The changing automotive industry: Is the development and supply model of automotive products still the same?

The era of intelligent vehicles has arrived, and it possesses at least the following features:

-

Autonomous driving function: The current autonomous driving technology assists human driving, but in the future, the car will be able to achieve a higher level of autonomous driving, with the system controlling the car.

-

Equipped with an intelligent cockpit system: The car is no longer just a means of transportation, but through the cockpit to perceive passengers, it can interact with users.

-

Online connectivity: The software system of intelligent vehicles can be connected to networks and clouds, making the car an intelligent mobile terminal.

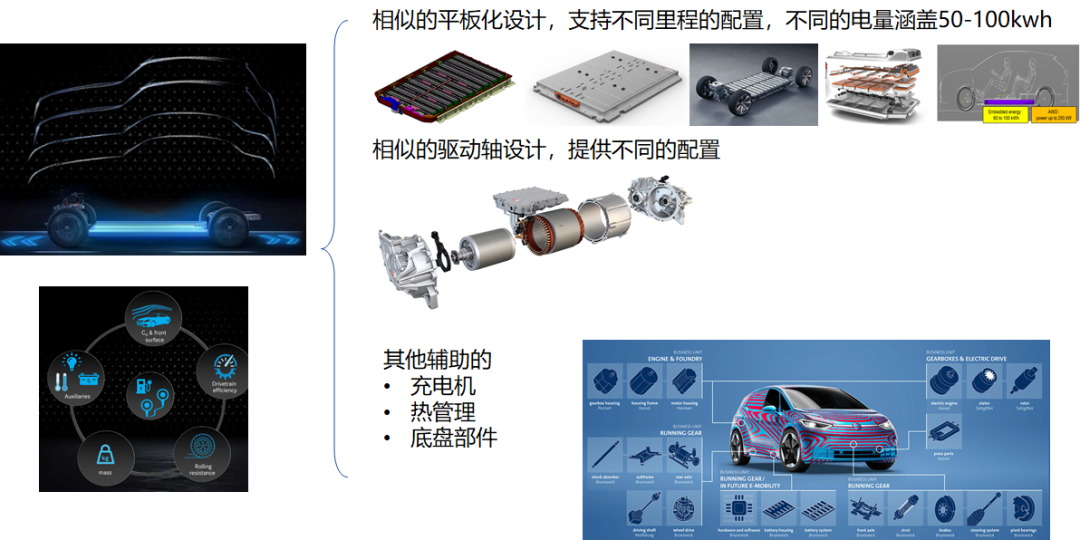

These features mean that intelligent cars no longer revolve around powertrain to differentiate their functions. Traditional vehicle manufacturers are moving towards the electrification and software of cars from the design of powertrain, chassis control, appearance, interior, and electronic systems. All these changes serve for smarter cars.

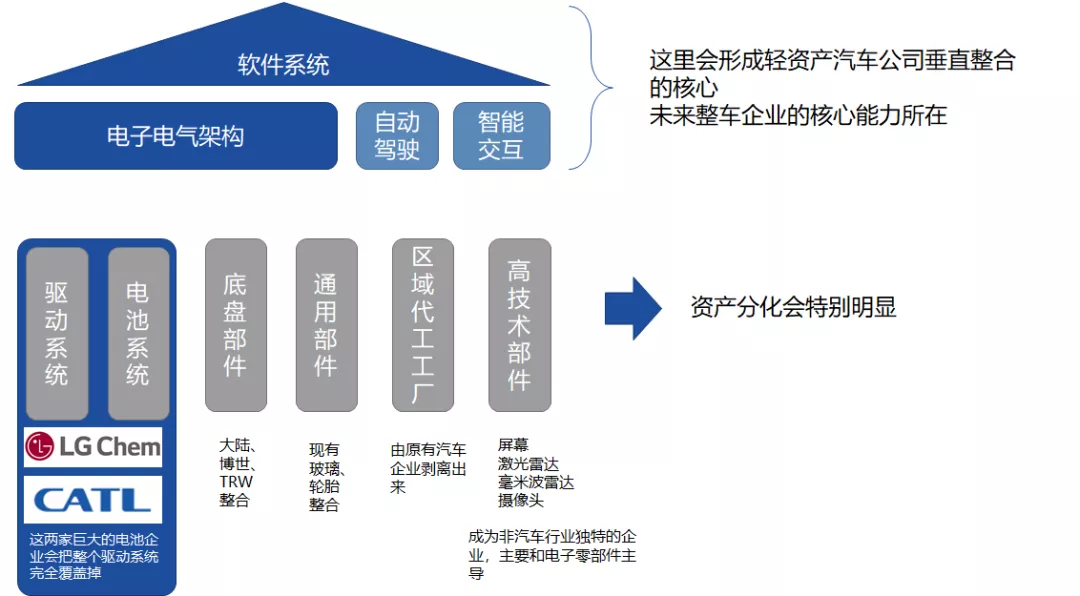

The automotive industry is undergoing a transformation, and the industrial landscape is changing with it. One phenomenon is that leading battery companies such as CATL and LG are expanding their industrial footprint with the aim of creating a complete solution.

