Tesla Q2 Earnings Report: Increase in Production and 4680 Battery Updates

On July 27th, Tesla released its Q2 earnings report. While it is yet another record-breaking quarter, more interesting information was revealed during the earnings conference call.

Tesla CEO Musk and other executives discussed a number of hardcore details, including:

-

The in-house production of 4680 batteries is in the process of solving mass production engineering issues and is expected to achieve an annual production capacity of 100GWh next year.

-

In the long term, two-thirds of Tesla’s car models may use lithium iron phosphate batteries and one-third may use nickel-based batteries.

-

At the end of this year, the Texas and Berlin factories will begin small-scale production of the Model Y. The manufacturing process of the Model Y at these two factories will be further improved by introducing a casted front body in addition to a casted back body. Both will significantly reduce the number of components.

-

Chip shortages have caused a strain on Tesla’s production capacity. However, if Tesla decides to manufacture its own chips, it will take at least 12-18 months.

-

For the Cybertruck and Semi, Tesla is currently focusing on solving the production issues for the Model Y in Berlin and Texas, along with addressing the chip and battery capacity issues. The mass production of the Cybertruck is expected to begin next year.

-

In the long run, Tesla’s total battery production capacity (including energy storage) from in-house and suppliers needs to reach 1000-2000GWh.

4680 Battery: Expected to Achieve 100GWh Production Capacity

During the previous Battery Day, Tesla introduced the 4680 battery, which provides 5 times the energy and 6 times the power of existing batteries while reducing the cost by 14% and increasing the range by 16%.

Tesla has successfully verified the performance and life span of the 4680 battery. The product quality and factory production capacity are both feasible. The current focus is on optimizing and improving the 10% production process that restricts the production capacity of the 4680 battery.

During the earnings conference call, Musk revealed that the bottleneck lies in the roller press of the positive electrode. Due to the larger size of the electrode compared to the 2170 battery, there are marks on the roller press machine. However, Musk and Senior Vice President of Powertrain and Energy Engineering, Andrew Baglino, both believe that this is an engineering issue that can and will be solved, but it will take some time to do so.

While continuing to solve these engineering problems, Tesla has already ordered and installed a large number of pieces of equipment and is preparing for mass production of batteries at its factories in Berlin and Texas. Musk expects that Tesla’s in-house battery production capacity will reach 100GWh/year at some point in 2022.

In terms of materials, Musk emphasized that Tesla uses very little cobalt, with cobalt-free lithium iron phosphate batteries and only a small amount of cobalt in high-nickel batteries. In the long term, Tesla will move towards cobalt-free development. Lithium iron phosphate batteries will account for two-thirds, while nickel-based batteries and others will account for one-third. Energy storage batteries will be all lithium iron phosphate.

In terms of materials, Musk emphasized that Tesla uses very little cobalt, with cobalt-free lithium iron phosphate batteries and only a small amount of cobalt in high-nickel batteries. In the long term, Tesla will move towards cobalt-free development. Lithium iron phosphate batteries will account for two-thirds, while nickel-based batteries and others will account for one-third. Energy storage batteries will be all lithium iron phosphate.

Musk also admitted that other suppliers are helping Tesla produce 4680 batteries, but did not respond to whether self-production or supplier production would be used first. He also stated that, in addition to power batteries, Tesla’s Powerwall is also in short supply. So when Musk receives a call from a supplier asking about Tesla’s plans to produce batteries, his response is always, “You go ahead and produce.”

Musk predicts that Tesla and suppliers will need to achieve long-term annual battery production capacity of 1000GWh or 2000Gwh.

Small-scale production to begin at Berlin and Texas factories later this year

This conference call was conducted at the Texas factory where Musk and other senior executives were present.

Musk stated on the call that the Tesla Texas and Berlin factories are expected to be operational in 2021. Both factories will produce the Model Y, but there will be significant differences between the new factory and the ones already in production. The Model Y produced in the new factory will have cast rear and front body, which will significantly reduce the number of body parts.

Musk also mentioned that the Model Y from these two factories will use structural (equivalent to CTP) 4680 battery packs, which can significantly reduce production costs. However, as a backup plan, non-structural battery packs and 2170 cells will be used. Nevertheless, in large-scale production, Tesla clearly hopes to use the 4680.

