On June 30th, Volvo conducted a live event in Gothenburg, Sweden. Although not many people paid attention to it in China, the amount of information released was enormous.

Henrik Green, CTO of Volvo, sat on the sofa and announced a grand figure: By 2025, half of all Volvo’s pure electric models will be sold, reaching 600,000 units. By 2030, Volvo will become a fully electric vehicle brand.

However, my focus was not on Volvo’s various sales targets for pure electric models, but on what Hakan Samuelsson, CEO of Volvo, said: “Software is as important as electrification!”

Self-developed Software

Christian Senger, former head of Volkswagen’s software department, announced in July 2019 that Volkswagen’s self-developed software ratio would reach 60% by 2025. Recently, Volkswagen Group CEO Diess even resigned as Chairman of the Supervisory Board of Skoda and Seat to fully focus on Volkswagen’s software construction.

In October last year, Mercedes-Benz announced that the MB.OS operating system would be independently developed by Mercedes-Benz and is expected to be released in 2024.

Tesla has not only achieved full-stack self-development of chips and systems but also plans to establish a world-class Dojo supercomputer to accelerate data processing, driven by massive autonomous driving vision data.

Why is self-developed software so important? Why do many OEMs bend over for it?

In traditional car production processes, customer demand for software is not given much consideration, so, similar to many parts, a package solution from suppliers is often used. However, under the influence of the internet and new car makers, intelligent electric vehicles are tending to listen to user opinions and even have the more radical concept of “user co-creation.”

OEMs adopting traditional package supplier solutions will find themselves in a very tricky situation. At the end of 2019, the first mass-produced model under Volkswagen’s MEB platform, the ID.3, was found to have software problems in the media. Due to software issues, this strategic model, which is extremely important for Volkswagen’s transformation, was forced to postpone its release, and thousands of engineers worked tirelessly to fix the vulnerabilities. Even the Volkswagen Group’s “volume pioneer” eighth-generation Golf was also forced to reduce production due to the same software issues.

The wide-range product software issues in the VW.OS are attributed to the extensive use of “black box development mode” by the Volkswagen software department in the early stages of the project. While testing the functionalities individually, they worked perfectly fine. However, a series of issues occurred when they were placed in the car as a whole. Due to the insufficient number of engineers in the department, many tasks were outsourced to third-party vendors, exacerbating the situation.

The wide-range product software issues in the VW.OS are attributed to the extensive use of “black box development mode” by the Volkswagen software department in the early stages of the project. While testing the functionalities individually, they worked perfectly fine. However, a series of issues occurred when they were placed in the car as a whole. Due to the insufficient number of engineers in the department, many tasks were outsourced to third-party vendors, exacerbating the situation.

Patrik Bengtsson, the head of software platform at Volvo, said that in the past, fixing a bug in the EE (Automotive Electronics and Electrical Architecture) took several weeks, or even more than a month because they used the solutions provided by the vendors. However, having a self-developed software team, they can finish fixing the same bug in just one day. Creating new software functionalities used to take the vendors up to two years, but their own software team can complete it in three months.

Is self-developed software for a better user experience?

Yes, and no.

From a user’s perspective, OEM having a self-developed software and a dedicated team can respond quickly to their demands, fix bugs promptly, and shorten the software iteration cycle. Controlling the software can assist in pushing the development of the SOA-based architecture.

From an OEM’s perspective, the benefits to users are only a part of the reason. In the era of intelligent electric vehicles, OEM has recognized the significance of data and decided to seize this opportunity. By self-developing software and assembling their software team, they can further expand their scope of functions, take over vendors’ jobs, and profit from their share.

About Operating Systems

Volvo claims to develop their software, but Bengtsson clarifies that it is not entirely accurate.

The underlying operating system of VolvoCars.OS includes Android, QNX, AUTOSAR, and Linux. Of course, no car manufacturer will be foolish enough to develop an underlying system from scratch. Instead, they select an appropriate foundational system for custom development based on their investment in software.

