Flatting the Price of Electric Cars and Gasoline Cars

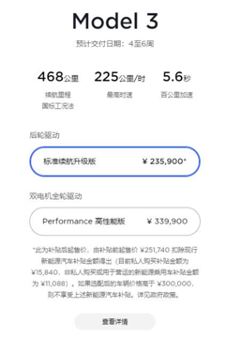

On July 30th, Tesla lowered its prices again. Previously, the price of the Model Y Standard Range was 276,000 yuan, which had already made people feel that if the Model 3 did not lower its price, the internal competition between Model Y and Model 3 would be very intense. Therefore, Tesla did not make us wait too long. The entry-level model of Model 3, the Standard Range Plus, has also encountered a price reduction, with a subsidized price of 235,900 yuan. Taking into account Tesla’s gross profit margin in the second quarter is still 28.4%, it has already revealed a signal to other domestic automakers: Tesla’s price war is far from over.

Flattening the Price of Electric Cars and Gasoline Cars

According to Elon Musk’s idea, in order to popularize electric cars, they must inevitably be priced the same as gasoline cars, and currently, Tesla is firmly moving forward along this path of price reduction. As a mid-size SUV, the Model Y, and a mid-size sedan, the Model 3, the continuous price reduction of these two models not only puts great pressure on other domestic electric car companies but also makes gasoline cars, especially luxury brand gasoline cars, feel a significant impact.

In terms of sales volume, the monthly sales volume of domestic Tesla Model 3+Model Y has already surpassed that of the second-tier luxury brands, approaching the first group of BBA brands. From a price perspective, Model 3 and Model Y, which have license plate advantages, have shown higher cost-effectiveness than the same level of luxury brand models. With the continuous expansion of production capacity and the continuous dilution of related R&D and tooling costs, Tesla will have further room for downward exploration in the future. Especially with the release of a series of cost-reducing technologies around the semi-earless battery and other cost-reducing technologies at Tesla’s battery day earlier, Tesla’s true killer move to be launched soon, the $25,000 electric car, is sure to have a profound impact on the global car market.

Can the Red Cloak Leader’s Dream of a 150,000 Yuan Smart Electric Car Be Realized?For the founder of 360, Zhou Hongyi, the Red Leader, investing in NIO’s NETA Automotive was a first step into the automotive industry. However, Zhou Hongyi and He XPeng, founder of XPENG Motors, the leading new brand of domestic startups, have different opinions on whether an intelligent electric car can be priced below 150,000 yuan. Starting from He XPeng’s perspective, considering the current hardware costs, it is difficult to launch an intelligent electric car priced below 150,000 yuan. But Zhou Hongyi doesn’t believe that.

In fact, this debate has little significance because both parties have not defined intelligent electric cars very well. Battery life, desired cruising range, artificial intelligence level, and autonomous driving functions that electric vehicles carry can cause significant differences between vehicle cost and final retail price. However, the mid-term facelift model G3i of the latest XPENG G3 has lowered the entry-level price to below 150,000 yuan, extending the brand’s reach into NETA’s traditional market segment. We do not know what He XPeng thinks about his intelligent electric car priced below 150,000 yuan.

FF91 has taken the first step

Only four days after the launch of the Future Foundation’s FF91, a global limited edition of 300 cars that sold for as high as 2.8 million yuan each called “the Futurist Alliance Edition”, all units were reserved. The stumbling Future Foundation seems to have seen a brighter future. Whether these orders will eventually translate into actual sales is yet to be seen, but the fact that the FF91 can receive such high pre-orders is already the greatest endorsement for Jia Yueting. From the product perspective, as long as the design goals proposed initially are achieved, the FF91 remains a highly competitive car model. Rather than the sales volume, it is more important to produce a quality product. Using the FF91 to attack higher brand positioning and to raise more capital for the company is critical for Future Foundation to enter a period of positive growth.

In the final analysis, whether it is a gasoline car or an electric car, it is an industry that requires profits from large-scale production. Therefore, continuously lowering its price, Tesla will be the biggest competitor for domestic electric car companies in the future. Not only does Tesla obtain a low supplier price through using pressure, but also it achieves a win-win situation for both the enterprise and the customers by innovating in technology and reducing cost on things such as batteries, which is one of the largest cost components of electric cars. As for NIO, after receiving investments from 360, it also has the confidence to compete with other new domestic automakers. However, its biggest challenge is to capture the market of cars below 150,000 yuan, and to prepare for coping with the impact brought by Tesla’s price-cutting strategy. As for FF91, the successful financing is just the first step, and it remains to be seen whether it can mass produce its cars. We can expect that the Chinese electric vehicle market will become even livelier in the next two or three years!

In the final analysis, whether it is a gasoline car or an electric car, it is an industry that requires profits from large-scale production. Therefore, continuously lowering its price, Tesla will be the biggest competitor for domestic electric car companies in the future. Not only does Tesla obtain a low supplier price through using pressure, but also it achieves a win-win situation for both the enterprise and the customers by innovating in technology and reducing cost on things such as batteries, which is one of the largest cost components of electric cars. As for NIO, after receiving investments from 360, it also has the confidence to compete with other new domestic automakers. However, its biggest challenge is to capture the market of cars below 150,000 yuan, and to prepare for coping with the impact brought by Tesla’s price-cutting strategy. As for FF91, the successful financing is just the first step, and it remains to be seen whether it can mass produce its cars. We can expect that the Chinese electric vehicle market will become even livelier in the next two or three years!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.