“Within three years, we aim to surpass Tesla in terms of autonomous driving algorithms, and our sales target for 2025 is 800,000 vehicles,” said Zhu Jiangming, chairman of Leapmotor, at the 2.0 strategy release meeting. However, some media interpreted this as “bragging.”

This statement also sparked discussion among some people, whether this is just a “boasting phrase” by automobile companies. I believe that because the electric vehicle runway is still in the qualifying race stage, everyone is still on the way to “survival”. Referring to the example led by Byton, I believe that car companies that can survive until today and still contribute a certain amount of sales every month must have some ability.

However, throughout the industry, Leapmotor is not the only car company that “brags.” For example, Li Xiang of Ideal intends to sell 1.6 million vehicles in 2025, Li Bin of NIO hopes to achieve an annual sales volume of 4 million high-end markets, accounting for 25% of the market share. Zhang Yong of WM Motor stated that he wants to achieve a scale of 500,000 by 2025. The reasons behind this are that car companies hope to achieve a certain scale and smoothly obtain tickets to the elimination round.

However, I believe that from the perspective of corporate competitiveness, products are only one aspect, and it also involves founders, corporate strategies, values, organizational structure, research and development progress, and channel capabilities, etc.

Only spent 3 billion

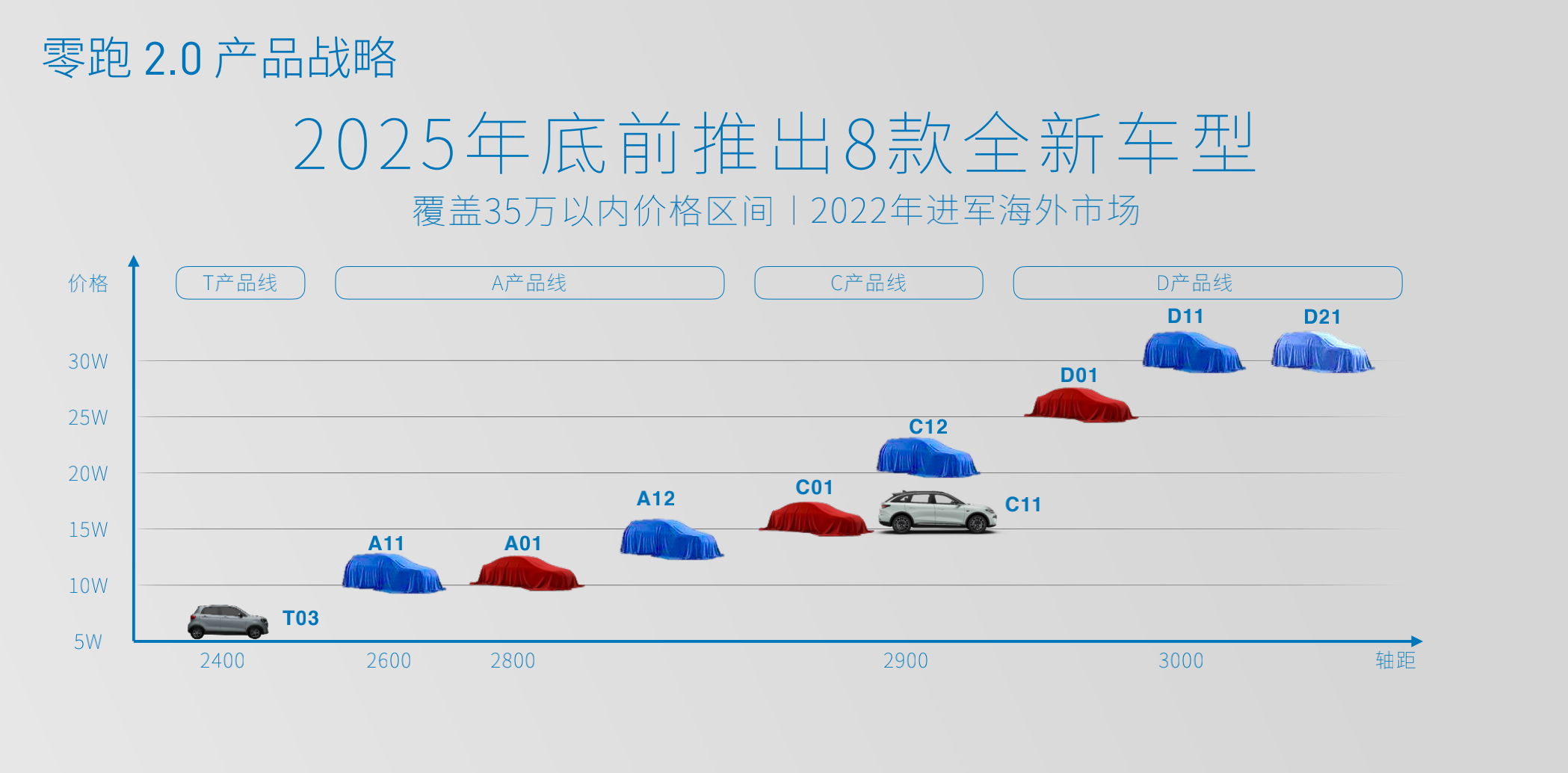

Automakers announcing sales targets is no longer unusual, and what is novel is that Leapmotor has released detailed product plans for eight models within the next 4.5 years.

Zhu Jiangming mentioned that all C-platforms are B-class cars, and the first model launched is C11. The second sedan C01 will be launched in August next year. There will also be a crossover product with six seats between SUV and MPV in August 2023, and price ranges will be marked.

I believe that for Leapmotor, which has just completed pre-IPO financing, revealing such product plans that could reveal personal ID card numbers indicates they are still hoping to gain more attention in the market.

Objectively speaking, in both the consumer market and the capital market, electric vehicle brands with higher popularity are still “Tesla fans.” Of course, they also have certain similarities, such as the relatively high-end product positioning in the early stage and the relatively strong financing ability, which can better cover supply chain costs, introduce products earlier, and obtain a first-mover advantage.“`markdown