Utilizing mature open-source foundational systems such as Android and Linux, with support for open APIs, Volvo provides developers access to car functions like sensor data, user interfaces, and cloud capabilities through APIs. This enhances external developers’ efficiency and is favorable for the development of the software ecosystem.Currently, VolvoCars.OS has 400 registered developers and over 200 software development teams. About 30% of the software is developed internally by Volvo, with the goal of reaching 60% in the future. Volvo will use their own VolvoCars.OS system to support infotainment, ADAS, cloud connectivity, and remote control in the next generation of electric vehicles. They will also introduce a subscription model. “The value, complexity, and quantity of software are all increasing and will rebuild many things,” said Bente Thomassen, emphasizing the importance of software in defining cars. “Software-defined cars are more about software than suspensions or engines. Cars leave the factory not in their optimal state but will improve through continuous software and functional updates.” As part of the software rebuild, Volvo’s current automotive electrical and electronic architecture contains over 100 distributed electrical control units (ECUs) from different suppliers with unique compiled codes that integrate into the car’s complex architecture. The integration work and software portion have become exceptionally complex, with “an exponential growth” of integration work. Volvo’s new EE (Automotive Electrical and Electronic Architecture) will launch in 2022, consisting of three main computing platforms that correspond to visual processing and AI, general computing, and entertainment. Thomassen said that in the next generation, these platforms would be integrated into one. Additionally, the new EE will have an Android infotainment networked system and an Ethernet communication protocol. According to Thomassen, not depending on ECU suppliers can bring many advantages of in-house development and improving the user experience while taking full advantage of the potential of software-defined cars, shortening the core system and internal software technology stack development cycle. As NVIDIA’s Orin X central integrated computing platform is used, ECU quantity, weight, and operating costs all decrease by 50%. Volvo’s core of software development is the algorithm engine, and the software team is seen as a crucial asset while they continue to search for talented software personnel. Volvo’s software also includes the ability to develop self-driving capabilities. ZENSEACT CEO Odgard Andersson’s view is consistent with Tesla’s; excellent self-driving abilities can reduce traffic accidents.

Many people may not be familiar with ZENSEACT, a company established after the joint venture between Volvo and Veoneer split, focusing on the development of autonomous driving and active safety software. ZENSEACT is a wholly-owned subsidiary of Volvo, and its partners include Nvidia, Luminar, MobilityXlab, and HP.

And the pure electric version of XC90, which will officially debut next year, will be the first to adopt ZENSEACT’s solution on the SPA2 platform. Based on the official image, this set of perception hardware will include:

- 1 Luminar LiDAR (300m range)

- 2 front-facing cameras (one wide-angle, one telephoto)

- 4 surround-view cameras

- 6 mmWave radars

- 12 ultrasonic sensors

This set of perception hardware will be equipped with the NVIDIA DRIVE Orin chip and will also support redundancy such as steering and braking, achieving autonomous driving on highways.

Volvo also defines its autonomous driving capabilities into three modes: Drive, Cruise, and Ride. In the next generation of its vehicles, Volvo will be compatible with all three modes:

- Most of the current Volvo models are in the Drive mode range, which can be compared to our understanding of L2, providing functions such as lane keeping and collision warning, etc.

- In the Cruise mode, a driver monitoring system is added, consisting of two face detection cameras and a capacitive steering wheel. It can approach L3 and achieve hands-off driving in some scenarios.

- In the Ride mode, “users can do other things freely behind the steering wheel”, which can be understood as default hands-off and blind driving, similar to L4, but only providing this service in a limited area, of course, this range will continue to expand. It is speculated that this is achieved by relying on high-precision maps to achieve something similar to Xpeng NGP and NIO NOA on highways.

In terms of lidar, Godfrey Anderson stated that Luminar’s lidar has better detection range than humans on highways, detecting vehicles at distances of 230-300 meters, and objects in close proximity with centimeter-level precision. Additionally, lidar serves as a complement to vision, ensuring better recognition in tunnels, adverse weather, intersections, scenes with low visibility, and complicated congestion scenarios.

