Carbon Trading: What Is it All About?

You may have heard about carbon trading recently, but you’re probably still confused about what it actually means.

What if we told you that carbon trading helped Tesla make $1.58 billion last year, more than selling cars? Still confused?

On July 16th, this unfamiliar carbon trading market was launched in China. For car industry businesses, the emergence of the trading market means more urgent pressure: who will stand out as the “charcoal seller” in China, and who will be “under great pressure” and panic about being eliminated under the carbon neutrality trend? Will carbon neutrality and carbon trading affect our car sales and usage in the future?

What is Carbon Trading?

If you open the website of the Shanghai Energy Exchange, you can see the daily trading prices of the national carbon market.

After establishing an account with the institution (Shanghai Energy Exchange), enterprises can buy and sell carbon emission quotas through various methods such as agreement transfer and bidding within trading time from Monday to Friday. Prices of quotas fluctuate according to the changes in supply and demand. Do you feel familiar with the curve and trading time in the picture as a stock trader?

Carbon trading is the quantification and commodification of carbon emissions quotas. Each enterprise is allocated a corresponding emission quota and carbon-reduction objective. Enterprises must emit greenhouse gases within the specified quota.

What if you exceed the limit? What if the quota isn’t sufficient? You would have to purchase on the “carbon market”. If emissions exceed the allotted level, enterprises are subjected to extra penalties, or maybe even directly out.

This process is somewhat like playing Happy Landlord. Everyone is initially given some happy beans, but if you run out of them, you need to buy more or you can’t play anymore. Of course, the consequences of exceeding the carbon emissions quotas can be much more severe.

Where do these purchased carbon quotas come from? There are two sources: emissions reduction and emissions offset.

For example, some enterprises do well in reducing carbon emissions, so they emit less carbon dioxide than planned every year, allowing them to sell their remaining quotas to companies in need. This method of trading with existing carbon quotas is called emissions reduction.

Other enterprises not only do not exhaust their allocation of carbon quotas, but also create more by engaging in the clean energy business, producing green electricity through hydroelectric power, photovoltaic power generation, planting carbon-absorbing forests, and creating carbon emission quotas. The transaction volume generated by this open source approach is called voluntary emission reduction (CCER).## How Can Automakers Turn Energy Revolution from Passive to Active?

In the carbon trading market, the goal for each automaker is to avoid becoming a buyer and instead enter the seller camp. Simply maintaining the status quo or producing new energy vehicles in a routine way is obviously not enough to meet increasingly strict carbon-neutral requirements. So how can automakers seize the opportunity of the energy revolution and turn from a passive position to an active one?

Exploratory Phase: Increase New Energy Vehicle Models

Since China proposed the “3060” carbon peak and carbon-neutral goal last September, it has not been a year yet. The fastest and most direct response for domestic automakers in a short period of time is product transformation: pushing out more new energy vehicle models on one hand while reducing the proportion and emissions of fuel vehicles on the other. In fact, the “dual credit” policy implemented by China’s auto industry started several years ago based on the calculation of fuel vehicles and new energy vehicle models.

If in the past few years, new energy vehicles were mainly driven by policies and market competition, the launch of carbon-emission trading market has added invisible costs for both fuel vehicles and hybrid vehicles – the carbon tax. With limited carbon emission quotas and the price of each ton of carbon indicators in the carbon trading market, increasing the production of new energy vehicle models has naturally become the first choice for automakers.

Take BYD, one of the earliest Chinese automakers to undergo electrification transformation, as an example. In its latest sales data in June, the sales volume of new energy vehicle models has exceeded four times that of fuel vehicles. Judging from BYD’s upcoming DM-i hybrid vehicle models, this proportion is likely to become five times, seven times, or even ten times next year. Not only did domestic automakers set goals of more than half of their total sales volume by 2025 for new energy vehicles, but traditional luxury brands have also begun to focus on pure electric vehicles, and even supercars that have always boasted speed and excitement are rushing to go electric.

!(Mercedes plans to establish a carbon-neutral new passenger car fleet by 2039.)[https://upload.42how.com/article/image_20210724225617.png]

Looking at the goals set by automakers, I can’t help but imagine that in the future, fuel vehicles may become like “rare and valuable” vintage cars, and driving a fuel vehicle may become a luxurious choice.

In-depth Exploration of the Supply Chain of Parts and Components# Producing New Energy Vehicles Is the Most Direct and Rapid Response to Carbon Neutrality Goals

However, simply producing new energy vehicles is not enough to meet the increasingly stringent “30/60” carbon reduction targets, which aim to regulate carbon emissions throughout the vehicle’s lifecycle. At the BMW Group’s Sustainable Development Summit in China, data was presented showing that the carbon emissions generated by a car during use account for only 14% of total carbon emissions, while the remaining 86% come from the production process. To achieve carbon emissions reduction, the focus must be placed on the production process.

To achieve this goal, we can look to the European Union with its earlier and stricter carbon emissions regulations to learn how European automakers are reducing carbon emissions.

