Who Rents You the Battery of Your NIO Car if You Choose Battery Rental Service?

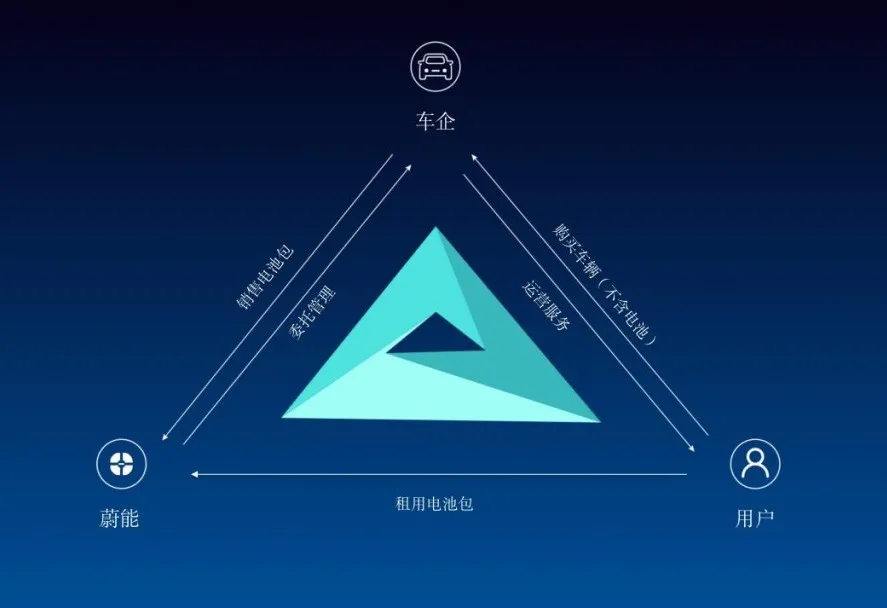

If you buy a NIO car and choose the battery rental service, who rents you the battery on your car?

Is it NIO? Not exactly. In fact, it is Wuhan Wenergy Electric Vehicle Technology Co., Ltd. that rents the battery to you.

Wuhan Wenergy Electric Vehicle Technology Co., Ltd. (Wenergy), currently holds tens of thousands of batteries. This asset worth more than 2 billion yuan is all on the car owner’s vehicles or in the battery swapping stations.

Isn’t it the so-called “Battery Bank” that we all talk about?

Wenergy thinks it is not.

In the view of Lu Ronghua, the general manager of Wenergy, the financial business is just a part of Wenergy and is not enough to sum up all of Wenergy’s abilities.

On July 21st, under the scorching sun, the “Electric Vehicle Observer” came to Wuhan Wenergy to have a more than two-hour in-depth communication with Lu Ronghua, attempting to unveil the mysterious veil of this battery asset company.

Wenergy self-defines as a digital asset management company with the goal of not only serving NIO, and is currently expanding its business by working with companies outside the NIO system.

Wenergy also has a grand goal: to manage 100 billion yuan worth of battery assets by 2025, including those from NIO and other brands.

Moving Forward in Exploration

On August 20, 2020, NIO officially launched the Battery as a Service (BaaS) rental service.

Just two days before the launch of the BaaS model, on August 18, 2020, Wuhan Wenergy Electric Vehicle Technology Co., Ltd. was also officially established.

It seems to be a perfect timing. However, Wenergy was actually established after continuous exploration and testing.

Lu Ronghua recalled that Li Bin began considering making electric vehicles in 2012, and one of the energy supplement methods considered was battery swapping.

Lu Ronghua joined NIO in 2016, and one of the assigned tasks was to plan the separation of the car and the electricity, but there was great resistance at the beginning.

At that time, the national policy for battery swapping was not so clear. With the development of the battery swapping model, it gradually gained recognition from the industry and consumers, and the policy became more and more clear. NIO then put the car-electricity separation model on the agenda.# Key is who will carry the assets

“He expressed that NIO had not initially considered establishing an asset company, but rather sought to directly cooperate with financial institutions.

After several years of exploration, they gradually realized that a role was missing to connect the automaker and financial institutions.

Lu Ronghua said that with the asset company, cooperation between NIO and financial institutions has become much smoother. Because there is an independent entity that only undertakes the operation and management of assets, the rights and responsibilities are clear.

“It was really clear that we needed to create an independent battery asset company,” Lu Ronghua remembers very clearly, it was January 21, 2020.

Two days later, Wuhan announced “lockdown” due to the epidemic, so Lu Ronghua remembers it well. Because the first preparatory meeting was held in Shanghai, the “lockdown” of Wuhan did not have a practical impact on them. But with the development of the epidemic, they moved the meeting online and kept pushing forward.