In terms of lidar, Godfrey Anderson stated that Luminar’s lidar has better detection range than humans on highways, detecting vehicles at distances of 230-300 meters, and objects in close proximity with centimeter-level precision. Additionally, lidar serves as a complement to vision, ensuring better recognition in tunnels, adverse weather, intersections, scenes with low visibility, and complicated congestion scenarios.

Anderson also made a bold statement that they will establish a “data factory” capable of processing 200PB of data in the next few years. This data factory will utilize AI capabilities to process ZENSEACT’s real-time collected data, helping improve autonomous driving capabilities. Vehicle owners can choose whether or not to collect data related to them, and privacy protection measures will be provided for collected data.

Lastly, Anderson emphasized that “software and AI are Volvo’s new DNA.”

Battery

Battery Factory

Whether they are new electric vehicle manufacturers or traditional fuel vehicle companies in transition, all OEMs have never stopped worrying about batteries. And the solutions offered by various OEMs for battery supply are basically the same, which is joint venture with battery factories.

Volvo chose to cooperate with Northvolt. On June 21, Volvo established a joint venture with Northvolt to prepare for the production of power batteries for the next-generation models. And on June 30, Volvo announced the specific plan for battery production in the live streaming: the first step is to develop solid-state batteries in cooperation, which will be launched in 2022; the second step is to set up a factory in 2024 with an annual production capacity of 15GWh; the third step is to establish a 50 GWh super factory in 2026.

According to Volvo’s own projections, their demand for batteries will reach 70 GWh by the middle of this century from 4 GWh in 2020. Therefore, Volvo has formulated a battery factory plan that matches this demand.

Since the battery is produced through a joint venture, Volvo can provide user battery usage data to software for learning and optimizing charging performance through OTA.

In addition to battery production, Volvo and Northvolt will also collaborate on recycling, reducing emissions and promoting sustainability.

Battery Technology

Lutz Stiegler, head of the Volvo battery project, has a very thorough analysis of the evolution of battery technology roadmap.In the next 5-10 years, the technology of using nickel-containing cathode and graphite anode still has great potential. The future technology direction mainly focuses on increasing the nickel content in the cathode while reducing the use of cobalt. Volvo’s collaboration with Northvolt is researching the silicon-doped graphite anode technology to further improve energy density. Through this improvement, the energy density of the new battery will far exceed 700 Wh/L.

However, the improvement of battery energy density requires technology support such as pure lithium anode, new type of diaphragm, and new type of electrolyte to further approach the true solid-state battery and increase the energy density to the level of 1,000 Wh/L. In the mid-2020s (the second half of the next decade), it will provide a range of 1,000 kilometers for electric vehicles.

