Author: Michelin

At the same time as the announcement of July car sales figures, the electric vehicle company, IDEAL, announced its plans to list on the Hong Kong stock market.

A month ago, XPeng Motors (stock code: 9868) became the first new energy automaker to land on the Hong Kong stock exchange, raising HKD 14 billion at a stock price of HKD 165 per share. Though IDEAL, which has only released one extended-range electric vehicle model so far, priced its stock at HKD 150, slightly lower than XPeng, its plan to raise HKD 15 billion indicates no sign of weakness.

The competition among new automakers has extended from product development, sales volume, and their stock prices in the US, to the Hong Kong stock market. This has raised questions: When will the “Big Three” new energy automakers reunite in Hong Kong? Will other autonomous automakers also choose to list in Hong Kong? Can Hong Kong become a new battlefield for automobile companies?

The Reasons for Listing on the Hong Kong Stock Exchange

Listing on the Hong Kong stock exchange after an initial public offering in the US is not a new trend. Major internet giants like Alibaba, JD, and Meituan have all gone through the same process. However, for the still-young intelligent electric vehicle industry, this is just the beginning, and it seems that they are taking a different approach.

Companies like Alibaba, JD, and Meituan choose to carry out “secondary listings,” which means that after being listed on the US stock market for two years and meeting certain requirements, they can enjoy some exemptions for compliance and regulatory checks when listed in Hong Kong, and the safeguards are more “relaxed.” In such a case, the shares of the same company from both the US and Hong Kong stock markets can be circulated across markets, and share prices naturally influence each other.

However, last year’s IPOs in the US by XPeng and IDEAL were less than two years ago and did not meet the conditions for secondary listings. Both companies seem not to want to wait for another year, and have chosen the more stringent “dual listing” process. In this process, the company needs to undergo a stricter review for the second listing and face regulatory checks from both the US and Hong Kong markets. The shares between the two markets are independent and not transferrable.

The choice of dual listings shows the firms’ eagerness to enter the Hong Kong market, motivated by their own needs and external factors.Talking about going public, financing is the first thing that comes to mind, and it’s no exception for new car makers.

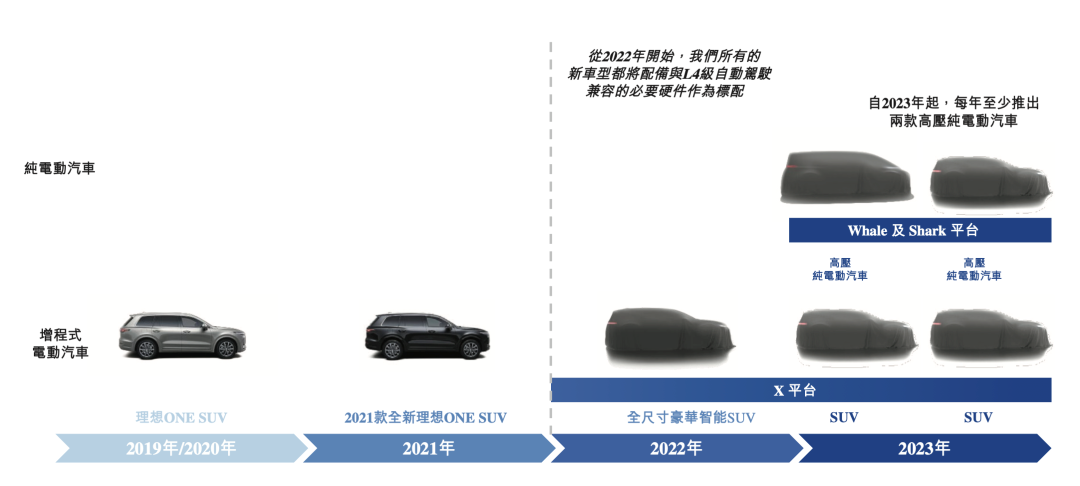

Although this year, the “Li Xiang One” in the new energy market has gradually gained a foothold, with sales increasing month by month and surpassing its own sales records time and time again, the negative profit on the financial report cannot be ignored. Everyone knows that making cars burns money, and as the competition for intelligent electric vehicles enters a white-hot stage, burning cash has become a lasting war. Nowadays, car companies not only have to produce cars, but their products cannot have any shortcomings, and their strengths have to be prominent enough to have their own competitiveness.

Therefore, we see that car companies have begun to develop and research their own automatic driving, voice interactive systems, pure electric platforms, and other technologies to enhance their technological attributes; they are expanding their product lines to meet the needs of different consumers; they are establishing their own fast charging stations and battery swapping stations to improve their services; they are using Internet-based services to establish their own user communities and bring themselves closer to their users…

