This article is authorized by Chuxingyike (WeChat ID: carcaijing), created by the Transportation Industry Team of the “Economic” Magazine, written by Li Yang and Wang Ying, edited by Shi Zhiliang and Lu Ling.

At the forefront of the battery industry, CATL (Contemporary Amperex Technology Co., Ltd.) has begun to diversify, which may be a new starting point but also a turning point for giants.

On May 31st, the first trillion-dollar market value company on the ChiNext board was born. CATL (stock code 300750.SZ), founded in 2011, China’s leading power battery company. Its stock price hit a historical high of RMB 435.57 per share, with a closing price of RMB 434.10 per share, an increase of 5.98%, and the company’s market capitalization reached RMB 1011.2 billion. However, on June 1, the stock price dropped slightly, closing at RMB 425.34 per share, falling below the trillion-dollar mark, and its market value was RMB 990.8 billion.

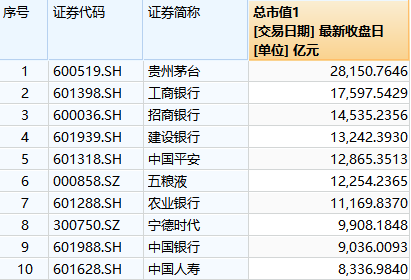

CATL currently ranks first on the ChiNext board, second on the Shenzhen Stock Exchange (SZSE), only after Wuliangye (a liquor brand), and eighth among all A-share listed companies.

In terms of the industry, CATL has the highest market value in the Chinese automotive and parts industry. Its current market value is about the sum of BYD (002594.SZ), SAIC Motor (600104.SH), Great Wall Motors (601633.SH), three automakers in China.

Undoubtedly, CATL has already reached the pinnacle of the battery industry. However, CATL is no longer satisfied with its identity as a battery supplier. Its business has transformed from simple battery supply to more complex and diverse energy services.

However, diversified businesses have always been a double-edged sword. New business areas also mean unknown risks. In a more complex competitive environment, whether CATL can continue to thrive is full of uncertainty.

The path to trillion-dollar market cap

Looking back at CATL’s growth path, the company was founded in 2011 and primarily engaged in the research, development, production, and sales of new energy vehicle power battery systems and energy storage systems. In June 2018, only 24 days after the “flash” review, CATL was listed on the ChiNext board of the SZSE, with an issue price of RMB 25.14 per share and a market value of nearly RMB 50 billion.

In three years, CATL’s stock price has been rising all the way, especially from about RMB 70 per share in November 2019 to over RMB 400 per share now, during which the stock price has occasionally adjusted, but each time it has set new highs. Currently, CATL’s stock price has risen more than 16 times compared to its listing.”Fund purchased during the Chinese New Year has broken even, primarily thanks to Ningde Times New Energy. ” Some investors expressed on social media. However, some investors also pointed out that Ningde Times New Energy’s P/E ratio of 129 times is severely overvalued. A significant reason for this is institutional speculation.

For Qi Haisheng, the CEO of Beijing Teeyo Sunshine New Energy, what supports Ningde Times New Energy’s trillion-dollar market value is the prosperity of the new energy battery industry, as well as Ningde Times New Energy’s position in the industrial chain of China’s power battery industry.

He stated in an interview with “出行一客(ID:carcaijing)” that it was not surprising for Ningde Times New Energy to exceed a trillion-dollar market value. The hot new energy vehicle industry, coupled with the stimulation of “cross-border car manufacturing,” has led to a significant increase in demand for lithium batteries. The new energy electric vehicles, driven by “product-driven” market demand instead of the previous “policy-driven” market sales, provide the most critical driving force for growth in the new energy electric vehicle industry, including the power battery industry. In the context of global carbon neutrality and peak carbon emissions, relevant stocks also have the long-term logic of an upward trajectory.

“Ningde Times New Energy’s market value surpassing China Petroleum & Chemical appears to have already decided the winner of the new energy vs. traditional energy. However, just a year ago, even the most optimistic investors found it difficult to predict such a result,” Chen Wenhui, the deputy director of the National Social Security Fund Council, said at the 2021 Sustainable Development Summit of “Caijing.” He mentions that the new energy automobile industry has shown a clear trend of leading the world by China and America. The United States relies on Tesla to lead the industry’s development, while China has cultivated three new forces of car manufacturing, attracting capital continuously and promoting the electrification transformation of traditional car companies such as BYD and Great Wall Motors, driving the rapid development of core components like batteries, motors, and controllers, forming a relatively complete and independently controllable industrial chain.

While Ningde Times New Energy hit an all-time high, the lithium battery concept sector has also been strong recently. According to Wind data, since May, the lithium battery index has risen nearly 18%. More than ten lithium battery concept stocks have seen monthly increases of more than 50% this month.

Zhang Xiaorong, the director of the Institute of Deep Technology Research, stated to “出行一客(ID:carcajing)” that, “the recent increase in the power battery industry has been significant, leading companies still have room for growth, but the price of some companies has already entered the high-risk zone.” For power battery companies, only by placing the right bet on the race can they achieve high-speed development. If there are mistakes in the technology roadmap, their future is doubtful.

Market opinions on the future market trends of lithium battery concept stocks such as Ningde Times New Energy differ.

Many institutions are confident about Ningde Times New Energy’s development. According to Wind data, about 40 institutions have released over 70 research reports on Ningde Times New Energy this year, with target prices concentrated between 430 yuan and 460 yuan.

