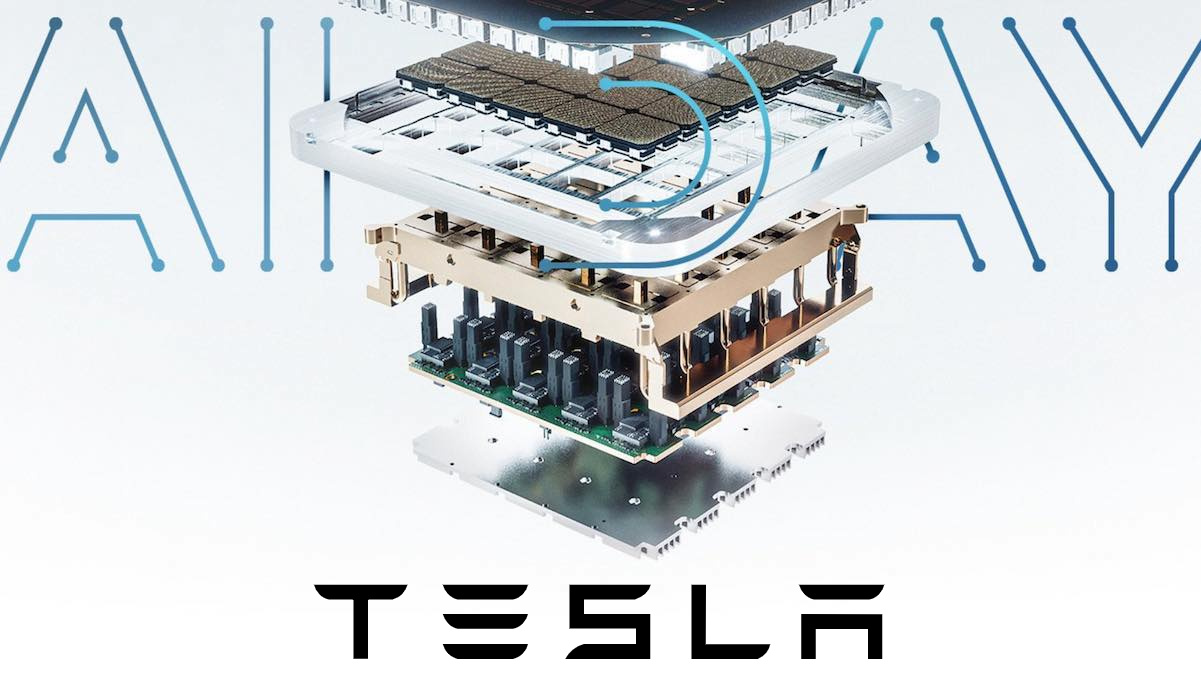

As the leading star in the global electric vehicle industry, every move of Tesla, the company, sparks heated discussions. Last month, on AI Day, Tesla released its own AI training supercomputer called DOJO and self-developed training chip D1, which added another spark to the already turbulent world of chips. This is not Tesla’s first time releasing self-developed chips. As early as 2016, Tesla started self-developing control chips, especially the most important AI processing unit. AutoPilot HW3.0, launched in April 2019, is based on Tesla’s self-developed Tesla FSD chip, which has ten times higher performance compared to previous NVIDIA Drive PX2, bringing tremendous performance improvement.

(Photo source: Tesla AI Day live broadcast)

Not only Tesla, but many car companies have also launched self-developed automatic driving chip plans. In our inherent impression, self-developed chips have always been a matter of continuous investment, long R&D cycle, and high unknown risks. So why are car manufacturers reversing the trend and showing a determined attitude to tackle this challenge?

