*Author: Sun Li

The Shanghai Auto Show will officially open on April 19th with the slogan: Embrace Change.

As one of the few top auto shows held on schedule globally, the Shanghai Auto Show carries the expectations of numerous automotive enterprises, with many new products set to debut.

New energy vehicles are undoubtedly the absolute protagonist. Since last year’s Beijing Auto Show, traditional fuel-powered vehicles have lost the glory they once had at auto shows – the stage for showcasing technical prowess and forward-looking products.

Perhaps in order to stagger their efforts, a few enterprises have released their “big moves” just before the auto show, with new and old forces taking turns.

- On April 13th, the veteran automaker Ford released the domestic version of the Mustang Mach E, positioning the new car directly at the Model Y.

- On April 14th, XPeng Motors released its first model equipped with a lidar, the XPeng P5, kicking off the mass production of lidar.

- On April 15th, the newly independent Geely sub-brand Zeekr released its first model, the Zeekr 001, under the SEA platform, becoming the pioneer for Geely’s high-end push.

- On April 17th, BAIC BluePark joined forces with Huawei to release the BluePark Alpha S, which is equipped with Huawei’s full set of automatic driving system solutions and can realize high-level automatic driving in urban areas.

What’s important is that these models are not futures, but rather models that have already been or are about to be pre-sold, and can be delivered within the year.

In addition to models that have already been publicly released through press conferences, some models will also make their debut at the Shanghai Auto Show, such as Mercedes-Benz’s EQS, BMW’s IX, Volkswagen’s ID.6, and Hyundai’s IONIQ. These models are also expected to hit the market this year.

The fresh feel of the new designs and the abundant application of new technologies have provided enough impact to the outside world.These car models will represent the new design language, technological strength, and brand image of car companies in the era of electrification and intelligence. If you want to quickly grasp the cutting-edge trends, these car models will undoubtedly be the most worth seeing models at this year’s Shanghai Auto Show.

Below, we will focus on several popular car models that were recently released before the auto show.

Startling the World by a Single Sound

The outside world has always believed that the first to launch conditional autonomous driving in the most difficult urban scenarios are either autonomous driving startups targeting robotaxis, disruptors like Tesla, or new car makers.

But unexpectedly, it was Huawei.

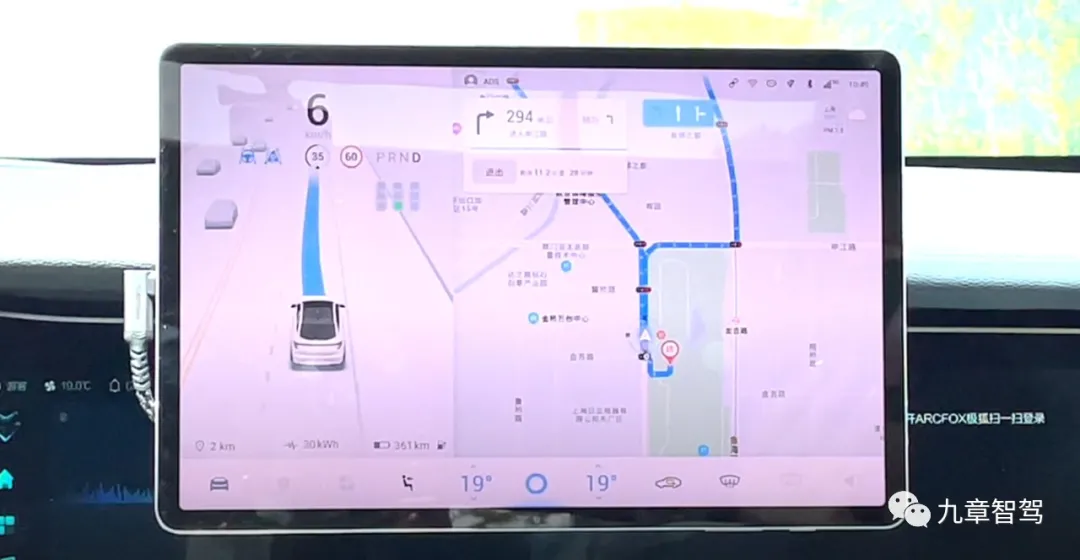

On April 16, 2021, the eve of the release of the Alpha S from JIMU, Huawei organized an ADS advanced autonomous driving test ride event in Shanghai R&D Center and opened the test ride experience to the media. Nine Chapters participated in this experience.