Restricted by strict regulations, many European automakers have set their sights on zero-carbon components and supply chain segments, such as building zero-carbon factories; selecting lower carbon designs and manufacturing methods for components; etc.

These experiences have been brought to China. For example, Volvo’s factories in Chengdu and Daqing rely on hydroelectric and wind power to achieve 100% renewable electricity production. The Brilliance BMW factory uses biogas to achieve 100% green power supply. BMW also cooperates with Shougang to recycle steel from scrapped vehicles and uses low-carbon interior materials.

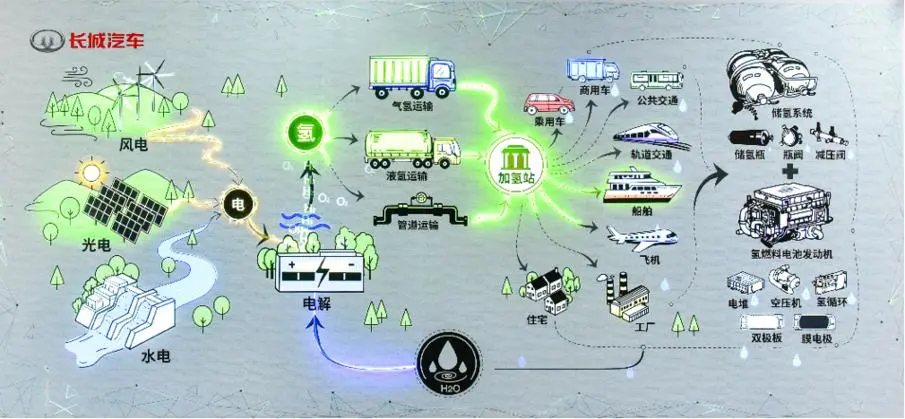

At the same time, local auto brands have also started taking action. Great Wall Motors plans to build a zero-carbon factory in 2023 and use recycled parts.

By deeply collaborating throughout the supply chain, considering low-carbon environmental protection at the initial design phase of a vehicle, and reducing carbon emissions throughout the entire product lifecycle including selection of raw materials, production and manufacturing, use, and recycling, automakers can reduce carbon emissions to a minimum.

AI Technology Enables “Carbon” To Be Traceable

Many people may have the same question when it comes to carbon trading: how do you know how much carbon I emit?

Let’s go back to middle school physics and look at the “Law of Conservation of Energy.”

In the production process of automobiles, whether it is the transformation of iron ore into a steel frame or quartz sand into glass, or the assembly of components on a vehicle assembly line, the coal, oil, and electricity consumption, as well as the coal and oil used by power plants supplying electricity, are all evidence of carbon emissions.

In the production of automobiles, the carbon emissions from processing, assembling, transporting, recycling each component, as well as the fossil fuels consumed for lighting and air conditioning in factories and office buildings, are all included in the “per-vehicle carbon emission” of each car. Such complex and detailed data cannot be calculated manually, which requires the use of technological means such as artificial intelligence and big data.

In the production of automobiles, the carbon emissions from processing, assembling, transporting, recycling each component, as well as the fossil fuels consumed for lighting and air conditioning in factories and office buildings, are all included in the “per-vehicle carbon emission” of each car. Such complex and detailed data cannot be calculated manually, which requires the use of technological means such as artificial intelligence and big data.

Big data platforms can help track the whereabouts of retired power batteries, use them on forklifts, service vehicles, or recycle the materials in the batteries to reduce carbon emissions in the production process of raw materials. For instance, Volvo uses blockchain technology to trace cobalt elements in power batteries while collaborating with Contemporary Amperex Technology to apply regenerated cobalt in the power batteries of XC40, preventing cobalt elements from flowing into nature and being wasted after the power batteries are scrapped.

There are many intelligent means in the electricity use process of upstream factories as well. Tencent’s “AI + Environmental Protection” program, for example, collaborates with thermal power plants by using AI technology to reduce the fuel consumption of thermal power generation, which in turn reduces the carbon emissions of car companies and suppliers using thermal power. Some clean energy companies use tools like Analytics Zoo to adjust wind power generation output based on weather and wind conditions, providing a company with green energy at the highest efficiency…

The application of intelligent technology in carbon neutrality is still in its infancy stage. As the carbon trading market opens up and corporate demand for carbon emissions regulation and optimization becomes stronger, it will naturally foster the application of new intelligent technologies.

Lastly

Developing new energy vehicle models, building zero-carbon factories, and choosing low-carbon components is a high-cost, high-investment, and possibly short-term return choice.

“With the launch of the carbon trading market, carbon neutrality is no longer just a demand from car companies. Power plants, steel plants, power battery manufacturers, interior suppliers… every enterprise has its own carbon emission quota and carbon reduction needs.”

“Therefore, when car companies shout out the slogan of carbon neutrality, it is not just a lone hero, but a tangible and necessary goal to achieve.”

As to whether the launch of the carbon trading market is an opportunity or a crisis, whether it becomes a “charcoal seller” or a “pioneer” under the wave of carbon neutrality in China, it depends on the countermeasures of each car company.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.