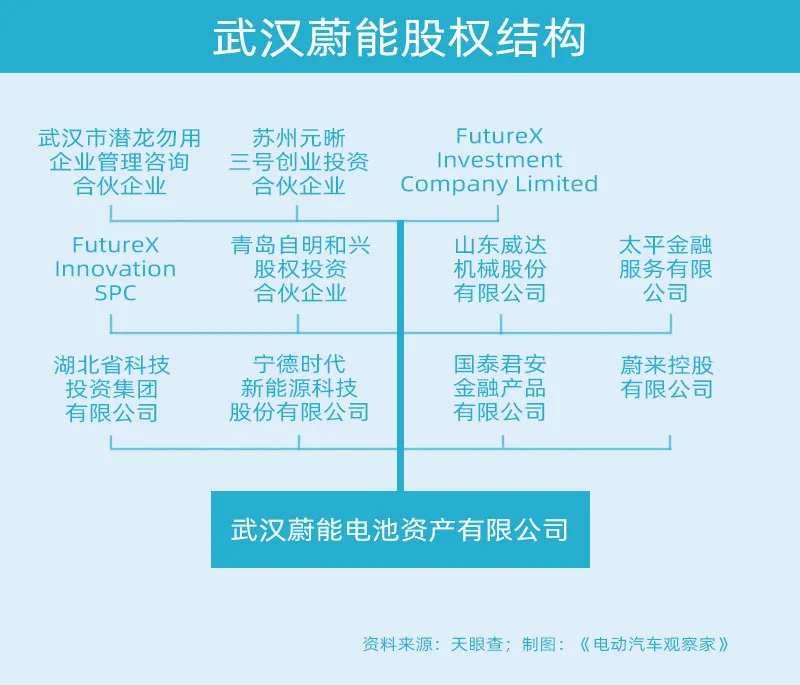

Finally, NIO, as the initiator, established Weilan with seven other shareholders.

Weilan is located in Wuhan, which is also a continuation of the relationship between NIO and Wuhan.

NIO and Wuhan were first acquainted in December 2016. NIO and the local development zone and industrial fund cooperated on the industrialization and development of the electric vehicle industry.

Later, in 2017, NIO also signed a contract with the local government on the NIO Power project. The registered place for NIO Power, who is responsible for NIO’s energy business, is also located in Wuhan Optics Valley.

As an important region that supported the early development of NIO, NIO has a deep affection for Wuhan. Hubei Provincial Science and Technology Investment Co., Ltd. is also an important investment party of Weilan, so they first thought of Wuhan.

Core competency is not just finance

The battery asset company has been established. But without a precedent to follow, how will Weilan do it?

It can only be explored.

Lu Ronghua believes that the most fundamental point of Weilan is to solve a fundamental contradiction: the problem of inconsistent lifetimes between the car and the battery. “The depreciation brought about by battery attenuation, battery maintenance is a very professional matter, and electric vehicle owners should not bear these troubles.”

Therefore, Weilan focuses on the full life cycle of the battery, including the standardization of battery packs, installation, incremental utilization, and the final battery recycling.

Of course, Weilan also enters the entire ecology as a holder and lessor of battery assets in the separation of the car and the battery. From the outside, Weilan is an image of an “battery bank”, with leasing batteries to car owners as its primary business.

Actually, the term “battery bank” is not entirely accurate and appropriate, according to Lu Ronghua. Lu believes that if it is positioned as a “battery bank”, its existence may be meaningless when the battery cost becomes slightly cheaper in two years.

Actually, the term “battery bank” is not entirely accurate and appropriate, according to Lu Ronghua. Lu believes that if it is positioned as a “battery bank”, its existence may be meaningless when the battery cost becomes slightly cheaper in two years.

Lu believes that their capabilities are reflected in two aspects: battery technology and asset management.

On the technical level, the first thing is reflected in data.

Every battery block of EVE Energy uploads thousands of pieces of battery data every day. After a year, it’s a huge asset data capacity. Their job is to compare these data horizontally and vertically, continuously shape the battery asset attribute portrait, digitally enhance the ability of asset management and operation, so that battery assets can maximize their value.

Secondly, EVE Energy has also made many explorations in the technical management of battery assets throughout the cycle.

For example, EVE Energy’s exploration of battery standardization promotion. EVE Energy believes that when there is a certain scale of a general battery pack, the cost can be reduced, the utilization rate can be improved, and the operating income can be increased. It is also convenient for scale and hierarchical utilization and recycling. For example, EVE Energy also focuses on the research of the reuse of positive electrode materials. How to quickly return to the battery regeneration process with less energy consumption is the consideration of EVE Energy in the technical management of the battery’s overall life cycle.