Background of the test ride vehicle:

-

The JIMU Alpha S uses Huawei’s most advanced 3-96 line vehicle-level lidar mounting solution, which can achieve a 300-degree field of view. It is also equipped with six millimeter-wave radars, 12 cameras, and 13 ultrasonic radars.

-

The test ride vehicle is currently still in the engineering vehicle state, but it is very close to the final mass production model. Huawei has adapted it for only about two months, and the completion rate of the adaptation is only 30-40%. There are still nearly six months before delivery, and the experience of the final mass production version will be better.

Test ride scenario and time:

Due to time constraints, this time, the most difficult city open road sections were the focus of the experience, and there was no driving on city expressways such as middle ring and outer ring. However, Huawei stated that the scenes of highways and city expressways are simpler, and Huawei’s N-high-level autonomous driving capability is equally applicable and provides a better experience.

The test ride location was in the Jinqiao Industrial Park, Pudong New Area, Shanghai, and the entire route was open city roads. The time was from 10:00 a.m. to 11:30 a.m. and from 2:00 p.m. to 4:30 p.m.

The entire route includes various lanes such as two-way single lanes, two-way four lanes, six lanes, and eight lanes. Due to the change in the number of lanes, there are a large number of intersections where lane merging occurs, and the road speed limit ranges from 30 to 70 kilometers per hour.The total length of the route is about 12 kilometers, in a counterclockwise direction. This direction features numerous challenging left turns, many of which are unprotected and extremely difficult. The route simulates the daily commute of users in an urban area.

There is no V2X along the entire route, and the autonomous driving capability is completely dependent on the intelligence of the bicycle.

Test ride results: 0 takeovers throughout the entire route.

Summary of Test Ride Experiences:

- The vehicle successfully recognized all traffic signals. The four forward-looking cameras, including long-distance, wide-angle, and binocular mid-range cameras, can achieve long distance traffic light recognition. Currently, the ability to read traffic light timing has not been added, but it can be upgraded in the future.

- The lane-changing capability of the vehicle is very close to that of human drivers.

The lane-changing process is clean and tidy, and there is almost no extra sway of the vehicle after the lane change is completed.

In terms of lane-changing time, it is more proactive. For example, it actively avoids the bus lane and actively changes lanes to overtake slow vehicles when the two side lanes are relatively empty. In addition, when it is necessary to change lanes to the left or right for turning at the intersection, the change is made in a relatively early time.

- The vehicle can autonomously decide on its speed and following distance based on road conditions.

During this test drive, the speed of the vehicle reached nearly 70 kilometers per hour, and when the traffic flow was normal, the vehicle would quickly accelerate to the speed limit range, maintaining the maximum speed limit. In addition, considering the commuting efficiency of the lane, Huawei engineers stated that the driver has the authority to manually increase the speed by operating the lever at this time.

During low-speed driving, the following distance from the front vehicle is very close, and the anti-cut-in ability is relatively strong.

When road conditions are complex, the vehicle will adopt a more defensive driving style. For example, when the vehicle senses parked cars, people or electric bicycles on the sides of the road, it will simulate human drivers and actively limit the speed to avoid “ghosting” situations as much as possible.

- At complex intersections, especially at unprotected left turns, when facing right-of-way games, the vehicle’s execution strategy tends to be conservative, prioritizing safety and actively giving way to others rather than taking the initiative to compete. The vehicle will not exit autonomous driving mode until it confirms that there is no danger from oncoming traffic.

- The vehicle has a strong perception ability in its surrounding environment at close range, especially in recognizing pedestrians, electric bicycles, and other targets in front of and on both sides of the vehicle, with a high accuracy rate in recognizing static small objects like traffic cones.

It is capable of autonomously identifying dangerous targets, such as vehicles quickly approaching from both sides of the lane or pedestrians, electric bicycles and other targets that are too close to the vehicle. When the system judges that these targets may interfere with normal driving, they are displayed in yellow or red on the display screen for the convenience of the driver’s observation.

After identifying the target, the vehicle will actively avoid pedestrians, electric vehicles on the roadside, and buses running side by side.

One can feel that the combination of lidar and high-precision maps can play an important role in improving the perception system in complex urban environments.

