This article is reproduced from the autocarweekly public account.

Author: Karakush

“Plan to sell 800,000 vehicles annually by 2025!”

Yesterday, Lynk & Co held its 2.0 strategic press conference in Jinhua, announcing its strategic goals for the next five years.

At first glance, the target of selling 800,000 vehicles annually seems ambitious, accounting for roughly 10% of the new energy passenger vehicle market by then.

But a closer examination shows even more ambition. In terms of product, there are plans to launch eight models covering a price range of under CNY 350,000 by the end of 2025, with plans to enter foreign markets next year. In terms of technology, Lynk & Co plans to surpass Tesla in autonomous driving within three years.

Many readers may be skeptical of Lynk & Co’s ambitious plans, but the figures actually speak for themselves. In the first half of this year, Lynk & Co received over 21,500 orders, making it the fourth-best performing Chinese car manufacturer among new innovative players. Cumulative deliveries have exceeded 21,700, rising for four consecutive months. However, over 90% of this performance comes from the A00 class small car Lynk & Co 03.

Considering this, it is difficult to imagine how the company can achieve its goals, making one wonder whether setting these targets was just an expression of wishful thinking.

However, prior to the conference, we spoke with CEO Alain Visser and discovered that Lynk & Co does have the confidence to back up its ambitious goals. As a technology company, Lynk & Co leverages its background in IT and believes it can become one of the top players in intelligent driving and intelligent networking.

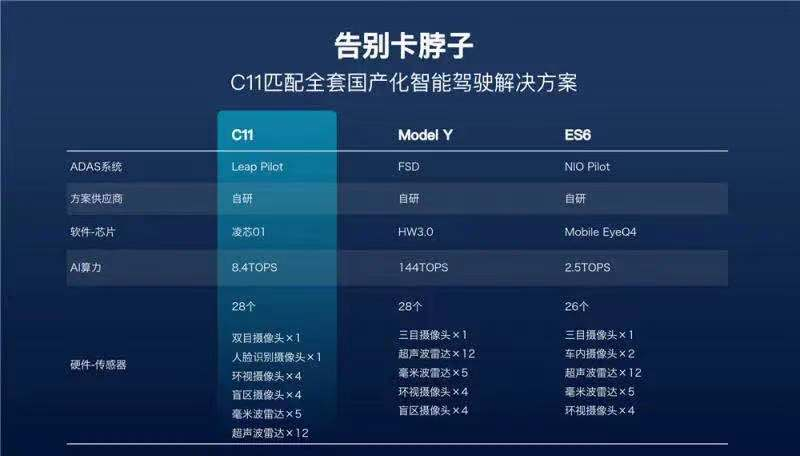

It is difficult to see this technological advantage reflected in its current product offerings. The T03 and S01 models currently available do not have advanced functions such as automated navigation, and the C11 model set to be delivered in September 2021 is not expected to provide high-speed NOA until the first quarter of next year. Compared to other industry leaders with strong technological prowess, Lynk & Co’s intelligent driving technology may be one to two years slower to hit the market.

Visser admitted that the company is indeed slow in terms of intelligent driving, as it began with chip development and has pursued independent research and development of hardware and software.

Self-developed chips are at the forefront of the industry trend, with rumor having it that the leading companies in China are aggressively exploring this field. Lynk & Co is at the forefront of this trend, having already achieved full intellectual property rights for its in-car intelligent driving chip, the Lingx1. The C11 will feature two of these chips, each providing 4 TOPS of computing power, delivering L2-L3 autonomous driving capabilities.Although it is short on features, it is a cost-effective powerhouse. Zhu Jiangming is confident that the LingXin 01 below L3 level has great cost and performance advantages. Compared with Horizon and Black Sesame, it is currently the most powerful vehicle-level AI chip. It can also be implemented as ADAS with a single chip which can support up to 12 cameras due to its high integration. Furthermore, it is available for practical use, with timely delivery and implementation.

This is a business stemming from Dahua. “I am very passionate about chips,” Zhu Jiangming says, “Dahua set up a chip team in 2004, and sold it for $1.6 billion last year due to U.S. sanctions. The team has developed 35 chips, with the highest shipment volume of almost 100 million units. 30% to 40% of all the Dahlua system-level chips related to its own business are independently developed, including one AI chip that was planned, the LingXin 01.”