Zero Run has chosen to start from the mass market, which inevitably limits its early stage by the characteristics of supply chain costs and consumer market, simply put, it is high manufacturing cost and no one willing to buy. At this point, I believe it is a test of a car company’s ability to operate at low cost, that is, in the next round of funding or before the consumer market becomes more mature, it can do more accumulation while ensuring survival. According to people familiar with Zero Run, the company has spent no more than 3 billion yuan since its establishment. On the one hand, it shows that Zero Run has invested money in the right place with high capital efficiency, on the other hand, it also indicates that Zero Run’s capital is truly not large.

However, under such low-cost operations, I believe Zero Run has also done a lot. First, it runs the process of whole vehicle production and manufacturing and obtains production qualifications. Second, it compresses the turnover of factory spare parts to 3-4 days, improving capital utilization efficiency. Third, it accumulates user reputation and enhances the company’s soft competitiveness.

First, look at the factory. Currently, the maximum annual production capacity of Zero Run’s Jinhua factory for whole vehicles can reach 200,000 units, matched with the production capacity of 200,000 battery packs and 250,000 motors. In addition, in the pre-IPO round of financing, the Hangzhou government invested 3 billion yuan, which also means that Zero Run’s Phase II plant is likely to settle in Hangzhou.

Furthermore, from a longer-term perspective, electric vehicles will eventually be popularized, and the mass consumer market is gradually opening up. As of July 1, 2021, Zero Run’s cumulative delivery volume in the first half of the year was 21,744 units. It is important to note that Zero Run only sold 11,391 vehicles throughout the year in 2020. It is obvious that Zero Run’s brand and product target groups are expanding in 2021.

As for product user reputation, I think we can discern from the “repurchase” ratio. Zhu Jiangming mentioned that 10% of the 6,000 orders for the Zero Run C11 model are T03 users, which is about 600 people. Is this data high or low?

To answer this question, we need to combine it with another information point mentioned by Zhu Jiangming: “More than 80% of users who use the T03 as their second family car are those whose first car is a luxury brand, while the other type of user is mainly educated by low-speed electric vehicles in Shandong and Henan areas.”

If we combine these two pieces of information, we can make a reasonable assumption: from the group, users are less likely to “buy more” and are more likely to “replace.” I think it is illogical to swap a Zero Run C11 with a luxury brand such as BBA. As a result, the base of T03 users that C11 can convert is relatively limited. Therefore, I believe that a 10% ratio is not low and even quite high.