The most intuitive experience throughout the test drive process is that the vehicle will do its utmost to ensure that it does not exit the autonomous driving state, avoiding situations that require the driver to take over and ensuring the continuity of the experience.

In the event of an emergency situation requiring an abrupt stop or road right-of-way dispute, the vehicle may be in a stopped state but will not exit the autonomous driving mode, and will resume autonomous driving once the situation stabilizes.

In my memory, there was only one instance of an abrupt stop: when the vehicle was passing through a green light intersection and a vehicle and a delivery van suddenly turned left onto the opposite lane. The vehicle began an emergency brake, decelerated, but did not stop nor require the driver to take over, and continued its autonomous driving. Even a human driver might react awkwardly in such a situation.

It should be noted that the above test drive experience is limited to the driving route of the day. Due to time and venue limitations, we did not experience its driving performance on city expressways, highways, and in more congested morning and evening peak hours. After the vehicle is officially launched, we will pay attention to the driving experience of higher-completion delivery versions.

The BJEV Arcfox Alpha S is a vehicle that is the result of a deep cooperation between BAIC and Huawei.The mechanical structures, including the body, chassis, and power system, of the vehicle are mainly developed by BAIC, while the development of intelligent technologies such as autonomous driving, smart cockpit, and intelligent connectivity, are led by Huawei. As a result, this is a Huawei-branded car with true “Huawei Inside”.

Huawei was the first to implement high-level autonomous driving technology in mass-produced passenger cars with the Robotaxi, which came as a “surprise” to the outside world but was viewed as an accumulation of experience by Huawei internally.

After test driving, Huawei’s head of autonomous driving, Jing Su, held an open group interview and had a very candid discussion on Huawei’s autonomous driving-related issues. The following are key highlights of the discussion:

- Huawei has invested enormously in the field of autonomous driving, with nearly 7 years of research and development experience starting from its Connected Car Lab. The autonomous driving department currently has a team of around 2,000 people, including nearly 1,200 algorithm experts, and has been conducting algorithm research for more than 5 years, with its vehicles traveling millions of kilometers every year.

The current R&D budget is USD 1 billion per year and is expected to grow by 30% annually. Huawei has developed its own full-stack capabilities in terms of perception, computation, data, hardware, and software, and has no profit requirements for its autonomous driving business in the short term.

- Huawei’s autonomous driving solution has three modes for achieving different functionalities: NCA mode, ICA Plus mode, and ICA mode.

The autonomous driving mode available in the test drive of the BAIC Arcfox Alpha S in the city is NCA mode, which features a pre-installed high-precision map and an end-to-end autonomous driving system.

The NCA function will first be launched in the four first-tier cities of China after the vehicle’s delivery, and other batches of cities will be opened every quarter thereafter. The plan is to gradually cover second-tier and third-tier cities.

In ICA Plus mode, vehicles do not have high-precision maps and cannot achieve complete point-to-point autonomous driving, but they can learn and share information independently, such as sharing map information with other vehicles. This can produce a highly accurate map with the participation of numerous vehicles.

ICA mode is an L2+ advanced driving assistance system similar to Tesla’s Autopilot.

-

Huawei ADS has a reliable and complete solution for adverse scenarios such as tunnels and storms, and the experience of automated parking (AVP) will reach the top level of the industry.

-

The computing plan that Huawei ADS is equipped with is ADCSC, which is a specially customized supercomputing platform that is different from general-purpose MDC products. The computing power can reach up to 400 TOPS, and the advanced version will be equipped with 800 TOPS. This is currently the most powerful computing product among mass-produced autonomous driving computing platforms and is not a futures product.5. Huawei also has a self-learning feature similar to Tesla’s Shadow Mode, called DDI, which can learn the driving behavior and habits of car owners and continuously optimize and iterate driving capabilities.

6. Huawei has the qualification for high-precision map collection, currently having two collection systems: Roadcode HD and Roadcode RT. Roadcode HD is similar to traditional map merchants’ high-precision maps, collected by a dedicated drawing team. Roadcode RT is the vehicle’s self-learning map, which is autonomously learned by the vehicle through crowdsourcing and uploaded to the cloud.

- Huawei will focus on cooperation with automakers to build cars. In cooperation with BAIC, BAIC is mainly responsible for the mechanical and chassis systems of the vehicle, while Huawei is responsible for digitalization, intelligence, cabin and backend cloud.