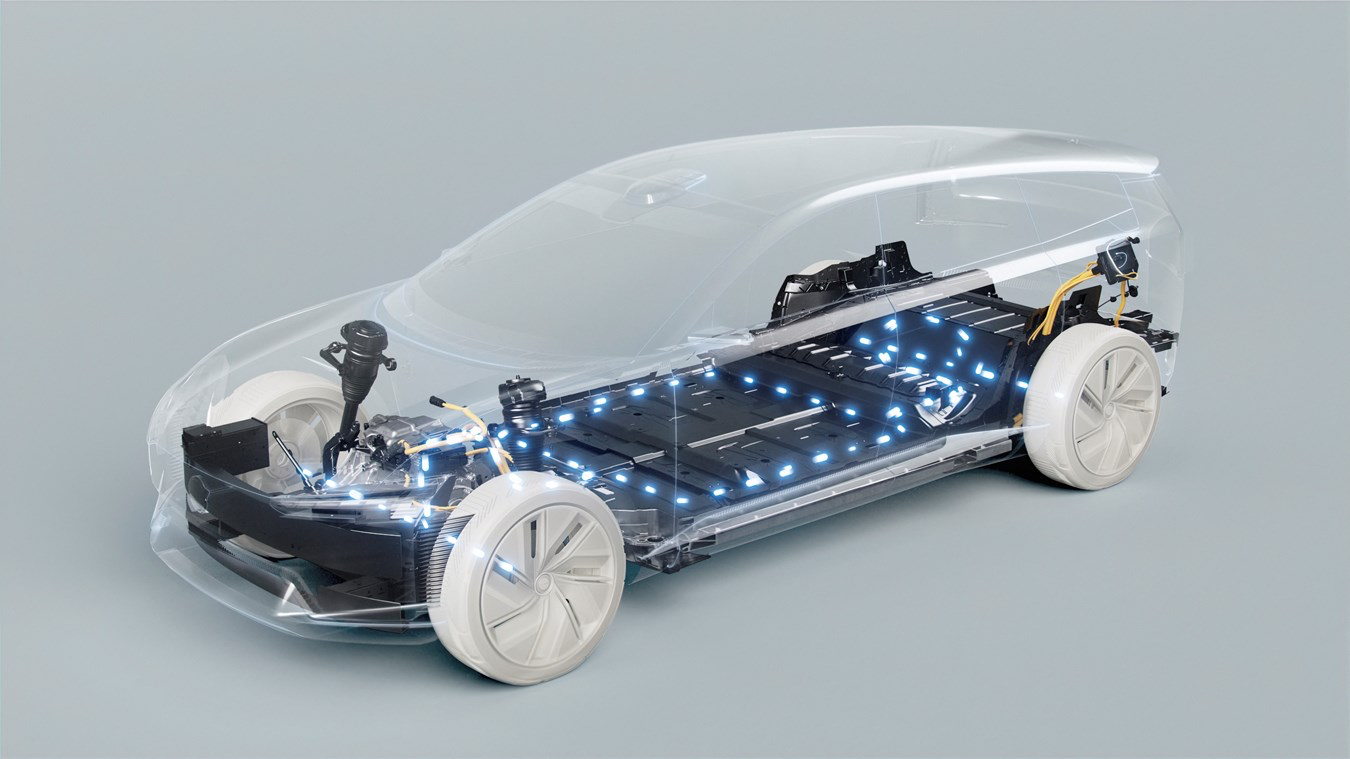

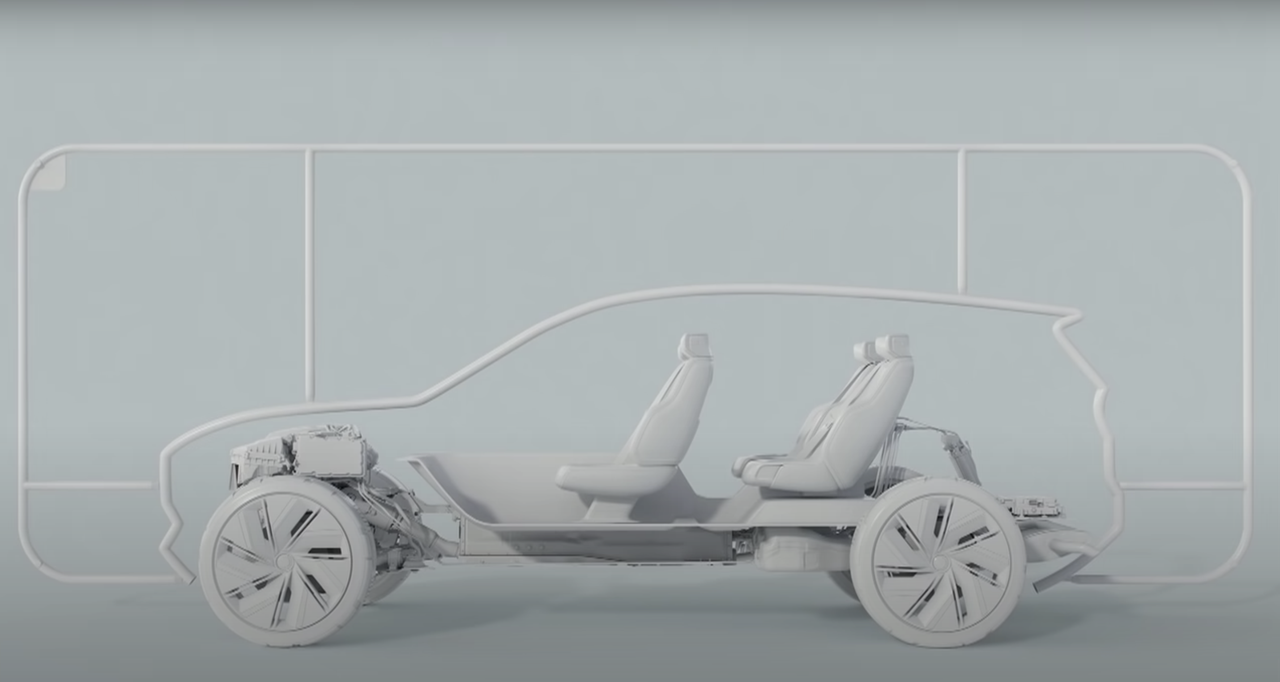

Volvo currently uses the first generation battery, consisting of a bed-layer modular VDA, complying with the “oil-to-electric” architecture. Therefore, the central platform is filled with battery packs that were originally reserved for the driveshaft.

The second-generation battery is obviously designed for the pure electric platform, with a flat and non-raised platform and a fixed battery pack beam. Volvo plans to increase the energy density of the second-generation battery by 50\% compared to the current level by 2025.

