Author: LYNX Unknown

In mid-May, BYD’s one millionth new energy vehicle rolled off the production line. At that time, I sat in the stuffy BYD factory, listening to the guest speaker’s endless speech on stage, and subconsciously pulled out my phone to check BYD’s stock price.

“At more than 170 yuan, it is estimated that it will rise slightly with today’s good news. I will buy it on a slight pullback.” That was my inner thought at the time.

Just over two months later, when domestic new energy vehicle manufacturers released their July sales figures at the beginning of the month, “NIO, XPeng, and Leap Motor” with a monthly sales volume of about 8,000 made me feel the “Warring States period has come.” However, this company, which claims to be a “leader in new energy vehicles” in its advertisements, is more aggressive:

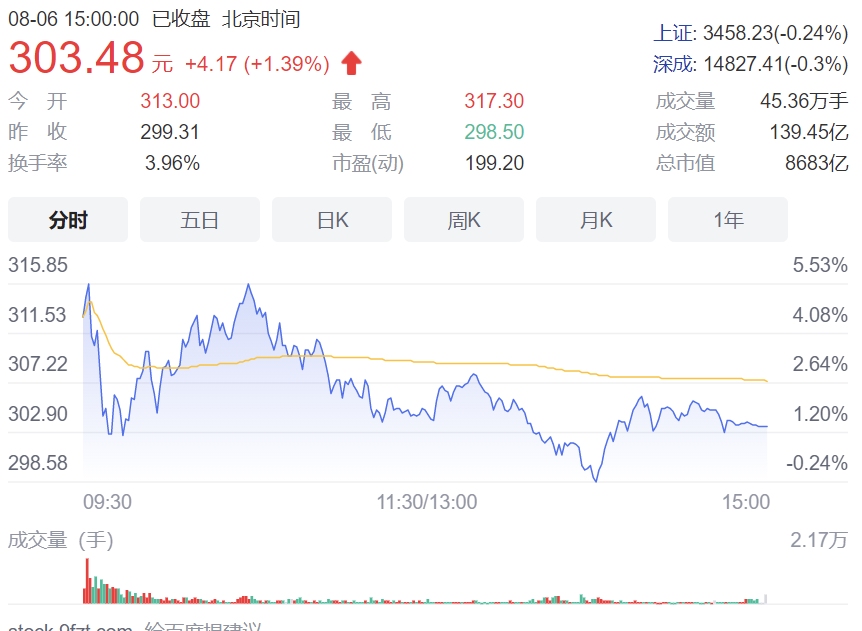

This week, BYD A-shares rose limit for two consecutive times, the stock price exceeded RMB 300 for the first time, and the total market value reached RMB 868.3 billion, surpassing China Petroleum to rank among the top ten A-shares in Shanghai and Shenzhen.

At the same time, BYD announced its total sales for July: the total sales reached 56,975 units, an increase of 89.4% year-on-year and 14.5% month-on-month.

Among them, sales of new energy models reached 50,057 units, a year-on-year increase of 262.7%, accounting for nearly 90% of the total sales that month.

In terms of cumulative sales data, from January to July, BYD’s new energy vehicles have sold a total of 205,071 units, a year-on-year increase of 170.62%.

“One’s success not only depends on the historical process but also on personal struggle.” The heat of the industry has created an opportunity. The “Dynasty” family of models, DM hybrid technology, blade battery, and other terms have given BYD the confidence to take off.

As for whether I invested in their stock later? I can only say that I didn’t make the meat but had some soup.

Of course, the purpose of Super Charging Station is not to teach you how to speculate on stocks. Even if you see such excellent results, when you see the word “BYD,” you may still have some subtle emotions – always feeling not high-end enough, nearly there but not quite, and even thinking of negative words such as “pirated” and so on.

Then, after the market value exceeded one trillion and the monthly sales of new energy models exceeded 50,000, how will BYD’s yesterday, today, and tomorrow be after all the controversies?

The Controversial “Engineers”For a long time, in various promotions and media reports, BYD’s leader Wang Chuanfu has always been portrayed as a “technology fanatic”, and BYD has been self-proclaimed to have an “engineer culture” that focuses on research and development.

Looking back at Wang Chuanfu and BYD’s origin, there are indeed not many dog blood plots like Musk and Tesla, but a history of hard work in Chinese manufacturing.

Wang Chuanfu was born in a poor rural family in Anhui, with 5 sisters, 1 brother, and 1 younger sister. With his own hard work and the mutual support of all family members, Wang Chuanfu was admitted to the university with outstanding grades and completed his postgraduate studies.

After graduation, Wang Chuanfu entered the Institute of Nonferrous Metals, where he became a senior engineer and mainly focused on battery technology research.