The development time of the first car is about 3 years, and the development speed of subsequent models will be accelerated, with the fastest time being shortened to 24 months.

Currently available cooperation information includes deep cooperation between Huawei and BAIC, Changan, and GAC, as well as cooperation with a major European manufacturer in China. It is expected that a series of HUAWEI Inside models will be launched in 2022.

In terms of the charging model for autonomous driving, both one-time charges and subscription charges will be available, and Huawei will also participate in revenue sharing.

8. In response to the issue of sharing driving information of vehicles from different manufacturers, Huawei has taken the lead in establishing Club. After joining Club, manufacturers can choose to combine and share the de-identified driving data of their member vehicles.

- Although the autonomous driving capability is similar to Robotaxi, Huawei will not operate Robotaxi business, as it will take at least 5-10 years for Robotaxi technology to land.

10. The hardware architecture of this generation of Huawei ADS will not undergo major changes, with little difference across different car models. The hardware update cycle is about 18 months, with a slight increase in the number of hardware sensors, while software updates will continue to be pushed.

- China’s road system is worse than that of foreign countries, but it is more suitable for training autonomous driving algorithms, and local autonomous driving companies in China are growing rapidly.

Huawei is the first company to land a high-level autonomous driving system similar to Robotaxi in mass-produced passenger cars, which is “very sudden” to the outside world, but Huawei believes it is the result of “accumulating strength for future development.”

For seven years, Huawei has continued to invest heavily in fully self-developed production, which is probably the basis for Huawei’s confidence in “accumulating strength for future development”.

Now, the biggest pressure for Huawei and BAIC may come from car prices and how to sell more cars.On the evening of April 17th, JIMU Motors officially announced the pricing for the Alpha S Huawei version, with the basic version equipped with highway navigation assisted driving system priced at 388,900 yuan, and the high-end version with urban automatic driving assistance function priced at 429,900 yuan.

Compared with models without Huawei’s automatic driving technology, they are priced at 2.519-3.449 million yuan.

The high-end version is priced about 85,000 yuan higher than the top-of-the-line version of general models, slightly higher than Tesla’s optional FSD price of 64,000 yuan. However, the higher price can bring more powerful hardware and advanced driving assistance functions, and is currently the only vehicle on the market to provide high-end automatic driving assistance functions in urban areas.

Compared with Robotaxi near a million yuan, JIMU Alpha S is more affordable in terms of automatic driving ability.

During the Shanghai Auto Show, the Huawei and JIMU booths are worth looking forward to.

Lidar starts the game

The release of XPeng P5 marks the beginning of the mass production of Lidar.

This car has been in the spotlight since the public announcement, especially due to the addition of Lidar.

Before the release of P5, XPeng P7’s NGP mode has been accumulating data and mileage continuously, and its automatic driving experience on high-speed roads is also known as the most suitable high-end automatic driving assistance system for Chinese highways.

This time, the addition of Lidar has brought new expectations, especially in unlocking urban road scenes.

The Lidar of P5 comes from Livox, a subsidiary of DJI, and is also its first car-grade Lidar HAP. They are installed on both sides of the front bumper, with a horizontal viewing angle of 120 degrees, and the exploration distance can reach 150 meters.On the P5, XPeng’s Xpilot 3.0 will evolve to Xpilot 3.5, which integrates 13 high-definition cameras, 5 millimeter-wave radars, 12 ultrasonic sensors, 2 automotive-grade lidars, a total of 32 sensors, and a high-precision positioning unit (GNSS+IMU) for visual+radar 360° fusion perception of the environment.

Compared to its competitor Tesla Model 3, P5 has 10 more sensors, and more importantly, it has lidar and high-precision maps. The downside is the computing power. Like the P7, the P5 uses two Nvidia Xavier chips, providing 30 TOPS of computing power.

In addition to autonomous driving, XPeng continues to upgrade its intelligent cockpit system on the P5.

The XPeng P5 uses the latest Qualcomm Snapdragon SA8155P automotive grade chip, which has more than three times the computing power of the previous generation, along with 128 GB of storage space and 12 GB of RAM for smoother human-machine interaction.

