Author: Big Eyes

On August 12th, NIO released its 2021 Q2 financial report and held an online earnings conference. Unlike previous times, this earnings conference for NIO had a more stable and reassuring feel.

As the leading new carmaker in China, NIO has been pushed back in overall sales by XPeng and Li Auto. Additionally, Tesla’s continuous price cuts, especially the upcoming entry-level model priced at $25,000 (~RMB 160,000), pose a significant challenge to NIO.

Therefore, in addition to regular sales and financial data, Li Bin took the initiative to reveal NIO’s next-generation vehicle platform, autonomous driving technology, and new models based on that platform, specifically targeting mass markets. This signifies that NIO is ready to compete against Tesla and other new entrants in the Chinese market.

Financial data continues to improve, and systemic capabilities are significantly enhanced

In terms of sales, NIO delivered 21,896 vehicles in Q2 2021, a year-on-year increase of 111.9%. This includes 4,433 ES8s, 9,935 ES6s, and 7,528 EC6s. Without a doubt, ES6 is still the mainstay of NIO’s current sales.

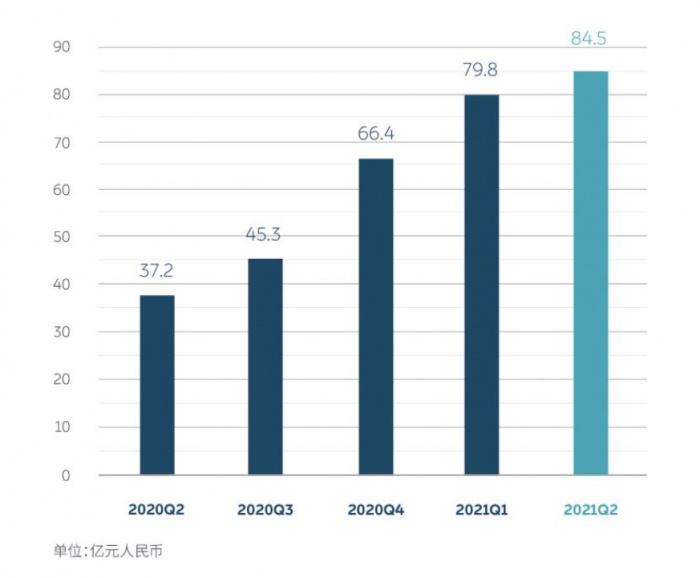

With the significant year-on-year increase in sales, NIO’s total revenue in Q2 also achieved a year-on-year increase of 127.2%, reaching RMB 8.448 billion. Among them, the revenue from car sales was RMB 7.9118 billion, accounting for 93.6% of the total revenue. In terms of profitability indicators, NIO’s gross profit in Q2 reached RMB 1.5739 billion, a year-on-year increase of 402.7%. The gross profit margin for the whole vehicle sales, which we are most concerned with, reached 20.3%.

Regarding the cash reserves, which people are most concerned about, as of June 30th, NIO had a total of RMB 48.3 billion in cash and cash equivalents, restricted monetary funds, and short-term investments, setting a new record for cash reserves.

Supported by sufficient financial resources, NIO’s R&D investment continues to increase. In Q2, NIO’s R&D expenses reached RMB 883.7 million, and it is expected that the total R&D expenses will reach RMB 5 billion. Along with the increase in R&D investment is the simultaneous expansion of NIO’s R&D team and new vehicle projects.In 2021, NIO will launch three new cars based on its NT2.0 platform, including the ET7, along with three similarly competitive models based on the NT1.0 platform, forming a relatively complete vehicle matrix.

The R&D team’s size will double by the end of the year. Li Bin highlighted the autonomous driving team as a major area of focus. This includes not only the expansion of the existing engineering team for autonomous driving from 500 to 800 people but also the presence of four VPs responsible for hardware, operating systems, algorithms, and system integration and operation, demonstrating NIO’s attention to autonomous driving technology.

The NT2.0 Platform Becomes NIO’s Biggest Highlight in 2022

In 2022, NIO will introduce three new cars to the market. In addition to the already revealed ET7, the other two models based on the NT2.0 platform will become the driving force behind NIO’s sales and revenue growth.