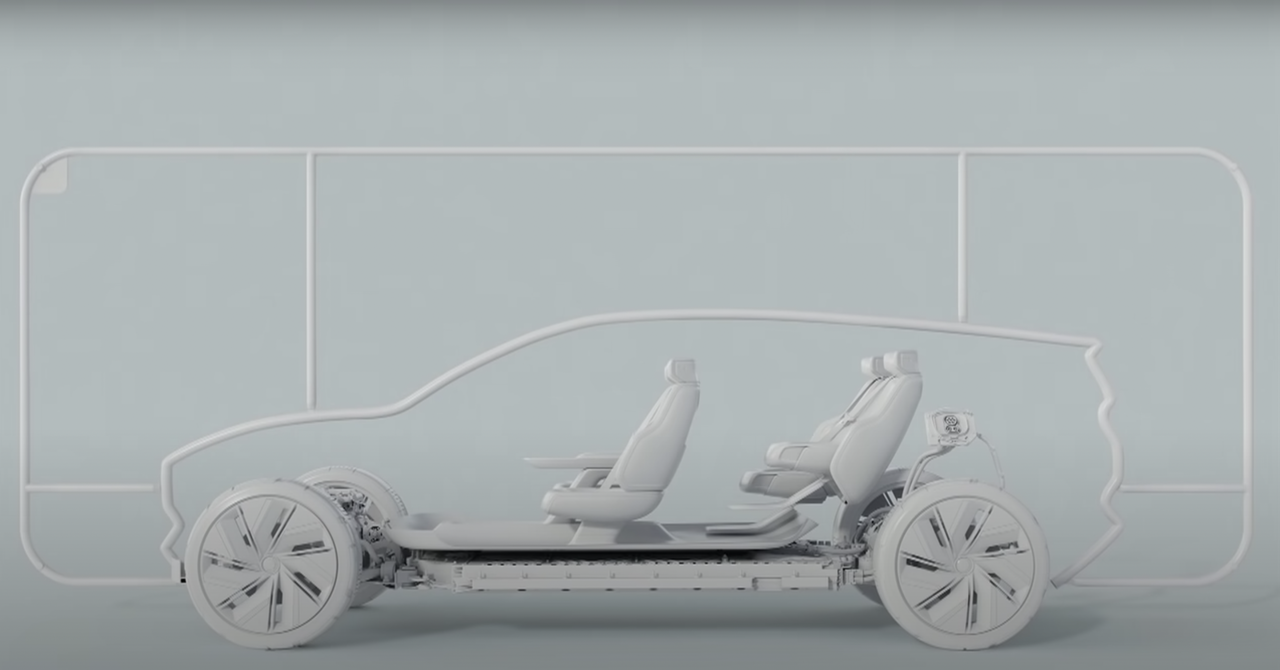

Volvo’s third-generation battery will remove the aluminum slot for the fixed battery pack. At the bottom and top, a “sandwich” structure similar to a plate is used to support the rectangular battery arranged in the middle. In fact, the battery has become part of the chassis, serving as a structural component to withstand torsional forces. This is similar to Tesla’s CTC technology, which is another extreme for battery replacement. It can be expected that many cars will use similar CTC technologies in the future.

Stigler said that the advantages of this technology are a reduction in weight, an increase in physical energy density, an improvement in torsional stiffness, and better thermal management. However, like CTC, placing batteries densely in the chassis will increase the demand for heat dissipation and thermal management. Therefore, I have always been a bit unclear about how to dissipate heat.

Charging Speed

The increase in battery capacity needs to be accompanied by an increase in the charging rate to achieve a better charging experience.

Volvo plans to halve the charging speed of the battery SOC from 10\% to 80\%. By reducing the internal resistance of the battery, optimizing thermal management, and developing high-voltage system adaptability, the second-generation battery can achieve a charging power of over 200 kW.Volvo’s third-generation battery system is an 800-volt platform that supports charging power of over 350 kW and integrates bidirectional current output, which can also be used as a source of household electricity.

About “Concept Recharge”

At the end of the live broadcast, Volvo showcased the “Concept Recharge” concept car that will debut next year.

Volvo’s classic “Thor’s Hammer” and “Viking Axe” headlight designs are preserved, making it easy to recognize the Volvo brand. The headlights also achieve an “opening eyes” effect when switching between daytime running lights and high beams.

The transition between the roof and the rear of the car is almost vertical, probably to maximize interior space. The rear spoiler fixed on the rear windshield helps streamline the air flow.

Volvo has chosen to place the lidar at the junction of the front windshield and the roof, with a hollow design for heat dissipation.

In my opinion, the design of the Concept Recharge is a bit strange because it retains the look of a fuel SUV, and from the side, the length of the front cabin occupies a considerable portion of the body.