P5 will be equipped with the newest Xmart OS 3.0 system, with the “full-scenario in-car system” that allows all interface functions to be controlled by voice. It supports continuous conversations, semantic interrupt, semantic rejection, dual-tone zone voice recognition, and meets different passenger needs for human-computer interaction.

Regarding the three-electric system, XPeng has not released too many details. The new car’s NEDC cruising range will exceed 600 km, or provide two versions with either ternary lithium batteries or lithium iron phosphate batteries.

As the third car model of XPeng Automotive, the positioning of P5 is lower than that of P7, but in terms of intelligent configuration, P5 is even higher than P7, and P5 reinforces XPeng’s image of smart technology.

From an industrial perspective, XPeng P5 will be the first high-end autonomous driving car model to be priced below 200,000 yuan. In the price range of 150,000-200,000 yuan, XPeng P5 is undoubtedly the strongest in autonomous driving configuration and ability.

Although the price is not high, selling a good car model in this price range is not easy. Currently, in China’s new energy vehicle market, pure electric vehicles with a price range of 150,000-200,000 yuan do not have outstanding sales performances.

In terms of length and wheelbase, the XPeng P5 is 4808 mm long, with a wheelbase of 2768 mm, slightly smaller than the P7 but larger than the Tesla Model 3, and the whole vehicle belongs to the A+ grade car positioning.The competition in this market comes from mature technology, comprehensive product strength, and cost-effective fuel vehicles, especially joint venture brands, with family users as the main customer group. The different user groups undoubtedly have an impact on the positioning and design of the XPeng P5.

Unlike the emphasis on technology and sportiness in the P7, the P5 makes certain compromises in practicality to cater to the market and consumers. From the perspective of chassis and platform, the P5 and G3 come from the same platform. While creating a sense of youthfulness, it also takes into account the needs of family cars, and the design is conservative, with an overall visual experience close to an SUV.

The XPeng P5 is a “bellwether” model that uses intelligent experience as its selling point to enter the market for less than RMB 200,000, testing the market’s willingness to buy electric and intelligent technology.

If the P5 can successfully open up the market, it means that intelligent technology will become an important factor for consumers when buying cars for less than RMB 200,000. This will affect the development pace and direction of other car companies in this segmented market, including the upcoming Xiaomi cars.

After announcing its entry into the car-making industry, Xiaomi will inevitably develop high-quality intelligent electric cars for young people that are likely to overlap with the XPeng P5. The product strength and positioning of the XPeng P5 and its subsequent market performance are good research targets for Xiaomi.

The final price of the P5 may be released during the auto show. As the first intelligent electric car tailored for young people, XPeng dares to enter the market for less than RMB 200,000, demonstrating commendable courage. Its subsequent market performance deserves attention.

Rapid Landing, Sprinting to High-End

Within 23 days, from the establishment of the brand on March 23, 2021, to the official release of JiKe 001 on April 15, JiKe may have broken the record for the fastest time from the establishment of a car brand to its public release. The speed is so fast that even the official website has not been built yet.

Although an independent JiKe brand, JiKe 001 was under the Lynk & Co brand during its development. Therefore, it inherited many design elements from the Lynk & Co family in terms of design style.

The front part of the car is very similar to the Lynk & Co 03, but the large sloping roof rack at the back of the car gives it a fresh look. From the perspective of the car’s posture, this body shape is relatively rare in the market. In addition, the large sloping roof rack design is very helpful for the car’s interior space.# Geely K-Cross 001: A Medium-Sized Vehicle Targeting Pure Electric Platform

Geely K-Cross 001 is a medium-sized vehicle with dimensions of 4970 * 1999 * 1560 mm (L * W * H) and a wheelbase of 3005 mm. Its dimensions are closest to those of XPeng P7 and BYD Han, while BYD Han has a size of 4980 * 1910 * 1495 mm (L * W * H) and a wheelbase of 2920 mm.

The biggest innovation of Geely K-Cross 001 is its underlying architecture, which is the first product under the Geely SEA architecture.

As a pure electric platform from the start of design, Geely K-Cross 001 has strong competitiveness in the field of electrification. It has achieved top-level performance in the industry, especially in terms of endurance.

The battery capacity of Geely K-Cross 001 is 86 kWh and 100 kWh respectively. The dual-motor version can accelerate from 0-100 km/h in 3.8 seconds and has a maximum range of 606 km in NEDC testing. The single-motor version can accelerate from 0-100 km/h in 6.9 seconds and has a maximum range of 712 km in NEDC testing.