At that time, it was the era of “brick” cell phones. Just like electric cars today, the battery was one of the most expensive components in a tens of thousands yuan cell phone.

Wang Chuanfu, who researched batteries, keenly perceived the business opportunities. In 1995, he gave up his job at the Chinese Academy of Sciences and borrowed 2.5 million yuan to establish BYD, focusing on the production of nickel-cadmium batteries for “brick” cell phones.

Seven years later, with the technical genes of Wang Chuanfu’s battery expertise and the cost advantage of manufacturing in China, BYD developed into China’s largest and the world’s second-largest rechargeable battery manufacturer.

At the same time, BYD also competed with Taiwan Foxconn in the field of IT equipment OEMs such as mobile phones and laptops. The competition between the two sides even staged a wonderful commercial espionage dispute.

In 2003, BYD, which was already listed on the Hong Kong stock market, spent 270 million yuan to acquire 77% of the shares of Shaanxi Qin Chuan Automobile Co., Ltd. and officially launched the step from IT OEM to automobile manufacturing.

However, like many other Chinese domestic brand car companies at that time, BYD also faced technical blockade from multinational car companies, and naturally focused on “reverse engineering” in terms of research and development path. (In fact, many domestic new car-making companies did the same in the past few years.)

In 2005, BYD launched the BYD F3, which “imitated” Toyota Corolla. The sales volume reached 100,000 units in the second year. Subsequently, BYD successively launched models such as the F3R, F6, and F0, gradually stabilizing its position in the fuel vehicle market.Meanwhile, it could be attributed to the difficulty in understanding the technology of gasoline vehicles, or maybe due to BYD’s original business in battery manufacturing, BYD naturally took the research and development path of “putting batteries into cars”.

In 2008, BYD launched the world’s first plug-in hybrid vehicle, BYD F3DM. In the same year, the potential of BYD was recognized by the stock god Buffett, who subscribed to about 10% of BYD’s shares with HKD 1.8 billion.

However, constrained by the high cost of batteries and the inadequate charging infrastructure, the two plug-in hybrid passenger cars initially launched by BYD did not succeed in sales.

Faced with reality, BYD turned its attention to the commercial vehicle sector, where energy supplementation was easier to concentrate and large-scale orders were easier to obtain. BYD electric buses and the E6, which catered to the taxi market, were launched successively, helping it reap substantial new energy subsidies under the policy dividend.

Subsequently, the story proceeded, and Qin DM of BYD was launched in 2013, marking the beginning of the “Dynasty” family models, which drove BYD’s new energy passenger vehicles into countless households.

After reviewing the development path of BYD, we can also explore why we always have mixed feelings when talking about BYD.

Firstly, it is BYD’s “reverse research and development” and “research and development manpower strategy” that have proven successful time and again. Putting it bluntly, it always feels like “shanzhai” in Chinese.

When BYD began its business in battery production, it encountered patent infringement lawsuits from international giants such as Sony and Sanyo.

Later when it entered the IT contract manufacturing industry, BYD and Foxconn staged a long-running commercial espionage dispute.

And when purchasing factories to produce cars, BYD’s early products were unreservedly “imitating” Toyota models.

Although BYD managed to turn technology into its own use through its own efforts, won patent lawsuits, and even made further innovations, it still left a bad impression on public opinion.

Secondly, BYD had the perennial issue of focusing only on the car and having shortcomings in aspects such as design, brand marketing, and after-sales services.# The Markdown translation of the Chinese text

In terms of appearance design, although BYD later hired Audi’s design master, the new car design represented by BYD Han EV has undergone a complete transformation, but unfortunately, the design of early models was too “stunning”, leaving many consumers including the author with “too deep” memories of the rear styling of the earliest BYD Qin.

As for the shortcomings in after-sales service and brand marketing, they have formed a certain stereotype among consumers. In a random BYD-related report, readers’ complaints can always be seen in the comments section.

Anyway, from last year to this year, the Chinese new energy vehicle consumption market has flourished, allowing BYD, a “science student” which started from scratch and worked hard on research and development, to finally usher in a period of rapid development.

In addition to selling more cars, what really pushed BYD’s market value beyond PetroChina was its “three major events” in 2021.