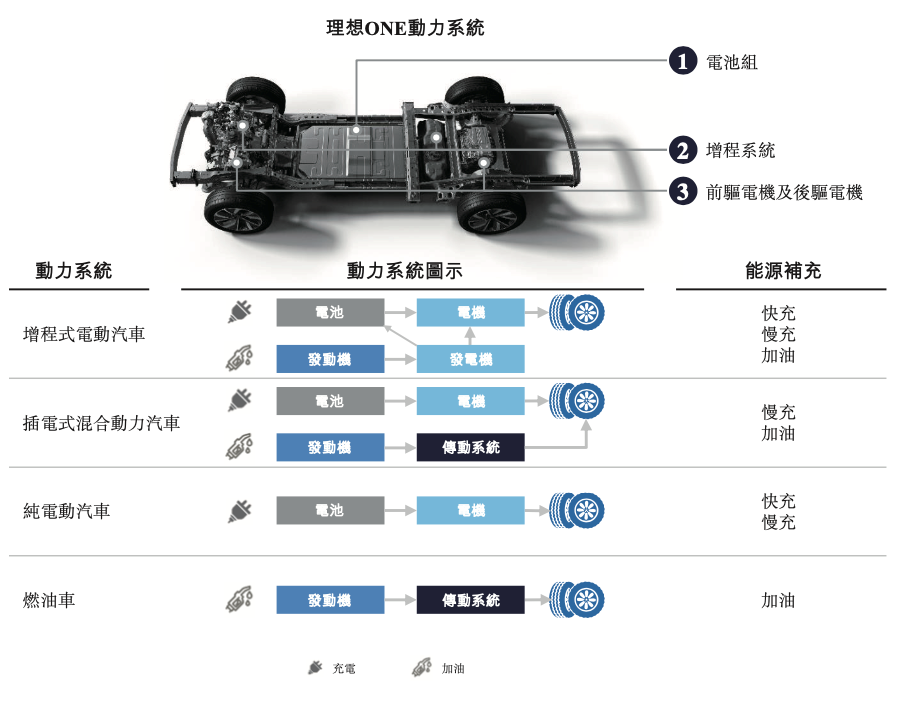

In fact, XPeng Motors and Li Auto have also made it clear in their prospectuses where the fundraising will be used: XPeng will use 45% of the funds raised to expand its product line and technology research and development, and 35% for business expansion; Li Auto will also use the fundraising mainly for the research and development of high voltage pure electric vehicle technology, platforms and future models, and the research and development of intelligent vehicles and automatic driving technologies, etc.

The development of these technologies and the improvement of product strength can help car companies build their own moats in the fierce and lengthy competition, and the establishment of these moats cannot be achieved without sufficient cash reserves as a backing. After going public on the Hong Kong Stock Exchange, XPeng’s cash reserves reached $7.6 billion, and after a successful listing, Li Auto’s cash reserves will also reach nearly $7 billion.

Along with the fundraising requirements is the boom of new energy and intelligent cars.

Whether it is the improvement of people’s acceptance of electric vehicles, the market prospects brought by the concept of the third space of smart cars, or the increase in demand for new energy under the carbon neutrality goal, intelligent electric cars have become the hottest investment track in the investment circle.

Tesla, which also produces intelligent electric vehicles, has a market value of more than twice that of traditional car maker Toyota and even briefly topped the world’s richest person list; NIO, a leader in power batteries in the A-share market, has a market value of over trillions of RMB, surpassing the oil giant, PetroChina; In the Hong Kong stock market, which is urgently seeking suitable smart electric car targets, the representative of the new energy automobile BYD Co., Ltd. (Hong Kong stock code: 01211), has seen its stock price continue to rise in the Hong Kong stock market in the past six months; even Evergrande Motors, which has not even delivered a car yet, has once had a market value of over HKD 500 billion with the concept of smart cars.Compared to new car companies such as XPeng and Li Auto, which have established their own brand tags and achieved steady sales growth, they seem to have more confidence in gaining favor from the Hong Kong capital market. It’s worth noting that when the opportunity comes, being listed in Hong Kong in advance may be due to this consideration.

Of course, choosing the “dual listing” mode, also known as the “hard mode”, not only means stricter regulation, but also has advantages.

Recently, the series of turmoil surrounding Chinese concept stocks and the backdrop of global trade frictions have made overseas regulatory agencies more stringent in auditing and supervising Chinese concept stocks, and stock prices have fluctuated significantly. At this time, choosing the “dual listing” model that allows independent listings in the US and Hong Kong to some extent avoids mutual influence; it also provides a choice for future risks.

Moreover, according to regulations, mainland investors can purchase Hong Kong-listed stocks of “dual-listed” companies through the Hong Kong Stock Connect, which means that although the company is not listed on the A-share market, it can still obtain financing from the mainland.

It is natural to choose to land on the Hong Kong stock market first to avoid risks, obtain a wider range of financing channels, and also enhance influence through the market impact of being listed in Hong Kong.

At this point, we have to mention NIO in “Wei Xiaoli”.

As a car company that has been listed on the US stock market for three years and already meets the conditions for secondary listing, NIO seems to have the lowest threshold for listing in Hong Kong. However, although there have been rumors about its listing in Hong Kong from time to time, NIO has not confirmed it yet. Is it because of sufficient cash reserves, “no shortage of money”? Or is it because it feels the timing is not right? After all, in the past six months, the performance of the Hang Seng Index has not been very good, and the index has experienced a significant decline, with capital outflows continuing. Or is there some other consideration?

Written in the last paragraph:

Recently, several car companies preparing for listing on the Science and Technology Innovation Board have successively announced the suspension of their IPOs. In the future, as the threshold for A-shares gradually increases, and the attitude of US stocks towards Chinese concept stocks continues to shrink, for smart electric vehicle companies that need to fight a lasting battle and continuously infuse blood, Hong Kong stocks may not be a choice, but a trend, becoming the next stop for car-making.

Of course, as users, what everyone wants to see is for car companies to allocate their capital to technology research and development and products during the capital game. After all, soaring stock prices also need products to support.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.