Geely K-Cross 001 uses the SuperVision system provided by Mobileye in the field of autonomous driving.

This is a set of 360-degree vision-based intelligent driving system with two Mobileye EyeQ5H autonomous driving chips, 15 high-definition cameras, 12 short-distance ultrasonic radars, and one 250 m millimeter-wave radar, but no LiDAR. It has high-precision maps and can complete autonomous path planning and control algorithm.

EyeQ5 chip is built on TSMC’s 7-nanometer FinFET process, with a single-chip computing power of 24 Tops, which is close to ten times that of EyeQ4. The total computing power of two chips is 48 Tops.

In addition to perception, the SuperVision system can also perform autonomous path planning and control algorithms.

For Geely K-Cross, adopting Mobileye’s solution can quickly solve the problem of L2 level autonomous driving assistance before the self-developed autonomous driving solution is mature. However, there may be some pressure on the future upgrade potential, especially for high-level autonomous driving scenarios in urban roads.

In terms of intelligent cockpit, the new car is equipped with an 8.8-inch 3D LCD instrument panel and a W-HUD full-color head-up display system.

In addition, in the dynamic chassis and interior, Geely K-Cross provides a large number of high-end configurations and luxury options, including high dynamic chassis, luxury seats, and Brembo brakes. It shows great sincerity in creating a luxurious and high-performance atmosphere.From the perspective of hardware product strength, the Zeekr 001 has the confidence to compete with the BYD Han and the XPeng P7, but it also has the highest price among the three models. The starting price of 280,000 yuan is even higher than the top configuration price of the BYD Han.

If you choose luxury options such as advanced autonomous driving and air suspension in the optional package, the price is easily over 300,000 yuan.

Price pressure comes from platform development and material costs, such as the 100kWh battery pack, the Mobileye full Super Vision system, air suspension, Napa leather seats, and other configurations. This will inevitably bring considerable cost pressure.

In addition, as the first car of the Zeekr brand, the Zeekr 001 will also play a core role in setting the tone for the brand. If the cost performance ratio is too high, it may affect the high-end positioning of the brand. To uphold the high-end brand tone, the Zeekr 001 has to increase the configuration and raise the price.

Although there are many reasons for the independent development of the Zeekr brand, the core reason is the trend of high-end positioning of domestic independent carmakers.

The hasty birth of the Zeekr brand has brought some challenges to the marketing of the Zeekr 001.

The Zeekr 001 model has too high a association with the Lynk brand, lacking sharpness and brand recognition, and its user groups and mindsets have not yet been accurately reached. The design language is also not fresh enough.

Although price and brand may limit the sales performance of the Zeekr 001, it does not hinder it from being a car with high visibility and playfulness.

More importantly, it represents Geely Auto’s strongest self-developed research and development strength and the highest car manufacturing technology, as well as the efforts and achievements of independent brands in breaking through the high-end market.

The domestic market in China should give domestic enterprises a certain amount of patience and time to grow together with domestic high-end brands.

Mustang Ahead

Unlike the Beijing Auto Show, where domestic brands acted alone, mainstream joint venture automakers began to try to voice themselves at this year’s Shanghai Auto Show.

This time, Ford, who has been out of the mainstream spotlight for a long time, took the lead and released the Mustang Mach E.

The most direct competitor of this car is the Model Y. In product development, many technical indicators are aimed at the Model Y, and the final price is also very close.

In order to suppress Tesla, Ford even registered the trademark of model E and refused to sell it to Tesla. In addition, Ford hung the Mustang logo on this electric car and added more than 50 years of Ford nostalgia to it.

The Mustang is indeed more suitable than Ford to support the high cost and high price of electric cars.This vehicle has indeed grabbed a lot of Model Y orders in the United States. From Ford’s released data, 6614 Mustang Mach-E were sold in the first quarter of this year in the US, and it is said that 70% of the orders are from potential Model Y users.

The Chinese and American markets are not completely the same, especially for Mustang, as China does not have the brand sentiment and history of Mustang. Of course, compared with Ford’s brand image in China, Mustang may be a better choice.

Compared with the brand, the bigger attraction for Chinese consumers to the Mach E may come from its exterior design, which has a strong sense of novelty and technology.

