Author: Tian Hui

Finally, the Beijing auto market has come to life with the issuance of new indicators.

On May 26th, Beijing issued 60,000 electric vehicle indicators, including 32,520 household indicators and 21,680 individual indicators, and more than 54,000 private consumers obtained the indicators. They will release the purchasing power that has been suppressed for many years in the coming year.

For car companies, this is the most important marketing point of the year. However, the market reaction on the first weekend after Beijing issued the new indicators was not so intense.

Although various car dealers held promotional activities in their stores on the first weekend after the issuance of the new indicators, large vehicle models and group buying events were hard to find in the auto market.

Beijing’s motor vehicle quota policy has been in place for more than 10 years, and the issuance of electric vehicle indicators based on the order of the queue has entered its eighth year. After years of concentrated stimulation by releasing indicators, the relative calm after the issuance of the new indicators in 2021 indicates that Beijing’s electric vehicle consumption is approaching the regular automobile consumption pattern.

The result is that in the Beijing electric vehicle market of 2021, strong brands are no longer seeking to please customers who have obtained indicators. Cars with indicators are basically out of stock, and consumer preferences are increasingly upscale, with Tesla and new car forces rising as a result. In addition, the supermarket model has clearly proven effective.

Earn a “lay-down” profit of 5000 yuan with the electric vehicle indicators

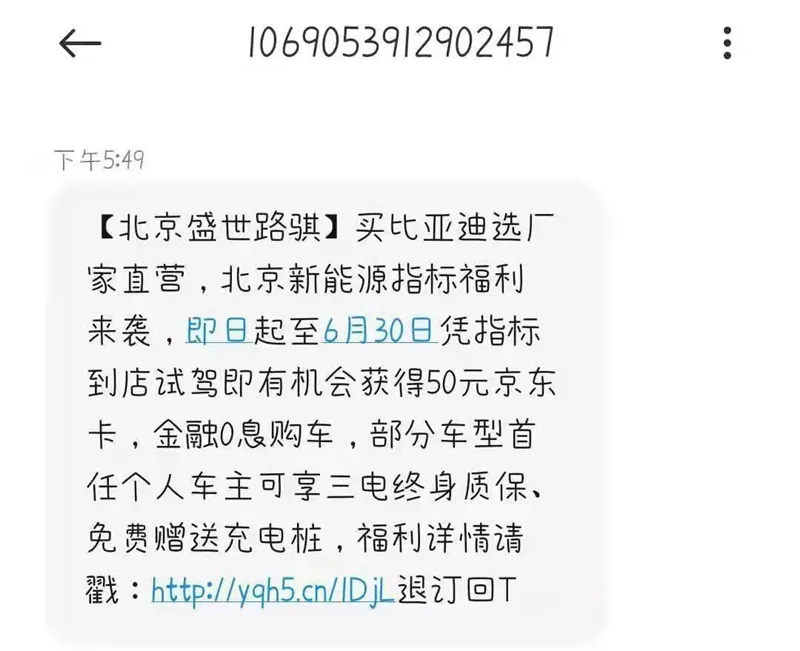

A 500 yuan JD card is the bottom price for “wool shearing” for Beijing’s customers who hold purchasing indicators. As long as you go to the electric vehicle 4S stores to test drive, whether you buy or not, you can get a 500 yuan JD card or equivalent gift.

The fundamental reason for this unspoken rule is the electric vehicle purchase restriction policy.

Because of the purchase restriction, potential customers may not be able to buy a car, which makes Beijing dealers suffer. It doesn’t matter how many customers without indicators they acquire because they cannot be converted into orders. Only by obtaining information about customers who have indicators can they be converted into sales.

“Whoever obtains more indicator clues will have the advantage.” Spending money becomes a common selection method.

The issuance rules for Beijing’s electric vehicle indicators are also extremely special. On May 26th of this year, all electric vehicle indicators for the entire year were issued at once, and consumers who obtained indicators must purchase a car within a year. Therefore, each car company must obtain sales leads for customers with indicators before and after the issuance of indicators.

