Author: Cai Jialun

Introduction: Since the advent of new energy vehicles in the market, the automotive industry has undergone tremendous changes in a short period of about ten years. We have witnessed the rise of new stars and the fall of old car companies. Faced with the constant pressure from new forces, BBA, a leading luxury brand, also had to make changes.

On March 17, 2021, BMW Group CEO Zipse mentioned at the BMW fiscal 2020 financial report release conference, “Now, BMW is starting the next stage of development.” Regarding BMW’s transformation, the seven directors of the BMW Group Board of Directors explained the work BMW is doing for the transformation at the press conference. It is noteworthy that in BMW’s century-old history, this is the first time. In other words, the high-level personnel of BMW are actively promoting the transformation of this old German luxury car company, especially in the development of electric travel.

Early Bird Catches the Late Show

In fact, in the field of electrification of automobiles, BMW is ahead of most automakers. In 2008, BMW announced Project and began laying out electric vehicles. Subsequently, BMW successively released two epoch-making models, the i3 and i8, around 2014. These models emphasize new energy vehicles and mobile travel solutions and launched the i brand, an independent electric vehicle brand. From the perspective of products, the i3 and i8 launched by BMW were unique at that time, not only using the most advanced carbon fiber but also using an independent new platform, which was far ahead of the electrification path of many traditional car companies that followed the “oil-to-electricity” approach. However, the i brand did not achieve the expected performance after entering the market, and even the i3 was announced discontinued in 2019.

Therefore, many people believe that the reason why the BMW i3 and BMW i8 failed was that the global new energy vehicle market was still in its infancy at that time, and neither the market environment nor the acceptance of new energy vehicle models by consumers was high. Perhaps because these two “epoch-making” products did not achieve the expected market effect, BMW became unusually cautious in the electrification path thereafter.

But with the acceleration of the new wave of the Fourth Industrial Revolution, more and more traditional manufacturers are starting to follow in the footsteps of the “new forces”. With the market competition becoming increasingly intense, BMW has also begun to accelerate its efforts in this area, launching the BMW iX3, transformed from X3. It is noteworthy that the BMW iX3 is a typical work known as “oil-to-electricity” in the industry. It is a model built under the platform of the main business of fuel cars, which is inherently inferior to the models built by other car companies on a pure electric platform. Data shows that in the last month of 2020, the sales volume of BMW iX3 was only 857 units. The monthly sales volume of less than a thousand units is undoubtedly the most direct description of the product power of BMW iX3 in the market. Today, after several price cuts, the sales volume of iX3 has just crossed the mark of 2,000 units.

But with the acceleration of the new wave of the Fourth Industrial Revolution, more and more traditional manufacturers are starting to follow in the footsteps of the “new forces”. With the market competition becoming increasingly intense, BMW has also begun to accelerate its efforts in this area, launching the BMW iX3, transformed from X3. It is noteworthy that the BMW iX3 is a typical work known as “oil-to-electricity” in the industry. It is a model built under the platform of the main business of fuel cars, which is inherently inferior to the models built by other car companies on a pure electric platform. Data shows that in the last month of 2020, the sales volume of BMW iX3 was only 857 units. The monthly sales volume of less than a thousand units is undoubtedly the most direct description of the product power of BMW iX3 in the market. Today, after several price cuts, the sales volume of iX3 has just crossed the mark of 2,000 units.

The slow iteration of the electrical mechanism has caused several years of pending investigation, and the brand’s insufficient independent software design, including many car companies including BMW, are being rubbed on the ground in terms of intelligence and marketing performance by new forces in promoting smart cars. What is even more surprising is that well-known traditional brands have begun to lose out. On May 28th, this year, BMW Brilliance Automotive Co., Ltd. announced the recall of some domestically produced iX3 electric vehicles with production dates from September 1, 2020, to April 30, 2021, for a total of 6,636 units. According to statistics, iX3 has been recalled three times, which shows that the quality is worrying, and the quality system issues reflected by this are even more chilling.

It’s Hard for the Elephant to Turn Around!

As the lightweight advantage of new car-making forces becomes more and more obvious, more and more people are beginning to re-examine the ability of traditional car companies to respond to the “new quad” wave. During this time, the electric impulse reporters have seen many colleagues discussing the difficulty of traditional car companies’ transformation, although everyone has raised the view that “it’s hard for the elephant to turn around,” but no one has really discussed where the “difficulty” in the “elephant turn” lies.

In fact, the “difficulty” of traditional carmakers’ transformation is not only limited to technological changes, but also to supply chain issues, especially for century-old car manufacturers such as BMW Group. For the most part, most carmakers focus mainly on developing and producing the overall platform architecture and body structural parts, including a small part of the powertrain, while the remaining components are basically outsourced to large component suppliers such as Bosch, Continental, and other Tier 1 suppliers. After obtaining cooperation, these large component suppliers also adopt outsourcing policies and outsource non-critical technologies and small parts to secondary small component suppliers. In other words, carmakers such as BMW play a role more like a platform integrator.