“`# About Leapmotor

As mentioned by Zhu Jiangming earlier this year, there has been a reorganization of the company’s structure, which included making user operations an independent first-level department. This suggests that Leapmotor is now focusing on the interaction with its users.

However, these pieces of information alone are not enough to highlight Leapmotor’s corporate personality.

Overtaking Tesla

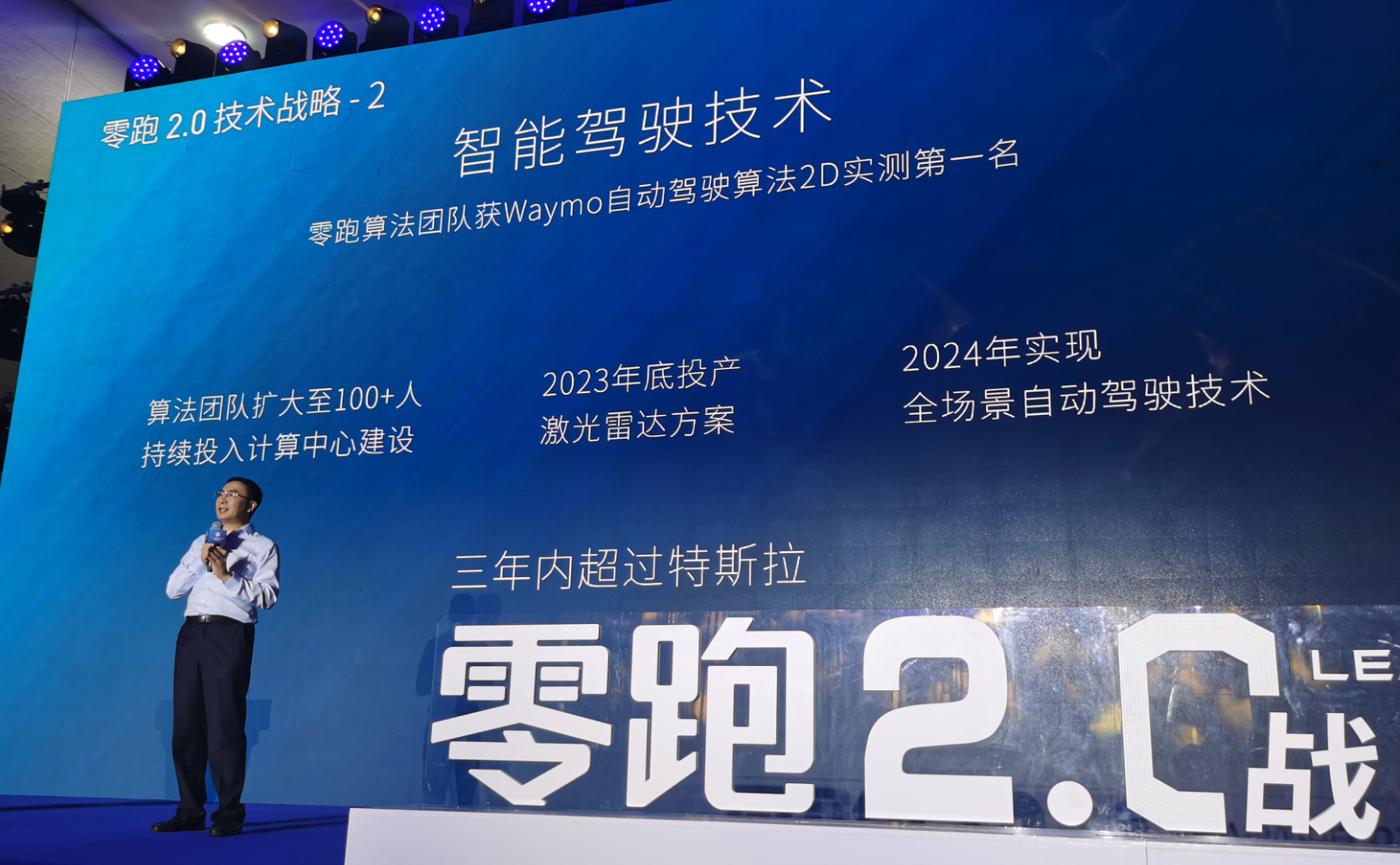

As a tech person and the former CTO of Dahua Technology, Zhu Jiangming appears to think more like a science student. This can be seen in his 2.0 strategic PPT, where only one page is dedicated to product and user strategy, while six pages are dedicated to technology.