Having customers with indicators come to the store and offering a 500 yuan JD card souvenir is direct and effective, but it is also the best approach.

After the indicators were released in 2021, Beijing Automotive New Energy, GAIC Aion, XPeng, WM Motor, Volkswagen, Chevrolet, and Hyundai, from independent to new forces to joint venture automakers, all offered a 500 yuan JD card as a gift for consumers.

The gift idea began in 2018, and has become increasingly bizarre. For example, some brands offer 800 yuan JD cards instead of just 500 yuan. Once, a new car-making enterprise offered customers with indicators RMB 1000 in cash.

Every year, consumers who get the indicators can easily make RMB 5000 by test driving various electric cars from different automakers.

The gifts, advertising promotion, and social media marketing costs behind them have driven up the cost of customer acquisition in Beijing. It is common for a dealer’s customer acquisition cost to be in the tens of thousands of RMB, with some exceeding hundreds of thousands of RMB.

But, is it worth it for automakers to spend so much money vying for customers with indicators?

Yes.

It is easy to find 10,000 potential customers by casting a wide net, but finding 10,000 indicators is difficult. With 22 million permanent residents in Beijing, only 54,000 people have indicators each year. Finding indicator-holders is like finding five ordinary people from a crowded square of 2,200. This is why paying RMB 500 for a precise indicator lead is a great value.

The competition between automakers and dealers is all about the ability to obtain indicators, and then the competition for products and services.

In 2021, signs of loosening are appearing in the battle to grab indicators.

Beijing’s electric vehicle market leader, BYD, as well as Tesla and NIO, the leaders of new automakers, are all keeping a low profile. BYD offers only a 50 yuan JD card; NIO gives away a smart speaker with a cost of less than 100 yuan; the most stingy of all is Tesla, which only gives away a paper notebook.

These three top automakers have a combined market share of nearly 60% in Beijing’s electric vehicle market.

Whether or not the restrained attitude of these top automakers can create a driving effect, at least it shows that the top automakers believe that pleasing customers who already have indicators is meaningless, and that having a competitive product is the key.

There are bestsellers every year, will it be the Model Y this year?

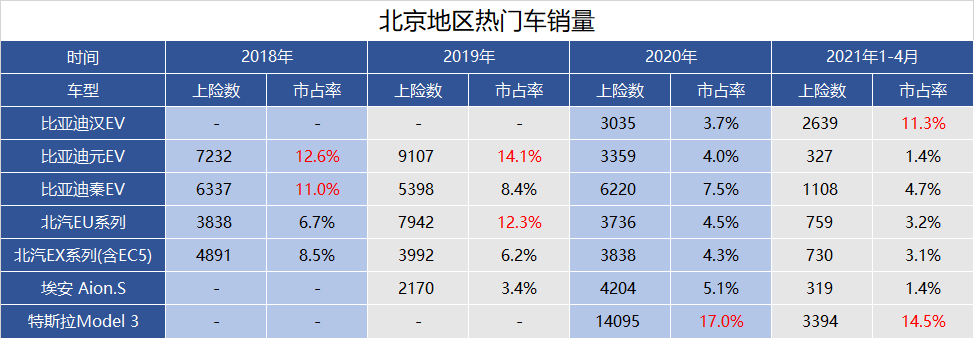

One or two best-selling cars with a market share of over 10% are the hallmark of Beijing’s electric vehicle market every year.

In 2021, the best-selling cars trend towards high-end models.

Compared to electric cars with a range of 300 kilometers, which were common a few years ago, the minimum range requirement for electric vehicles in Beijing’s market has now been raised to 500 kilometers.The customer is interested in the Song Pro EV with a range of 500 kilometers, but not interested in the Element EV with a range of 400 kilometers. According to salesperson Laoma who has had five years of experience selling electric vehicles at BYD and was interviewed by “Electric Vehicle Observer”, “The price difference between the Song Pro EV and the Element EV is about 50,000 yuan, but consumers still prefer cars with longer ranges.”