Musk once again emphasized the difficulty of ramping up production. He also referred to Tesla as the only American automotive start-up that had not gone bankrupt after reaching the production stage in history.

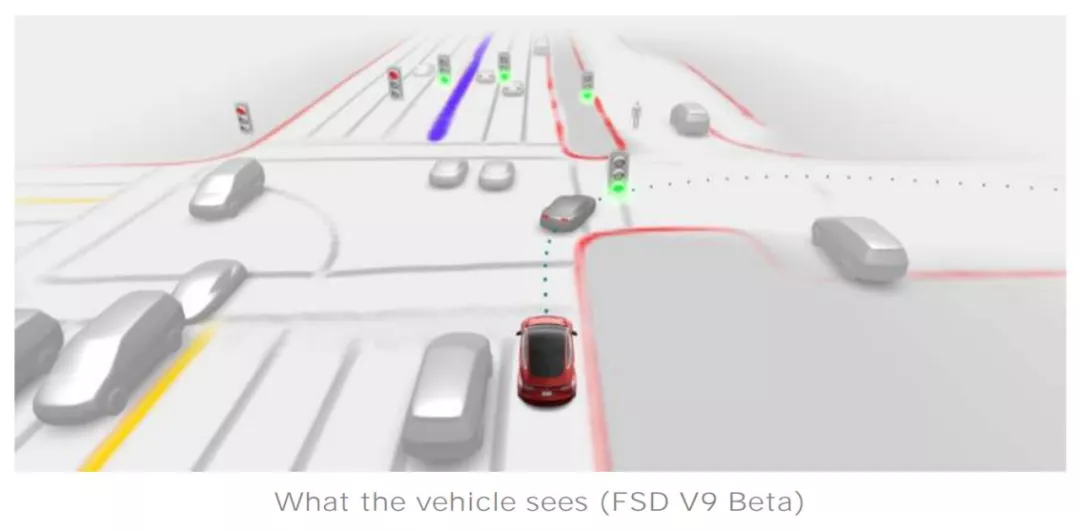

FSD subscription service does not affect one-time purchase

In July, Tesla launched the FSD subscription model, priced at $199/month, with EAP (Enhanced Autopilot) priced at $99/month. Previously, Tesla’s FSD was a one-time purchase with a price of $10,000.

Analysts were very interested in this subscription pricing strategy and continued to ask about subscription data.

However, Musk and other executives did not provide any data. Musk emphasized that if someone wants to try it, they should be given the chance.

Regarding regulation, Musk said that at least in the United States, they do not believe that regulation is a fundamental limiting factor for autonomous driving. “We must make it work and then prove that its reliability far exceeds that of ordinary human drivers.”

CFO Zachary Kirkhorn revealed that there has not been a shift from one-time purchase orders to monthly subscriptions based on Tesla’s existing order delivery situation.

Musk was confident in his remarks: “We expect it to develop slowly, but with time, quantitative change will lead to qualitative change, and we will have full autopilot. So I think FSD subscriptions will be an important factor next year.”

In addition, during the conference call, Musk once again confirmed that Tesla’s superchargers will be opened to other models. However, he did not specify the brand. He only revealed that because Europe and China have a unified charging interface, while North America needs to have a switching interface. Additionally, slow-charging models will be charged at a higher rate.

Based on Musk’s tendency to set high KPI goals, whether it is the 4680 battery, the Berlin and Texas factories, the opening of supercharging, FSD subscription, etc., it may not reach the stated goals on time.

However, based on past records, Musk ultimately achieved the results he wanted.

Other important information from Tesla’s Q2 report:

Revenue: In Q2 2021, GAAP operating profit was $1.3 billion, achieving an operating profit rate of 11%. GAAP net profit was $1.1 billion, and non-GAAP net profit (excluding stock-based compensation) was $1.6 billion, achieving a GAAP net profit of over $1 billion for the first time.

Deliveries: Q2 2021, Tesla broke a new record and produced and delivered 201,304 cars, exceeding 200,000 for the first time. Of these, 199,409 were Model 3/Y and 1,895 were Model S/X.

Shanghai Factory Capacity: In Tesla’s Q2 financial report, the capacity of the Shanghai Super Factory quietly increased from 450,000 to “greater than 450,000 units” annually.

Tesla stated that due to strong local demand in the US and global average cost optimization considerations, the transformation of the Shanghai Super Factory as the main automotive export center has been completed.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.