Self-developed chips bring tremendous efficiency improvement

A complete automatic driving system usually consists of three parts: perception, decision, and execution. AI chips and automatic driving algorithms are the most important link in the decision layer. Deep neural networks are widely used in automatic driving algorithms. For example, the FSD system currently used by Tesla is based on deep neural network research. The evolution of deep neural networks requires training with a large number of instance data with correct annotations to ensure that they can correctly identify key information such as lane lines and vehicle contours in various scenarios. The larger the training data, the higher the accuracy. Millions of Tesla electric vehicles around the world are Tesla’s most significant source of data, and Tesla has accumulated more than one million 10-second videos and annotated 6 billion objects with information such as speed and depth. The total amount of data exceeds 1.5 PB, which is also one of the essential reasons why Tesla’s automatic driving is at the industry’s leading position.Other autonomous driving companies in the industry also improve recognition accuracy by continuously feeding data to autonomous driving algorithms, so the computing speed of training chips largely determines the speed of deep neural network evolution. Faster training speed often requires more efficient dedicated training chips. Tesla’s D1 training chip and the D1-based training supercomputer DOJO have emerged to meet this demand. Ganesh Venkataramanan, senior director of Tesla’s Autopilot hardware, said, “The D1 chip is part of Tesla’s DOJO supercomputer system, manufactured using a 7-nanometer process, with a processing capacity of 362 TOPS. each DOJO consists of 25 D1 chips, achieving a bandwidth of 36 TB/s and 9 PetaFLOPS of computing power.” It has already ranked high in the world supercomputer performance rankings.

AI autonomous driving chips are roughly divided into three categories. The first is GPUs with good compatibility, high performance, high power consumption, and high cost, represented by manufacturers such as NVIDIA and AMD. The second is ASICs with customized design, stable performance, and high R&D costs, represented by manufacturers such as Intel and Horizon. The third category is FPGAs between the two. Automakers have inherent advantages in developing their own chips. They can directly adjust the hardware architecture according to the underlying logic requirements of the algorithm to achieve maximum efficiency for a certain computing content.