BYD’s Three Major Events in 2021

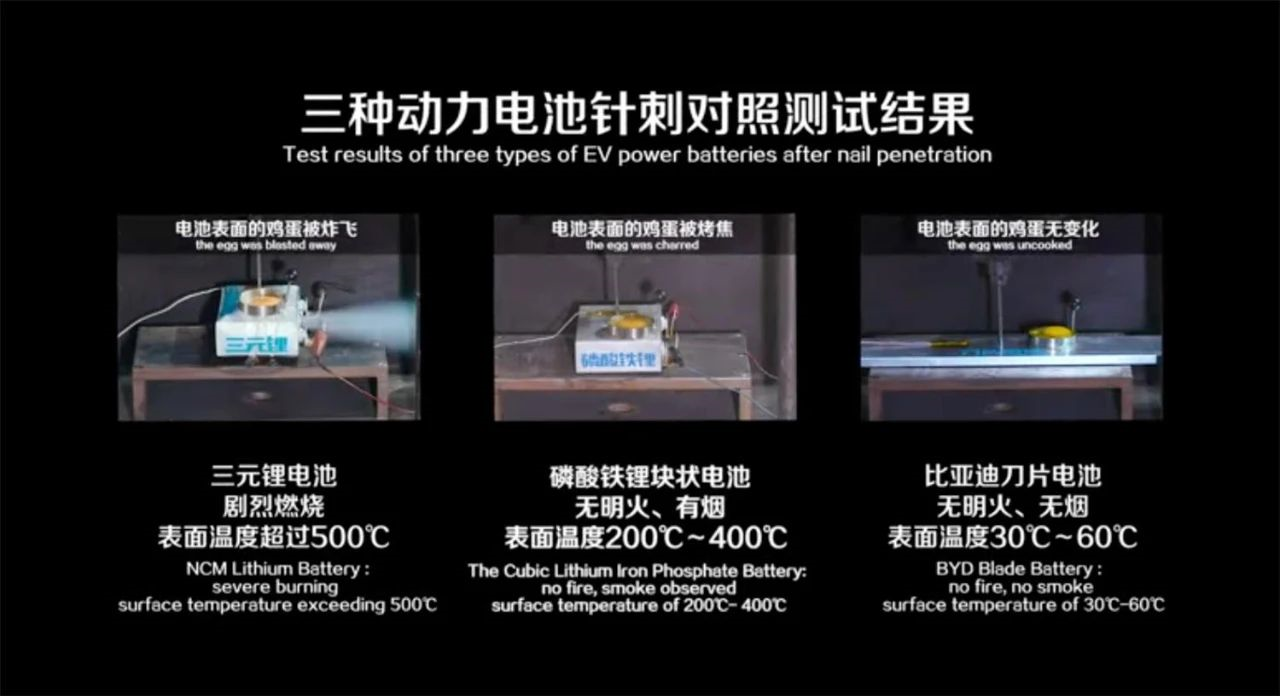

The first thing, of course, is BYD’s proud “blade battery.”

In 2020, BYD’s power battery ranked fourth in terms of global installed capacity, reaching 9.01 GWh. It ranks second in China, second only to CATL. Last year’s “red-headed” lithium iron phosphate “blade battery” has garnered numerous attention for BYD.

This year, after the increase in production capacity, BYD’s first move was to install blade batteries on all its new energy vehicle models and supply batteries externally.

“Full blade installation” is easy to understand. It means to equip blade batteries on all other BYD new energy vehicle models, such as Tang EV, following the first installation on Han EV.

At the market level, the demonstrated safety of blade batteries undoubtedly has full appeal to new users who have just paid attention to new energy vehicles and potential consumers who have hesitated due to fire accidents.

At the cost level, after the expansion of production capacity, the cost advantage of lithium iron phosphate over ternary lithium also allows BYD to be more confident in the face of news like “Tesla’s price reduction.” Just recently, Tesla Model 3 had just lowered its price and BYD had released Han EV standard endurance model priced at CNY 209,800.

Supplying batteries externally with blade batteries has given BYD greater imagination.As early as when BYD announced the blade battery, its officials claimed that “all car brands you can think of are discussing cooperation plans based on blade battery technology with us.”

According to subsequent reports, companies that have shown interest in blade batteries include both domestic and foreign giants such as Hyundai, FAW, and Daimler.

Just recently, a familiar name was added to the list: Tesla.

On August 5th, it was reported that BYD will supply blade batteries to Tesla in the second quarter of next year. At present, Tesla models equipped with blade batteries have entered the C-sample testing stage.

Although BYD officials have not commented on the news, in combination with the news that a lower-priced Tesla model is under development during the same period, it is likely not a coincidence.

Over the past three years, gross margin of BYD’s battery business increased from 9.46% in 2018 to 20.16% in 2020, following closely behind the gross margin of the entire vehicle. In terms of production capacity, BYD’s battery production capacity has been planned to reach 165 GWh, and it is expected that the production capacity will exceed 70 GWh by the end of this year, ranking second in the industry behind CATL.

On one hand, BYD’s own cars are selling more and more, on the other hand, the batteries will also be installed in competitor’s car models, which naturally attracts the pursuit of capital.

