Yesterday, Tesla once again reduced its prices (on July 30th, according to the Tesla official website, the price of Model 3 standard range plus was reduced by CNY 15,000), let’s review the article “Model 3 and Model Y, the strategy from top to bottom”, many of the predictions have gradually become reality.

Tesla is currently making efforts around sales volume and its means are direct and simple – reducing costs through the upstream expansion of the industrial chain on a large scale, and increasing the cost-effectiveness of its products through price measures. Its motivation comes from two factors: first, the gambling target set at the beginning of the establishment of its Shanghai factory, and secondly, to increase production value, this year’s output must be guaranteed.

Currently, the pace of pure electric vehicles in Europe is very fast, so Tesla has gradually accelerated its overall pace. The delay of Berlin factory has allowed the Model Y produced in China to enter Europe, and the total demand for Model 3 must be shouldered by the Chinese factory. Based on the current estimated production capacity, the monthly production of Model 3 is 20,000, and Model Y is expected to reach 20,000 to 30,000. The total output of 50,000 to 60,000 per month needs to be absorbed by the market.

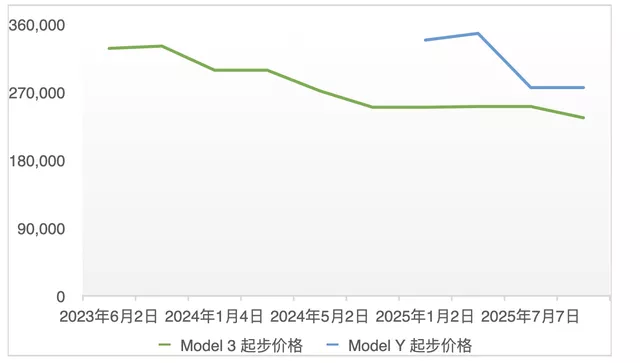

In terms of timing, from the expected quantity of insurance from above, the Model 3 in July must be very low, which directly promoted the price decrease of the Model 3. It is expected that by around November, the Model 3 may reach a price level of CNY 210,000 to CNY 220,000, while due to demand adjustments in Europe, I estimate that the final price of the Model Y may be adjusted to CNY 250,000 in November.

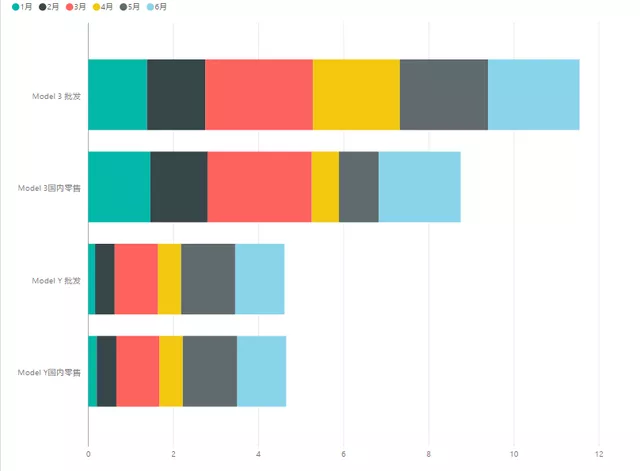

As shown in the figure below, Model 3 is likely to maintain a production capacity of over 20,000, moving towards 25,000, while Model Y gradually unlocks from 15,000 to 25,000. Based on the current production capacity estimates, Tesla’s production target in China this year is expected to be around 420,000, including 260,000 Model 3 and 160,000 Model Y.

Predictions from January and Current Situation

In previous articles, I made the following predictions. Let’s see if the direction is certain.- Currently, Tesla is still promoting the long-range version of Model Y as its flagship product, and even stopped producing the long-range version of Model 3 to make way for a product with a range of about 600 kilometers. Customers are encouraged to switch to the domestically-produced performance version of Model 3. We can see that the price in Q1 2021 has remained stable.

- Following the initial production curve of Model Y, after this wave of 100,000 orders is gradually fulfilled in 3-5 months (I understand that this stage mainly uses LG’s ternary version), the standard range version based on LFP (CATL version) will be released, and the price will be around 250,000-260,000 RMB. At that point, the standard range of Model 3 will drop to 230,000 RMB, creating another wave of demand. This is the second stage in Q2-Q3.

- By the time Q4 comes around and production capacity is fully ramped up, the price of the long-range version may be under 300,000 RMB, and after removing subsidies, it will be around 280,000 RMB. The price of Model 3 will drop to around 210-220,000 RMB, and Model Y will be priced at 230-240,000 RMB, if the goal is to increase sales volume to nearly 500,000 units.

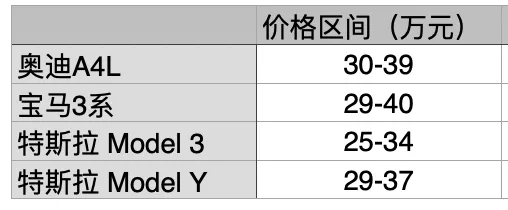

From the above strategy, it can be seen that there are still significant changes in prices (as shown in the table below).

We can analyze the association between Tesla’s sales volume and prices, as shown in the following figure:

Impact of price reductions

Currently, there are mainly two impacts resulting from Tesla’s price reductions:

(1) Tesla has accelerated the speed at which consumers are transitioning from gasoline vehicles to electric vehicles.

Tesla has completely distorted the cost-effectiveness of low-end gasoline vehicles in the Chinese market. Under the difference in vehicle registration fees in Shanghai, this practical distortion is really significant. As the price gradually drops to 235,900 RMB and then to 220,000 RMB, this trend will continue.

(2) Tesla and new carmaking leaders are mutually reinforcing each other.I believe that for NIO, XPeng and Li Auto, Tesla’s continuous price reduction is gradually increasing the voice of new energy vehicles, diverting consumer attention to electric vehicles. In response, these leading companies must increase their own product strength to meet the demand from customers who have switched from fuel-powered cars. Some of these demands will inevitably transfer directly to Tesla, but there is a certain opportunity for customers who do not like Tesla to choose these enterprises.

However, for traditional Class A pure electric vehicles, each price reduction is a heavy blow. It is hard to imagine that as Tesla approaches the threshold of 200,000 yuan, there will still be room for resistance for Class A pure electric sedans and compact SUVs.

In summary, I think the most disappointed group in the automotive industry this year are the students from traditional strong fuel joint ventures. On the one hand, they are affected by chip supply; on the other hand, the demand for luxury cars is constantly squeezed by Tesla, completely distorting the entry-level demand. The mid-range demand is also under the impact of a series of attacks from BYD and Great Wall, making it difficult to continue to use the traditional way of selling cars. In reality, more traditional independent car manufacturers are also affected, and all aspects can truly feel that Tesla as a revolutionary and pioneer is rapidly changing the existing market pattern.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.