On the evening of August 30th, 2021, at around 6 pm, Ideal Automotive released its Q2 2021 financial report. Surprisingly, Ideal’s founder and CEO, Li Xiang, did not attend the phone conference held at 8 pm, and no groundbreaking news was announced during the conference. This article will interpret this quarter’s financial report information through horizontal comparison and review of recent relevant information. The recent popular phrase in garage 42, “可以的嘛” (“It’s Okay”), which describes a subtle state that is not too powerful but also not bad, is very suitable to describe the performance of Ideal’s Q2 financial report this year.

Q2 Turnover

As of July 31st, 2021, Ideal Automotive has delivered a total of 38,743 Ideal ONE vehicles this year, and the cumulative delivery volume since its listing has reached 72,340 vehicles. This makes Ideal ONE the sales champion of mid-to-large-sized new energy SUVs.

In Q2 2021, Ideal Automotive (LI.NASDAQ, 2015.HK) had a total revenue of 5.04 billion yuan, a month-on-month increase of 40.9%. Among them, automotive sales revenue was 4.9 billion yuan, a month-on-month increase of 41.6%.

In Q2, Ideal’s gross profit was 952.8 million yuan, a year-on-year increase of 54.5%. The gross profit margin was 18.9%, slightly increased month-on-month. The vehicle sales gross profit margin was 18.7%, slightly higher than the 16.9% of the previous quarter. The main reason for the increase in the gross profit margin of automotive sales compared to the previous quarter was the sale of the new Ideal ONE model, which increased its price by 10,000 to 20,000 yuan since the end of May.

When compared horizontally with the other three major players in the new energy automotive industry in China, Ideal’s comprehensive gross profit margin is at a lower end. Among them, NIO’s gross profit margin is 18.60%, and Xpeng’s gross profit margin is 11.90%. From the perspective of automotive gross profit margin, Ideal is slightly behind Nori but ahead of Xpeng. NIO’s automotive gross profit margin for the quarter was 20.30%, while Xpeng’s data was 11.00%.

In terms of sales costs, a total of 4.09 billion yuan was consumed in Q2 2021, a month-on-month increase of 38.2%. Regarding this data, Li Tie, Chief Financial Officer of the company, said that it was mainly due to the increase in the number of directly-operated stores and the increase in market promotion efforts in Q2. The increase in the number of employees as a result of the increased number of stores led to a corresponding increase in salary expenses.As of July 31, 2021, LI (Li Auto) has 109 retail stores covering 67 cities and 176 after-sales service and authorized sheet metal spraying centers covering 134 cities. LI plans to build 200 retail stores by the end of the year and further enter lower-tier cities. Shen Yanan has also stated that opening stores in large shopping malls is more efficient than advertising because the flow of people in malls brings higher conversion rates. However, when LI’s brand’s customer acquisition ability reaches a certain level, it will also consider independent stores.

With a cash reserve of 50 billion yuan, LI has the least losses among the three giants. The net loss of the second quarter has decreased to 235.5 million yuan, a decrease of 34.6% compared to the net loss of 360 million yuan in the first quarter of 2021. In comparison, NIO and XPeng had losses of 587 million yuan and 1.19 billion yuan respectively during the same period. However, part of the reason for this data also means that LI, which operates on a shoestring budget, invests less in research and development than its competitors. In fact, LI’s R&D expenditures of 650 million yuan are indeed lower than NIO’s 880 million yuan and XPeng’s 860 million yuan.

Regarding R&D expenses, Li Tie stated in a conference call that “this year’s R&D expense guidance will be maintained at 3 billion yuan for the whole year. It will reach $1 billion in R&D expenses in 2023, mainly used for R&D of new models, autonomous driving functions, the R&D of new functions that we want to independently develop in the next 2-3 years, and the R&D of future smart technology.”

As of June 30, 2021, the company’s cash reserve, that is, cash and cash equivalents, restricted cash, and the balance of fixed deposits and short-term investments, totaled 36.53 billion yuan. However, it should be noted that this does not include funds raised from the secondary market in Q3 after listing on the Hong Kong Stock Exchange.

On August 12, 2021, LI Auto went public on the main board of the Hong Kong Stock Exchange, raising HKD 11.6 billion. LI Auto will use this funding for high-voltage pure electric platform, autonomous driving and intelligent cockpit, and range-extending product development, infrastructure construction and marketing, and company operations.

Comparatively, LI’s cash reserve of nearly 50 billion yuan is almost the same as XPeng, which is also listed in Hong Kong, and slightly lower than NIO, which has not yet listed in Hong Kong.

Shen Yanan revealed that the development progress of high-power charging pure electric vehicle (HPC-BEV) is “smoothly progressing according to the plan,” and that the sample of 4C batteries is ready, marking a significant milestone. In addition, they have completed the concept design of the high-power fast charging pile and plan to start the pilot work of the first charging station within this year.

Improvement in product strength

In addition to the objective reasons such as the gradual relief of chip supply and the increase in production capacity in this quarter, the improvement of product power brought by the facelift should not be underestimated. For the 2021 facelifted Ideal ONE, the major highlights are concentrated in the enhancement of assisted driving and endurance capabilities, as well as the improvement of comfort and practicality. The two optional colors with a price increase of 10,000 RMB are also a new revenue stream.

The facelifted Ideal ONE has abandoned the Mobileye EyeQ4 visual recognition chip and instead adopted two domestic AI chips, Horizon Journey 3 chips, becoming the first car model in the world equipped with Horizon Journey 3 chips, and the computing power has been increased from the previous 2.5 TOPS to 10 TOPS. After this switch of automatic driving chip supplier, Ideal Automotive’s automatic driving algorithm has also been self-developed, freeing itself from the constraints of black box mode iteration ability.