In fact, the “difficulty” of traditional carmakers’ transformation is not only limited to technological changes, but also to supply chain issues, especially for century-old car manufacturers such as BMW Group. For the most part, most carmakers focus mainly on developing and producing the overall platform architecture and body structural parts, including a small part of the powertrain, while the remaining components are basically outsourced to large component suppliers such as Bosch, Continental, and other Tier 1 suppliers. After obtaining cooperation, these large component suppliers also adopt outsourcing policies and outsource non-critical technologies and small parts to secondary small component suppliers. In other words, carmakers such as BMW play a role more like a platform integrator.

To be able to manage such a complex production and business chain, and to ensure the stable work efficiency of hundreds of suppliers, traditional carmakers have developed a very rigorous certification system and development management process. Based on the situation where one hair moves the entire body, the difficulty of BMW’s transformation can be imagined.

Apart from being subject to supplier restrictions, BMW also has a significant gap in basic technology compared to new forces such as electric vehicle carmakers. Compared with fuel-powered cars, electric vehicles have many disruptive changes, the most obvious of which is the greatly simplified vehicle structure, while fuel-powered cars need to integrate complex parts such as engines and transmissions. It must be admitted that traditional carmakers such as BMW are indeed ahead of many carmakers in manufacturing technology, but the changes of the times caught BMW off guard.

In the era of electric vehicles, these components will be phased out, which will lead to a significant reduction in the production cycle and difficulty of car manufacturing. According to a report by Morgan Stanley, based on close communication with mainframe factories, suppliers, and electric vehicle experts, in the next 10 years, as car manufacturers achieve higher production volumes, simplify production processes, and improve car designs, the number of parts required for electric vehicles may be reduced from about 10,000 to 100 or even fewer. In other words, the electrification of cars will bring unprecedented changes to the current car hardware system, that is, the upgrade of mechanical systems. Of course, the changes in hardware systems will not pose any threat to carmakers such as BMW, because after all, the electrification of car power systems did not fundamentally change the product. It is still a means of transportation.

Therefore, it is unanimously believed in the industry that the real challenge facing the automotive industry and causing difficulties for car companies’ transformation is how to achieve intelligence in cars. In late February 2020, the National Development and Reform Commission and 11 other departments jointly issued the “Intelligent Innovation Development Strategy,” which provided a clear official interpretation of intelligent vehicles: through the use of advanced sensors and other devices, as well as artificial intelligence technology, intelligent vehicles will gradually become a new generation of intelligent mobile space and application terminals with autonomous driving capabilities.

From the official definition, future automotive products will not only be a means of transportation but also a mobile “third space” beyond home and office. Cars are expected to become platforms or entry points for various services and third-party applications, thereby evolving into a new ecosystem. People can connect with their office, home, and public facilities at any time in the car, realizing entertainment, socializing, and work, among other things. In other words, BMW’s transformation goal should be to change the tool experience of cars for people, change the attributes of cars, and reconstruct the relationship between people and cars, and car products will enter the intelligent ecosystem.

To verify this point, our reporter consulted relevant industry insiders. Taking the development trend of PCs/servers as an example, in the beginning, SUN and IBM did vertical integration, making the whole machine and operating system, and even chips themselves. Later, the advent of Microsoft and Intel made openness the mainstream in the industry, and even destroyed IBM’s technological advantage. Then, after entering the mobile era, we saw a more developed ecosystem and even a trend towards openness. Now, ARM’s servers have been occupying more and more market share, and the service operating systems have begun to shift from closed to Linux. In other words, the bottom layer of the ecosystem has been developed, and openness has become the trend. These changes mean that in the process of entering the intelligent ecosystem, the competition between car products will shift from a hardware battle among car companies to a competition between ecosystems.

However, in the current automotive industry, except for Tesla, the operating system is almost never exclusive to the OEM, but belongs to a third-party alliance. As BMW has been focusing on car manufacturing technology and related issues for a long time, it has lacked deep cultivation in the field of software. With the acceleration of the smart electrification era, BMW is likely to be constrained by third-party companies in its development. Therefore, the difficulty of BMW’s transformation is not only due to the lack of a pure electric vehicle platform, but also due to its hardcore software capabilities. To put it more broadly, Germany and Europe’s inaction in the internet has led to a shortage of software talent. Against this background, for BMW, it not only tests its hardware integration capabilities, but also comprehensively tests the core capabilities of software and hardware. In other words, the changes that BMW needs are not only to solve the problems of the supply chain, but also to solve many problems such as software, talent, and system.