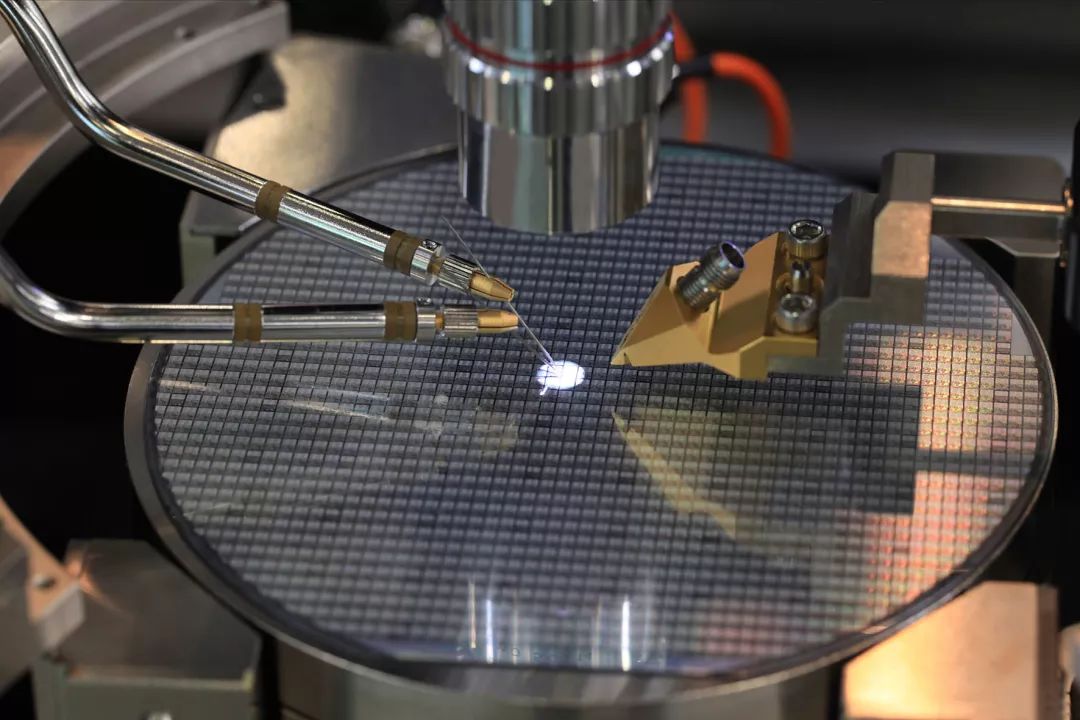

Chip foundry technology has become more popular, leading to a decrease in manufacturing costs. The separation of chip design and manufacturing has been the mainstream direction of development in the semiconductor industry in the past decade. TSMC has grasped this trend and become the world’s largest chip manufacturer. In April of this year, Intel announced its return to the chip wafer foundry field and plans to invest $20 billion to build two large chip factories in Arizona. Another heavyweight player has entered the chip foundry market, which is likely to reduce the cost of chip foundry. As chip manufacturing processes approach the limit of 1 nanometer, the development speed has slowed down, which means that the performance gap of chips is more prominent in the design rather than manufacturing side. Vehicle chips are more tolerant of power consumption than mobile handheld devices, which greatly reduces the design difficulty. Secondly, the chip industry has entered a mature stage, and the increasing number of chip design talents makes it no longer difficult for manufacturers to build a professional design team from scratch.

(Image Source: Internet)

