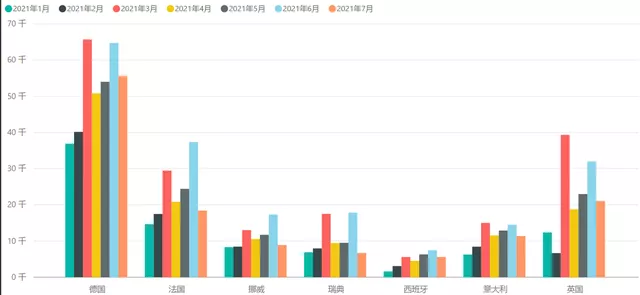

The complete new energy vehicle sales data for July in various European countries has been released. Based on data from several major countries, it can be seen that July saw a significant decline compared to the previous month. In July, Germany, Norway, Sweden, France, Italy, the United Kingdom, and Spain sold a total of 127,500 vehicles, a decrease of 31.24% from June’s 191,000. We previously published a simple analysis on “Overview of New Energy Vehicle Sales in Europe in July” when the data was incomplete.

Next, let’s analyze the data from two perspectives:

In terms of each country, Germany had the smallest decline in new energy vehicle sales, and overall rigidity still objectively exists.

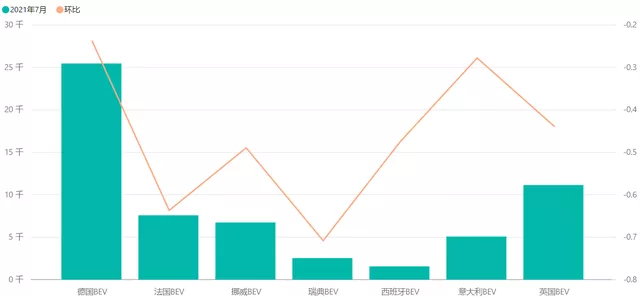

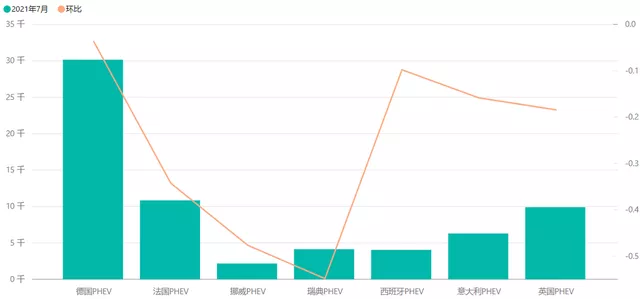

In terms of segmentation of new energy vehicle types, PHEVs had a relatively small overall decline, while BEVs fluctuated due to concentrated deliveries at the end of the quarter by companies such as Tesla. The data looks relatively better after Tesla is removed.

Analysis by new energy vehicle type

The following figure breaks down the sales by type:

BEVs: Germany sold 25,464 vehicles, United Kingdom sold 11,139 vehicles, France sold 7,576 vehicles, Norway sold 6,731 vehicles, Sweden sold 2,535 vehicles, Italy sold 5,073 vehicles, and Spain sold 1,557 vehicles. It can be seen that the fluctuation range of BEVs is relatively large, with an average decline of about 50%, and Sweden has exceeded 70%.

PHEVs: Germany sold 30,154 vehicles, with little change; France sold 11,139 vehicles, United Kingdom sold 9,900 vehicles, Italy sold 6,287 vehicles, Sweden sold 4,126 vehicles, Spain sold 4,034 vehicles, and Norway sold 2,166 vehicles. The average decline was about 20%. The overall feature this year is that the supply of plug-in hybrid electric vehicles in Europe is very strong.

