Recall Cases of Passenger Cars and Commercial Vehicles

Since 2021, under the pressure of the General Administration of Quality Supervision, Inspection and Quarantine, the recalls of power batteries have been increasing. So far, for passenger cars, there have been recalls involving power batteries and battery systems from car companies such as JAC, GAC, Cheetah, Ora, and Chery, involving approximately 60,000 units; with the addition of searchable commercial vehicles, there have been a total of 65,000 units. The overall inventory of electric vehicles is currently about 6.03 million units, and the recall rate is estimated to be less than 1%.

Recall Cases of Passenger Cars and Commercial Vehicles

I won’t go into detail about the cases that occurred too long ago. At present, the types of batteries involved in the recall are mainly soft packs and cylindrical batteries, as shown in the figure below. Since Funeng is a listed company, both of the cases involved are announced by the company. In the latest announcement, it is particularly emphasized that Funeng Technology only supplies modules installed in the recalled vehicles. The reason for the recall is mainly that the BMS software control strategy of the recalled vehicles does not match the power battery, and long-term continuous frequent fast charging may cause a decline in the battery performance. In extreme cases, it may cause thermal runaway of the power battery, which poses certain safety hazards. The BMS is not a company product and is not supplied by the company. I believe Funeng means that these are all used for online car-hailing platforms, and the battery management control exceeds the battery’s capacity. So, who made this battery management system? It was Dongsoft Ruiqi. But is it the third-party enterprise that sets these management and control parameters, or are they set by the battery management enterprise? There is a point to be discussed here—whether the parameters set by third-party enterprises are all set by the car companies and they will not set particularly aggressive settings without any reason. For weak battery companies, whether they can meet the operating requirements of demanders one by one is very critical for the operating results two or three years from now.

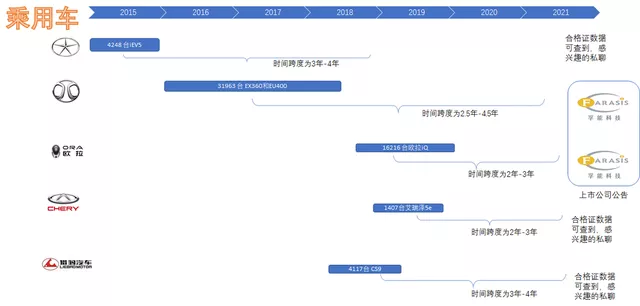

As shown in the figure below, from the perspective of the General Administration of Quality Supervision, Inspection and Quarantine, the instruction to issue recalls generally requires the accumulation of multiple repetitive cases. Therefore, the recall problems that can be seen now have occurred over a time span of two to three years, and there will be action only after many cases have accumulated.

Note: All passenger car companies involved in recalls do not specify the origin of the battery cells. According to the manufacturers’ announcements and part of the identification data of the certificates, all the batteries recalled for passenger cars are of the ternary type, which is closely related to the subsidy level at that time.

In commercial vehicles, due to the small volume and the fact that the enterprises are 2B, it is very clear which single-cell battery is adopted, as shown in the figure below.

In buses, there have been recalls of lithium iron phosphate batteries, which should be related to the design of battery cells.## Battery Accidents and Recall Issues

From an international perspective, recalls related to pure electric vehicles are still ongoing. Currently, both the Bolt EV and Kona EV are in an awkward situation where car manufacturers and battery manufacturers have drawn a line, but problems are still appearing in the practical use of the vehicles. Consequently, General Motors is now recommending that owners park their vehicles outdoors after charging or simply not charge them at home overnight (meaning that they must keep an eye on the charging process at all times). In other words, it takes 2-3 years to expose these problems due to the accumulated historical debt, and it will take a long time to find a solution.

Currently, there are still several bottlenecks that constrain the development of fast charging in China:

Standardization of fast charging: The Chaoji charging port is still a modified version of the original GBT port, which requires further discussion to determine a standard;

Battery safety: As previously mentioned, many problems occurred in ride-hailing and taxi vehicles after fast charging with the original 60 kW set-up. The safety of lithium-ion batteries decreases rapidly after use, and Chinese experts are mainly concerned about safety issues, especially related to higher power fast charging, which the battery manufacturers themselves also fear.

In my personal opinion, as people begin to say, “My battery is not afraid of burning or overheating” and with overseas situations continuously transitioning to 300 kW and 350 kW, the transition to fast charging will be rapidly hastened. One reason for this is that single battery cell thermal runaway is no longer of concern and secondly, the overseas situation is indeed shifting towards faster charging.

Note: The Bolt EV and Kona EV probably have fast charging power of around 50-60 kW, with battery technology playing a more significant role than fast charging itself.

Conclusion: Safety and (fast charging) speed are contradictory, and safety issues have always restrained the improvement of fast charging speed. With the reintroduction of iron-lithium batteries and increased confidence in Pack design, I believe that the increase in fast charging speed will be significant. As for how to solve historical safety problems, it’s likely that some old batteries will be replaced or upgraded in modules, step by step. One possible solution is to limit the use of SOC limits, which is currently the only option available.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.