Self-Driving Cars Attract Users to Pay for High-Priced Chips

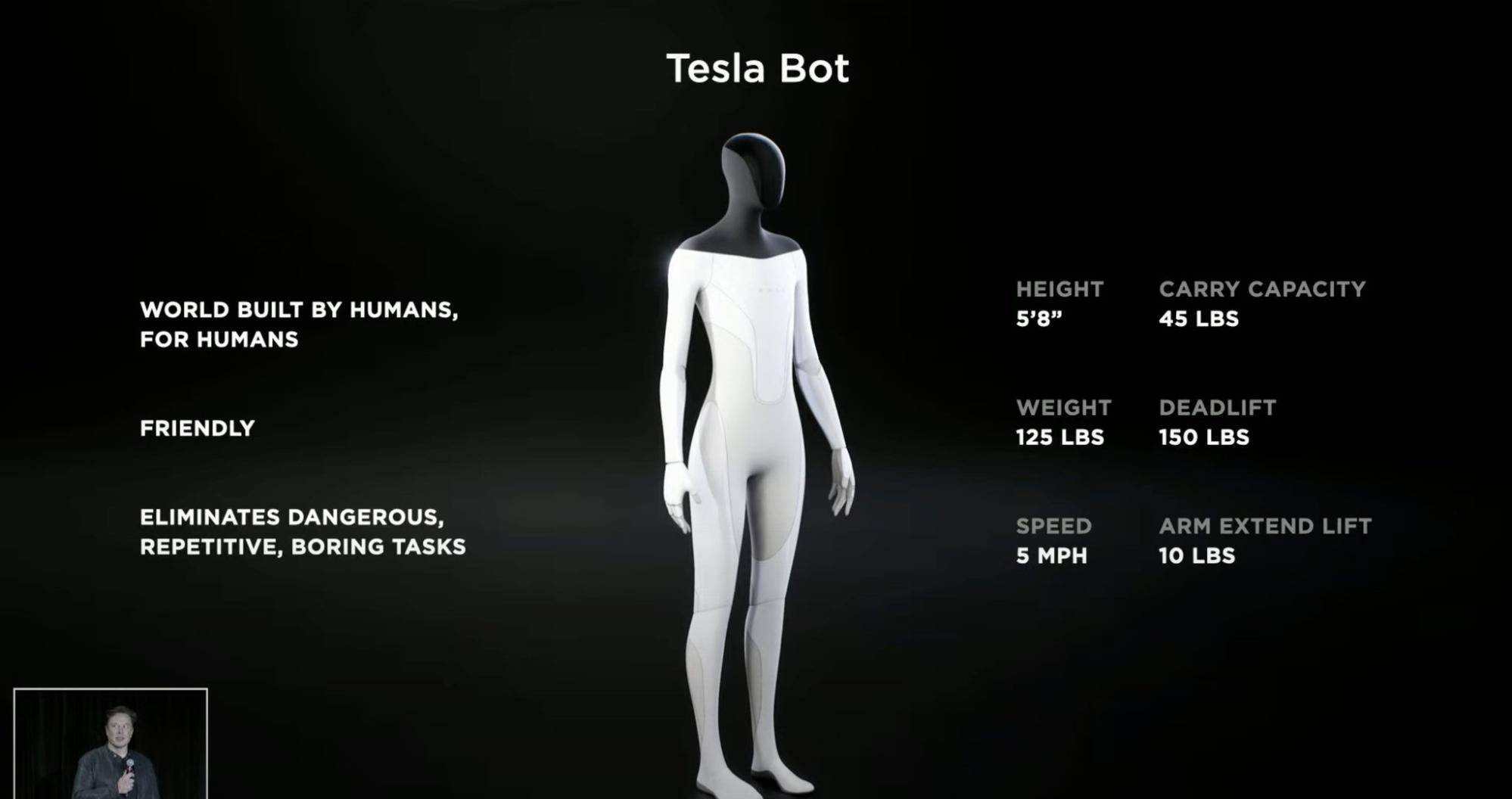

The new driving experience brought by self-driving cars has made consumers willing to pay for high-performance, high-priced chips. Since the concept of self-driving cars became prevalent, both autonomous driving and assisted driving have become one of the key features that consumers focus on when purchasing a car. Thanks to the retail price of hundreds of thousands of yuan for car purchases, tens of thousands of yuan for driving assistance packages are not as expensive, so chips costing over 10,000 yuan have entered the mass consumption field for the first time. The increase in the unit price of chip consumption enables manufacturers to balance the high hardware R&D costs in the early stages, and slight modifications to self-driving chips can be applied to other vision-related functions in subsequent developments. For example, Tesla’s latest release, the Tesla Bot, uses the FSD chip, and the vast development space for AI chips has led car manufacturers to believe that investing in AI chips is a profitable venture that won’t result in losses.

The pricing strategy of Tesla Model 3 has an interesting aspect. On the Tesla China official website, purchasing a basic standard range plus version without any additional options costs 239,000 RMB. However, the price for the full self-driving option package is as high as 64,000 RMB, which is nearly 4:1 in proportion. This is a situation that is impossible to occur in traditional automobiles. The core of autonomous driving lies in software algorithms. The low marginal cost of software makes the profit margin of Tesla’s self-driving package even higher than that of selling a Model 3. This business model, which continuously compresses hardware prices to expand sales and relies on software to make profits, reminds people of Xiaomi Company. If Tesla can maintain its current hardware product strength, further reduce the vehicle selling price through economies of scale, and rely on software services for profits, it may pose a huge challenge to other new energy brands. In addition, the independently developed AI training supercomputer and training chip D1 for accelerating the evolution of autonomous driving functions may remind us that Tesla may have already set out on the road of “making friends with hardware”.

The pricing strategy of Tesla Model 3 has an interesting aspect. On the Tesla China official website, purchasing a basic standard range plus version without any additional options costs 239,000 RMB. However, the price for the full self-driving option package is as high as 64,000 RMB, which is nearly 4:1 in proportion. This is a situation that is impossible to occur in traditional automobiles. The core of autonomous driving lies in software algorithms. The low marginal cost of software makes the profit margin of Tesla’s self-driving package even higher than that of selling a Model 3. This business model, which continuously compresses hardware prices to expand sales and relies on software to make profits, reminds people of Xiaomi Company. If Tesla can maintain its current hardware product strength, further reduce the vehicle selling price through economies of scale, and rely on software services for profits, it may pose a huge challenge to other new energy brands. In addition, the independently developed AI training supercomputer and training chip D1 for accelerating the evolution of autonomous driving functions may remind us that Tesla may have already set out on the road of “making friends with hardware”.

🔗Source: [Tesla AI Day]

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.