The 800-megapixel front monocular camera is also a world premiere. The 800-megapixel resolution means 4K-level resolution. With an FOV up to 120°, the effective detection distance is up to 200 meters. The lack of a corner radar on the old model, which causes low perception ability during lane changing and overtaking, has been improved with the new model equipped with five Bosch millimeter-wave radars with recognition range of 150° and detection distance of over 110 meters, fully covering the vehicle surroundings.

The improvement of hardware capabilities and computing power enables the Ideal ONE to have NOA (Navigation Assisted Driving) capability. It can achieve more accurate on and off ramping and automatic acceleration and lane changing on partially enclosed roads. It also supports visual parking function.

The change of the powertrain module is also noteworthy. The 2021 Ideal ONE still adopts the EREV (Extended-Range Electric Vehicle) product architecture and is equipped with a 1.2T three-cylinder engine from DongAn Power. However, with the switch to a brand-new and more efficient and compact permanent magnet motor and inverter, the fuel tank capacity has increased from 45 liters to 55 liters, the endurance has increased from 800 km to 1,080 km, and the fuel consumption per 100 km has also been reduced to 6.05 liters.

In terms of configuration, the 6-seater (with a high purchase rate of 96%) with greater advantages in annual inspection and practicality has become the only option, and the first and second row seats have added massage function. The external discharge function has also added to the Ideal ONE’s high-quality tool attribute in outdoor scenarios.

Future Prospects

Pressure of Multi-Thread Parallelism# Ideal ONE’s Strategy and Future Plan

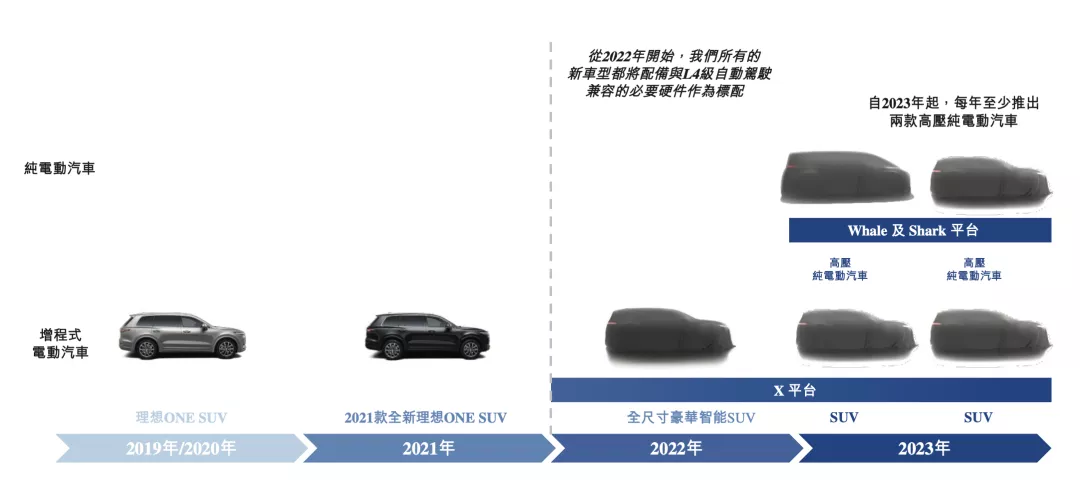

The ideal success from 0 to 1 comes from accurate positioning and breakthroughs in a single point. From pricing, driving mode, and body shape, Ideal ONE fully understands the market demand for ideal cars. The R&D and procurement costs of a single model strategy can be kept at a relatively low level. Moreover, with the introduction of Whale and Shark platforms, the appearance of a pure electric car in 2023, and the release of the X01 full-size luxury extended-range electric SUV on the new X platform, the multi-threaded route will also bring new challenges to R&D funds and human resources.

Founder and CEO of Ideal ONE, Shen Yanan, mentioned on August 12th, when Ideal ONE was listed on the Hong Kong stock exchange, that the R&D cost of a car is around 2.5 billion yuan, which indeed puts a lot of pressure on funding. The current R&D team of 2,000 people will continue to expand.

New Plant and New Engine

In addition to the plan to use the Beijing plant, Ideal ONE also signed an investment agreement with BMW supplier Mianyang Xinchen Power Machinery Co., Ltd. on August 27th. The two parties will establish a new joint venture company, Sichuan Ideal Xinchen Technology Co., Ltd., to be controlled by Ideal ONE. The newly established joint venture will develop and manufacture new extended-range engines. The products of this joint venture company will be launched on the X01 model, planned to be released in 2022.

Q3 Plan

Ideal ONE expects to deliver 25,000-26,000 vehicles in the third quarter of this year, which corresponds to a year-on-year increase of approximately 200%. In terms of revenue, it is expected to be around RMB 7 billion, a year-on-year increase of 180%.

Medium and Long-Term Plan

For the future 3-5 years, or even longer-term plan, Shen Yanan mentioned three goals:

- The problem of mileage anxiety must be solved. This is the core value that Ideal ONE provides to users. The company will continue to introduce extended-range electric vehicles and accelerate the R&D of high-power charging technology;

- The target user is mainly family users. This is a group with an increasingly strong demand. Product definition will fully consider the actual needs and pain points of this type of users;

- The R&D of intelligent driving functions.

🔗 Open an account on Hong Kong and U.S. stock markets (Get 1 share of NIO stock and trade U.S. stocks commission-free for 90 days)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.