The domestically produced Mustang Mach-E has been slightly lengthened compared to the overseas version in order to adapt to the Chinese market, with a body size of 4739 / 1881 / 1623 mm and a wheelbase of 2984 mm, which improves the riding comfort.

However, in the field of three-power, there is a certain degree of degradation in the domestically produced version compared to the American version, mainly due to a decrease in battery capacity, which makes the vehicle’s endurance competitiveness insufficient.

The pricing of the low-end model at 265,000 yuan is indeed surprising, but the endurance range under the new national standard is only 470 kilometers, which is not competitive enough in the domestic market.

By comparison, the competitiveness of the long-endurance version seems to be stronger, with an endurance range of 600 kilometers and a price of 309,900 yuan, but the acceleration capability of the single motor is not outstanding. The currently released data shows that the acceleration from 0 to 100 km/h is less than 7 seconds.

Ford may hope to use the Mach E’s short-endurance low-end model to compete with Model 3, and use the long-endurance and dual-motor models to compete with Model Y.

In terms of product and brand influence, it is undoubtedly extremely difficult for Mach E to affect Tesla’s position in the Chinese market. In the field of autonomous driving and intelligence, the technology image established by Tesla has deeply penetrated people’s minds. In comparison, Ford’s strength in intelligence has not yet been validated by the market.

Putting aside the effects of foreign brands, the overall product competitiveness is inferior to that of the JingKe 001.

However, the Ford Mustang Mach E is already one of the first pure electric models to land among mainstream joint venture brands. Its outstanding exterior design is still worth a look.

In addition to the Mustang Mach-E, some foreign brands will also bring new models to their debut during this auto show, such as Mercedes-Benz EQS and BMW iX.

These two models will be the new generations of pure electric vehicles developed by Mercedes-Benz and BMW.The Mercedes EQS has dimensions of 5216mm in length, 1926mm in width, and 1512mm in height, with a wheelbase of 3210mm, and is positioned as a mid-to-large-sized sedan. The EQS is equipped with a 108.7 kWh lithium-ion battery pack, and the maximum driving range for the single-motor version is expected to reach 770 km (WLTP cycle).

The EQS will offer two different interior design styles. One is a traditional central console design, and the other comes with the MBUX Hyperscreen system, which features a seamless OLED screen made of irregular curved glass that runs through the central control panel. This super large curved screen is more than 1.4 meters long, comprised of three display screens, and has a seamless integrated design, which was previously the highlight feature of Mercedes-Benz.

In addition, the MBUX Hyperscreen system is the core technology of the EQS, equipped with an 8-core CPU, 24 GB of memory, and 46.4 GB/s memory bandwidth, which can provide more than 20 customized functions and services based on users’ preferences.

The BMW iX is a pure electric mid-to-large-sized SUV and is currently the flagship electric SUV model of BMW. The iX is expected to be launched in the domestic market later this year.

The new car has currently announced two power versions, the xDrive50 and xDrive40. The xDrive50 model will have front and rear dual motors, with a total output power of up to 503 horsepower, accelerating from 0-100 km/h in less than 5 seconds, and equipped with a 100 kWh battery, with a WLTP range exceeding 600 km.

Undoubtedly, the pricing of the EQS and iX is destined to not be affordable for the general public. However, as representative models of traditional luxury car brands, these two models are still worth exploring.

Car shows are the barometer of the automotive industry.

At the Shanghai Auto Show, we can see that domestic brands continue to dominate the new energy vehicle market, while the pursuit of brand high-end is the main theme.

In comparison, most mainstream joint venture brands, except for Volkswagen and Ford, are still in the development phase of their first-generation intelligent electric vehicle models.Compared with the first-mover advantage in electrification, Chinese domestic brands are also taking the lead in the implementation of intelligent technology. In addition to benchmark automakers like Tesla, foreign brands are also in a catch-up phase with respect to self-driving and intelligent cabin implementation.

In the fields of electrification and intelligent technology, domestic brands have already taken the lead over foreign automakers in the speed of technology implementation. In terms of automobile manufacturing technology, domestic brands now have the confidence to compete with mainstream foreign automakers. This was unthinkable in the era of fuel-powered cars.

However, the window of opportunity for Chinese automakers will not last too long. In 2022, traditional car companies will usher in the first wave of intensive electric vehicle releases, and the real battle has just begun.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.