The second thing is BYD’s DM-i super hybrid technology.

In the first half of the year, BYD released three DM-i super hybrid models, the Qin PLUS DM-i, the Song PLUS DM-i, and the Tang DM-i.

Different from the “oil hybrid” route centered on internal combustion engines in traditional hybrid technology, BYD’s DM-i super hybrid has chosen the “electric hybrid” route centered on electric drive.

With large-capacity batteries and high-performance high-power motors as the design basis, it mainly relies on high-power and efficient motors for driving. The gasoline engine is mainly responsible for generating electricity in the high-efficiency speed range, greatly reducing the comprehensive working condition fuel consumption of the engine. Even in the case of a deficit in power supply, the fuel consumption can be as low as 3.8 L/100 km.

Official data shows that orders for BYD’s DM-i models have exceeded 150,000 units and are still growing, even causing BYD to experience “Tesla-style” production capacity woes.Apart from the topic of sales growth, it can be seen from the sales data for July that the proportion of BYD’s pure fuel vehicle sales has significantly decreased to 12.05%. The symbolic significance of BYD being the first traditional automaker to achieve “ban on fuel” in China is self-evident if it succeeds.

BYD’s final major project this year is to launch a new high-end brand. Compared with battery production expansion and new technology research and development, this is perhaps the most important and challenging task for BYD, the “engineering boy” this year.

Future challenge: New brand requires new ideas

Currently, the outside world has only heard the rumor that BYD is creating a high-end brand, but does not know the details. The news that the new brand may be named “Dolphin” was previously circulated and was eventually confirmed to be the name of a new BYD pure electric vehicle.

Therefore, in the absence of sufficient information, let’s discuss what changes BYD needs to make to create a high-end brand based on its development trajectory.

When we look back at BYD’s car manufacturing history, it is not difficult to find that it is very similar to its former imitation object: Toyota.

The founder of Toyota started manufacturing cars by “cross-bordering from the textile industry”. At the beginning of research and development of cars, he also disassembled and studied Ford’s products transported from the United States to Japan, and then reverse-developed and assembled his own products.

Like Toyota in terms of technology investment, cost control, and car manufacturing philosophy, the product forms of BYD also range from passenger cars to commercial vehicles, and they even researched the hybrid technology combining batteries and internal combustion engines.

Considering Toyota’s history, in 1983, after accumulating half a century of research and manufacturing experience, Toyota’s board chairman, Eiji Toyota, threw out a question to the entire company: Can we create a luxury car to challenge the top market?

Later, the well-known luxury brand of Toyota, Lexus, was born.

Today, the same question is put in front of BYD. This is a necessary requirement for BYD to enhance its brand strength, and it is also a trend of the era when the electric wave is coming and new brands are emerging.

So, how can BYD, like Toyota, create its own “Lexus”?

Some people may think that BYD should be more willing to spend money on a new logo, brand story, and marketing, telling a better brand story and creating a brand new high-end label.

Some people may think that BYD should be more willing to spend money on a new logo, brand story, and marketing, telling a better brand story and creating a brand new high-end label.

Others may say that BYD needs to improve its service level and rebuild its sales model to achieve a level comparable to luxury brands such as BBA.

More people may argue that BYD should still create “explosive” models, make up for the shortcomings in the field of intelligence, and produce high-end vehicles that are not only safe but also luxurious.

However, these are probably superficial. The most crucial thing for BYD may be to change its proud “engineering mindset.”

To put it more cliché, how to change from “product thinking” to “user thinking” is the key.

During a conversation with BYD staff, they told me that consumers who buy BYD cars often have a strong background in science and engineering. Many of them are male users in the electronics and construction industries. They choose BYD after in-depth understanding and comparison of various technical parameters. They even understand technology more than salespeople.

This is also the embodiment of BYD’s “engineering mindset”: focusing on technology. As long as the technology is good enough, those who understand it will naturally understand it.

The discrepancy between this technology and consumer perception and experience can be illustrated by an even more extreme example. Traditional automakers have publicly criticized the “backward range extender technology,” but it is unlikely to catch the eye of BYD engineers.

However, in reality, the Ideal ONE just topped the sales ranking of new energy vehicles in July.

In the internal corporate training of Lexus China, there is often a small story told: In order to understand American consumers, Toyota once sent a small team to conduct market research.

Instead of conducting scientific and meticulous user research, these people “ate, drank, played, and experienced life” in the United States, and finally understood what kind of luxury car Americans need.

So how will BYD’s enthusiastic technology “science and engineering men” cater to Chinese consumers’ vision of “high-end luxury” with the high-end luxury brand launched this year?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.