of new energy vehicles in China will reach 30 million, and the demand for charging poles will reach 7 million. If the number of new energy vehicles in China is nearly 100 million by 2030, the number of charging poles will reach 15 million. This means there will be a huge demand for charging equipment.

Two driving technologies

Can new energy vehicles be repaired in a regular repair shop?

Common exterior and vulnerable parts problems can be repaired, but if it is a problem with the three-electric system, users can only go to the after-sales service center of the brand they have purchased, and cannot repair at a comprehensive repair shop like traditional cars. The reason behind this is that the data protocols and maintenance permissions of the OEMs and battery factories are not open to the public, and repair shops lack professional equipment to diagnose the problems.

For repair shops, they also face three major pain points. First, the risk of repairing new energy vehicles is high, with potential risks such as thermal runaway and high-voltage electric shock if some operations are not carried out in accordance with regulations. Secondly, there is a shortage of specialized technicians who are suitable for repairing new energy vehicles, and different testing tools are needed for each car and battery factory, with battery testing tools facing the difficulty of acquisition currently. Third, the repair efficiency is low. The current mainstream testing solution relies on cycling charge-discharge to complete the detection of battery packs or battery modules, and one repair can take 2-3 days at the fastest. After the repair staff clearly identifies that a problem manifested in the battery, they first contact the OEM, and then the OEM lets the battery factory handle the repair, making it a lengthy process in the intermediary steps.

For OEMs, the coverage of after-sales service needs depends on their deployment of service centers, which are limited and cannot provide fast and high-quality services. Concerns about data leaks from the battery also force OEMs and battery factories to send corresponding professional service personnel to service sites for testing and repair, which in turn increases operating costs.The high threshold has made it difficult for traditional repair shops to transform and for automakers to expand their after-sales service network without openness, resulting in an awkward situation.

In response to this contradiction, at the DaoTong Technology press conference, Wen Jie, General Manager of the New Energy Business Unit, dismantled the problems faced by repair shops at different stages in the current mainstream automakers’ power battery maintenance process, as well as their solutions.

The current power battery maintenance process is divided into three stages: 1) fault diagnosis and detection to pinpoint where the problem lies; 2) maintenance for the problem; 3) reinspection and diagnosis report issued after the repair.

The first priority is how to diagnose faults quickly. In the past, only one-to-one detection equipment could be used due to the unopen protocols. However, the MaxiSYS Ultra EV200 diagnostic tool released by DaoTong Technology this time not only supports the TOP10 mainstream brands of new energy systems, but also is compatible with more than 90% of the overall vehicle and high-voltage system diagnostics, and can perform more than 40 battery special inspections, covering mainstream battery brands, with an accuracy of fault location greater than 98%.

Knowing where the problem lies, DaoTong Technology also provides a series of tools for the subsequent repair process:

The MaxiEV CDT100 charging and discharging machine obtains dynamic changes in battery cell parameters to enable fast lithium battery detection;

The MaxiEV ALT100 sealing tester real-time monitors the battery air pressure to prevent overpressure damage to the battery;

MaxiEV BCE100 lithium battery balance maintenance and testing instrument for battery unit repair, without the need for replacement of the entire pack, so small problems with individual cells can be repaired by the repair shop themselves.

In addition, during daily charging, DaoTong Technology integrates its own diagnostic and testing technology into charging piles, launching charging products with intelligent diagnostic systems, covering from 7-21kW AC piles to 120kW and 240kW fast charging piles, to 480kW super charging piles with full coverage.

Based on the new energy diagnosis and testing system, our charging pile products can effectively reduce the risk of battery thermal runaway, improve battery life, and increase charging success rate.

Furthermore, DaoTong Technology has signed a comprehensive cooperation agreement with Huawei Digital Energy, and joint research and development will provide solutions (as shown in the image below).

It can be seen that DaoTong Technology is already running in the first two stages and its main audience is offline repair shops.

This group of people hardly have any presence in the new energy vehicle industry, maybe because it is not so high-profile. However, without them, the new energy vehicle service will lack an important component.

How to help enhance the transformation and upgrading of the aftermarket, and anticipate new opportunities in industry development? DaoTong Technology’s answer is to provide technical, tool, and service solutions, enabling traditional repair shops to possess new energy vehicle repair capabilities.

During this process, DaoTong Technology, which can sell 1.578 billion yuan of digital intelligent vehicle inspection systems annually, will have greater opportunities in the hundreds of billions and trillions of new energy vehicle aftermarkets.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.