“China Merchants Securities pointed out that Ningde Times New Energy is currently in a global expansion period. Its balance sheet is solid, and future profit margins are expected to remain stable, maintaining a ‘strongly recommended’ rating and a target price of 450-460 yuan.”It is interesting that on the same day when CATL (Contemporary Amperex Technology Co. Limited) reached a market value of one trillion yuan, Morgan Stanley downgraded its rating to “underweight” with a price target of 251 yuan, which is a 40% discount from CATL’s current stock price of over 400 yuan.

As early as November 2020, Morgan Stanley had lowered its rating on CATL to “equal-weight” and stated that the mid-term prospects of new energy batteries were already reflected in the stock price, and whether global automakers could launch new popular models may not be verified until next year.

It is noteworthy that on June 10th, CATL will lift a 952.4 million restricted shares of its original shareholders, which is worth about CNY 390.095 billion.

The foundation of a trillion market value

CATL’s achievements in the battery field are remarkable, with its products attracting the attention of car companies, production bases spread across the country, a dominant position in the market, and a market capitalization that tops the Growth Enterprise Market (GEM) Board. Looking back at CATL’s success story, whether it was the opportunity created by the national system promoting new energy development or BMW’s assistance, there were inimitable external factors. Ultimately, all of CATL’s achievements stem from its technological leadership.

A senior battery R&D engineer from an OEM told carcaijing (ID: carcaijing), “In previous years, among the batteries from more than a dozen battery companies we tested, only CATL’s batteries met all of our needs.” In the era when BYD was “making cars behind closed doors,” ignoring cost and production capacity constraints, CATL was almost the only choice in the market.

It was precisely with its excellent product quality and development capabilities that CATL, which had only been established for one year in 2012, successfully broke into BMW’s supply chain and blazed the trail for domestic lithium-ion battery companies to enter international mainstream vehicle manufacturers. While in the process of cooperating with BMW, in addition to continuously increasing its brand awareness, CATL also continuously absorbed foreign battery technology advantages, improving its product performance and quality.

The above-mentioned engineer revealed to carcaijing, “There are rumors that BMW will directly provide CATL with the technology agreement with Samsung SDI to help its battery product technology improve rapidly.” Regardless of whether this is true or not, in the supply relationship with BMW, CATL’s technology level has indeed made a qualitative leap.

In 2017, CATL’s sales of power batteries surpassed Panasonic, making it the global leader in power batteries just six years after its establishment, and it has maintained its leading position in power batteries among domestic battery suppliers. CATL is also the only Chinese battery supplier that can compete head-to-head with foreign battery manufacturers in terms of product technology.The technical advantages have enabled CATL to rise rapidly in the new energy industry, and the company continues to improve its technology and maintain a leading position in product quality. This is evident in CATL’s annual R&D investment, which according to the annual report, has increased steadily over the past few years even as revenue continues to soar. R&D investment has been maintained at over 6.5% of revenue.

With such a large R&D investment, CATL is nearly unparalleled in the battery industry. Furthermore, the company has the largest R&D team in the world. As of December 31, 2020, CATL has 5,592 R&D technical personnel and a total of 2969 domestic patents and 348 foreign patents. The company also has a combined total of 3454 pending domestic and foreign patents.

In addition, CATL is building a 21C innovation laboratory that will be benchmarked against international first-class laboratories. The research direction includes next-generation battery development such as metallic lithium batteries, all-solid-state batteries, and sodium-ion batteries. According to recent news, CATL will announce its latest research results in sodium-ion batteries in early July this year. Regardless of the past, present, or future, CATL’s technological advantage will be its greatest reliance in market competition.

Not just a battery supplier

In the field of power batteries, which is the core component of new energy, CATL is undoubtedly the NO.1. However, CATL is no longer satisfied with being just a supplier of batteries.

On August 11, 2020, CATL announced plans to invest RMB 19 billion to invest in high-quality listed companies in the domestic and foreign supply chain. The purpose of upstream investment is undoubtedly to reduce costs and stabilize overseas supply chains. Downstream investment places greater emphasis on diversified applications, which is intimately connected with CATL’s transformation into an energy service provider.

In the second half of 2020, CATL and NIO jointly established a battery management company focusing on vehicle and battery separation. For CATL, the layout of battery exchange management and other services not only expands the battery application market but also generates energy storage battery operation experience. Analysis by automotive industry analyst Ren Wanfu indicates that “CATL’s active participation in battery exchange is mainly for pilot projects and early layout. In the long run, the scale of private cars will far exceed the B-end market, and cooperation with car companies like NIO and Xpeng will be more likely to yield results.”

Clearly, CATL’s underlying strategy is to expand the layout of upstream and downstream by leveraging its battery technology while actively laying out new battery application scenarios. A CATL insider revealed to “ChuxingyiKe (ID: Carcaijing)”, “CATL is extending its upstream and downstream layout, with strategic and financial investments.”In July 2020, CATL (Contemporary Amperex Technology Co Ltd) established a joint venture with Henan Yuxin Intelligent Machinery Co Ltd to provide a complete solution for electric intelligent unmanned mining. According to the economic model, a single electric mining truck can save nearly RMB 3 million in energy costs each year. At the same time, unmanned mining operations help reduce safety accidents in mining areas. Some analysts believe that CATL may provide power batteries for unmanned mining trucks and energy storage businesses for information digital centers and other infrastructure.

In 2021, CATL is accelerating its battery production capacity expansion and investing heavily in its industrial chain. Downstream of the battery, CATL’s investment range covers many fields including energy storage, charging infrastructure, battery swapping, autonomous driving, travel companies, vehicle manufacturing, automotive chips, and more. Although diversification has been a double-edged sword throughout the history of business, it is both a key to rapid expansion and also a turning point from prosperity to decline. However, with a diversified business, CATL’s future prospects are promising.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.