Sales performance of pure electric vehicles in major countries

(1) Pure electric vehicle market in Germany# German Market

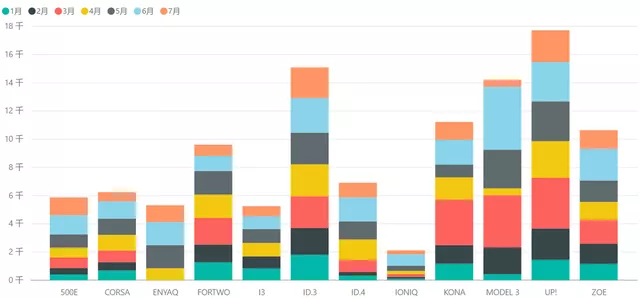

The top two pure electric vehicles in the German market for July were still the E-up and ID3, with 2256 units and 2180 units respectively, while none of the others exceeded 2000. In terms of cumulative sales, the E-up reached 17,727 units, and the ID3 reached 15,094 units, slightly more than the 14,208 units of the Model 3. The German market is beginning to shift from pure electric vehicles to slightly larger models, but the transition speed is not fast.

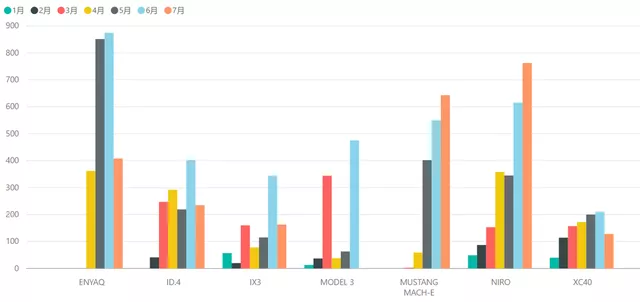

Swedish Market

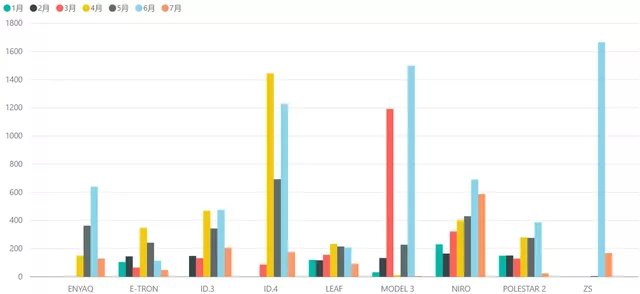

From the previous statistics, the Swedish market experienced a significant fluctuation in July (pure electric sales dropped by 70%, and hybrid sales dropped by 60%). Due to the adjustment of the company car tax rate in Sweden, the ID4, EnYAQ, ID3, ZS, and Polestar2 were all forced to participate in this squeezed game, which is similar to overdrawing the sales of the next two months in June. Judging from the data performance, just like Model 3, they played the diving game after the end of the quarter (as shown in the figure below).

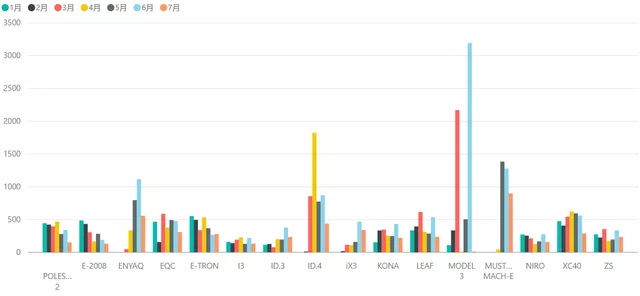

Norwegian Market

The highest sales of the Mach-E in Norway in July were only 898 units, and Tesla plummeted from 3196 units in June to 4 units. Most models are concentrated in the range of 200-500 units.

Note: In the Norwegian market, the Chinese ZS sold 233 units, the XPeng G3 sold 31 units, and NIO’s ES8 sold 2 units. The two new forces of car manufacturing seem to have not yet begun to exert their strength in the European market.

Dutch Market

The pure electric vehicle market in the Dutch market in July was 4,093 units. Overall, it has been sluggish in 2021. However, the most outstanding performers were the Mach-E with 643 units, the Nio with 762 units, and the third place was Skoda’s Enyaq408 with 408 units. Except for the 235 units of the ID4, the rest were all below 200.

## Summary:

## Summary:

During this period, Europe also faced a shortage of chips to some extent, which led to supply difficulties. Additionally, I expect to receive the sales data of China’s new energy vehicles in July on Monday and will share it with you then. I estimate that the sales performance of different automakers in July will vary greatly, as the aggressive automakers’ style will differ completely from those that lack chips.

Translated from Chinese with Markdown and HTML tags preserved.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.