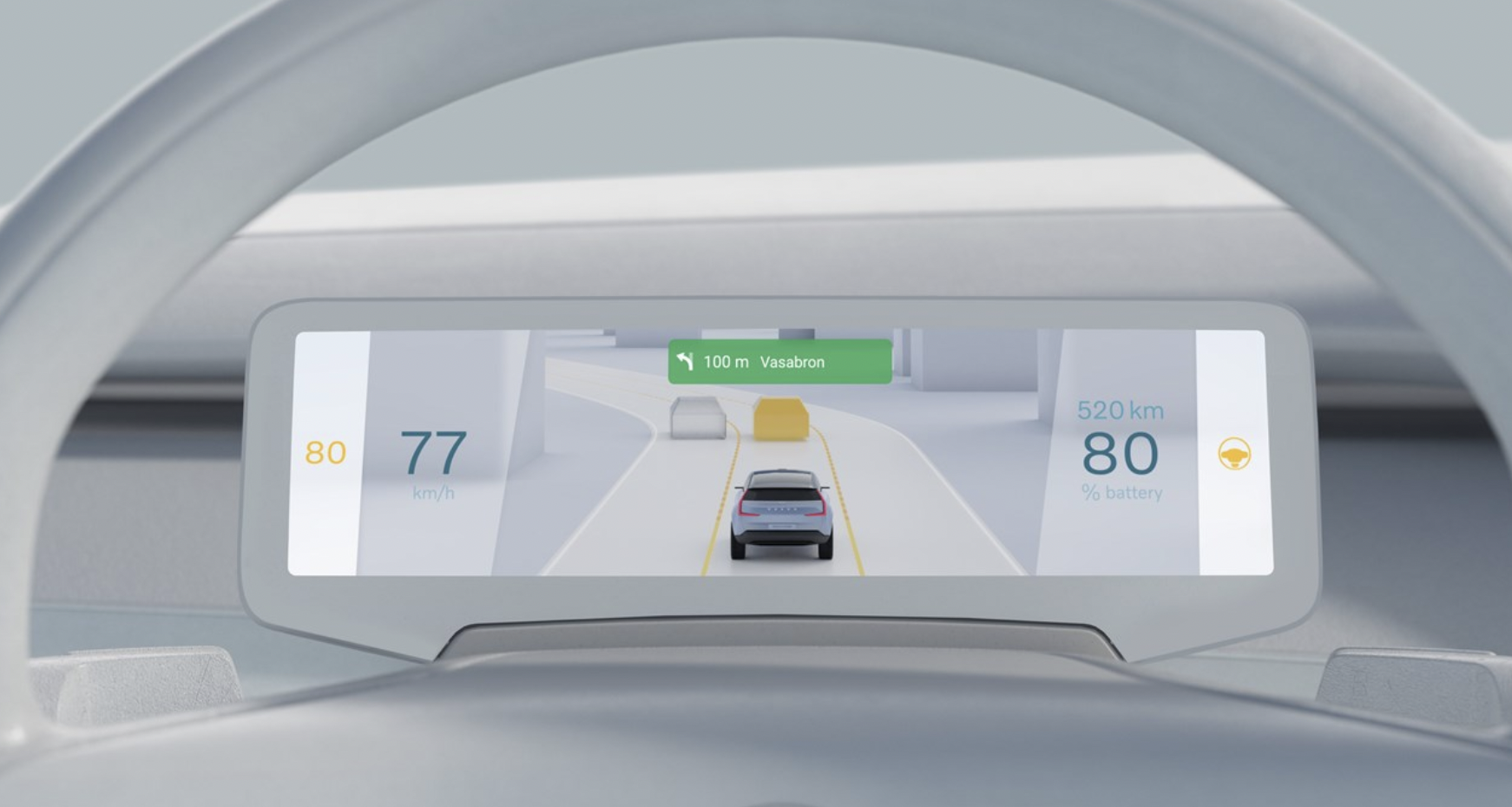

In the interior of the car, all my attention is focused on the two screens. The small instrument panel, vertical center console typical of Volvo, and a HUD projection area nearly equal in size to the instrument panel make up the main part of the cabin’s interior interaction.

The instrument panel serves as the main visualizer and also displays information such as battery life and vehicle speed. The center console anchors the map display and has a dock at the bottom with the home, app library, air conditioning, settings, and hazard light buttons, and the middle of the console has modular displays for music, vehicle information, and other functions.