This includes the self-developed Lingxinchip 01, the variable architecture oil-cooled electric drive, the silicon carbide controller, the penetrating large module battery pack, the 800V high-voltage platform, the SOA architecture, and the CBC battery + body integrated solution.

However, I believe that the most noteworthy part of this is the intelligent driving section, which is also the most criticized module. Taking all this information together, Leapmotor’s idea is to release a vehicle with a LIDAR before 2023 and to reach full-scenario automatic driving technology through OTA in 2024, surpassing Tesla.

So, what kind of LIDAR can make such a bold statement possible? Due to the longer R&D cycle in the automotive industry, the time to start product definition for a new model to be released around 2023 is limited. Therefore, we can be sure that Leapmotor has already chosen a LIDAR vendor. With this in mind, this question is not so difficult to guess.

First, let us make it clear that the LIDAR industry is generally divided into 1,550 nm and 905 nm based on the different wavelengths. Considering that the receiving sensor for 1,550 nm is indium gallium arsenide and that there is currently no effective cost-reduction technology available, I believe that Leapmotor, known for being “frugal”, is more likely to adopt 905 nm LIDAR.

Looking further into 905 nm, currently, the domestic 905 nm LIDAR manufacturers that have received mass production orders from the automotive industry are only Lanwo Tech and SureStar Technologies. However, choosing Lanwo LIDAR means reconstructing the entire algorithm system to match non-repeated scanning, which I believe is bad news for Leapmotor’s 100-person autonomous driving team that will be assembled this year.The most likely candidate for ZERO’s best choice is Kuandeng, according to insiders. It was reported that Kuandeng had provided M1 LiDAR samples to ZERO for testing in the early stages, and that ZERO was quite satisfied with the test results. Currently, ZERO is in the specific road testing phase. In addition, Kuandeng has already obtained orders from several other automakers, which will help to reduce costs after scaling up, so I believe that Kuandeng’s plan may be the best choice for ZERO.

First, let’s take a rough look at the performance parameters of this LiDAR. The M1 supports dual-wave function, with a maximum output of up to 1,500,000 points per second, a field of view of 125° x 25°, an average resolution of 0.2° x 0.2°, and a maximum detection distance of 200 meters. When detecting a black car 150 meters away with a reflection rate of 10%, it can obtain point cloud imaging of 4 lines and 13 points, which is greater than the detection threshold of 2 lines and 3 points required by the perception algorithm.

Furthermore, Kuandeng recently announced that it has implemented a “gaze” function on the M1 LiDAR, a zooming technology similar to a camera. In simple terms, by increasing the vertical resolution of the center ROI area from 0.2° to 0.1°, the density of point cloud imaging of obstacles is doubled, which means that the M1 LiDAR’s ability to measure the height information of small objects in front has been further improved, enabling the vehicle to detect whether there are raised obstacles ahead earlier and avoid them in time.

Although the performance of the M1 LiDAR is outstanding among its peers, the challenge of achieving full-scene autonomous driving is still considerable. In my opinion, LiDAR still plays a redundant role in assisted driving. The gaze function theoretically allows for longer ranging and better recognition of small objects, but visual perception still needs to be supplemented, otherwise some misjudgment scenarios are unavoidable.

Interestingly, from Zhu Jiangming’s perspective, he personally leans towards the visual solution rather than multi-sensor fusion, which is not difficult to understand since he has been working on image recognition for so many years. So why does ZERO choose to equip LiDAR rather than adhering to a full visual solution at this stage? I think the main reason is still the lack of data. In other words, there are still too few ZERO-branded EVs on the road, and LiDAR is still needed for 3D modeling to ensure redundancy.

Of course, I believe that on the one hand, this reflects the founder of ZERO’s “online” choice in the technical route, but on the other hand, it also leads to bigger challenges for ZERO in the future.

