This article is reproduced from the official account of Auto Car Weekly.

Author: Financial Street Lao Li

Autonomous driving may be a pseudo-proposition for a long time in the future.

Recently, there have been some hot events in the industry about autonomous driving. As a practitioner, Lao Li believes that there should be more neutral voices in the industry to objectively discuss autonomous driving. The capital market is called “red-hot” on the surface and is actually calm and rational with a “blue” attitude. Faced with autonomous driving, the capital market maintains sufficient rationality.

Many friends have been looking forward to the emergence of a new giant in the autonomous driving industry such as “CATL”, which can both create a money tree and drive the development and profitability of the intelligent electric vehicle industry. Lao Li’s team has studied for a long time in the first half of this year and obtained a negative answer. It is not only difficult for the autonomous driving field to produce a money tree like CATL, but also impossible to have evergreen concept stocks like CATL.

Today, Lao Li will describe the autonomous driving industry chain with everyone, and why the secondary market believes that the autonomous driving industry cannot produce a new “CATL”? Where will autonomous driving go in the eyes of capital?

These Three Systems Are Different from Those Three Systems

The autonomous driving industry chain is the longest, widest, and most diversified chain in the automotive industry, without exception.

As mentioned by Lao Li in the article “How to Invest in Auto Stocks” (link), one of the most important directions for capital research is the research of industry chains and value chains, and the analysis of the potential of industry chains and value chains through supply relationships. Today, Lao Li will use this concept to analyze the two chains of autonomous driving with everyone.

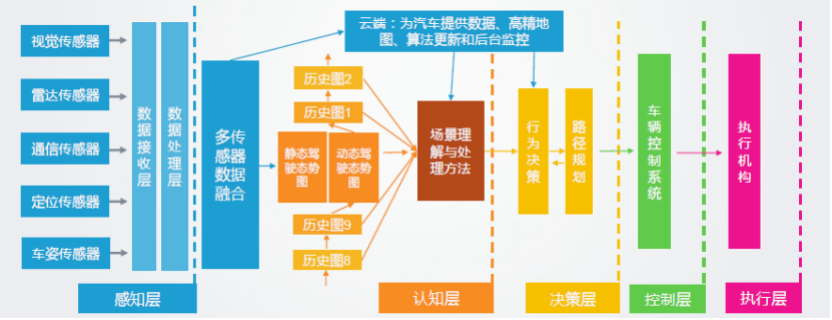

Like the core components of the three electric systems (battery, motor, and electronic control) in the direction of electrification, autonomous driving can also be divided into three systems, namely perception system, decision-making system, and execution system. Regardless of the technical route, these three systems are fundamental to autonomous driving.

Although the classification is the same, the valuation logic of the two is quite different. Due to the relatively mature technical route in electrification, such as the application of three-element lithium batteries and lithium iron phosphate batteries in battery technology, and permanent magnet synchronous motors and AC asynchronous motors in motor technology, the core electronic control components have gradually transitioned from IGBT to SiC. Under the mature technical system, the supply and demand relationship directly affects the valuation. The surge of lithium battery industry chain last year and this year was pushed by the supply and demand relationship.The logic of autonomous driving is different from that of traditional driving, and the industry chain and leading companies corresponding to different technical routes are different. Due to the immaturity of various technologies, investors cannot determine the final route and production schedule. As of today, the valuation of autonomous driving companies is uncertain.

Some core components of the three major systems are clear. The perception system can be divided into two parts: vehicle positioning and environmental perception. Vehicle positioning includes IMU (Inertial Measurement Unit) and GNSS (Global Navigation Satellite System), while environmental perception mainly includes cameras, ultrasonic radar, millimeter-wave radar, and LiDAR.

In the past, the focus was on whether LiDAR was a necessary component for autonomous driving (Tesla believes that it is unnecessary, while other automakers believe that it is necessary). Beginning last year, almost all institutions believed that LiDAR was necessary because Tesla also began testing LiDAR in Silicon Valley. High prices and high production volumes make LiDAR a battleground.

There is a separate supply chain for each upstream component. In the supply chain of in-vehicle cameras, the most critical component is the CMOS sensor, which is a camera chip. A listed company in China, NIO, acquired OV and became the leader in this field. With good performance and semiconductor prosperity, NIO’s stock price skyrocketed, and the secondary market industry research should seek out more companies like NIO.

The decision-making system is N times more complex than the perception system. The research team led by Lao Li made an incomplete statistics according to the technical route, including intelligent computing platforms, domain controllers, high-precision maps, information security, V2X, OTA, toolchains, etc., involving both software and hardware.