The Element EV, mentioned by Laoma, was a popular model of BYD in 2018 and 2019, with annual sales of nearly ten thousand units. Customers once paid an extra ten thousand yuan to buy the EV priced at only 100,000 yuan, which shows the popularity of the Element EV at that time.

However, the glory of the Element EV is no longer present. From January to April this year, its insurance registration only reached 327 vehicles, and it has dropped out of the top sales ranking.

The decrease in sales of the Element EV represents a phenomenon where the market share of small and micro electric vehicles is collectively declining, and this phenomenon is even spreading to compact cars. The sales of compact cars such as BAIC New Energy EU5, BYD Qin EV, and GAC Aion S are also trending down.

Li Jinyong, Chairman of the China Council for the Promotion of International Trade Automobile Dealers Association and Chairman of the New Energy Branch, believes that, due to the restrictions on car purchases in Beijing, consumers’ purchasing power is suppressed, and they tend to buy higher-end electric vehicles once they obtain quota access. In 2021, 32,000 quotas were granted to households without cars, and they have stronger purchasing intentions than individuals with existing quotas. Additionally, these families have a larger demand for space, which further drives the market towards high-end products.

Moreover, as the number of gasoline car quotas in Beijing further decreases, more families and individuals who urgently need to buy cars are squeezed into the electric vehicle quota pool, intensifying their willingness to buy electric cars.

This trend is verified by the insurance registration data. In 2020, the only model in the Beijing market with a market share of more than 10% was the Tesla Model 3. From January to April 2021, both the Tesla Model 3 and BYD Han EV had a market share exceeding 10%, and they are both pure electric sedans priced at over 200,000 yuan.

The trend towards high-end vehicles in the Beijing auto market has been evident since 2020 and is expected to further intensify in 2021.

At a XPeng Motors experience store in western Beijing, salesman Xiaowang told “Electric Vehicle Observer” that customers at the store are noticeably more interested in the sedan P7 than the G3, even though the latter is an SUV model.

In a WeChat group called “Beijing Car Enthusiasts”, a user named “Jrrr” obtained a car purchase quota and said in the chat, “I’m just going to look at NIO and Tesla, and then buy one.”There is no doubt that the trend of high-end market in Beijing may be irreversible as the restrained purchasing power has been gradually released. Small and micro electric cars will continue to shrink.

The high-end electric vehicle market in 2021 is really lively.

NIO’s ES8/ES6/EC6 three models, Tesla’s Model Y/3 two models, BYD’s Han Tang model, XPeng P7, and traditional car manufacturers’ high-end electric brands such as Voyah and Jiqu, as well as fuel-guzzling car brands’ electric vehicles, will compete in the electric vehicle market together.

And in the high-end market, the most likely blockbuster car is undoubtedly Tesla Model Y.

In terms of driving range, power, space, brand, price, etc., Model Y meets the needs of Beijing consumers.

Tesla salesperson Xiao Cui, who has been engaged in sales for 2 years, told “Electric Vehicle Observer” that several of her clients switched from buying Model 3 to waiting for delivery because of the space issue of Model 3.

In the eyes of competitors, Model Y is also a strong opponent.

NIO salesperson Xiao E is already tired of answering the differences between NIO ES6 and Model Y. Almost every potential consumer has compared the two.

After the Shanghai Auto Show rights protection event, the order volume of Tesla Model 3 was affected, but the terminal delivery volume of Model Y did not decrease and it is still in a state of difficulty in getting a car.

At the Tesla Experience Center in eastern Beijing, salesperson Xiao Jiang told “Electric Vehicle Observer” that consumers prefer Model Y, but the delivery time is longer, ranging from 2 weeks to a month. New indicators give loan discounts for ordering Model 3, but not for Model Y.

From the feedback of competitors, terminal discounts and delivery cycles, it is almost inevitable that Model Y will become a blockbuster.

Data has shown that there is a trend of Model Y outbreak. After the New Year’s Day, the number of Model Y insured in Beijing has reached 2316, and there is a trend of surpassing Model 3. If the factory’s production capacity does not have problems, Model Y is destined to become a blockbuster in the Beijing car market.