Will they succeed?

CATL’s ambition

In 2019, CATL proposed the concept of CTP (Cell to Pack), which represents its route from battery cells to complete battery packs solutions.

In 2020, CATL officially announced a new development roadmap and is designing the second and third generations of CTP battery systems. The ultimate goal of this path is to further improve the vehicle’s range and reduce costs. By 2025, CATL plans to launch the fourth generation of highly integrated CTC battery systems.

“The director of CATL, Zeng Yuqun said, ‘We are researching a new battery integration technology. This technology allows the battery to be installed directly on the chassis of an electric car.'” With this new technology, the vehicle’s range may exceed 800 km.

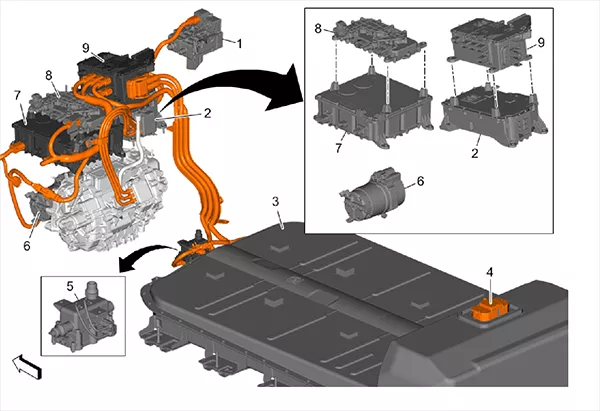

The technology is officially named CTC (Cell to Chassis), where Chassis refers to the base of the car. This technology integrates the battery cells and chassis together, and then integrates the motor, electronic control, high voltage devices such as DC/DC converters and on-board chargers (OBC), and optimizes power distribution and reduces energy consumption through the intelligent power domain controller.

From this moment on, we see CATL’s blueprint – integrating the entire electric drive system with the battery system.In August 2021, CATL (Contemporary Amperex Technology Co., Ltd.) took a big step forward by establishing a joint venture company with Shanghai Sieyuan Electric Co., Ltd., Jiangsu Newway, and Jiangsu Dewei, focused on the development of electric vehicle driving control systems in Suzhou, Jiangsu Province, named Suzhou CATL Sieyuan New Energy Technology Co., Ltd. with a registered capital of RMB 2.5 billion, of which CATL will contribute RMB 1.35 billion, holding 54% equity in the joint venture company.

The core purpose of this cooperation is to lay out the CTC (Cell to Chassis) technology. It is worth noting that Mr. Jiang Yong, who served as Vice President of Leadshine Technology and Chairman of Leadshine Union Power System Co., Ltd., has nearly ten years of experience in the field of new energy vehicle motor and electrical control. Through the establishment of a holding company, CATL can grasp the electric vehicle driving control technology, which is an important basis for the promotion and application of CTC technology by CATL. If this step can be successful, it will accelerate the maturity of CATL’s CTC technology, help the company grasp the development trend of power battery systems and electric drive systems and achieve a complete set of electrified powertrains solutions.

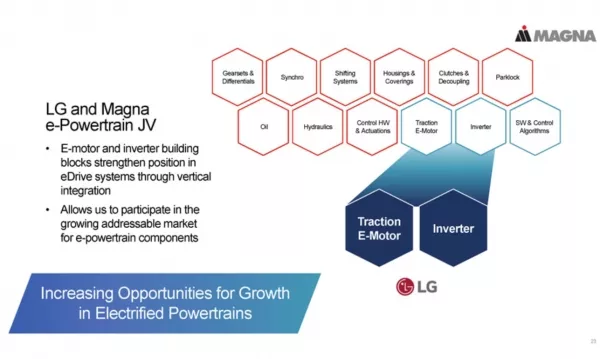

In addition, LG Group, through LG battery solutions and LG Electronics, is also laying out the entire electric vehicle powertrain solution. Furthermore, LG Electronics has announced a partnership with Magna to establish a new joint venture company, LG Magna e-Powertrain, headquartered in Incheon, South Korea. The two sides will establish a strong management team and integrate their advantages in electric vehicle power system development. The joint venture will focus on the development of power system components, providing scalable product portfolios for automakers, and a series of comprehensive solutions to help customers achieve the electrification and functionalization of automobiles, while integrating intelligent operating software and control software into the new electric drive system.