The most critical part of the hardware is the autonomous driving chip, which the secondary market has always been concerned about. Looking at the soaring stock price of American company Nvidia, we can only hope for early listings of domestic concepts such as Horizon Robotics and Black Sesame.

The core of the software is system software. Friends who have studied BlackBerry in the US stock market will find that its stock price soared for a period of time because some institutions discovered the application scenarios of its software system in the field of autonomous driving, thereby increasing its valuation.

Challenges of Investment in Autonomous Driving Industry

Executing an autonomous driving system may look simple, but in reality, it is quite difficult. Autonomous driving has been promoting the concept of line-controlled chassis, which includes line-controlled driving, line-controlled braking, line-controlled steering, line-controlled suspension, and so on. Each field has the potential for leading companies to emerge, but the problem is that no one can currently predict when and who will emerge.

For example, the Hong Kong-listed company Nishite experienced a surge for a period of time because it was structured by institutions with line-controlled steering skills, and the same goes for domestic companies such as Bortelli.

Although institutions have been exploring companies in the three major systems, the development of the industry is ambiguous, and the distribution is too scattered, so they cannot map an industry-recognized investment map in autonomous driving, which is the biggest pain point of autonomous driving investment.

Gathering Is a Fire, Scattering is a Starry Sky

The disheveled industrial chain of autonomous driving has already made researchers feel headache. To make things worse, the value chain of autonomous driving is also very scattered and it is not easy to price. The headaches that investors face are essentially caused by the immaturity of the industry. Autonomous driving only seems to be a complete value system, but it is actually chaotic and complicated.

The market price of the battery system of an economic electric vehicle is basically over 60,000 yuan, and the market price of the motor system can be controlled within 10,000 yuan. The price of the electronic control system can also be controlled within 10,000 yuan. The value distribution is obvious and concentrated, which makes it easy to make valuations. The price of a single vehicle of 60,000 yuan determines that Ningde era is valued at 1 trillion yuan, and it is constantly favored because of this.

In contrast, the autonomous driving industry is a completely different story. No institution in the world can judge the value distribution of the three major autonomous driving systems. This is still due to the immaturity of the technology route and mass production pace, and the prices of various systems and components are not mature. The value distribution has always been changing.

The perception system is the most expensive system in terms of price. The average selling price of a single rotating lidar of Hesai technology was around 110,000 yuan in 2019, and it decreased to around 90,000 yuan in 2020. Huawei and DJI’s prism and rotating lidar cost from thousands to tens of thousands of yuan. After MEMS lidar is mass-produced in the future, the cost can be reduced to a few hundred yuan. The price distribution of a small lidar is so scattered, making it easy to understand why no one can make a value chain.The difficulty of evaluating the value of decision-making systems is greater due to the many software and hardware components. For reference, Mobileye’s visual solution for Zeekr 001 costs about 20,000-30,000 RMB, Huawei’s autonomous driving system for Changan’s high-end brand costs about 20,000 RMB, and the cost of Xpeng’s P7 NGP solution is about 50,000-60,000 RMB. There is a huge price difference for different functions.

Due to fierce competition, software costs are also constantly decreasing. Taking high-precision maps as an example, currently Baidu and Gaode’s high-precision maps charge per bicycle per year. In the past, Baidu charged around 500 RMB per bicycle per year, gradually decreasing to 200 RMB, and even possibly to zero in the future.

The difficulty of executing each line control technology in the execution system is very high, with low output and high price. After seeing the distribution of the industry chain and value chain, it is not difficult to understand why it is difficult to have another Ningde era in the autonomous driving field. According to personal estimation by Mr. Li, the value of an electric bicycle is at least 80,000 RMB (60,000 RMB for batteries, 10,000 RMB for motors, and 10,000 RMB for electronic controls), with hardly any room for decrease.

After autonomous driving matures, the value of a single bicycle will be difficult to reach 80,000 RMB. The software part will be difficult to monopolize and its cost will be very low. Although the hardware part will have higher costs, it will face more intense competition than the electric vehicle field.

Before Huawei and DJI entered, many researchers were enthusiastic about autonomous driving. After Huawei’s entrance, it dealt a heavy blow. Huawei’s entry into the autonomous driving field is a boon for car companies and users, but a nightmare for capital.

Huawei’s cost and price of LiDAR are lower than those of Hesai, Sutengjuchuang, and its technology and applications for chips are stronger than Horizon Robotics and Black Sesame Technologies. More frighteningly, Huawei has also invested in and acquired some upstream supply chain companies. The supply chains of Huawei’s MDC and ADS product lines are all related to Huawei’s products. Smaller upstream startup companies will inevitably be suppressed, and companies that may have had the opportunity to go public before will find it difficult to do so in the secondary market.