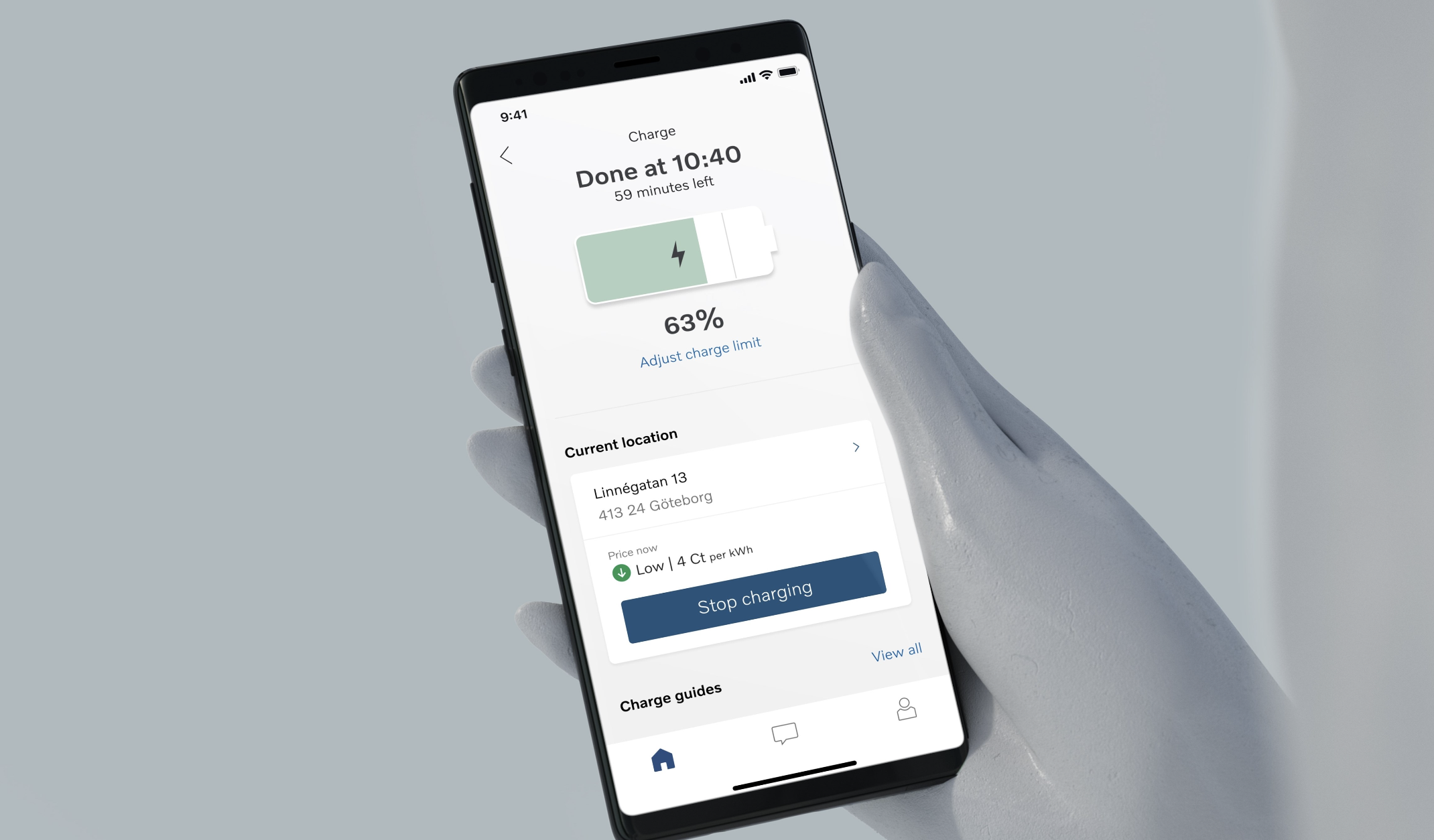

The UI of the entire VolvoCars.OS system is white, and the design style is relatively simple. At the same time, Volvo also showcased a new version of the mobile app, which only showed online connectivity and charging status and did not exhibit any other functions.

Final Note

Volvo CEO Hakan Samuelsson began the live stream by acknowledging Volvo’s accomplishments over the past decade.

In the past 12 months (the second half of 2020 and the first half of 2021), under adverse conditions such as the COVID-19 pandemic and chip shortages, Volvo sold approximately 770,000 vehicles, nearly achieving the company’s 10-year-old goal of selling 800,000 vehicles annually and becoming an excellent “traditional fossil fuel vehicle company.”

It appears that this 70-year-old man is quite satisfied with his accomplishments. In the next 10 years, Samuelsson has decided to lead Volvo into the embrace of electrification. This is not just joining the trend of the times – Volvo aspires to become a “high-end pure electric car company”!

A few days ago, Samuelsson publicly announced the resumption of Volvo’s IPO plan in Sweden and said that the progress is good and it will be completed by the end of this year.

Volvo needs to use tags such as “electrification”, “autonomous driving”, and “software team” to increase its valuation, as well as incorporate more new technologies and talents to enhance its strength. Perhaps in the era of pure electric vehicles, Volvo can truly succeed in the high-end pure electric car market, which has a relatively low technology barrier, by making the most of its strength.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.