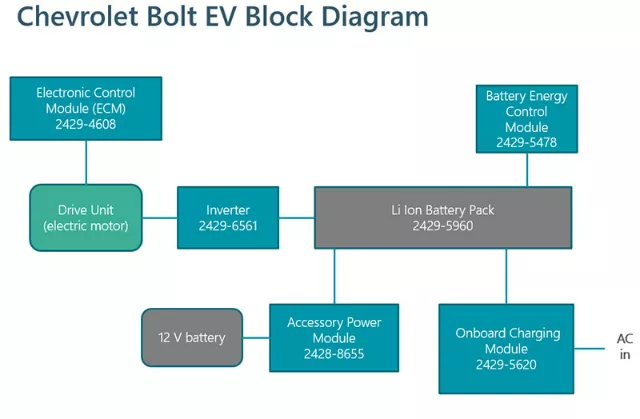

Previously, LG Group attempted to deepen its cooperation with General Motors on the Bolt EV. The two sides’ cooperation platform was to manufacture and supply all the following systems:

- Lithium-ion battery cells and battery packs

- Battery heater

- Electric drive motor (designed by General Motors)

- Electric drive inverter module (designed by General Motors)

- Onboard battery charger (OBC)

- Electric compressor

- High-power distribution module

- DC-DC converter

- Power line communication module (for communication with DC fast charging stations)

## Instrument panel and infotainment system

## Instrument panel and infotainment system

This almost encompasses the entire electric drive system, and it is the first time we have seen a complete solution provided by battery companies and related companies under strategic cooperation with car companies.

Tesla Model VS Ecosystem Model

From the perspective of the vehicle manufacturer, what are their considerations?

New players are still coming in. With Tesla’s breakthrough in the field of electric vehicles, not only Tencent, Alibaba, Baidu, and Meituan are entering the intelligent car industry through investment in new car companies, but IT and electronics companies such as Huawei, Xiaomi, and Apple are also making inroads in this field.

I believe that several different models will coexist in the future:

1) Tesla Model: gradually transform the entire electric vehicle.

We can see that Tesla is gradually deepening in the battery system, drive system, cabin entertainment, automatic assisted driving, and thermal management system, and then starting to enter the cell manufacturing stage.

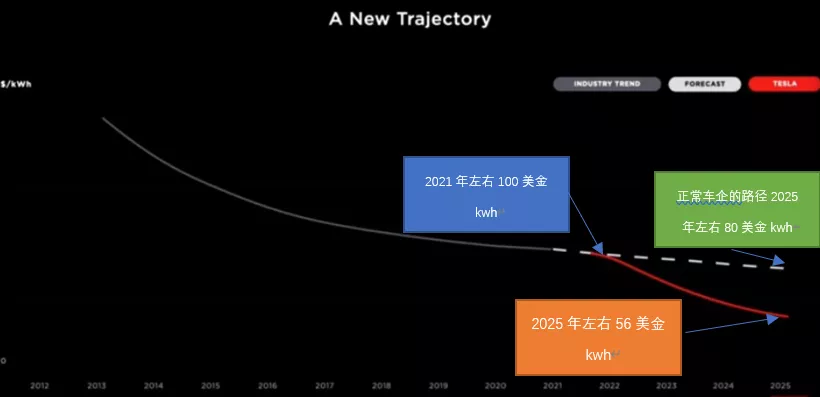

From the technical path announced by Tesla in the Battery Day, on the one hand, Tesla is confident that it will increase the cruising range by 54% (the electric core design, negative electrode, positive electrode, and electric core chassis integration contribute to the improvement of 16%, 20%, 4 % and 14% respectively), unit cost reduced by 56% (electric core design, electric core factory, negative electrode, positive electrode, and electric core chassis integration contribute to the reduction of 14%, 18%, 5%, 12%, and 7% respectively), which means that the expected cost of the cell can be reduced from 100 US dollars per kWh in 2021 to 56 US dollars per kWh in 2025. The unit investment amount decreased by 69%— which means that Tesla can greatly improve its production line capacity and manufacture more cells by itself (the contribution brought by the five measures is 7%, 34%, 4%, 16%, and 8%, respectively).

With the deepening of the Tesla model, European car companies are not only developing electric vehicle platforms, but also step by step entering the battery manufacturing field, and deeply differentiating the entire battery system and electric drive system in-house.

2) Ecological Mode: Focus on ecological construction like ecological enterprises, only focus on product design and vehicle engineering.

Similar to Apple and Xiaomi, the focus is definitely on smart cars and vehicle engineering design. The job of the vehicle engineering is system integration, carrying various technologies in different directions on the platform, and then sells it in refined and subdivided areas.

Now facing the revolutionary change of smart cars, only the definition of the whole vehicle can make an immediate impact and move the whole lever. From their needs, traditional components in the car are standard products, and they can strategically purchase those products that are difficult to differentiate in the early stage.

Technological enterprises that focus on the core competitiveness of smart cars and invest in the automobile industry must focus on the parts that consumers perceive in the car, such as autonomous driving, intelligent cabin, software connecting the car interior and the mobile phone, and other interaction-oriented parts.

Therefore, under this mode, it is very likely that battery and electric drive, as CATL and LG have thought, can both be paacked together.

Looking forward in the future, I believe that battery companies’ entry into the deep integration of electric drive systems and the introduction of complete sets of electric vehicle power solutions is actually a way for small cars and new players. Traditional car manufacturers, as big players, want to further incorporate system development into their own production. These two forces will work together and develop in parallel. It remains to be seen who will occupy a larger market share in the future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.