However, in the current automotive industry, except for Tesla, the operating system is almost never exclusive to the OEM, but belongs to a third-party alliance. As BMW has been focusing on car manufacturing technology and related issues for a long time, it has lacked deep cultivation in the field of software. With the acceleration of the smart electrification era, BMW is likely to be constrained by third-party companies in its development. Therefore, the difficulty of BMW’s transformation is not only due to the lack of a pure electric vehicle platform, but also due to its hardcore software capabilities. To put it more broadly, Germany and Europe’s inaction in the internet has led to a shortage of software talent. Against this background, for BMW, it not only tests its hardware integration capabilities, but also comprehensively tests the core capabilities of software and hardware. In other words, the changes that BMW needs are not only to solve the problems of the supply chain, but also to solve many problems such as software, talent, and system.

“NEW CLASS” Plan Restart

In the 1950s, BMW was acquired by the Quandt family in Germany. With the support of the Quandt family, BMW launched the NEW CLASS plan in the 1960s, which is also regarded as the beginning of modern BMW products, and BMW began to move towards brilliance. Nowadays, BMW has restarted this plan code as the transformation plan of BMW, which shows the determination of BMW on the road of transformation.

Zipser said: “For us, ‘new generation’ constitutes a complete rethink of the core of the car. We are liberating ourselves from today’s segmented market and architecture. Based on the principle of electric travel first, we are innovating the basic logic of the product and combining it with a brand new car architecture.”

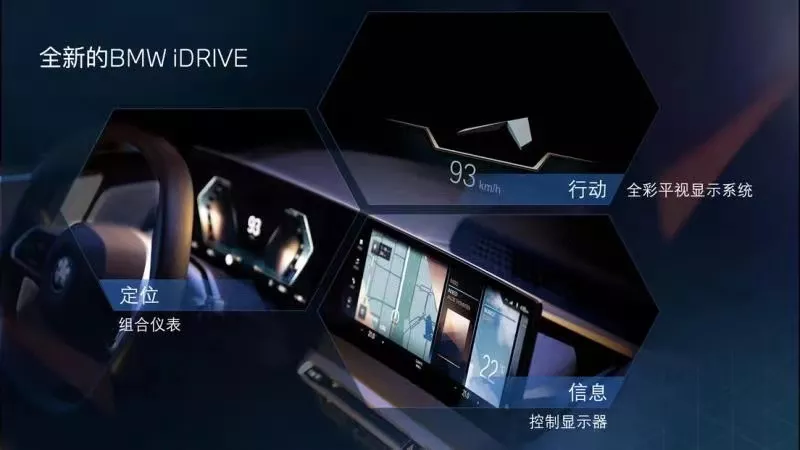

From the information currently available, the “New Generation” series of models mainly have three major characteristics: first, a completely redesigned IT and software architecture; second, a new generation of high-performance electric drive and battery; third, a brand new sustainable concept throughout the entire vehicle life cycle. At the same time, “New Generation” models can also achieve OTA online upgrades, which can always keep the vehicle fresh for users. In addition to OTA upgrades, in the face of the problem that the average selling price of new energy vehicles is higher than that of fuel vehicles, BMW believes that the new generation of models can achieve the manufacturing cost of electric vehicles to be lowered to the same level as the “most advanced” fuel vehicles. For example, in terms of power, BMW will build a highly scalable module, which can cover all segmented market models from high-volume production models to exclusive high-performance M models.

Although BMW has made changes in its strategic planning, it is difficult for us to believe that BMW can win this war without a strong product launch. Here, the author actually wants to say that the biggest difference between BMW and the new forces is not only in terms of products, technology and other aspects. To truly win the victory, BMW needs to take off its high-pitched image of “product-driven” and turn it into “user-driven”. At the same time, BMW should re-examine the strength of the new forces, as the saying goes, “a proud soldier will be defeated”. Only by truly understanding the strengths of the new forces and formulating targeted strategies, can car companies get growth. If BMW still believes in “closed-door production and self-righteousness”, it will eventually be eliminated by the market.

The transformation process of traditional car companies such as BMW and Toyota reminds people of Nokia. In 2007, Apple released the first-generation iPhone, ushering in the era of transition from feature phones to smartphones. For mobile phone manufacturers at that time, the competition was about reliability, durability, and cost. However, the emergence of smartphones broke this situation, and the competition between manufacturers was a comprehensive experience of “hardware+software+ecosystem”. This is like now, before the emergence of new energy vehicle companies, traditional car companies compete with their ability to integrate hardware. But in the era of smart electric vehicles that follows, everyone will compete with software+hardware+services. Therefore, centennial BMW is undoubtedly in the most critical battle. Can it open the next century?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.