Leapmotor once considered purchasing chips. In the early days, there were few options on the market besides Mobileye, which packaged and sold algorithms with black box output, meaning that its level represented your level, regardless of your ability to customize it. Leapmotor still wanted to depend on its own AI algorithms and technical reserves, but unfortunately, there were no loose chips available. So they established their own chip division, and spent two years developing it.

Investing in this chip costs RMB 40-50 million, which is a significant burden for a startup company, but Leapmotor also benefits from Dahua’s teamwork by sharing the R&D costs. Dahua uses it internally for security purposes, and the components company that was co-founded by Leapmotor and Dahua sells it externally.

In terms of technology, the computing power of LingXin 01 can be further improved, even if it can reach 100T or higher. The risk lies in the process; LingXin 01 is a 28-nanometer chip that requires at least a 14-nanometer advancement, or even higher. To move forward, it is necessary to sell it nationally or even globally. For the more advanced chips, Nvidia is still critical.

However, for L3 and below, it is better to produce the chip themselves, rather than purchasing a product from Nvidia costing at least $500. This will effectively improve Leapmotor’s cost structure. This type of preparation will slow the pace, but as the algorithm continues to iterate, being slow to start will leave the company better off in the end.

In Zhu Jiangming’s view, intelligent driving is all about AI technology, and he is very familiar with the iteration cycle of AI technology. Dahua began to get involved in face recognition in 2010, when the success rate was very low. However, within five years, it had improved to 70-80%, and today, it is no problem for thousands of people. Its performance in this area and with license plate recognition is always among the top three globally. The development of technology is always advancing rapidly.Meanwhile, LI is also increasing investment, with a projected algorithm team of over 100 people this year. The team is led by seasoned leaders with solid track records.

This year, Waymo held an open dataset challenge, and LI won first prize in real-time 2D object detection. This challenge is highly renowned in the self-driving industry, with various large and small companies participating in the four projects. The 2D real-time detection project mainly tests the accuracy of the algorithm model in detecting and classifying obstacles and the real-time operating speed of the device.

Interestingly, when the results were announced, LiXiang’s algorithm manager was reluctant to publicize the win and asked if they could keep the name anonymous due to aggressive headhunting.

“We never used to say we would surpass Tesla in three years,” said Zhu Jiangming, “but now we say it because we’re confident we can.” Their plan is to introduce a solid-state LiDAR solution by the end of 2023 (Zhu personally prefers vision as the primary perception method with other sensing methods as complimentary); and achieve full-scenario autonomous driving technology by 2024.

As for current products, Zhu Jiangming’s strategy is to first establish a solid foundation and focus on enhancing Level 2 autonomy, especially ACC, LKA, and AEB. They aim to achieve almost fully autonomous driving on highways and help users have a more practical experience with less cost, just like in the T03 model – an A00 level vehicle priced at 75,000 yuan with ACC, providing users with a high value proposition.

“I believe we will have a better acceleration in the future. We’ve laid a solid foundation, and our momentum should be greater going forward.”

This momentum relies not only on chips, but in fact, LI’s core technology strategy has been self-research and self-manufacturing since its inception, ranging from intelligent driving, intelligent cockpits, to electrification. Otherwise, cost and core competitiveness would be restricted.

A prime example is the C11. Although it hasn’t been delivered yet, since its release, many have been puzzled by how a car priced between 150,000–200,000 yuan can have such a high-level configuration:

This is largely due to LiXiang’s self-research and self-manufacturing, which has helped reduce costs. For example, “many battery packs are independent, and the entire box is made up of expensive aluminum alloy pieces that are welded together, which leads to a low-quality finish.”Next year we will mass-produce a CBC technology with integrated design of chassis, body, battery, and battery cell. The entire battery pack is formed by a 2400-ton press using steel plates, with a base made with General Motors process, reducing weight by utilizing mutual strength. Despite being all steel, it weighs the same as an aluminum box, and improves the vehicle stiffness by 20%. The single-vehicle cost can also be reduced by 1600 yuan.

In fact, the electric drive unit this year has introduced an oil-cooled motor, and will release a 300 kW high-power silicon carbide 800V product within 2 years. The battery pack, including module, PACK, and BMS, as well as car lights, automotive controllers, and meters, are all self-developed and manufactured.