Unlike the NT1.0 platform, the biggest highlight of the NT2.0 platform is undoubtedly its autonomous driving technology. According to available information, the NIO NT2.0 platform will include four NVIDIA Orin computing chips with a computing power of up to 1,016 TOPS, fully meeting the hardware and computing power requirements of Level 4 autonomous driving.

In addition, the NT2.0 platform will also be equipped with Innovusion LIDAR and 11 8-megapixel high-definition cameras, with Innovusion LIDAR still able to detect up to 250 meters at 10% reflectivity. NIO vehicles on NT2.0 will support point-to-point assistance driving with NAD.

According to Li Bin, NIO’s new generation of autonomous driving system, NAD, will surpass mainstream autonomous driving systems in the market and become a new highlight for NIO in technology and revenue.

Currently, the adoption rate of NIO Pilot is already over 80%, and NIO has initially established the basis for profitable software. With NAD’s launch, NIO will further increase its confidence in relying on software subscriptions as the company’s main source of revenue.

The New Brand for the Mass Market Will Be the Biggest Highlight.For consumers and investors, the most anticipated thing is NIO’s new brand for the mass market.

As we all know, Tesla is actively promoting an entry-level model with a selling price of $25,000, or about RMB 160,000. If this model can be successfully mass-produced, it will have a significant impact on the entire domestic electric vehicle market, including NIO. Therefore, NIO’s announcement of entering the mass market at this time is a reassurance for investors.

The biggest challenge in launching an entry-level electric vehicle is cost control. Whether Tesla’s low-cost model can be successful depends on whether it can successfully mass-produce low-cost variable ear-type batteries and a set of other methods to lower battery costs.

For NIO, finding feasible cost reduction methods for batteries, which account for about one-third of the cost of electric vehicles, will also be a key factor in determining the fate of this new brand in the future.

Of course, in addition to batteries, the customer operation and maintenance costs of the NIO brand are also relatively high.

How to create a new channel, what kind of service standards to provide, and whether to adopt BaaS and battery swap technology for this brand will also be the areas that NIO needs to balance. However, Li Bin clarified at the press conference that NIO will not focus on the micro electric vehicle market where the Wuling Hongguang MINI EV is located.

Where is NIO’s hidden worry?

At the financial report meeting, Li Bin also mentioned the two pain points that NIO faces, namely supply chain issues and overseas markets.

Continuing the impact of the pandemic in 2020, car companies still face great challenges in the supply chain this year. For example, NIO’s supply chain team continues to be under pressure due to the chip factory in Malaysia, a parts factory for interiors in Nanjing, and the flooding in Germany.

For NIO, the NIO Europe business starting from Norway has not yet been able to create substantial benefits for NIO’s sales. From Li Bin’s point of view, the current European market is more focused on cultivating brand appeal and improving brand awareness, which cannot help the overall sales in the short term.

However, in the author’s view, NIO’s biggest problem is the lack of a explosive model similar to Ideal ONE.This is closely related to NIO’s high brand positioning and high customer operation and maintenance costs. However, if we only measure success based on sales, NIO still needs to solve this problem. Whether it is the lower positioned NIO brand models on the upcoming NT2.0 platform next year or a new brand targeting the mass market in the future, both are responsible for NIO’s sales volume.

After all, the auto industry is a profit-seeking industry based on scale, and NIO can only occupy a place in the Chinese new energy vehicle market, which is not spacious but gathers almost all mainstream global auto brands, by increasing profits.

For new forces in the auto industry like NIO, developing and launching three new models in 2022 is a significant challenge for the entire company system. Regardless of the final sales of the three models, promoting them from R&D to launch alone is a big test for the company.

We can only say that three days apart can make a difference, and today’s NIO is no longer the same as the fledgling company of years ago. However, the competition in the domestic and even global electric vehicle market is already fierce, and NIO needs to gather energy to focus on developing more underlying core technologies while launching new models. Only then can NIO walk more steadily and further.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.