Where is the future of investment in autonomous driving? Recently, Mr. Li said that the future of investing in autonomous driving is “waiting,” which is not the end goal. The goal is to discover market opportunities during the waiting process.## Old Li doesn’t know when autonomous driving will fully explode, but based on technology and company development cycles, combined with the capital evolution time of electrification, we can predict that the starting period for intelligentization should be from 2022 to 2024, and the leader of intelligentization is autonomous driving. Once the market moves, Old Li will update with everyone.

The first sign of movement in the market is the mass production speed of the key link in the autonomous driving industry chain. As mentioned in the first two sections, the industrial chain and value chain of autonomous driving are relatively scattered. In such a scattered market, the secondary market can only be a small pond, and only a few sips of water can be taken.

The closest stage to the market is actually LiDAR. In the second half of last year and the first half of this year, many LiDAR companies went public in the United States, and their valuations were briefly raised. In the first half of this year, China’s LiDAR leading company, Hesai Technology, also submitted an application for listing on the STAR Market, but failed to list successfully due to various financial reasons.

Many friends believe that Hesai Technology and other companies such as RoboSense will try to enter the A-share market in various ways in the second half of this year. As long as the market is prosperous, it is likely to have multiple consecutive limit up situations. In addition to the hottest LiDAR stage, some companies upstream of the perception layer will also be tracked in the long term, such as Horizon Robotics and others.

The decision-making layer is the area most likely to have giants in the future, including whole vehicle companies, autonomous driving software companies, autonomous driving hardware companies, and so on. The autonomous driving companies we are familiar with are basically focused on this stage.

For example, companies such as Xiaoma Zhixing and Wenyuan Zhixing mainly focus on developing autonomous driving solutions, while Momenta and other enterprises mainly focus on developing autonomous driving algorithms. Geely and SAIC have also gradually applied Momenta’s algorithms. Recently, the valuation of certain AI companies has been suppressed due to the lack of applicable scenarios. Correspondingly, the valuation of AI companies that have found landing application scenarios will be higher. Momenta is a typical example.

The second important trend in the automotive market is the application of autonomous driving technology in various scenarios. Due to insufficient communication, when users mention autonomous driving, they usually only consider its narrow application in passenger cars at L3 level or above. In fact, autonomous driving has a broad range of application scenarios from low to high speeds, from L1 to L5 levels. These scenarios have different safety standards and implementation difficulties, and closed scenarios – such as mining and port applications – are the easiest to implement. The most typical example of this is the automatic driving at Yangshan Port. Low-level high-speed autonomous driving for commercial vehicles and passenger cars comes next, while high-level autonomous driving at full speed is the most difficult to realize.

The second important trend in the automotive market is the application of autonomous driving technology in various scenarios. Due to insufficient communication, when users mention autonomous driving, they usually only consider its narrow application in passenger cars at L3 level or above. In fact, autonomous driving has a broad range of application scenarios from low to high speeds, from L1 to L5 levels. These scenarios have different safety standards and implementation difficulties, and closed scenarios – such as mining and port applications – are the easiest to implement. The most typical example of this is the automatic driving at Yangshan Port. Low-level high-speed autonomous driving for commercial vehicles and passenger cars comes next, while high-level autonomous driving at full speed is the most difficult to realize.

Each scenario has its own industry chain, with differences in technology, cost, and leading companies. For example, cost is more important than technology for autonomous driving in closed scenarios, with single vehicle cost basically controlled below 20,000 yuan or even lower, and the realized autonomous driving function being relatively weak. On the other hand, the cost for high-end autonomous driving for passenger cars is basically above 60,000 yuan, and the function is more fully developed. This not only expands the scope of researchers, but also puts higher demands on investment decisions and market penetration.

When a signal appears in the market, the prospects for autonomous driving will gradually rise. However, when the first signal appears, the corresponding company’s valuation will skyrocket, followed by a divergence in the market’s expected production volume, leading to the valuation most likely returning to a relatively normal level. When the second signal appears, autonomous driving in various scenarios enters the mass production stage, and the corresponding industry chain companies’ valuations will experience a significant increase – the market will reach a high degree of agreement, and the valuation will not fall.

If both signals appear in the market at the same time, it is the true realization of value, with both valuable points and mass production applications – this is the ideal scenario everyone hopes for.

As Gu Cheng said in “A Generation,” the dark night has given me black eyes, but I use them to look for light. Although high-level, full-speed autonomous driving is a pseudo-proposition for a long time to come, and it is difficult to reproduce another “Ningde era” in this field, we are still seeking light in the dim and chaotic autonomous driving industry, and the rise of autonomous driving will come at the dawn of light.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.