“We absolutely won’t touch those traditional suspensions, interior, and seats that we are not good at, but we have complete autonomy in electronics.” This category is not considered complicated, at least not comparable with that of IT.

As long as the scale goes up, such as achieving 200,000 units, all investment will have a good cost-performance ratio. If we achieve 600,000 or 1 million units, the advantages will be very obvious.

In addition, the experience will be more controllable. For example, the intelligent cabin that Zhu Jiangming is proud of can recognize who the passenger is through facial recognition after entering, and can adjust the seats, music, air conditioning, and rearview mirror.

“We even designed the seat controller ourselves, so although the sales of S01 are not good, we will make the intelligent cabin more advanced than all car companies now in 2019.” said Zhu Jiangming.

In addition to research and development, ZERO Run also pursues cost reduction and efficiency improvements in manufacturing. Yesterday, the first self-produced T03 Comfort Edition of ZERO Run went offline. Previously, they manufactured through subcontracting and started producing in their own Jinhua factory after obtaining qualifications, which is also a symbol of 2.0.

In addition to the traditional four major processes, this factory also has a dedicated three-electric workshop, which can match the production capacity of 200,000 vehicles. All manufacturing from the motor workshop to the battery workshop goes directly to the final assembly line through automated pipelines, which is very intensive, modern, and intelligent.

ZERO Run needs a master storyteller. In the past, when ZERO Run was mentioned, people thought of a strange and rebellious local car brand. Many early reports described it as a long-tail brand that crossed the line without knowing the qualifications to build a car and even experienced building collapse.

Today you can definitely see its progress, and it has achieved much more than what you see. There exists a huge communication gap. Previously, ZERO Run didn’t bother to let the public know, and now ZERO Run hasn’t figured out how to make the public accept it. At the scene, a friend asked, “Don’t you think your goal is too radical?””Maybe no one has seen any car company that has announced how many cars they will release in the next five years,” said Zhu Jiangming. “Eight models, which means two cars will be released every year in the future. This pace is necessary. The development of new energy vehicles is very fast. From last year to this year, the growth has been over 100%. The growth rate will not drop below 50% from 100%. Therefore, we need to make more models to match customer needs and seize the market opportunity.”

As for the current two models, they are doing well.

T03 is outstanding and the most expensive high-end car in the A00 segment. It has L2, a 55kW motor, and will be upgraded to 80kW in the future. They hope that T03 will maintain its current linear growth and reach 8,000 units per month by next year. They believe this is highly likely to happen.

C11 is also excellent, and even without a test drive, it has nearly 6,000 pre-orders from customers who have already paid a deposit of 20,000 yuan and cannot be refunded. This shows that these customers are very fond of Zero Run’s products.

Zero Run hopes to make this car a classic, similar to the enduring hot models of Toyota Camry or Great Wall H6, so they try to make it as top-level as possible, even with full packages. For example, the sound system wasn’t good enough when it was first released, so Zero Run changed the supplier and spent 10 million yuan on audio tuning software, which was a sincere investment.

Last year, they also established an operation department and paid attention to customers as a primary department. Zhu Jiangming also personally interacted with customers through the APP to understand their needs. Based on feedback, they added double-layer glass for the front windows, privacy glass for the rear windows and ventilation system for front seats without increasing the price. Now they are considering adding heated steering wheels if the progress allows it.

Compared with products, technology, and attitude, the brand and communication are weaker. This is also one of the origins of questioning its lack of greed: where do friends hang out?

Now they have 5,000 orders per month, most of which are from referrals by old customers. More than 40% of T03 users are referrals and 10% of C11 users come from T03 users. Reputation is durable, but even car owners complain that the brand lacks notoriety.

They are trying to change this. For example, this press conference is the largest media event by Zero Run in over five years. They want to change their low profile image and promote the brand. Zhu Jiangming is also very eager to interact with the media and put his WeChat account on the screen. I have never seen such an open founder.However, it’s not enough. They lack a good story. Many brands’ stories come naturally, such as Huawei’s patriotic appeal and NIO’s user-centric philosophy. What kind of story can an honest person tell?

The bigger challenge is to overcome a psychological bias: an honest person who isn’t great at boasting may receive far more criticism for doing so once in a while than someone who boasts eight hundred times.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.