The hot sale of Model Y may form a follow-up effect, driving the overall sales of high-end pure electric SUV market to rise.

New Retail shows its power

From the number of insurance insured, in the private market, in the first four months of this year, the number of Tesla insured exceeded that of BYD’s pure electric vehicles.

And one of the key factors that contributed to Tesla surpassing BYD was the change brought about by the new retail marketing model for automobiles.

Tesla had an average of more than 300 insurance purchases per store in 17 Beijing malls, while BYD had fewer than 200 insurance purchases per store in 30 stores in Beijing (including 9 mall stores).

In terms of the overall market, Tesla and NIO, which mainly have mall stores, have significantly higher insurance purchases per store than traditional 4S stores represented by BYD and GAC Aion.

This trend can also be seen from the insurance purchase situation of XPeng and WM in Beijing. XPeng focuses on the mall store model, while WM primarily sells through traditional 4S stores. Since 2018, WM’s market share has fallen below 1%, while XPeng has steadily risen to become the third highest insurance purchase-making new car brand.

In Beijing, where every inch is precious, most traditional 4S stores have moved to the fifth ring road far away from the city center due to the policy of relieving traffic congestion, while mall stores are built inside convenient shopping centers, making them easier to reach consumers.

The combined market share of Tesla, NIO, and XPeng, the three new retail mode automakers in the Beijing market, is nearly 40%, and even BYD has opened stores in shopping centers. In the future, the competition among car companies for core shopping mall resources in Beijing will become even more intense.

The Life-and-Death Battle at the Bottom of the Sales List

The Beijing electric vehicle market has a clear head-effect.

The market share of the top three has remained above 60% until 2020, when it fell to 50%.

BYD has been the champion of pure electric vehicle sales for many consecutive years, while BAIC New Energy is gradually declining and fell to third place in 2020, surpassed by Tesla.

In the first four months of 2021, the market share of the top three automakers, Tesla, BYD, and NIO, returned to 57%. Below the top three, first-tier self-owned brands, new automaker forces, and joint venture automakers are engaged in fierce competition.

In 2020, GAC Toyota had more than 2,500 electric cars insured in Beijing, surpassing XPeng Motors. In the first four months of 2021, the number of pure electric cars insured was nearly 300, showing a clear upward trend.

Similarly, the sales of Volkswagen pure electric cars are gradually increasing, with more than 260 cars insured in the first four months of 2021.After the release of new indicators, joint venture brands may continue to improve their sales performance due to their channel advantages. The top three companies continue to maintain their dominant position, while the sales of middle-tier automakers have increased. The disappearing part includes tail-end automakers.

Especially, automakers that focus on producing small and micro electric vehicles are facing tremendous pressure. In the past, consumers who had a large demand for these vehicles are now the minority.

Tail-end automakers that cannot win enough indicator clues in the scramble for indicators, and products that cannot be quickly adjusted to meet the demands of the Beijing market may face the embarrassment of exiting the Beijing market.

As the domestic private electric vehicle market that started the earliest, Beijing’s electric vehicle market has created two types of vehicle consumption markets, thanks to the policy of grade separation of oil and electricity in the early stage. On one side is the high-end oil vehicle consumption market full of BBA (BMW, Benz, and Audi); on the other side is the electric vehicle consumption market mainly occupied by small compact cars.

After nearly two years of adjustment of the lottery policy, oil indicators were reduced while electric vehicle indicators remained unchanged. Moreover, priority was given to families without cars, making consumers who newly obtained indicators highly willing to buy vehicles, leading to an increase in demand for high-end and large-sized electric vehicles that is similar to the characteristics of the oil vehicle consumption market.

Meanwhile, high-end electric vehicle products from Tesla, NIO, BYD, and other automakers have already possessed the strength to attract consumers with fuel vehicle indicators to buy electric vehicles, and even eat into the fuel vehicle market.

The confrontation between electric vehicles and fuel vehicles in Beijing has already begun. Will it spread to the whole country?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.