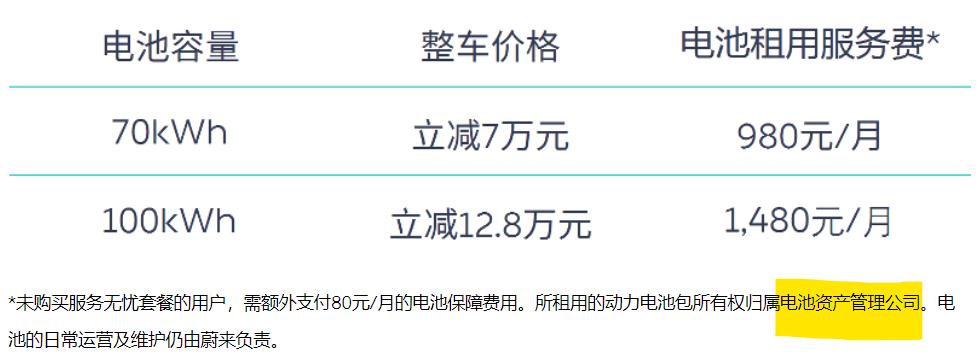

On the asset management level, EVE Energy has always stood behind its customers, cooperating with customers to provide seamless services for consumers. When consumers purchase a car, they choose to rent different capacity battery packs according to their actual usage needs, pay monthly service fees, and enjoy the “rechargeable, replaceable, and upgradable” power supplement experience like battery purchasing users.

Currently, the main group of people served by EVE Energy is customers of NIO, but Lu Ronghua expects that more customers will cooperate with EVE Energy in various ways starting from 2023.

Risk control and value-added of battery assets

A prerequisite for the continuous development of an asset management company is asset safety and value-added.

As an asset, batteries face many risks, including decay, spontaneous combustion, and recall in addition to extreme cases.

How to control such risks?

Lu Ronghua summarized it in 12 words, “quality belongs to quality, and insurance belongs to insurance.”

Lu said that if it is a quality issue, the battery supplier will be responsible, while unexpected accidents will be covered by insurance. They have already cooperated with many insurance companies.

To achieve value-added, two aspects need to be addressed, which Lu Ronghua summarized as “full cycle” and “standardization”.

Full cycle means unified management of the entire industry chain from production to recycling.

According to Lu Ronghua, one of their ways to increase revenue is to maximize the application time (life) of batteries on cars as much as possible.

In his opinion, this is much more efficient than taking it off the car for hierarchical utilization.# Standardization is about creating universal battery packs. Ronghua Lu hopes that after a few years of development, battery packs will be divided into several models, similar to finished petroleum products such as 92#, 95#, and 98#.

Although Lu Ronghua did not elaborate further, it can be imagined that the uniformity of battery pack models will save a lot of resources in various links, make battery asset management more straightforward, and the use of resources will be more efficient and convenient.

“By operating these two forms of massive battery assets, we can create different values, which individual users cannot obtain.”

In addition, the value of raw materials should not be ignored. Lu Ronghua gave an example that after nearly a year of operation, their asset management company owns nearly 2,000 tons of nickel, cobalt, and manganese materials, which may exceed 10,000 tons by the end of next year.

The prices of these metal materials are clearly marked on the market.

Goal: Manage billions of assets by 2025

This model cannot be successful solely by using Envision AESC.

In Lu Ronghua’s view, when there are 2-3 battery asset management companies in the market, it will be the success of battery leasing model. For Envision AESC, achieving the largest market share is considered successful.

Currently, Envision AESC’s battery pack is growing at a rate of several thousand pieces per month. In Envision AESC’s future vision, more automakers will cooperate with Envision AESC and use the battery rental model. By then, more than 50% of users in the entire industry will experience the energy supplement experience brought by the battery rental model.

Lu Huarong also set himself a small goal of reaching a nearly 100 billion yuan asset scale by 2025 for Envision AESC.

Envision AESC currently has more than 20 employees and manages assets worth over 2 billion yuan. Lu Ronghua believes that when the asset scale reaches billions, the number of Envision AESC employees will only be more than 100, meaning that one person will manage about 1 billion yuan worth of assets on average.

Envision AESC’s start-up relied on NIO’s BaaS model, and its natural relationship laid a high starting point for Envision AESC’s development, but sustainable development requires unique competitiveness.

Perhaps in the early conception, Envision AESC should be a company that manages assets and connects with finance, but as they have a deeper understanding of business, they position themselves in battery technology and data intelligence, rather than just finance.

In Envision AESC’s view, financial business should be the strength of banks and financial companies. Having financial strength is not enough to support the high-speed development of an asset management company. Therefore, they resolutely choose battery technology and data intelligence as the main direction outside of finance. But these two areas are more like the competitive barriers of battery manufacturing enterprises. Whether Envision AESC can form the core competitiveness of a third-party battery asset management company may require time to answer.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.