What are the challenges?Recently, Lynk & Co. participated in the Google Self-Driving Algorithm Challenge, which set four projects including dynamic prediction, correlation prediction, real-time 2D detection, and real-time 3D detection. Lynk & Co. won the first place in the third project – real-time 2D detection, beating many well-known enterprises. This is not surprising because Dahua has many years of experience in the security industry, mainly engaged in the recognition of 2D images such as faces and license plates. Lynk & Co. has accumulated deep experience in this area.

However, in the autonomous driving scenario, relying solely on 2D detection is not enough. Dynamic and correlation prediction requires a lot of actual road scene data to better optimize the algorithm logic. This is currently lacking for Lynk & Co.

Another aspect is that I believe self-developed chips will be a major challenge for Lynk & Co. in the future. The reason why Lynk & Co. chose to self-develop chips was more due to cost and technical considerations. First of all, Mobileye is not a low-cost “black box”. Since Lynk & Co. itself has reserves for AI algorithms, it certainly hopes that the algorithm can be developed by itself. However, there was no more suitable chip choice on the market at that time, so they chose the path of self-developed chips.

In addition, due to Dahua’s background, the cost of investing in the Lingxin 01 chip development is not high, about 40 million to 50 million RMB. Secondly, in terms of diluted costs, this chip was not only used in Lynk & Co. car models, but also shared by Dahua security products and sold by Dahua’s auto parts sales team, which is the basis for Lynk & Co. to self-develop chips.

However, the Lingxin 01 chip, which uses TSMC’s 28-nanometer process and has a computing power of 4.2 TOPS, can currently meet the demand of L2 level driving assistance, but full-scenario autonomous driving will definitely pose higher requirements for the chip.

Therefore, for Lynk & Co., developing the next generation of chips may not have such a good foundation environment as before. On April 2, 2020, Dahua Technology Co., Ltd. announced that, in order to further optimize the business structure of the listed company, improve the efficiency of existing resource allocation, and transfer the 100% equity of its wholly-owned subsidiary, Huatu Microelectronics, at a cost of approximately RMB 1.6 billion.And the reason behind it is partly due to the continuous decline in revenue of Huatu Microelectronics, which is overly reliant on Dahua and its subsidiaries. In 2018, 2019, and 1-4 months of 2020, the revenues of Huatu Microelectronics were RMB 20.84 million, RMB 13.89 million, and RMB 1.02 million, respectively, with net profits of RMB 4.73 million, RMB 2.34 million, and -RMB 0.5464 million, respectively. Of course, besides the single revenue channel, the reason for the loss of Huatu Microelectronics may also be related to the U.S. technology blockade.

I’m not saying that if the chip company is sold, Dahua can’t make chips anymore. I mean that if proprietary chips don’t have enough volume to amortize costs, it may not be a profitable business. Because for ZhiRun, if they want to develop a next-generation chip, they will inevitably need to use a 14nm or more advanced process, which means that costs will increase in all aspects from design to wafer to production. And Dahua’s security industry is a limited market, and it is impossible to help ZhiRun reduce costs infinitely. The only way to increase the volume is to enter the international market, which requires ZhiRun to go global. Although Dahua’s overseas business volume is relatively large, I think that relying solely on Dahua’s resources is still too single for ZhiRun to go global.

On the other hand, because the CPU processor of Lingxin 01 is based on the open-source RISC-V architecture of Alibaba’s Flat Head Brother Semiconductor Xuantie C860, most of the other auxiliary driving chips on the market currently adopt the ARM architecture. For ZhiRun, if they do not go down the path of proprietary chips, they will have to accept the cost of hundreds of dollars per chip from companies like NVIDIA and start over again due to the switch in architecture, which is not an easier path.

Taking everything into consideration, I believe that ZhiRun is at a crossroads in terms of choosing its technological path at this moment.

Conclusion

As Li Shufu said, the automotive industry is a marathon, not a sprint. For ZhiRun, they have successfully survived the industry’s infancy period by operating at low costs.

However, as the industry continues to develop and more players enter the electric vehicle market, competition among automakers is becoming increasingly fierce, and the advantages of low-cost operation will be gradually diminished. For example, NETA Motors, which is in the same niche as ZhiRun, recently formed a strategic partnership with 360 Group. 360 Group will help NETA Motors with technology and capital.

Therefore, for ZhiRun, entering the 2.0 era means accelerating further and winning more attention on the increasingly crowded electric vehicle racetrack through a stronger product matrix.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.